21 Vegan Startups Driving Growth in FoodTech

Category: Uncategorized

Thanks to a whole host of new vegan food startups, gone are the days where being meat-averse meant choosing between thai green curry and some form of mystery Quorn mince on the menu—or scouring the supermarket shelves for biscuits that are accidentally vegan (Oreos, if you’re wondering). Indeed, the UK’s food industry has been transformed by fast-growing businesses using innovative means to vegan ends. So now you can skip the sweetcorn fritters and order a Beyond Meat burger in your local Spoons instead.

From animal welfare advocates and eco-conscious consumers adopting plant-based diets, to flexitarians, meat-eaters, and everything in between, growing demand for vegan food products has significantly boosted investor interest in the space. In our recent FoodTech Report with Huckletree, we found that private vegan food companies in the UK secured £63.9m worth of equity funding in 2020—whilst in 2021, they’d already raised more than £100m by the end of Q3.

So who are these ambitious businesses? Read on for an overview of the market, plus a closer look at 21 of the UK’s most exciting vegan food and drink startups, the investors backing them, and the entrepreneurs leading them forwards.

Have you read our free analysis of UK FoodTech yet?

Vegan foodtech market overview

We’ve identified 125 active vegan foodtech companies that are high-growth and headquartered in the UK. Of these ambitious businesses, 1 in 3 have attended a UK accelerator programme, compared to 1 in 5 across the wider high-growth population. The vast majority of them have attended NatWest’s Entrepreneur Accelerator (formerly Entrepreneurial Spark), alongside several impact-focused programmes, such as Impact Central, MassChallenge and Unreasonable Impact, and sector-specific schemes like the EIT Food Accelerator (for early-stage agrifood startups).

Still a very nascent sector in the UK, vegan foodtech companies are predominantly in the seed stage of evolution (69%). In comparison, only 25% are venture-stage businesses, 5% growth-stage, and just 1% established. This means they’re mostly young companies (less than three years old) with a small number of employees and an unproven product-market fit. Meanwhile, their most common funding sources are grants, crowdfunding, and angel investment.

Between Q1 2011 and Q3 2021, we’ve tracked 237 equity deals secured by this cohort of vegan food startups, amounting to £263m in investment—just 96 of these funding rounds were announced to the press. Top backers so far include crowdfunding platforms Seedrs and Crowdcube (the food and drinks sector has always been very popular for this investor type), alongside several Scottish funds—namely Edinburgh-based angel network Equity Gap, The University of Strathclyde, and Scottish Enterprise.

Vegan meat startups

Whether you’re vegan, veggie, pesci, or cutting down your meat intake, it’s not all tofu and jackfruit these days. California-based players Impossible Foods and Beyond Meat (the latter being the most Googled vegan food brand in the world) have helped bring vegan burgers into the mainstream with their imitation meat, opening the way for similar innovations, like vegan seafood. We even saw the debut of the world’s first commercially-sold lab-grown meat in Singapore late last year, developed by US startup Eat Just.

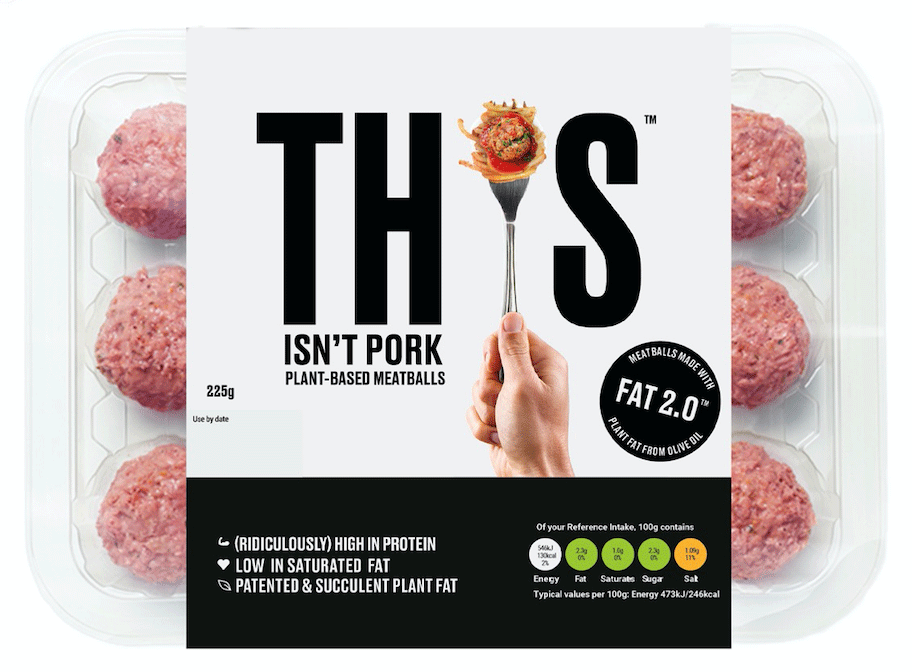

In 2019, Ipsos Global Advisor found that 50% of Brits would eat a plant-based substitute for animal meat. And the UK is ready to cater to these changing attitudes, with numerous ambitious businesses offering vegan meat (and other alt proteins). London-based THIS, for instance, produces a range of high-protein meat alternatives that are animal-free, have a longer shelf-life to reduce waste, and are packaged in 90% less plastic. THIS has secured four rounds of equity funding to date, worth a total of £20.5m, with investors including Seedcamp, Backed VC, BGF Growth Capital, and French fund Five Season Ventures. It was also awarded an Innovate UK grant in July 2021, to commercialise a plant-based egg substitute with the University of Leeds.

Meanwhile, ENOUGH develops mycoprotein, a sustainable protein made from fungi (also used in Quorn) which vegan brands and retailers can then use to produce plant-based meat. Based in Glasgow (which is hosting the COP26 climate conference next month), the cleantech startup was spun out of the University of Strathclyde in 2016, by co-founders Jim Laird, Craig Johnston, and David Ritchie. It has since gone on to raise £44.9m in equity investment, and been awarded £2.69m worth of large innovation grants. The Meatless Farm Company is also a big player in this space, producing its own plant-based mince, burgers and sausages and with £35.6m of equity investment under its belt.

Then there’s Better Nature, which is transforming the tempeh fermentation process to produce protein-packed vegan products, like kebab strips, rashers and BBQ ‘ribz’. Backed by early-stage tech and impact VC Ascension, the startup has so far raised £2.37m worth of equity investment, across three funding rounds. Similarly, York-based VFC produces vegan fried chicken, made from deep-fried wheat flour (seitan). Founded in late 2020, VFC has already raised £2.5m in equity funding from Veg Capital, Johnson Resolutions, and various angel investors.

Vegan drinks startups

Of course, vegan startups and scaleups aren’t just fostering innovation in the UK, with Swedish oat milk producer Oatly becoming a huge player in this space. In 2020, the unicorn company raised $200m in fresh funding, with investors including Blackstone Group, Oprah Winfrey, Jay-Z, and Howard Schultz. Despite the controversy surrounding its (failed) trademark battle against a small, family-run farm earlier this year, Oatly continues to dominate the alt-milk market. The vegan giant IPO’d on the Nasdaq back in May, raising more than $1.4b, at a $10b valuation.

But there are several UK-based companies throwing their hat in the ring, offering alternative milk products of their own. Co-founded by lactose-intolerant brothers Tom and Nick Watkins, Mighty produces pea milk (or pea drink, m*lk, m.lk, not-milk, juice—whatever you want to call it). Since launching in 2018, the Leeds-based company has already grown to 5k stores, across 12 countries. Likewise, Minor Figures produces barista-style oat milks and cold-brew vegan coffees out of its carbon neutral microbrewery in London.

But UK startups are offering alternatives to a whole host of drinks that are traditionally made with animal products, not just milk. HUN Wines, for instance, sells fair-trade, vegan wines in recyclable cans—many alcoholic drinks are not vegan, due to the use of animal-derived ingredients like gelatine, isinglass (from fish), casein (from cow’s milk) or albumin (from egg whites) in the filtering process. Founded in 2019, HUN Wines has raised £1.05m in equity investment so far, across two funding rounds.

Vegan cheese startups

Do you grimace at the thought of sprinkling nutritional yeast on top of your pasta? Us too. Fortunately, considerable progress has been made in the vegan cheese market in recent years. One vegan business making headway is Kinda Co. Founded in 2017 by Ellie Brown, based out of her flat in Angel, the company has since expanded to a commercial-sized kitchen in North Somerset. Kinda Co currently produces 12 different varieties of dairy-free cheese, including cheddar and mozzarella style (or ‘Mozzarellie’), made from nuts and other plant-based ingredients mimicking dairy products.

Vegan supplements startups

Another popular area of the vegan foodtech industry is health and fitness supplements. One fast-growing startup in this space is Merseyside-based Vegums, which makes gummy vitamins for plant-based diets (including fish-free omega-3), in biodegradable, reusable and recyclable packaging. Vegums secured £308k in equity funding via Seedrs earlier this year. Also designed for vegan diets are the energy bars produced by Human Food, a Welsh startup focused on high-quality, wholefood nutrition.

Nutri-Genetix, headquartered in Brighton, develops vegan protein shakes that are personalised to an individual’s DNA, using a swab test. Since launching in 2017, the company has secured £464k worth of equity investment, across two funding rounds, both facilitated by Crowdcube. It also attended the Entrepreneur Accelerator programme from 2018 to 2019.

And you’ve likely heard of Huel, which produces vegan meal replacement powders (designed to be nutritionally-complete), as well as flavour pouches, snack bars, and ready meals. Founded by Julian Hearn and James Collier, the Hertfordshire-based company has received £21m in equity funding to date, and been named on several high-growth lists, including the Fast Track 100.

Vegan chocolate startups

Take a quick wander down the free-from aisle, and you’ll be spoiled for choice for vegan chocolate. The long list of companies operating in this space include Edinburgh-based Fellow Creatures, which has raised £550k for its creamy plant-based chocolate bars. Located in West Sussex, Conscious Chocolate also produces vegan chocolate but with a greater focus on health, offering raw cacao bars that are also soy, refined sugar and gluten-free (much like fellow vegan chocolatier Enjoy). Over the past decade, Conscious Chocolate has secured £956k in equity investment, across four funding rounds.

But it’s not just chocolate startups making a splash in the world of vegan desserts, with many companies now offering plant-based cakes, ice cream and cookies as well. Supergood! is one such business, producing vegan, gluten-free baking mixes and ready-made treats. Launched in 2017, by co-founders Tetiana Vynokurova and Ksenia Tkacheva, Supergood! has raised £310k in equity investment so far, across three funding rounds.

Vegan food subscription startups

Bringing together these innovations in vegan foodtech are the subscription startups setting out to make it easier for consumers to eat plant-based meals. Most notably, allplants provides a subscription service for vegan ready meals, offering everything from aubergine parmigiana to ‘chicken’ tikka masala and saag paneer. Founded in 2016 by brothers Jonathan and Alex Petrides, allplants has since gone on to raise £16.1m in equity fundraisings, across five rounds—investors include Felix Capital, Octopus Ventures, and Seedrs. In 2018, the sustainability-led company also became a certified B Corp.

Fellow B Corp TYME has a similar business model, offering a range of ready-to-eat vegan meals through weekly subscription boxes. Having attended Founders’s six-month accelerator programme in 2020, TYME went on to secure its first round of equity (worth £229k) in February this year. The Brook also operates a vegan food delivery service, boasting restaurant-quality menus, and has secured three rounds of equity funding so far, worth £796k in total.

Meanwhile, Staffordshire-based Grubby provides a subscription service for plant-based recipe kits. Initially delivering to office pick-up points, the company set up their eco-bike home delivery service during the pandemic. Grubby has so far raised £1.15m in equity funding, from funds including Access EIS (managed by SyndicateRoom) and Crowdcube. It was also awarded a £98.4k grant from Innovate UK in 2020, to develop the world’s first recipe kit vending machine for public spaces.

Everything you need to know about the UK’s FoodTech market—all for free.