Who will IPO in the next few years?

Category: Uncategorized

See our most recent post on upcoming IPOs here.

2018 saw several leading UK startups undergoing Initial Public Offerings (IPOs) on stock exchanges around the world. This is the process by which high-growth companies go public, allowing for their stocks to be traded on stock exchanges like the London Stock Exchange, or NASDAQ.

An IPO forms one of two main options for entrepreneurs and venture capitalists to exit from a high-growth business – the other is an acquisition. Whilst both usually see investors receive a positive return on their initial investment, an ongoing debate exists as to which is more desirable for the businesses themselves and their investors.

That said, there is a certain prestige attached to an IPO. This is related to simply being a public company – the world’s leading businesses are largely listed on public markets. An IPO also allows companies and the entrepreneurs behind them to retain independence, rather than simply being folded into a much larger corporation.

With that in mind, we’ve used Beauhurst searches and data analysis to highlight some of the likely companies that could be looking at an IPO in the next few years.

Building a search

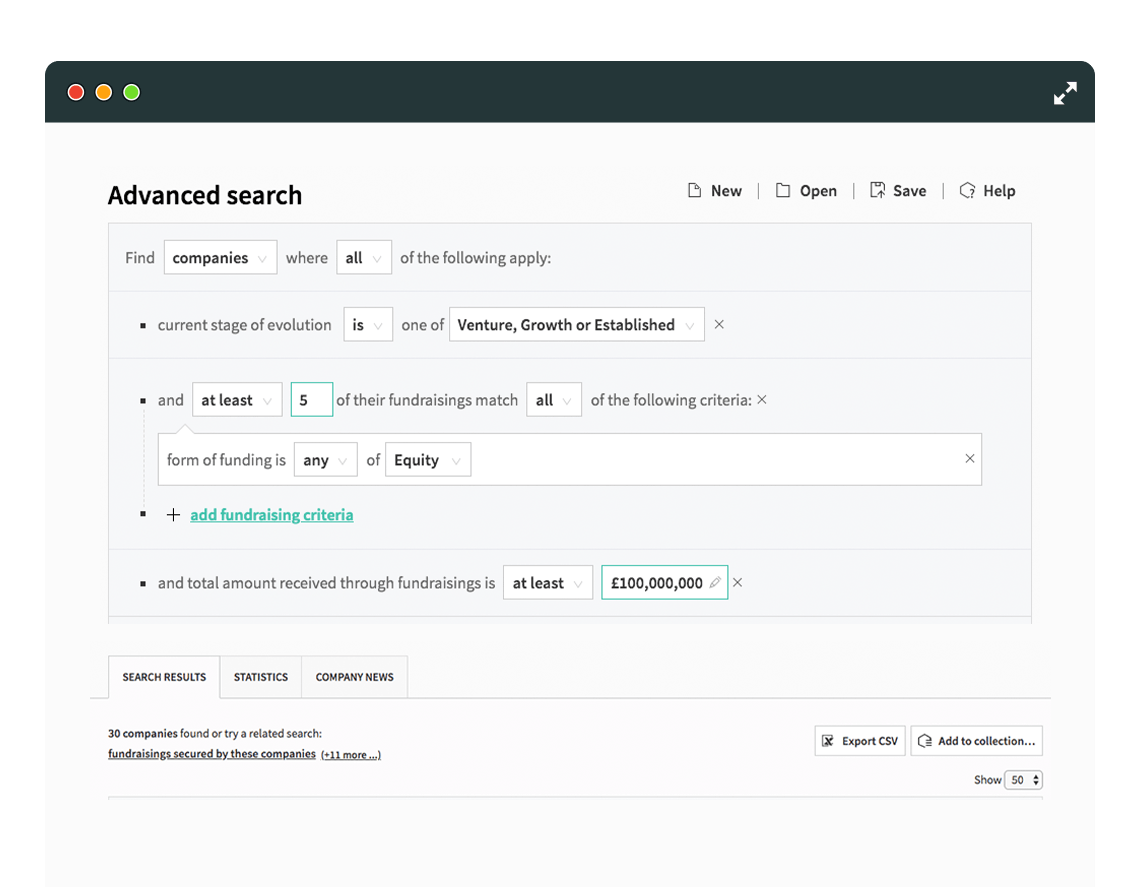

Using the Beauhurst platform, we can build a search based on clues that a company might be approaching an exit event. Of course, this could eventually be an acquisition rather than an IPO, but for many larger companies, a public listing on a major exchange is the ultimate goal.

Here we have chosen to focus on companies that have completed more than five fundraisings with a total value of over £100m. This gives us some of the usual, well-publicised suspects, but also those that might not be such obvious picks.

- Atom

- The Hut Group

- Neyber

- Improbable

- Freeline Therapeutics

- Darktrace

- Zopa

- Secret Escapes

- Nested

- Impact Oil & Gas

- WorldRemit

- Revolut

- Monzo

- Immunocore

- Estover Energy

- Cell Medica

- Truphone

- Oxford Nanopore

- MarketInvoice

- Hyperion Insurance Group

- Transferwise

- ezbob

- CMR Surgical

- Eleather

- Nutmeg

- Kymab

- Gigaclear

- Deliveroo

- Brewdog

- Cambridge Broadband Networks

*Despite meeting our criteria, both The Hut Group and Darktrace have announced that they won’t be planning an IPO any time soon.

Nested, the data-driven online estate agents, have raised £166m from top-tier investors including Balderton Capital, Northzone Ventures and Passion Capital. Their turnover is rapidly increasing, although it remains to be seen if this will generate significant profits (like many startups, they don’t currently disclose full financials). With a clear proposition and product-market fit, combined with a range of top equity investors likely to want an exit at some point, they could be a good bet for a public listing – something their CEO doesn’t deny.

Founder Matt Robinson doesn’t just run Nested, he also co-founded GoCardless, another young hopeful for UK tech. The company shares some common investors and shareholders with Nested (Passion and Balderton), and has raised £33m over 5 rounds.

The most well-known potential IPO would be Deliveroo, one the UK’s most-publicised tech exports of recent years. Recent reports have circulated rumouring of several takeover attempts by American tech giants such as Uber and Amazon. All have so far been rebuffed – the company, and CEO Will Shu in particular, seem keen to remain independent.

Deliveroo last raised capital in November 2017, and apparently still have enough cash to last them for a significant period. Whether they IPO in 2019 or postpone till 2020 is currently unclear, though 2020 seems more likely. The company may well undertake another funding round to boost its valuation before an eventual IPO, according to The Telegraph.

Another likely candidate from the UK’s unicorn cohort is Transferwise. A couple of years older than Deliveroo, this international currency transfer platform has already reached profitability. In their 2018 accounts operating profits sat at almost £10m, whilst turnover had jumped by 75% compared with the 2017 accounting period. Whilst sales are not as high as Deliveroo’s £277m in 2017, Transferwise has clearly proven its business model, and entered a new, more stable period in its commercial growth. At this point, it seems like it is only a matter of time till they IPO.

Will any of the UK’s challenger banks go public in 2019? It is hard to tell, but it seems unlikely for Revolut, Starling and Monzo, who are still in early loss-making phases. OakNorth, also with a billion-dollar valuation, has raised nearly £300m in equity finance, and between the 2016 and 2017 accounting periods sales grew by nearly 300% to £35m, on an operating profit of £10m. If that sort of financial performance continued in 2018, an IPO could well be on the cards.

Another less well-known challenger bank is Capital On Tap, who provide financial products such as loans to SMEs (much like Funding Circle). This company is also already profitable, with turnover topping £17m in 2017. Whilst they’re clearly at the smaller end of the spectrum when compared with the other companies in this post, London’s AIM stock exchange is designed specifically for smaller, alternative businesses. The regulatory requirements to list on this stock exchange have also been loosened, making it easier for smaller companies to comply.

Recent companies to list on this exchange include Footasylum, Eve Mattresses, and Team17 (the game developers behind Worms). If Capital On Tap were to list, the AIM would be the most obvious option.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.