Ziylo acquired in one of the UK’s largest academic spinout exits

Category: Uncategorized

In a landmark moment for the UK’s spinout scene, Ziylo, a young life science company set up by a Bristol PhD student back in 2014, has been acquired in a deal worth £623m (nearly $800m). According to Tony Raven, Chief Executive at University of Cambridge Enterprise, the Ziylo acquisition could potentially constitute the third largest acquisition of a British spinout this decade, after UCL’s Biovex in 2011 and Cambridge’s Astex in 2013. Please do get in touch if you have evidence otherwise.

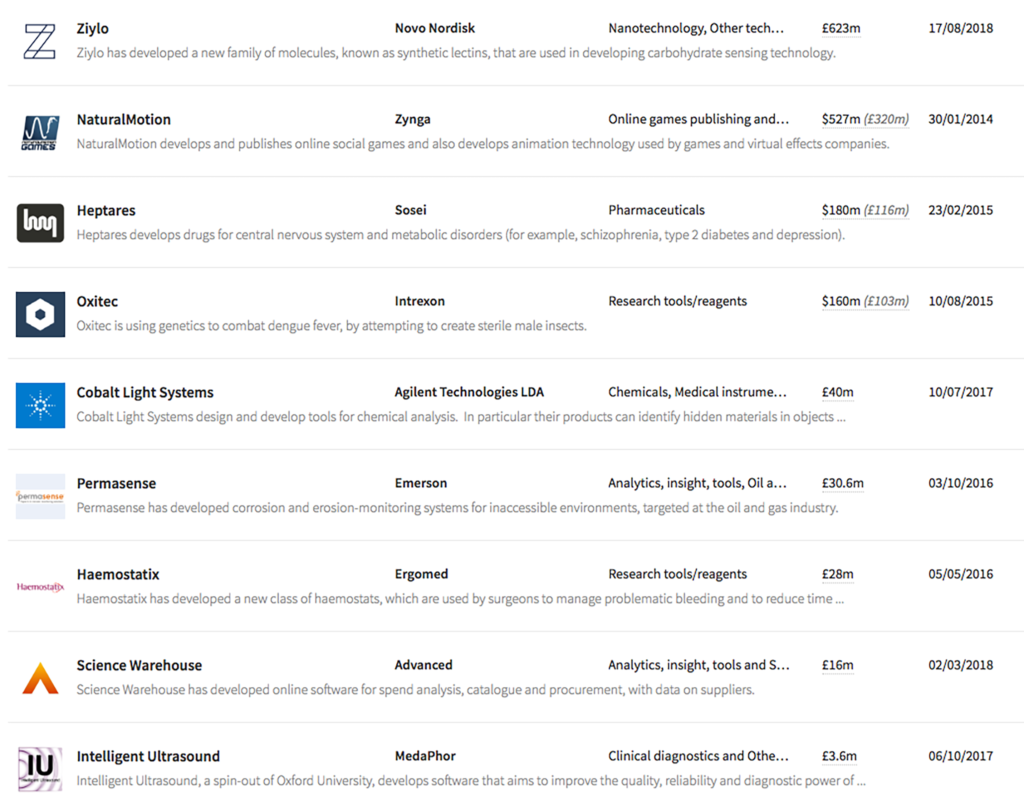

Largest acquisitions of spinouts that raised equity after 2011

Ziylo has developed a new family of molecules known as synthetic lectins, which really means a synthetic, “smart” insulin. (Insulin is a hormone which binds to glucose sugar in the body, removing it from the blood stream). This is used in the treatment of diabetes, a condition which causes blood sugar levels to become too high. Synthetic lectin differs to usual insulin treatments in that it modulates its activity based on how much glucose there is the blood stream. This has important potential in the treatment of “hypoglycaemia” (low blood sugar), a common side effect of current diabetic treatments.

Interestingly, the company’s latest funding round gave them a valuation of just £8m. Danish firm Novo Nordisk, which completed the Ziylo acquisition, is one of the world’s largest producers of diabetic medicine. Clearly, their corporate venturing team sees a huge amount of commercial potential in the young company’s IP.

At the time of purchase, Bristol University owned a 6.86% stake in the company. If the full funding amount does come through (which is dependent on several development and commercial milestones), this will constitute a return of £40m for the university. That’s a sizeable windfall sum for a university who currently receives an income of around £608m.

Founder Harry Destecroix, aged 31, has reportedly become a multi-millionaire through the deal, from a 23% stake. Both he and the university could be in for a lucrative deal if this drug becomes widely used in the treatment of diabetes.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.