UK Unicorn Companies

1.

The top ten UK unicorn companies

Discover UK unicorns

Follow the herd. Get the latest data on every unicorn company in the UK.

Beauhurst Privacy Policy

2.

What is a unicorn?

First things first, what is a unicorn company?

Unicorns are private companies with a valuation of at least $1b (currently about £793m). Aileen Lee, Founder of Cowboy Ventures, first coined the term back in 2013, in her article ‘Welcome to the Unicorn Club: Learning from Billion-Dollar Startups.’

Such businesses were classified as unicorns due to the scarcity of privately-held startups achieving this billion-dollar valuation — but unicorn companies are no longer so rare. Revisiting the topic in 2023, Lee noted that there were 532 unicorns in the United States, up from just 39 in 2013 — and in 2025, this figure has now topped 700.

Closer to home, there are currently 41 unicorn companies stabled in the UK, with nine having exited in recent years — making just over 3.4% of the global herd.

What about 'papercorns' and 'zirpicorns'?

With over 1,200 companies worldwide thought to be unicorns, startup vocabulary is expanding accordingly.

For example, companies worth over $10b are known as ‘decacorns’, while those worth over $100b (such as Elon Musk’s SpaceX in the United States and China’s Bytedance, the owner of TikTok) are named ‘hectocorns’ — or, affectionately, ‘super unicorns’.

More recently, terms like papercorn and zirpcorn have entered modern parlance within equity circles. Papercorns are private companies given $1b+ valuations that are yet to demonstrate real-world financial performance to justify that valuation, and are unlikely to succeed on the public market.

Zirpicorns refer to unicorns minted in the halcyon days of 2021 — when interest rates were close to zero, resulting in a bullish investment market where unicorns were popping up with far greater regularity.

How many unicorn companies are there in the UK in 2025?

There are currently 41 active unicorns headquartered in the UK, whilst a further nine have since exited the private market since achieving unicorn status.

The number of UK startups reaching unicorn status is slowing to a point of stagnation. In 2024, only three new unicorns were minted, down from an already-low figure of five in 2023 — and much lower than the heights of 2021 and 2022, which saw 11 unicorns named in back-to-back years.

This isn’t really a surprise given the decline in overall equity funding in the UK. In 2024, we saw the lowest number of deals completed since 2015 according to the latest figures in The Deal, our flagship report into the UK equity market, with total deal value down by 19%.

And whilst venture capital is more widely available compared to, say, 10 years ago — with early access to funding, mentoring, and business networks enabling startups to scale and reach higher valuations more quickly — equity investment is withering under the present macroeconomic conditions. This simple fact makes unicorns all that much rarer as a result.

However, despite all of this, there are still a number of companies rising to unicorn status, creating wealth and innovative technologies.

Why are unicorn companies so interesting to look at?

A unicorn company has the potential to find (or create) an established market, and successfully exit via an acquisition, merger, or a lucrative IPO — making a lot of money for early adopters.

Fund managers run a diverse portfolio with multiple businesses that may fail to make any return on investment. With this in mind, just one multi-billion dollar exit could mean the portfolio still makes a significant return.

This is primarily why so many early-stage angel investors are on the hunt for future unicorn companies to put their money behind. After all, Amazon, Apple, and Google all started out as early-stage companies — and plenty of early investors made significant profits.

In order to spot tomorrow’s unicorns, what better place is there to start than examining the herd as it currently stands?

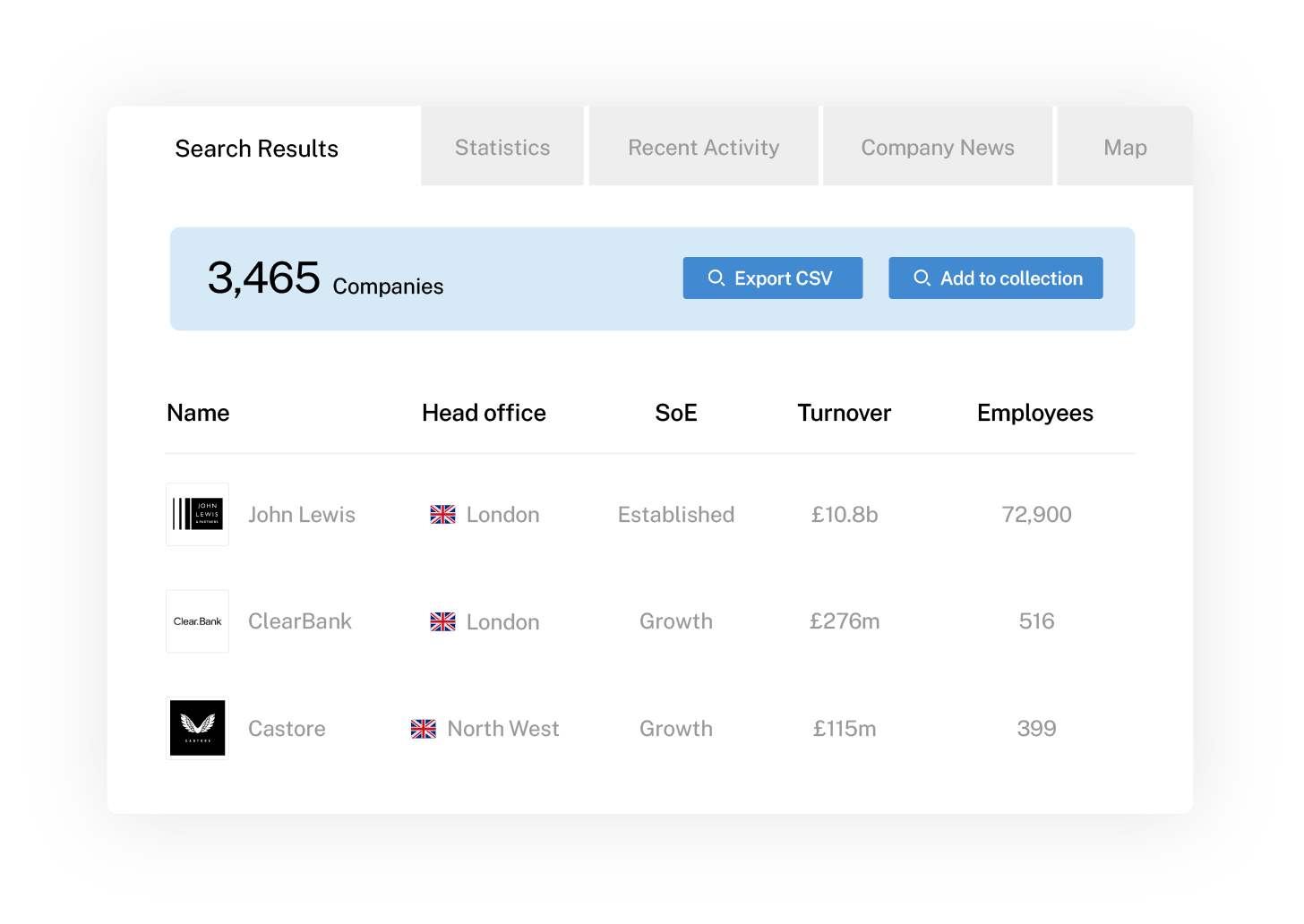

See the data in action

Want to see the data in action? You’re in luck. Take a virtual tour of the platform and discover how we get our unbeatable data insights.

3.

Mapping the herd:

The UK’s active unicorns in 2025

The herd is beginning to thin. Unicorns are becoming rarer in comparison to the year of the unicorn in 2021 when, at one point, 40% of the total active unicorns globally were minted in the first eight months of the year.

This is a symptom of the wider investment market, with the number of UK equity deals down 24% between 2023 and 2024, hitting their lowest since 2015.

Here, we’ve mapped out the UK’s active unicorn companies, including those that have exited. This illustrates which regions are producing the most billion-dollar companies, the industries they commonly operate in, how long it takes to reach that fabled valuation, and the types of founders who are leading them there.

We’ve also explored the impact of UK unicorn companies on the broader economy, the proportion of these companies with patents, and how many unicorns have come from spinouts.

Where in the UK are unicorns based?

London dominates the UK’s high-growth ecosystem as a whole, but this is especially true of unicorn companies. 74% of UK unicorns (37 of a total 50) call the capital their home, benefitting from their proximity to nearly 70% of the country’s private equity and venture capital investors, and access to a world-class talent pool.

Hailed as the ‘fintech capital of Europe’, London also claims all but one of the UK’s 17 fintech unicorns — with challenger bank OakNorth, which is headquartered in the North West, the only fintech unicorn based outside of London.

The remaining 13 unicorns are spread across the country. Renewable energy supplier OVO is based in Bristol, for instance, alongside chips and processors firm Graphcore. The city of Bristol, part of the Silicon Gorge tech cluster, is a hub for innovation and entrepreneurship in the South West and, with its strong roster of university spinouts and accelerator programmes, could soon be home to more unicorn companies.

Further North, fitness brand and online retailer Gymshark hails from Solihull in the West Midlands, whilst acquisition aficionado The Hut Group (THG) controls its empire of e-commerce brands from Manchester, which is also home to Matillion. In 2023, Manchester scored a hat-trick of unicorns as sports outfitter Castore joined the herd — with the total number of unicorns in the North West now reaching a height of five.

Skyscanner remains headquartered in Edinburgh, despite being acquired by Chinese online travel company Ctrip back in 2016. It was the first private company to reach a billion-dollar valuation in Scotland, but has since been joined by Aberdeen-based BrewDog.

These companies are prime examples of how ambitious startups can flourish outside of the capital — especially in the North West, which is now the fastest growing region for equity investment, as we reported in The Deal 2024.

Whilst this could be a sign of greater wealth distribution across the UK, we suspect future unicorns will continue to be concentrated between London and the research clusters of Oxford and Cambridge. These trio of cities — dubbed ‘The Golden Triangle’ — still claim the vast majority of equity investment in the UK, and also remain the most attractive locations for foreign investors to deploy large-scale capital.

Map of UK unicorns

What industries do UK unicorns operate in?

In the UK, unicorn companies are spread across a fairly broad range of sectors, from cleantech and eHealth, to gaming and proptech companies. And these billion-dollar businesses are applying all sorts of disruptive technologies, including artificial intelligence (AI).

Fintech and SaaS are by far the most common industries for UK tech unicorns, with 17 companies each. Of the 17 fintech businesses, five of these include the country’s leading challenger banks — Monzo, OakNorth Bank, Revolut, Starling Bank, and Zopa.

Fintech’s dominance in the unicorn club comes as no surprise, given that it consistently ranks as the UK’s top-performing high-growth industry, attracting more equity investment than any other startup sector.

Yet the first UK fintech company to become a unicorn, Funding Circle — which has since lost its unicorn status — didn’t reach its billion-dollar valuation until January 2017, with the remainder of the fintech herd amassing over the past few years.

More broadly, UK artificial intelligence companies doubled the amount of equity investment raised in 2024, surpassing even investment into fintech companies. And given the success of OpenAI’s ChatGPT following its November 2022 launch — and with the industry now packed with viable competitors — it’s entirely possible that we could see more AI unicorns minted in the next few years.

The result of this uptick in investment is that 13 of the UK’s unicorns — over one quarter of the total — feature artificial intelligence in their products.

Besides fintech and AI, other common industries for UK unicorns include SaaS (17 companies) and mobile apps (13 companies). It’s also worth noting the appearance of less traditional industries including alternative finance and cryptocurrency (3 companies). In 2024, we also saw the UK’s first unicorn in the electric and hybrid vehicles sphere, in Wayve.

How old are UK unicorns?

The average age of UK companies reaching unicorn status is now just over eight years. However, there is considerable variation amongst the unicorns, which does skew this average. For example, Octopus Group and Howden Group both took 20 years or more to reach the billion-dollar valuation, whilst Zopa was just shy of this figure with 19 years.

At the other end of the scale, some UK businesses reached their unicorn status at lightning speed — Cazoo and Graphcore hit unicorn status within two years of being founded. Meanwhile, challenger bank Monzo and consumer loan-lender Zilch both took only three years to be named as unicorns.

Ultimately though, unicorn mintings are seemingly returning to the level we saw in the late 2010s. Just three companies joined the herd in 2024, the same as in 2018 and 2019 — and a far cry from the 11 UK unicorns created in each of 2021 and 2022.

Years to unicorn status

Unicorns with patents

Nine of the 41 active unicorns in our list (just under 25%) have been granted a patent — and whilst this might be surprising, here are some reasons why there aren’t more.

In emerging industries, there tend to be proportionally fewer patents. For example, just three of the 13 UK artificial intelligence unicorns possess a patent. This is because the first-mover advantage is often more strategically important than waiting for a patent to be filed before expanding.

Meanwhile, all four unicorn companies working in life sciences and medtech — CMR Surgical, Oxford Nanopore Technologies, Spectrum Medical, and Touchlight — have patents granted to them. Companies working in these industries are more universally patented, in order to maintain a competitive advantage.

The value of unicorns to the UK economy

One of the latest datasets added to the Beauhurst platform is GVA (gross value added). This enables clients to analyse the value that companies contribute to the UK economy.

And for the first time in the unicorn report, we can now reveal that UK unicorns have contributed a total of £10.37b to the UK economy.

Looking at the data by region, we can see that London accounts for £7.80b of the total GVA, which is more or less proportionate with the number of unicorns in London.

The South West has benefited from £1.45b added to the economy, whilst the North West comes in third with just under £600m.

How GVA is calculated

At Beauhurst, we calculate GVA using the GVA(i) formula, also known as the ‘income approach’. This means adding employee wages + operating profit (EBIT) + depreciation + amortisation together to deliver a final figure.

By comparison, the ONS adds the sum of all income from employment (compensation of employees), and other income generated by the production of goods and services and uses this data to deliver very good regional analyses.

The key difference here is that the Beauhurst method of calculating EBITDA data by company gives a much clearer picture of a company’s direct value to the local economy. And, as a result, we’re able to algorithmically calculate GVA when a company files its financials.

Unicorns and academic spinouts

Of the 50 UK-based unicorns, only four UK unicorn companies have been spun out from academic institutions. These are Oxford Nanopore Technologies, Graphcore, Synthesia and Darktrace —all of which set up shop in their hometowns (Oxford, Bristol, Cambridge, and London respectively).

As a result, these universities have generated massive impact for their local and national economies. Setting up locally benefits the businesses too — enabling each unicorn to make full use of their parent universities’ resources and state-of-the-art research centres, plus the large supply of graduate talent in each city.

Who are the UK’s unicorn founders?

Serial entrepreneurs

With unicorn companies regarded as the high-growth economy’s leading lights, one can assume their founders have fairly enviable CVs. And in many cases, this is true — in fact, many of the UK’s unicorn founders are serial entrepreneurs.

Even for those that lacked previous startup experience, many of the UK’s unicorn founders held senior positions at big name corporates, and already had years of experience, connections, and business know-how under their belt. It’s unsurprising, therefore, that the average UK founder age at the time of hitting unicorn status is 44 — and of the total repeat-founders (14 people), only three are under 40.

Take Martin Frost for example, founder of unicorn CMR Surgical. With a wealth of experience including 54 directorships since 2002 in life science, genomics, and medtech companies, he also currently holds five key positions in active businesses. This includes a Non-Executive Director role at Cyted Health and Founder of electric vehicle software startup, Monumo.

Meanwhile, Taavet Hinrikus, previously Chairman and co-founder of Wise (the exited fintech unicorn formerly known as TransferWise), is an active angel investor who has backed several European tech startups, and is on the board of insurtech unicorn Zego.

Similarly, Anne Boden was 61 when Starling Bank became a unicorn. Boden, Starling’s founder and CEO, is a well-known success story, having launched the company off the back of a 30-year career in finance. In 2018, she was awarded an MBE for services to financial technology and more recently headed up the UK’s Women-led high-growth enterprise taskforce in 2024.

Boden is also one of just 18 female entrepreneurs to have (co-)founded a UK unicorn, with only six still active in the business they founded. This is compared to 115 male (co-)founders in UK unicorn companies.

At the other end of the scale of experience, James Watt, co-Founder of Aberdeen-based BrewDog, started selling beer out the back of a van at age 24. In 2017, the company’s 10th year of operating, Brewdog hit that prestigious unicorn valuation via a US-based private equity fund and the rest was history. Since then, Watt has founded Social Tip and has amassed shareholdings in 19 companies with a paper value of over £350m

The youngest founder to hit unicorn status was Johnny Boufarhat, aged 26 years old, when Hopin became the fastest growing European startup ever. However, the ill-fated virtual events firm, which hit a $5b valuation within just 21 months of founding (notably during the global COVID lockdowns), liquidated its UK business in early 2024 as part of a move to the US market.

Gender of unicorn founders

Nationality of unicorn founders

According to a 2023 report by The Entrepreneurs Network (TEN), just under 15% of UK residents are foreign-born (i.e. born in a country different to where they currently live), yet 39% of the UK’s 100 fastest-growing businesses have foreign nationals in their founding teams. It’s also worth noting that this is down from 49% in the 2019 study.

From our own data, we saw a drop in foreign-born unicorn founders in the 2023 edition of the unicorn report, with around 16% of the UK’s active unicorns founded by a foreign national compared to 40% in 2022*. There are likely a number of reasons for this, including tax and visa-related frictions post-Brexit, For example, the UK is no longer part of the cross-border tax relief for businesses and investors.

However, our latest data shows that this statistic has increased marginally, with foreign-born founders of UK unicorns jumping back up to 24%. However, only 5.2% of unicorn founders hail from outside of Europe.

*The methodology for the 2025 iteration of the unicorn report no longer includes unicorns that have received subsequent valuations below $1b. Nor does it include dead unicorns, or companies that liquidated their UK businesses and moved to a different territory.

Nationality of unicorn founders

4.

How are unicorns reaching their billion-dollar valuations?

Equity investment

Over the past few decades, the UK’s equity funding landscape has matured considerably. It now offers a more diverse range of growth finance than ever before, from Silicon Valley-style venture and growth capital to comprehensive government grants and crowdfunding.

We’ve also seen a huge increase in the amount of capital available to high-growth startups. The effects of this are most pronounced at the extreme end of the scale, with 112 megadeals (funding rounds worth £50m or more) announced in 2021, including 51 gigadeals (£100m+).

However since the height of 2021, deals of this size have dropped, with just 27 megadeals and 13 gigadeals in 2024, as investors become more cautious due to market conditions. Still, these comparatively large investments are allowing companies to reach larger valuations in fewer rounds than before.

R&D-intensive tech companies, which many unicorns are, have a big appetite for capital to accelerate innovation, and achieve and maintain a market-leading position. Prior to reaching unicorn status, the average unicorn raised £139m in equity investment, across five funding rounds.

Of all the UK unicorns, Howden Group had raised the most before joining the herd, with £810m of equity funding already under its belt. Whereas, several companies (including Checkout.com and Gymshark) had never raised equity before securing the rounds that saw them enter the unicorn club.

Unannounced deals

In 2024, 61% of equity deals were not announced to the public, yet these unannounced rounds (also known as ‘stealth rounds’) are an important part of many high-growth companies’ growth journeys.

This is equally true for unicorn companies, with a similar figure — 56% of UK unicorns having secured at least one unannounced funding round.

International investment

The increasing involvement of international funds in UK equity deals has also stimulated the market. These funds will often have deeper pockets and more freedom to deploy greater amounts of capital in one go.

Indeed, all fifty of the UK’s unicorn companies, active or exited, have an international investor on their cap table.

International investment

Investors play a significant and multifaceted role in the growth trajectory of ambitious businesses, not only providing capital, but also mentoring businesses, and giving them access to their expansive business networks. And whilst there are hundreds of investors in the UK, only a handful have been successful in identifying high-potential startups and guiding them to a billion-dollar valuation.

Index Ventures has been involved in the most rounds, backing six UK unicorns 20 times, closely followed by Passion Capital (three unicorns, across 19 rounds). Meanwhile, Balderton Capital — a frequent co-investor with Index Ventures — has backed six UK unicorns, 14 times.

However, in addition to these private equity and venture capital films, crowdfunding has also played a role. Monzo, BrewDog, and Revolut have all raised at least one round of crowdfunding, enabling them to mobilise their loyal customer bases to take their own stake in the business.

Accelerating towards unicorn status

Startup accelerators are programmes designed to help entrepreneurs grow their ideas into fast-growing businesses, through mentoring, financial investment, business advice, office space, and access to investor networks.

First conceived in 2005, with Silicon Valley’s Y Combinator, there are now over 750 incubator and accelerator programmes operating in the UK, which have fast become one of the most important ways to nurture young companies from seed to scaleup and beyond. This is evident in the fact that 58% of UK unicorns attended an accelerator prior to reaching their billion-dollar valuations.

Between them, UK unicorn companies have attended 12 different accelerator programmes. The most popular of these is, by far, Tech Nation’s Future Fifty, a two-year programme focused on developing late-stage technology businesses. Future Fifty has accelerated an impressive 22 unicorns towards reaching their billion-dollar valuations, including Darktrace, Deliveroo, and Skyscanner.

Tech Nation also manages the Upscale accelerator programme, which counts Monzo, Improbable, Many Pets, and Zego amongst its seven-strong alumni.

"For UK companies, there is no other data provider I trust more than Beauhurst."

Growth by acquisition

One quick way to assert your dominance in the market is by subsuming your competitors and peers. By acquiring other startups, a business can expand its customer base, IP, and product range and value, whilst reducing competition in the landscape. It’s no wonder, therefore, that 45% of UK unicorns made at least one acquisition prior to reaching their billion-dollar valuations.

Most notably, however, THG (The Hut Group) made six acquisitions prior to becoming a unicorn company, and has gone on to acquire an additional 16 more businesses since then. As an operator of e-commerce websites, purchasing e-commerce sites and bringing them into the suite that they own and manage is a critical part of their business model. It’s a very direct example of how acquisition can fuel the growth of startups.

6.

What's next for UK unicorns?

Here, we take a closer look at the unicorn companies that have chosen to exit the private market, plus potential newcomers to the herd, so-called ‘soonicorns’.

Unicorn exits

An exit — whereby a business is acquired or listed on a public stock exchange — can provide significant financial reward to shareholders, particularly those with a large stake in the company. For many entrepreneurs, it is the prospect of this sizeable payout which incentivises them to undertake the high-risk venture of starting a company in the first place.

For others, an exit can be a method of growth, through nestling under larger companies of similar interest, or a means of securing additional funding to support ambitious growth plans into new markets or regions.

However, exits are not without their risks. Subjecting to the volatility of the stock market can magnify and scrutinise a company’s (previously private) mistakes or weaknesses, with potentially disastrous consequences to its share price, whilst being acquired risks businesses losing the culture upon which they’ve so far thrived.

Equally troublesome can be the additional bureaucracy associated with becoming a public company — red tape, in the form of additional corporate governance requirements, and the challenge of dealing with an increased pool of investors and potentially competing interests.

To date, nine of the UK’s unicorn companies have decided to exit the private market, five via an Initial Public Offering (IPO), two via acquisition, and one through Special Purpose Acquisition Company (or SPAC) mergers, whilst Wise underwent a rare direct listing (DPO).

Not all listings were deemed to have been successful, however. Deliveroo’s £1b float on the LSE was described by many as “London’s worst IPO in history” or (more colloquially) “Floperoo”. Following claims that the company was overvalued at £7.6b, Deliveroo’s share price fell 26% on its first day of trading.

Things haven’t got much better since — in spite of the FCA (Financial Conduct Authority) amending Listing Rules to make the UK market more attractive to float on, no UK unicorns have elected to exit the market via IPO since Oxford Nanopore in September 2021.

The London Stock Exchange has in particular struggled to attract IPOs more broadly, with high-profile cases such as UK-based companies ARM and Lloyds of London snubbing the UK exchange and instead opting to list in the US.

The UK's "soonicorns"

Whilst the investment landscape in recent years has been a challenge, there are still a number of UK companies on the cusp of unicorn status — with these high-potential companies affectionately known as ‘soonicorns’.

We’ve highlighted three companies with a chance of attaining unicorn status in 2025.

03.

Allica Bank

Industry: Fintech

Year of latest fundraising: 2024

Latest post-money valuation: £359m

Challenger bank Allica Bank, offers financial services to small and medium-sized enterprises (SMEs) via its proprietary app.

Established in 2019, the company has already raised £403m across 12 rounds, has appeared in nine high growth lists, and in 2024 acquired loan provider Tuscan Capital to boost its commercial finance offering.

02.

CarbonClean

Industry: Carbon Capture

Year of latest fundraising: 2022

Latest post-money valuation: £541m

Carbon capture company, CarbonClean, saw its valuation leap to £541m following a £140m raise in 2022.

With the UK government committing to investment in carbon capture technologies — and the company amassing over £4.31m in grants — 2025 could be a pivotal year for the Southwark-based business.

01.

Inigo

Industry: Insurtech

Year of latest fundraising: 2023

Latest post-money valuation: £745m

London-based Inigo offers insurance and reinsurance services, focusing specifically on underwriting high-risk lines for large commercial and industrial enterprises, including cyber, war, terrorism, and financial risk.

Established in 2020, the company has raised £641m across two fundraisings and saw its operating profit reach £113m according to its latest financial statement.

Find the next unicorn with Beauhurst

Beauhurst makes it easy to discover the UK’s most promising high-growth companies before they hit the mainstream. Our platform gives you unrivaled access to private company data, helping you track high-growth businesses, identify future market leaders, and stay ahead of emerging trends.

Whether you’re an investor, advisor, or industry professional, Beauhurst provides the insights you need to spot the next big success story — before everyone else does. Want to see the data in action? Why not take a quick tour of the platform. And if you’d like to talk to a member of our team, simply fill out the form below.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy

Ready to upgrade your approach?

Discover how BeauhurstInvest can help you make a real difference.