The State of UK Equity Crowdfunding

Equity crowdfunding is now a well-established method of raising capital for small businesses in the UK. In 2011, crowdfunding platforms were responsible for just eight announced equity fundraisings in the UK.

In comparison, crowdfunders facilitated an impressive 569 rounds in 2021. And whilst the number of rounds attributed to crowdfunding in 2024 (297) hit its lowest figure since 2014, this matches a wider downturn in investment activity since the 2021 global investment boom. You can read more about this in The Deal — our flagship annual investment report.

In this article, we will explore how equity crowdfunding works, the current state of the UK equity crowdfunding market, and rank the UK’s top five rounds involving crowdfunding in 2024.

Of course, if you’re a subscriber, you can access this data live on the Beauhurst platform. If not, why not take a tour of the platform?

What is equity crowdfunding?

Equity crowdfunding is a popular method of fundraising for early-stage and growth businesses, in which the public (aka the crowd) can invest in ambitious startups and scaleups.

As with other types of equity investment, investors receive an equity stake in the company in exchange for providing growth capital.

What about Kickstarter and GoFundMe?

Equity crowdfunding differs from donation or reward-based crowdfunding such as Kickstarter and GoFundMe.

On these platforms, entrepreneurs seek non-equity based backing for their business plans, as well as from loan-based crowdfunding (peer-to-peer lenders).

Take a tour

Want to see Beauhurst action? You’re in luck. Take a virtual tour of the platform and discover how we get our unbeatable data insights.

Who can invest via equity crowdfunding?

Prior to equity crowdfunding, only institutional investors and angel investors (with a high net worth and industry connections) could participate in equity rounds and profit from the UK’s fastest-growing startups.

The introduction of equity crowdfunding platforms in the early 2000s changed this, democratising investment in a sense, by providing retail investors with the opportunity to back promising private companies.

Practically anyone can take part in equity crowdfunding now thanks to online platforms like Crowdcube and Republic Europe (formerly Seedrs) — the most prominent equity crowdfunding platforms in the UK.

Individual crowdfunding platforms will determine who has access to investment opportunities, with some allowing you to invest immediately after completing a simple registration, while others require investors to pass more stringent due diligence checks.

Through these equity crowdfunding platforms, a high number of investors (often in the thousands) can participate in a single funding round. Each individual receives a small equity stake in the company in the hopes that it will eventually float on a stock market or be acquired for a large sum, thus giving them a tidy profit.

Crowdfunding regulations and tax incentives

Equity crowdfunding is well regulated in the UK, with the Financial Conduct Authority (FCA) enforcing Prospectus Rules on any deal above €5m. Equity crowdfunding platforms also have their own regulations to protect both investors and entrepreneurs, but this differs between each platform.

Crowdcube and Republic Europe (formerly Seedrs) have created questionnaires to see if parties are aware of all the risks associated with crowdfunding. Whereas SyndicateRoom required you to self-certify as an accredited investor or a high-net-worth individual. Previously an online crowdfunding platform that allowed amateur investors to co-invest alongside angels, SyndicateRoom stopped its crowdfunding offering in October 2019. It now raises capital for EIS-qualifying companies via its Access EIS fund.

EIS (The Enterprise Investment Scheme) is one of several UK Government schemes offering tax incentives to individual investors. Both EIS and SEIS (The Seed Enterprise Investment Scheme) were established to encourage early-stage investment in the UK. Equity crowdfunding offers individuals the opportunity to invest via these tax relief schemes, whilst also supporting the UK’s high-growth ecosystem.

Risks and benefits of equity crowdfunding

Any kind of investment into early-stage businesses is high-risk, and this is no different with equity crowdfunding. But there are also a number of potential benefits to equity crowdfunding for both investors and entrepreneurs.

Risks of equity crowdfunding

- No guarantee of success; it can also take several years before you see a return on your investment

- Illiquidity of equity crowdfunding investments

- There are typically platform fees for both investors and businesses

- Risk of equity dilution as companies raise further equity investment at a later stage

- Possibility of fraud, especially if platforms do not perform stringent due diligence checks

Benefits of equity crowdfunding

- Improved access to growth finance for small businesses, from a more diverse group of investors

- Potential for high ROI and early investment into future unicorn companies

- Many equity crowdfunding platforms offer support and advice throughout the investment process

- Opportunity for everyday investors to benefit from tax relief schemes like the EIS or SEIS

How has equity crowdfunding changed in the UK over time?

In keeping with wider market trends, 2021 was the best year on record for crowdfunding deal numbers, with 569 rounds announced in total. 2022 was marginally down on deal numbers with 519 deals, but since then we’ve seen the number of crowdfunding deals collapse to as few as 297 deals in 2024 — marking the lowest figure since 2014.

Investment figures tell a similar story, with exponential growth every year since 2014, peaking at 2021 (£773m), before plummeting to £324m in 2024.

When we produced our crowdfunding report in 2022, we predicted the following:

“Crowdfunding has become a central part of the UK’s high-growth ecosystem, with investments involving the crowd accounting for around 21% of deals in recent years.

Having survived the shock of the COVID-19 pandemic relatively unscathed, it will be interesting to see if this proportion changes amidst the current macroeconomic climate.

But with the cost of living climbing in the UK, we could expect crowdfunding platforms (which are reliant on individual investors) to be worse affected than institutional fund types.”The State of UK Equity Crowdfunding, 2022

Since then, the proportion of crowdfunding investments has dropped to 20% in 2024. More concerningly, the significant drop-off in investment figures in 2023 and 2024 — likely due to a combination of inflation and an increased cost of living — has meant that crowdfunding platforms are ‘feeling the pinch’ of an economy with slower growth.

How does equity crowdfunding compare to venture capital?

Crowdfunding investment takes a very different approach to that of venture capital, with smaller amounts of capital being deployed by a much larger pool of investors. As a result, the kinds of companies that receive crowdfunding also differ from those backed by VCs.

Here, we analyse every UK equity deal that saw participation from crowdfunding platforms and venture funds between 2014 and 2024, including both announced and unannounced rounds.

When we talk about “crowdfunded companies”, we mean any UK company that has successfully raised finance through an equity crowdfunding platform since 2014. The term “venture-backed businesses”, on the other hand, refers to every UK company that has raised equity finance from either a venture capital or private equity firm since 2014, where we can confirm the identity of investing funds.

In total, 2,514 UK companies secured equity crowdfunding between 2014 and 2024, across 4,254 funding rounds. Meanwhile, 6,125 companies secured venture funding in this same time period, across 23,861 rounds.

Stages of evolution

In 2024, the median round size for crowdfunding deals was £500k, considerably below the £1.72m median seen for equity deals involving private equity and venture capital firms during the same year.

This is unsurprising, given the historic prevalence of crowdfunding at the earliest stages of a company’s evolution, when they’re typically raising smaller rounds.

However, there are signs that trends in crowdfunding are changing. Since 2014, the majority of crowdfunded companies (46%) have been operating at seed stage at the time of fundraising, with venture stage companies comprising 43%. But when we analyse 2024’s data, there is a clear increase in proportion of funding rounds in more established companies, with seed companies representing 29% of crowdfunded investment rounds and venture companies representing 56%.

When analysed against private equity and venture capital’s investment (by stages of growth), the gap is closing.

In our 2022 report, our data showed that only 2% of crowdfunded companies since 2011-2021 were at later-stage (either growth or established), versus 25% of venture-backed companies. In comparison, in 2024 alone we saw that 9% of crowdfunded companies were at either growth or established stages of evolution, whilst 15% companies that received PE/VC investment were later-stage.

Target markets

Crowdfunded companies are much more likely to cater to consumers (76%) than other businesses (41%) or the public sector (5.7%). In contrast, only 40% of venture-backed companies target consumers, while 74% target businesses and 14% target the public sector.

Successful crowdfunding campaigns often draw on strong brand recognition and customer loyalty, with individuals often backing products and services that they’ve tried before. This likely explains why B2C companies more commonly seek and raise funds from the crowd than their B2B counterparts.

While technology, business and professional services and industrials are the most popular industries for both crowdfunding and venture capital investment, crowdfunded companies are more likely to operate in consumer-focused sectors. For instance, 9% currently operate in the food and drinks space, compared to just 2% of venture-backed businesses. On the other hand, 28% of venture-backed companies are in the B2B-dominated software-as-a-service (SaaS) sector, versus 11% for crowdfunded companies. Likewise, vegan and vegetarian companies make up 3% of crowdfunded companies, and just 0.9% for PE/VC companies.

Ready to upgrade your approach?

Geography

The regional distribution of companies that receive investment from crowdfunders versus venture capital and private equity funds is relatively similar. Both fund types invest predominantly into companies headquartered in London.

Between 2014 and 2024, the crowd backed 1,291 London-based businesses, representing 51% of all crowdfunded companies in the UK. In the same period, 3,282 London-based businesses secured funding from PE and VC firms, accounting for 50% of all venture-backed companies in the UK. This gap has narrowed from when we produced our report in 2022, where London accounted for 54% of crowdfunding investment and 48% of the nation’s PE/VC capital raised.

The next most popular destination for both types of equity investment is the South East—10% of crowdfunded companies and 8.1% of venture-backed companies are based in the region.

These figures are reversed in the North of England (made up of the North East, the North West and Yorkshire & The Humber). In total, just 8% of crowdfunded companies are based in the North, compared to 10% of venture-backed companies.

Progression rates

The difference between crowdfunding and venture capital is also reflected in the relatively slow progression of companies following investment from the crowd.

Our 2022 report showed that just 6% of crowdfunding rounds between 2011 and 2021 went to companies that have since exited the private market, either through an IPO or acquisition, compared to 11% of venture rounds.

Crowdfunded companies were also shown to be less likely to have progressed to later stages of evolution (18% of crowdfunding rounds versus 22% of venture rounds) and more likely to have gone under (20% versus 12%). The majority of crowdfunding deals (57%) went to businesses that have since stagnated, compared to 49% of rounds involving PE and VC firms.

The UK’s top five equity crowdfunding raises in 2024

To be included in this list, a raise must include crowdfunding as a portion of the wider raise.

05.

Watchhouse

Date of round: 1 May 2024

Equity raised: £5.82m

Established: 2014

Location: Southwark

WatchHouse is a London-based artisan coffee company. Established in 2016, it operates within the hospitality industry, managing a chain of coffee houses that cater to urban consumers. The company also runs a coffee subscription service as well as an e-commerce function that sells coffee-related goods.

The company has secured funding through multiple equity rounds. Recent fundraisings include £5.82m in May 2024, supported by Crowdcube and other investors, and £7.9m in December 2023, backed by Edition Capital and business angels. This raise was designed to continue funding its 2023 growth strategy which focused on international expansion, direct to customer growth, and launching its franchise.

04.

MishiPay

Date of round: 19 June 2024

Equity raised: £10.6m

Established: 2015

Location: Westminster

MishiPay has developed a mobile app designed to facilitate retail payments. Founded in 2015, the company operates in the application software and payment processing industries, focusing on solutions that allow customers to scan and pay for items with their smartphones, bypassing traditional checkout queues.

The company has raised significant funding through equity and grant sources. Its most recent funding round in June 2024 secured £10.6m, through Republic Europe and other investors.

MishiPay has received three R&D grants, including a £275k award from Innovate UK in December 2024. The company has also participated in accelerator programs such as Tech Nation FinTech and PwC Scale Programmes, supporting its growth and innovation in the payment technology space.

03.

Urban Jungle

Date of round: 30 April 2024

Equity raised: £1.2m

Established: 2016

Location: Hackney

Hackney-based Urban Jungle delivers insurance services tailored for urban lifestyles. Established in 2016, the company focuses on providing coverage designed for renters and sharers in cities.

The company has secured funding through a mix of private equity and angel investors. In April 2024, Urban Jungle raised £11.2m in a round backed by SyndicateRoom, Ingka Investments, Intact Ventures, Mundi Ventures, and more.

Urban Jungle has also participated in three accelerator programs including the Upscale initiative in 2021 and the Business Growth Programme in 2020, further supporting its growth and innovation in the insurance sector.

02.

Plum

Date of round: 1 May 2024

Equity raised: £12.7m

Established: 2016

Location: Islington

Plum is a fintech company based in Islington. Established in 2016, the company helps users automate saving, and manage their finances.

The company has raised substantial funds through a number channels, including a combination of private equity and crowdfunding platforms. Notable fundraisings include a £16.1m round in May 2024, with contributions from Crowdcube, Eurobank, and iGrow Venture Capital, and a £10.4m round in October 2024 through Republic Europe and other investors.

Plum has also been featured in nine high-growth lists and benefited from accelerator programs, including the Upscale initiative in 2020.

01.

Sunswap

Date of round: 11 March 2024

Equity raised: £17.3

Established: 2020

Location: Mole Valley

Sunswap, based in Leatherhead, focuses on developing zero-emission transport refrigeration systems. Established in 2020, it operates within the freight and haulage industries, aiming to deliver sustainable alternatives to traditional refrigeration methods.

The company has historically raised funds through crowdfunding platforms, as well as a wide range of private equity backers. Its fundraising in March 2024 raised a total of £17.3m, with participants including Republic Europe, Shell Ventures, BGF, Clean Growth Fund, and Sustainable Impact Capital.

Sunswap has also received four R&D grants and holds patents that support its work in clean transport technology.

Discover crowdfunding opportunities with Beauhurst

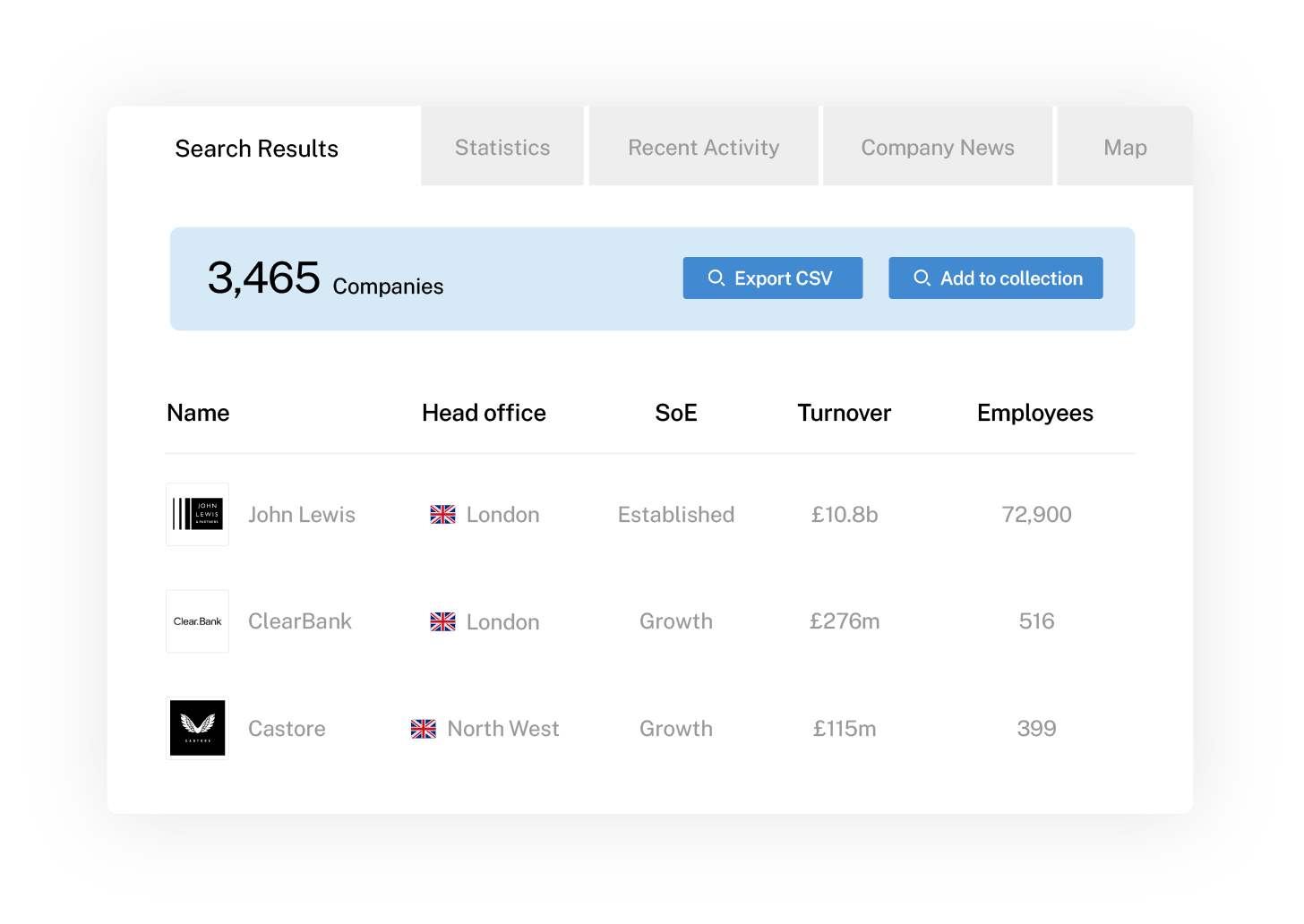

BeauhurstInvest makes it easy to identify crowdfunding opportunities across the UK and Germany. Our platform gives you access to detailed data on emerging startups and fundraising activity, helping you stay ahead in a highly competitive market.

Want to explore how Beauhurst can help you uncover your next investment? Speak to our team or book a demo today.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy