Growing Cleantech Funding

Category: Uncategorized

In March last year, we reported that levels of risk capital flowing into the UK’s cleantech sector have stalled since 2012. Whilst this is cause for some concern, venture capital forms a small part of funding in the renewable energy sector, the majority of which takes the form of asset finance for large projects, such as windfarms and large-scale solar installations. Startup funding a niche aspect of the climate finance market, and shouldn’t be taken as an indicator of the market’s overall health.

With that being said, there are viable startups looking to disrupt the UK’s energy and transport sectors with agile business models and innovative new tech, and investment into this sector seems to have risen in 2018.

This year contains some significant success stories, such as Chargemaster, an installer of electric vehicle charging points, who were acquired by BP for £130m in June. However, perhaps the most important development since our last update on the sector has been the fast-paced rise of Bulb. In June 2018 they raised a sizeable £60m in equity finance. This has boosted total levels of equity finance flowing into the UK’s high-growth sector by a fair margin.

Whilst this startup doesn’t develop new clean technology per se, it has used a web-based, data-optimised customer service to reduce costs, allowing for a green energy tariff to become competitively priced for UK consumers. As such, they are increasing the commercial demand for new clean energy generation, whilst helping UK energy customers cut their carbon footprints.

Company filings indicate they had been valued at around £350m, though other reports in the media have speculated that it was higher. This increase in its valuation suggest Bulb is on course for a $1b valuation at some point in 2019, which would make it the UK’s first “green unicorn”. Backers include equity giant DST Global, who have backed other leading unicorns such as Robinhood, Slack, and Deliveroo.

Despite this sizeable funding, levels of risk capital in the cleantech sector are still slight when compared with the UK’s other emergent sectors, such as FinTech, or AI.

The levels of funding we observe depend on how strict our definition of cleantech is. Does biofuel count as a clean technology? Growing crops for fuel production instead of food is less than desirable. Indeed, in 2016 reports were released indicating that biofuels are most likely worse for the environment than traditional fossil fuels. As such, we’ve excluded equity finance for biofuel companies from our figures.

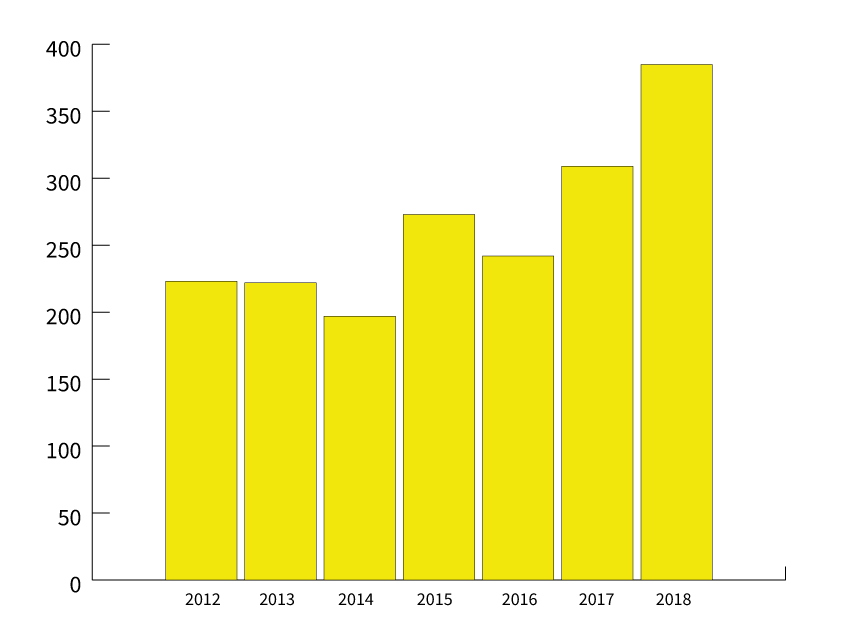

equity finance raised by cleantech startups, 2012 – 2018 (£m)

Note: our figures focus on minority stake investments only, and do not include capital raised through IPOs or acquisitions, though arguably these do constitute important forms of capital investments.

However, it is unlikely that a strong cleantech sector can be built solely on the success of Bulb. If we exclude Bulb’s financing from our figures, funding for the sector only increased slightly in 2018. Nevertheless, this still represents the best year of funding for cleantech startups, in terms of total equity finance amount.

Given the recent calls for a decarbonisation of economy, some from the very top of the UK government, one might think that risk capital in this sector would be growing with slightly more vigour. However, this sector is amongst one of the riskiest in the UK for venture capitalists and private equity firms. As we reported in June, of the UK cleantech startups that raised equity in 2011, 28%, almost a third, have now failed outright. Compare this with firms operating in the finance sector that raised finance in 2011, of which just 5% have now died.

Some of these failures have been spectacular, like that of Intelligent Energy, a developer of hydrogen fuel cells. This company IPO’d in 2014, raising £55m on a valuation of £639m. Less than two years later, the company’s share price dropped by 91% in a single day following the announcement of a failed funding round. Shortly after the company was bought for £20m by one of its shareholders Meditor (an asset management firm). Prior to its IPO, the company had raised over £120m in equity finance.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.