Fintech Deals & Acquisitions:

Q1 2022 Trends

In the second edition of our quarterly UK fintech analysis with Deloitte, we explore the exits and equity deals achieved by companies in the sector.

Q1 2022 was a record quarter for fintech investment in the UK, with a massive £2.4b in equity funding secured.

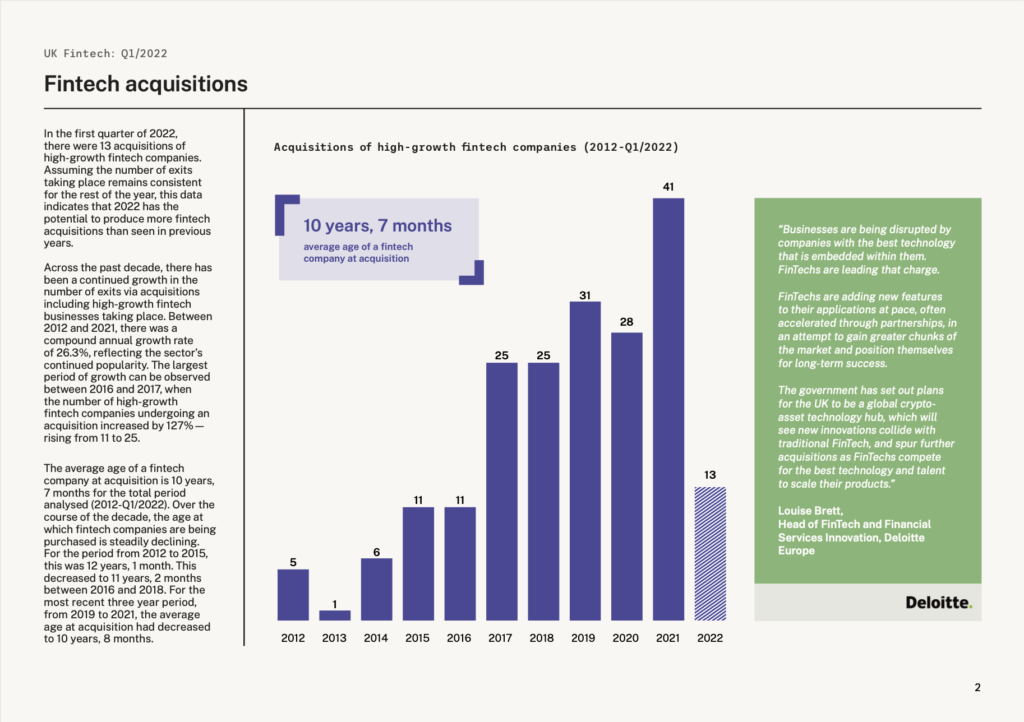

This is off the back of a record year for fintech acquisitions in 2021.

Meanwhile, Q1 of 2022 has already seen more acquisitions of high-growth fintech companies than the whole of 2016.

Download the free report for more key findings.

Here’s a sneak peek inside

About the authors

henry whorwood

Henry leads Beauhurst’s Research & Consultancy, and is an expert on equity finance and high-growth business. He has worked on briefs for clients including Barclays, SyndicateRoom, Innovate UK, Smith & Williamson and the British Business Bank. He regularly gives presentations on finance and market trends at events around the UK. Henry studied Classics at the University of Oxford.

Daniel robinson

Daniel conducts data manipulation, visualisation and analysis as part of the Research & Consultancy team. He has a background in business analysis and commercial copywriting in Australia and the United Kingdom. Daniel has previously worked at The Sunday Times Fast Track, Oxford University Press, and advertising network MullenLowe Group.

Freya Hyde

Freya performs data analysis and visualisation in the Research & Consultancy team, with a focus on design, and has worked on projects for Barclays, EY and JP Morgan. She holds a BA in History (International) from the University of Leeds, which included a year at Fudan University in Shanghai.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo today to see all of the key features, as well as the depth and breadth of data available on the Beauhurst platform.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client profile.