Capital Gains Tax Reforms: Balancing Risk & Reward

We surveyed UK founders, investors and advisors to quantify the potential impact of proposed changes to Capital Gains Tax (CGT) and Business Asset Disposal Relief (BADR).

We recently ran a survey on the proposed changes to Capital Gains Tax, gathering data to allow a more informed approach to the discussion of these proposals, and their potential effects on the UK entrepreneurial ecosystem.

We’ve now published the full results from this survey in a free report. Alongside them, we provide our thoughts on a potential solution to protect this vital part of the economy.

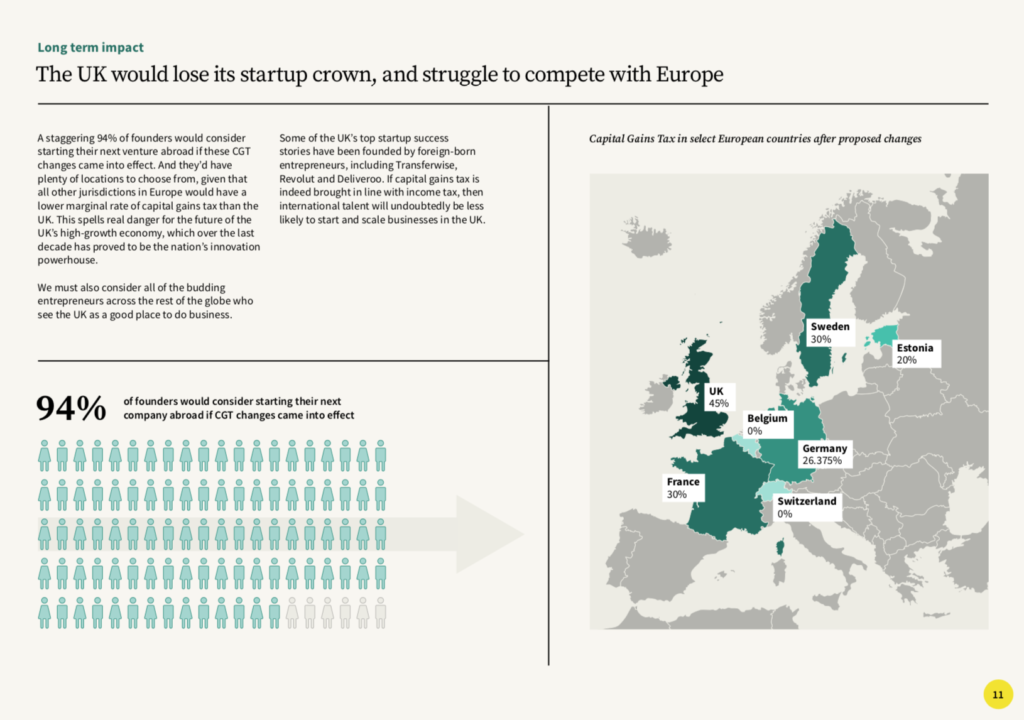

Given that UK startups and scaleups collectively employ over 3.5m people, across 40k companies, the impact of these changes on the UK’s small businesses would be catastrophic. Combined with the effects of Brexit, the UK would risk losing its crown as the startup capital of Europe.

In this free report on how CGT reforms would affect startups and economic growth in the UK, you’ll uncover:

- Issues with proposals from the Office of Tax Simplification (OTS)

- The financial ramifications for entrepreneurs vs their employees

- How the proposed Capital Gains Tax changes will impact UK startups in both the short and long term

- The proportion of founders who would consider moving operations abroad

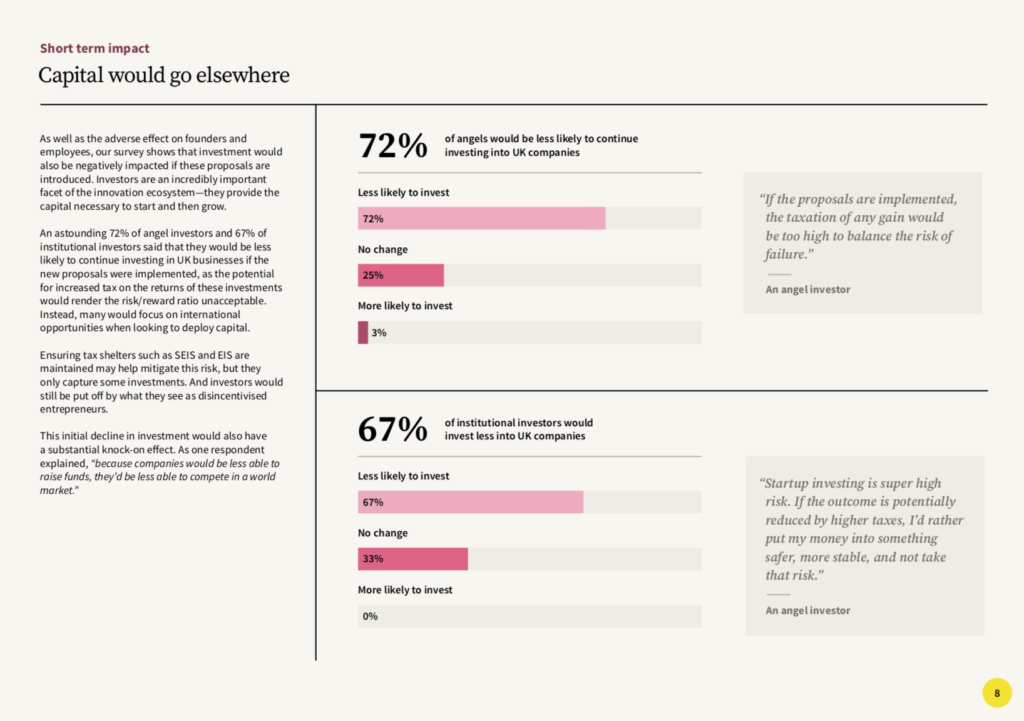

- The proportion of jobs that would be under threat and proportion of investors who would invest less in UK businesses

PLUS our recommendations on how Capital Gains Tax and Business Asset Disposal Relief should be reformed

Here’s a sneak-peak inside

If you work with high-growth, UK companies, you need Beauhurst.

Want access to our data platform?

Sign up for a free demo and we’ll help you navigate the platform, allowing you to:

- Search fast-growing companies and their funders

- Explore every UK fundraising (even the 70% of rounds that are unannounced, and not included in this report)

- Build targeted lists of key companies and contacts

Everything will be customised around your business and needs, so you explore can relevant data and get the most out of the platform.

Plus, you’ll get a customised report of your findings.