UK’s Top Drone Companies

Category: Uncategorized

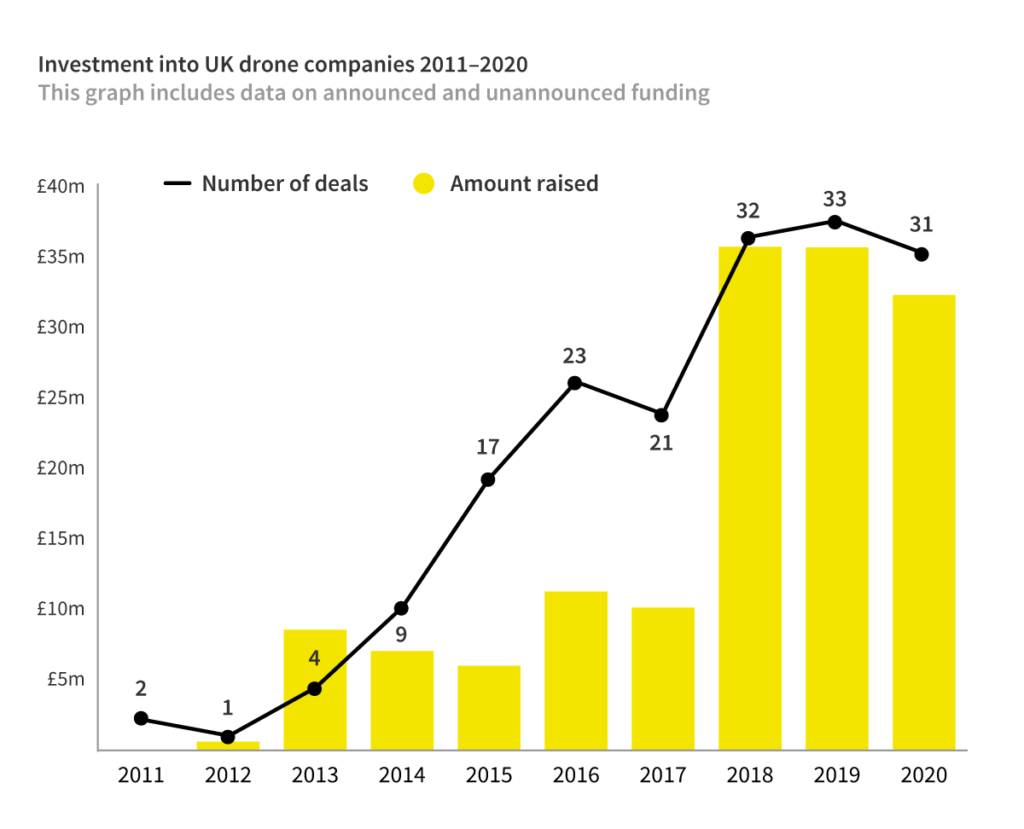

We first reported on the UK’s top drone startups back in 2016. Around that time, an upswell in consumer interest signalled an imminent increase in drone investments, and an uptick in the number of unmanned aerial vehicle (UAV) companies. Looking at past trends in the market, we then predicted funding levels into drone companies could reach £15m in 2017. We were slightly off on this: funding levels actually plateaued at £10.1m in 2017.

Funding rose sharply after 2017, however, more than tripling in just one year. Total equity investment in 2018 reached £35.6m across 32 rounds, and has remained fairly buoyant since—with £35.6m raised across 33 rounds in 2019 and £32.2m across 31 rounds in 2020.

Overall, the UK’s top drone investors by number of deals since 2011 is Crowdcube—with seven rounds—followed by Entrepreneur First, and MMC Ventures.

To date, five high-growth drone companies have exited through a merger or acquisition. This includes the country’s biggest drone company, Soil Machine Dynamics, which was acquired by Zhuzhou CRRC Times Electric for £130m in 2015.

Drone companies operate in three subsectors:

- Those developing specialty drones for tasks in specific industries

- Those designing software to improve operating systems for drones

- Those developing new types of drones altogether.

Top Specialty Drones Companies

The UK’s most successful drone startup companies to date have been those which develop drones for use in specific industries. Hummingbird Technologies is one such example. The UAV company has raised £14.1m, across five rounds, from investors such as Downing Ventures, Newable Ventures, and Oxfordshire Investment Opportunity Network. Hummingbird develops methods for analysing imaging data on multiple spectrums, collected using drones, particularly for the agricultural sector.

Aveillant is the UK’s top-funded drone startup, having secured over £15m in equity fundraising. The company exited the private market when it was acquired by aerospace and defence company Thales Group in 2020. Aveilliant develops a 3D holographic radar that enables airports to distinguish between aircrafts and noise from wind turbine blades.

Cyberhawk offers a similar product, but has expanded this to land-based energy facilities as well. Receiving its first seed round of funding in 2010, the startup had turned a profit by the 2018 financial year, and was promptly snapped up by Magnesium Capital, a private equity firm specialising in the energy sector.

Sensat—the recipient of over £12.4m worth of risk capital—provides high-resolution imagery to businesses operating in the land and construction sectors.

Meanwhile, BioCarbon Engineering uses drones to help benefit the environment, capturing aerial photography and video for land surveys. BioCarbon identifies the type and condition of local ecosystems, and its drones are also used as an aerial, and less labour-intensive, alternative to traditional replanting efforts.

Evolve Dynamics specialise in developing mission-specific drones (and associated systems and software) for the emergency services, security, and defence sectors. The company raised a £1m equity funding round back in April 2020, to further develop its Sky Mantis range of products which is currently being used by around a quarter of UK police forces.

Top drone tech companies (software)

Incorporated in 2014, SLAMcore has raised £8.8m in funding and £559k in grants. Company filings indicate the company may be valued at around £13m. SLAMcore markets its product as “spatial intelligence software”, developing cutting edge algorithms to improve how autonomous drone technology understands and interacts with the space around them. So it’s first and foremost an AI startup, and is helping to design the software that enables drones to move by themselves, without drone pilots.

Similarly—and of particular use after the Gatwick drone incident in late 2018—Altitude Angel develops software that fits into a drone’s operating system, preventing them from entering no-fly zones, or “geofenced” areas. This helps both commercial drone users and consumer drone pilots from breaking local laws. Altitude Angel has raised £9.76m to date.

Top drone making companies (hardware)

Animal Dynamics is a spinout from the University of Oxford’s Zoology Department. Incorporated in 2015, the company was founded by Adrian Thomas, a professor of Biomechanics at Oxford University, and CEO Alex Caccia. The company hopes to transfer mechanical designs from animals into artificial machineries, such as drones or other propulsion systems.

They currently have three UAV designs which are being trialled or under development, going by the names of Skeeter, Stork, and Malolo. The company has so far raised £13.5m in equity fundraising and secured £883k in grants (from Innovate UK and the Defence and Security Accelerator). Its latest round, closed in March 2020 totaled £5.83m and valued the company at £24m.

The Skeeter model is an unmanned aerial system with flapping wings, based on the flight mechanism of a dragonfly, has been undertaken in collaboration with the Ministry of Defence. The micro-drone weighs less than 200g, and is designed for covert surveillance and surveying tasks. Skeeter also has uses in search and rescue and agriculture.

In March 2019, Animal Dynamics acquired Accelerated Dynamics, which developed software that integrates artificial intelligence with drones, to make them autonomous. Eight months later in November, Animal Dynamics was awarded further MoD funding to develop a swarm of light drones that will be able to intercept and capture hostile drones without causing them to crash out of the sky, using a peregrine-falcon attack strategy.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.