2019 is already the best year on record for UK fintech companies

Category: Uncategorized

As Beauhurst’s latest equity analysis shows, investment activity in the UK is continuing to rise after a drop in H1 2018. With nearly £4.5b invested, H1 2019 is now the best first half since 2011. 2019 is hence on track to be a record year of funding, surpassing the record setting year of 2017.

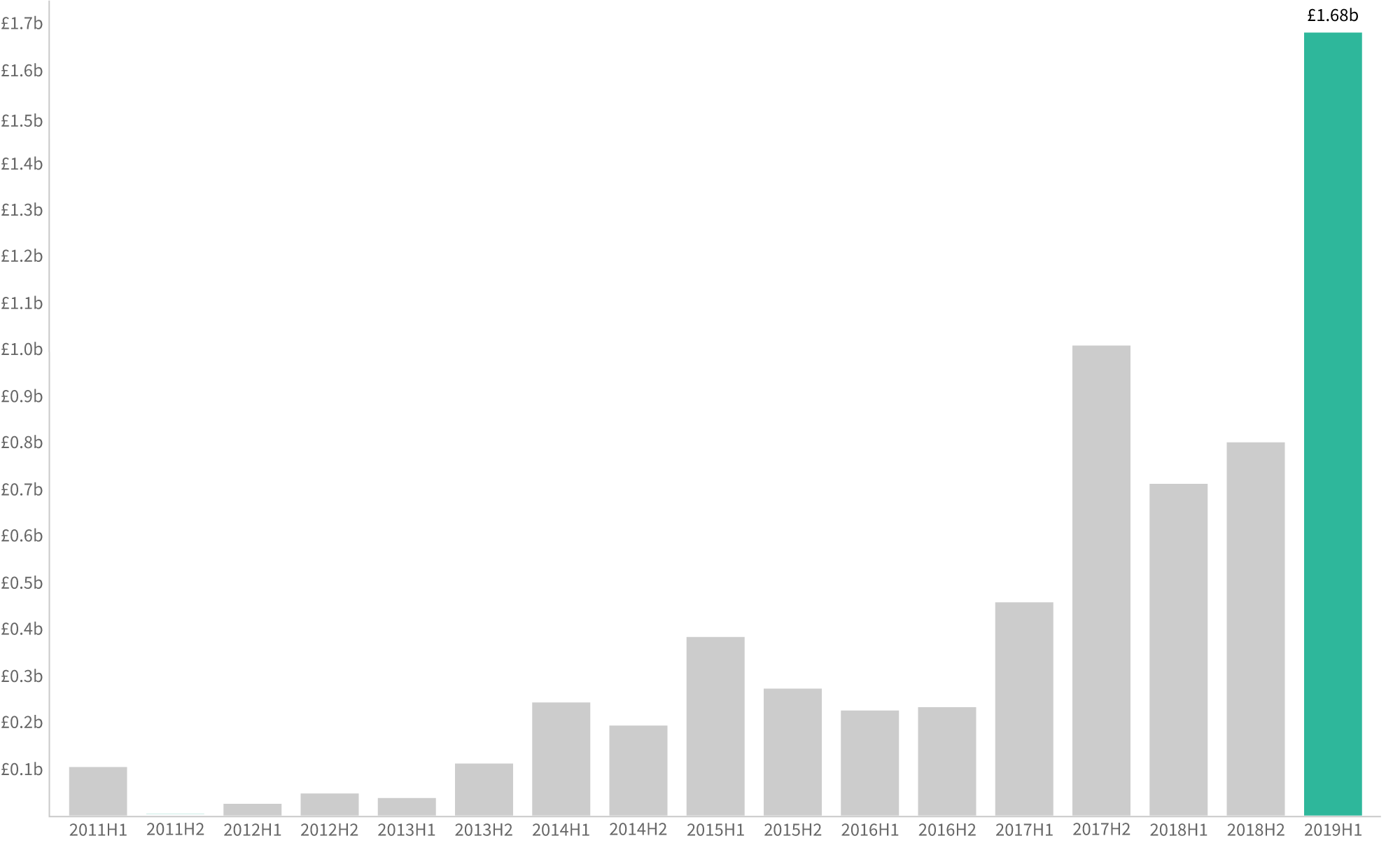

The UK’s fintech sector is responsible for £1.7b of this £4.5b – over a third. This remarkable six months of funding means 2019 is already the best funded year for fintech on record, beating the £1.5b raised in both 2017 and 2018. Clearly, exciting things are happening in the British fintech sector. In this post, we highlight the sector’s biggest events so far this year.

fintech equity funding per half since 2011

Exits of high-growth UK FinTech companies in H1 2019

Whilst no high-growth fintech companies have joined a public stock exchange through an IPO this year, 10 have so far been acquired. Two of these were for large disclosed sums.

worldfirst┃$700m

WorldFirst offers an online platform through which both businesses and personal users can exchange currency and transfer money internationally. This makes it a close competitor to businesses such as Transferwise and WorldRemit, who have received much more publicity. The reasons for this become clear when you look at WorldFirst’s funding history: the company bootstrapped its way to profitability, only taking on equity finance in its later stages of growth.

Founded in 2004 by two Citigroup bankers, WordFirst represented one of the first challengers to the industry incumbents operating in the international payment processing market. Whilst that mantle has since passed on to newer challengers, WorldFirst’s acquisition represents a sizeable exit, and a significant foreign direct investment into the UK by the Chinese payment processing giant Ant Financial (part of the Alibaba Group).

cypto facilities┃ £50m (unconfirmed)

This company operates a web-based cryptocurrency trading platform. Founded by Dr Timo Schlaefer, an ex-quantitative modeller at Goldman Sachs, this platform includes the facility for investors to invest in two relatively new phenomena: “cryptocurrency Futures” and indices. Just a few years after incorporating, this startup became the in-house cryptocurrency exchange platform for CME Group, the world’s largest exchange operator which owns exchanges for a near exhaustive list of commodity Futures. Going from launch to partnering with an international corporation in a few years is no mean feat.

The capital raised through this deal allowed the company to turn a profit by 2017. In February of this year, they were acquired by Kraken, which claims to be the world’s largest bitcoin exchange by amount traded. According to the press release in Finextra, this was Kraken’s largest acquisition to date, and one of the largest M&A deals to have taken place in the emerging “crypto industry”. Whilst the amount wasn’t announced to the press, company filings issued around the time of the acquisition suggest the company could have sold for over £50m (at the time of acquisition, Schlaefer owned a 50% stake).

Flyt┃£22m

Flyt operates a middleware mobile app that allows users in the hospitality industry to access a wide array of order management and payment processing software. Essentially, Flyt aims to bridge the gap between physical hospitality venues and relevant technology providers, in theory helping restaurants take advantage of the best technology available to them. The main use case of this technology is helping restaurant and takeaway owners access improved payment processing technology. Clients include UberEats, Just Eat, Nando’s and KFC.

Founded in 2013, Flyt undertook four funding rounds, with backers including Just Eat, TimeOut, and Entrée Capital, an international tech venture capital fund that is split between Israel, the UK and the US. In 2019 Flyt was acquired for £22m by takeaway delivery technology giant Just Eat.

UK FinTech Company megarounds in H1 2019

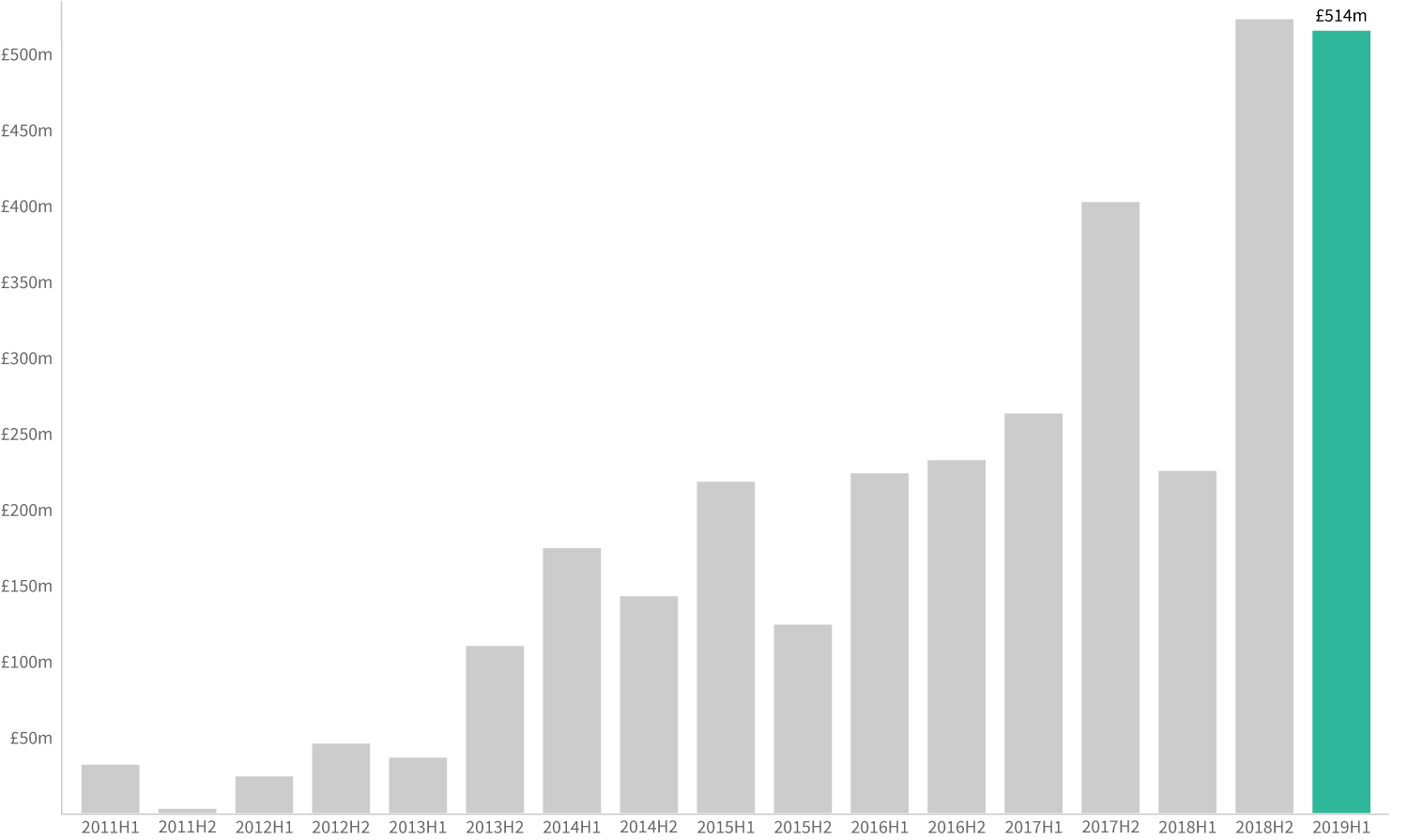

H1 2019 saw no fewer than nine fintech “megarounds” – equity finance rounds of £50m or more.

Interestingly, it seems that these nine megarounds are responsible for much of the funding boom seen by the UK’s fintech sector. If we remove these megadeals from the picture, the total funding received by the sector in H1 2019 was actually less than the figure raised in the previous half. These large rounds will continue to skew growth in the sector as they become a more permanent and frequent feature in the funding landscape. But we’re not worried about the sustainability of this just yet – even without the megadeals there is still steady and fairly consistent growth in fintech.

equity funding by fintech startups, minus megadeals

Two of H1’s megadeals were secured by the now very well-known consumer challenger banks: Monzo and Starling. Another challenger bank, OakNorth, received the largest equity investment, raising $440m from Japanese Softbank’s Vision Fund. Indeed, this is the largest funding round ever received by a European fintech company. Vision Fund is perhaps the world’s leading tech fund, and a backer of giants such as Uber and WeWork. In 2016, Softbank acquired Cambridge’s chip manufacturer Arm Holdings for £24.3b, in the largest ever investment into a European tech business.

Despite now boasting the largest fintech raise ever, OakNorth is less well-known than Monzo and Starling. Perhaps this is because it is business, rather than consumer, focussed. This new digital bank focuses on loans for small and medium-sized enterprises, joining a whole host of new companies operating in the SME lending sector, from Funding Circle to Capital on Tap.

Interestingly, the round’s press release suggests the company platform’s analytics capabilities are just as valuable as the financial service. This platform uses big data and machine learning to assess lending risks and monitor its portfolio. Known as “OakNorth Analytical Intelligence”, this software package is licensed to other banks.

Checkout.com, which provides payment processing software to retail merchants, was catapulted to unicorn status in its first ever equity finance round after bootstrapping for seven years. This is the first time a British startup has received a $1b valuation through its first funding round.

Similar to OakNorth, iwoca also operates in the SME finance market. That so many companies are emerging to provide better financial services to small and medium-sized businesses suggests the original SME lending market was suffering from poor customer experiences. According to iwoca’s marketing “the lending system just wasn’t set up for small business’.

iwoca has already done very well: between 2017 and 2018 its turnover doubled to £50m, and operating profits grew from £600k to £10m.

International remittance transfer company WorldRemit, direct debit facilitator GoCardless (founded by Monzo founder Tom Blomfield), and invoice financier MarketInvoice are other fairly well-known names to receive megarounds in H1 2019, with £138m, £58m, and £56m respectively.

The relative newcomer in this crop of fintech megarounds is DivideBuy. This company operates an add-on for a range of online retailers, allowing their users to access 0% finance when they checkout. Payment installments can be customised by users to suit their budget. In the words of co-founder Max Thowless-Reeves: “allowing retailers to offer interest free credit to their customers is conceptually simple but in practice significantly complex.” Their software is now able to link with most retail websites, and the corresponding IT estate.

DivideBuy incorporated in 2012 (before OakNorth and Monzo), and its growth has been more of a slowburn than its peers. Prior to their latest round of £60m, the company had raised less than £2m in total. That said, turnover is now growing rapidly, from under £100k in 2016 to £11m in 2018.

It will be exciting to see which other innovations the UK’s fintech sector can come up with if this golden era of expansion continues.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.