Unlocking investment: trends for high-growth companies, H1 2023

Continuing our partnership with Barclays Eagle Labs, we review the investment landscape for the UK’s high-growth companies in H1 2023.

Equity investment plays a distinct role in fostering growth and supporting innovation in early-stage companies. Despite a more challenging funding environment this year, high-growth businesses secured £7.61b in equity finance in H1 2023.

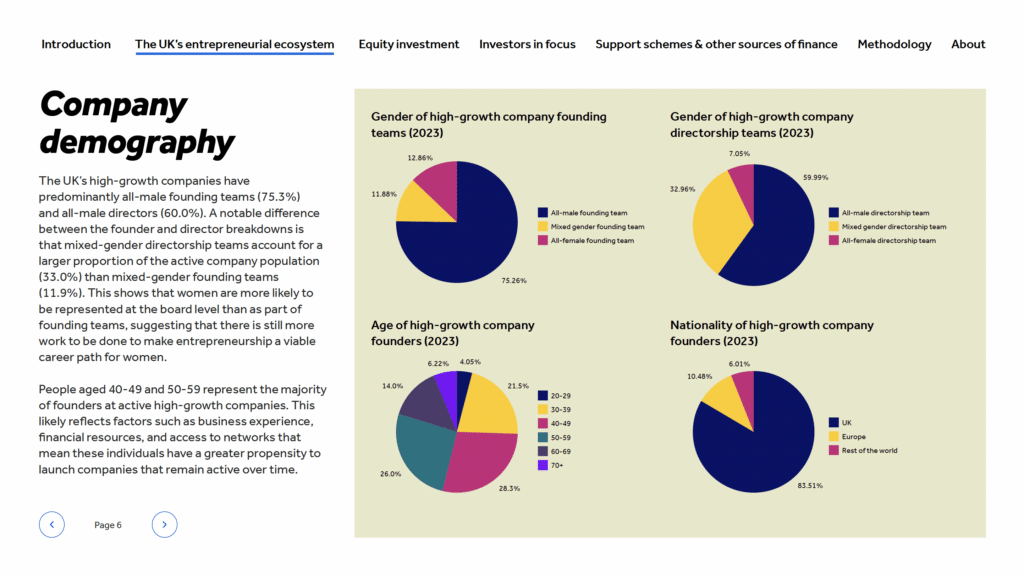

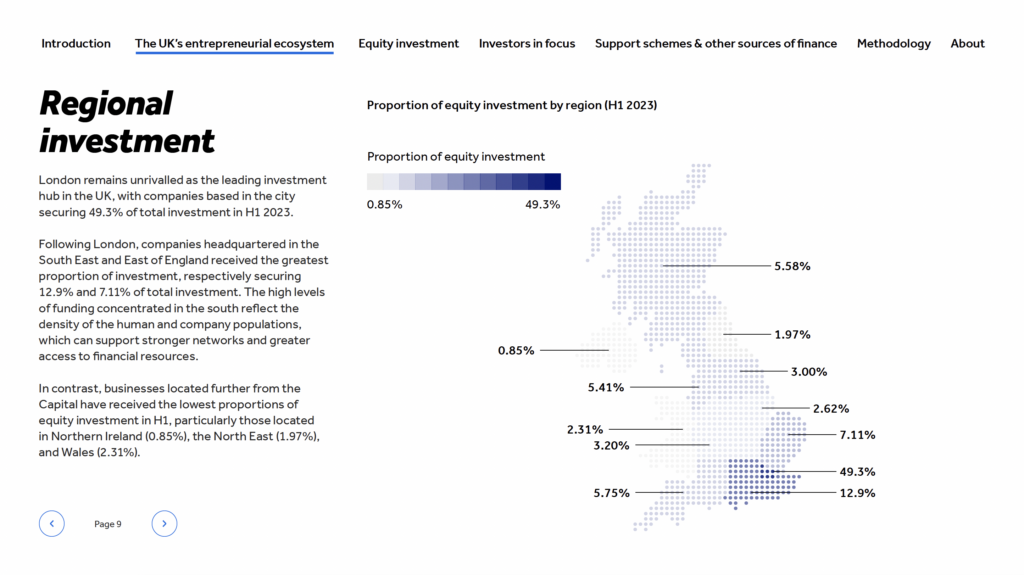

This report features regional investment trends, funding over the seed-stage and venture-stage, as well as the top sectors and emerging sectors. We also dive into the demography of the founders of these high-growth businesses.

Inside the report

About the authors

HENRY WHORWOOD

Henry leads our Research & Consultancy team, and is an expert on equity finance and high-growth business. He's worked on briefs for the likes of Barclays, SyndicateRoom, Innovate UK, Smith & Williamson and British Business Bank. He regularly gives presentations on market trends at events around the UK.

DANIEL ROBINSON

Daniel conducts data manipulation and analysis as part of the Research & Consultancy team. He has a background in business analysis and commercial copywriting in Australia and the UK, having worked at The Sunday Times Fast Track, Oxford University Press, and advertising network MullenLowe Group.

FREYA HYDE

Freya performs graphic design and data visualisation in the Research & Consultancy team. She has worked on projects for clients including Barclays, EY and JP Morgan. Freya holds a BA in History (International) from the University of Leeds, which included a year at Fudan University in Shanghai.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo today to see all of the key features, as well as the depth and breadth of data available on the Beauhurst platform.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client profile.