Top investor types: what does an average deal look like?

Category: Uncategorized

Equity investment is a critical form of financial support for companies throughout their growth trajectory. Introducing the top seven types of equity investors, the first blog in this series looked at the market share of announced equity deals that each type is involved in, and how these proportions have changed over time. Combined, these top seven investor types backed 74% of all announced equity deals in 2018. In this second edition, we inspect these investments and the companies that received them further, looking at average deal sizes and the typical profile of investee companies. These varied sources of equity investment provide a range of funding options for high-growth companies, which can be tailored to their capital needs at that moment in time.

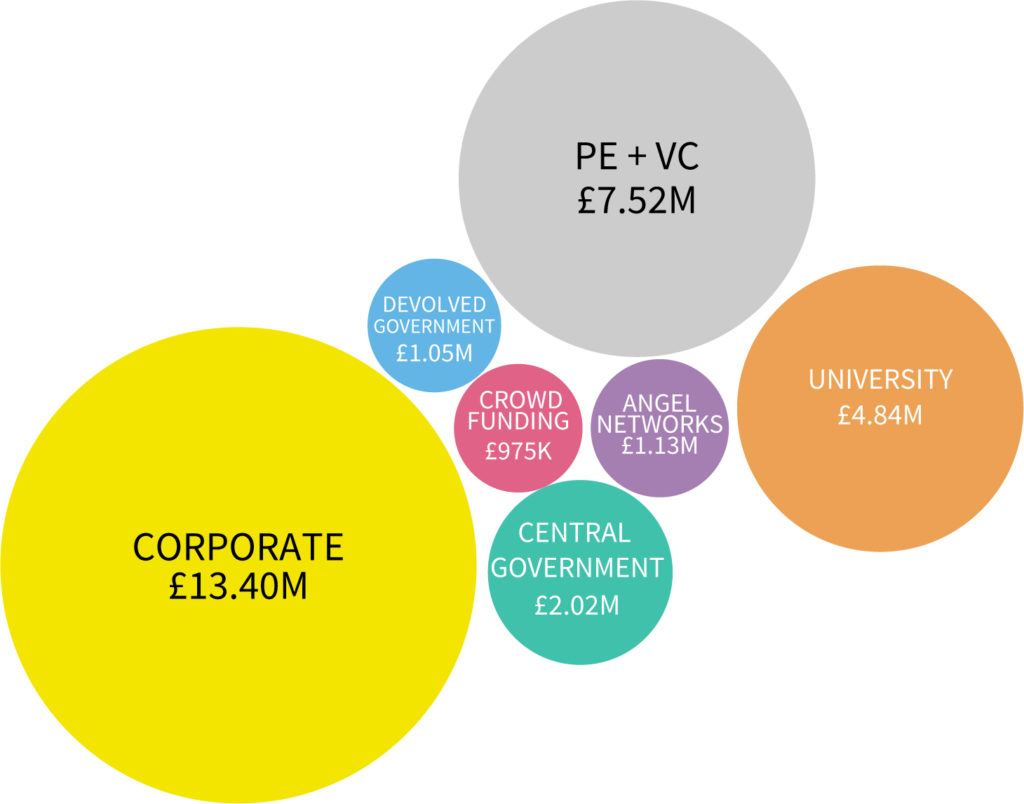

Average deal size for announced equity deals (2018)

Average deal size indicates the typical size of a round that an investor participates in. The precise amount each investor has contributed is rarely disclosed, but this aggregate data sheds light on the stages and rounds that a type of fund is most likely to get involved in.

Corporate investors are involved in some huge equity deals, with an average deal size of £13.4m, far above that of the cross-investor average of £5.4m. An example of a typical deal is that made by the capital arm of Amadeus IT Group, Amadeus Ventures, who participated in a $14.1m funding round held by CrowdVision – a company that develops software to monitor the size and distribution of crowds of people. However, mega-deals can hugely inflate this average. Graphcore’s £158m fundraising, backed by 14 investors including the venture investment arms of Microsoft, Bosch and Dell, inflates the average deal size for Corporate investors by more than £2 million. However, even when mega-deals are excluded, Corporate funds still exhibit the largest average deal size by a significant amount (£7.84m compared to Private Equity and Venture Capital funds’ £5.12M).

Alongside these giant deals, corporates are also involved in much smaller deals; indeed, this investor type showed the largest range of deal sizes in 2018. For example, CogBooks, a company who develops an online adaptive learning platform, held a £90k round partly backed by DC Thomson Ventures. UK Steel Enterprise also backed a £100k round held by Micropore Technologies, who are intending to take their membrane emulsification process through from laboratory to full-scale manufacture.

While the average deal size of Private Equity and Venture Capital firms is just 56% of that of Corporate investors, it is significantly larger than the cross-investor average of £4.85m. This above-average deal size is probably a reflection of the prolific activity of these investors; few equity deals occur in the UK without a PE or VC firm’s involvement. Since 2011, 10.7% of deals worth less than £100k were backed by PE or VC firms, while 67.6% of deals totally £5m-£10m had backing from these investors. The larger the deal, the more likely one of these investor types will throw their hat into the ring.

University investors support their spinout businesses during their early stages of development by supplying smaller slices of equity investment. Hence, the average deal size is 64% of the average for Private Equity and Venture Capital funds. A typical deal in 2018 may look like that secured by QKine; the company had a capital injection of £550k from the University of Cambridge Enterprise Fund and business angels, to help further their development of treatments that stimulate regenerative cell growth.

However, there are high costs involved in developing cutting-edge intellectual property and commercialising it. Many spinouts are pharmaceutical companies, which have very high upfront costs associated with product development and licensing. To bring in the financial fuel necessary for these activities, University funds often co-invest alongside other investors such as Private Equity firms, as these institutional investors can commit larger chunks of capital. Spinouts saw a large number of large deals in 2018, and this is reflected in the average deal size for University funds. For example, Freeline Therapeutics, a company that develops and commercialises gene therapies to treat or prevent diseases related to bleeding disorders, secured £88.4m in equity from Syncona Partners and the UCL Technology Fund. These large investments can skew the average deal size of the University funds that also backed these deals.

Central and Devolved Government investments tend to focus on small- to medium-sized companies within their specified regions, and this is reflected in their smaller average deal sizes. Equity investment is only one aspect of varied support that government bodies provide to small ambitious companies. Grants are also a key funding source for growing companies, and an important aspect of the government’s strategy for encouraging enterprise across the UK. The overlap of these different funding strategies and resources is demonstrated by the fact that 39% of the equity deals made by devolved government funds in 2018 were into companies that have also secured a large innovation grant.

As angel networks aggregate the private wealth of individuals, the deals led by these syndicates do not reach the heady sizes of corporate funds or private equity houses. These smaller injections of capital make angel networks and investors an important source of capital for early stage companies. However, the £1.13m average hides a wide range of deal sizes that have had the backing of angel networks, from £20k funding rounds (such as Dymag’s funding round backed by Envestors) to a £6.16m deal (secured by Cloudhouse, within which 24Haymarket contributed £292k.)

When investing in these smaller deals, Angel networks can benefit from EIS and SEIS tax relief schemes, which are only applicable to investments made into companies that have raised less than £12m and £150k, respectively. These initiatives works to mitigate some of risk that comes with investing in early stage companies. Read a recent blog post of ours that describes the state of the EIS and SEIS investment market here.

Crowd funding platforms are vital small capital providers in the high-growth ecosystem. The extensive flexibility they provide to companies, allowing them to raise as much as they need, from either a small number or potentially thousands of individual investors, means that crowd funds can support much smaller funding rounds than other investors, who make deals and commit capital on behalf of large institutions. The average deal size backed by crowd funding platforms has been climbing; from £546k in 2016 and £866k in 2017 to £975k in 2018. But for now, they supply the small, but far from insignificant, chunks of investment for companies at their earliest and most vulnerable stages.

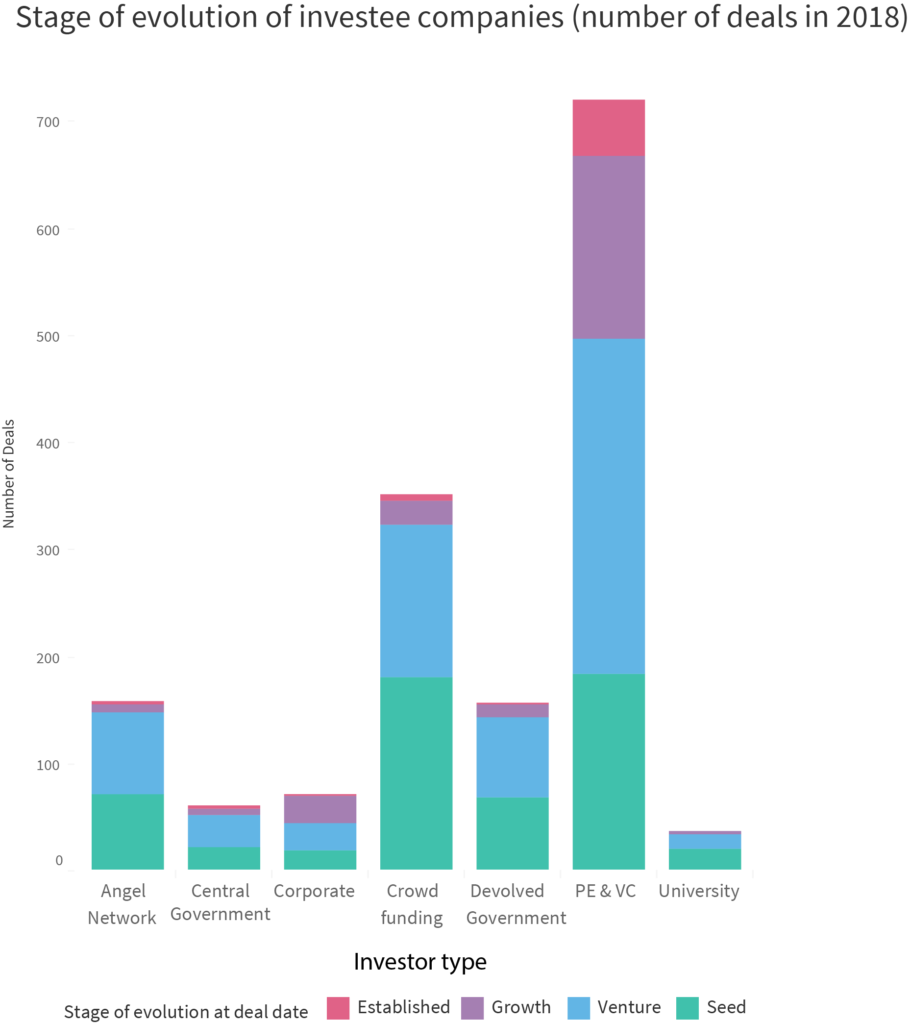

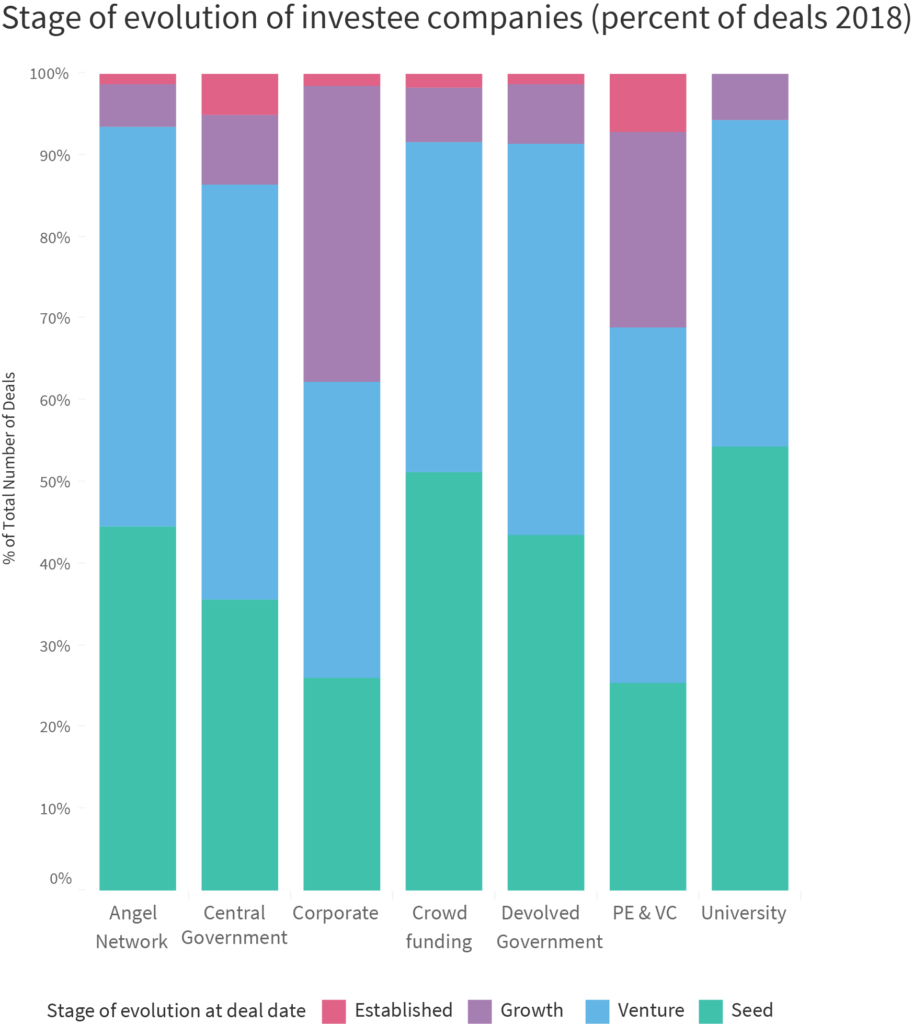

Stage of Evolution

Closely related to the average size of an investor type’s funding round, is the stage of evolution of the investee company at the deal date. The investor type with the highest proportion of seed-stage deals were University funds, followed by Crowd funding platforms. University investments are primarily funnelled into their respective spin-out companies whilst in their early stages (83% of investments made by university funds were into spinouts in 2018). This financial support facilitates the commercialisation of pioneering intellectual property, which includes demonstrating a proof of concept, as well as building a company brand.

For non-spinout companies, this initial support has to come from alternative sources. Crowd funding platforms and angel networks can step in here, supplying smaller chunks of equity investment for companies at their earliest stages. Angel networks sometimes provide mentorship and guidance to their portfolio companies, especially if individual angels are in the same or adjacent industries. In this way, they can provide crucial non-financial support to young companies that commercialisation and technology transfer offices deliver at academic institutions.

Government bodies and Angel Networks have made the largest proportion of deals investing into Venture stage companies. These companies are those that have established a revenue stream, have gained regulatory approval for their business idea, and have begun to raise capital into the millions. This stage of evolution is in fact the most popular stage for all investor types, except crowd funding and university funds. Venture stage companies combine the excitement and innovation of a new business idea, as well as the potential for huge returns on investment, with reduced risk when compared to seed stage businesses.

Corporate investors make most of their deals into either Venture or Growth stage businesses, while Private Equity and Venture Capital firms had the largest share of investments made into Established companies. Established companies are likely to have multiple (often worldwide) offices, be a household name, and have a lot of traction; these characteristics makes their future growth more reliable and, consequentially, any ROI on investment. Companies in the later stages of development can make great use of equity investment, often holding a lot of potential for further growth and return on investment; yet, only 24% of Established companies have utilised this form of financial support. While Established-stage companies secured the smallest number of publicly announced equity deals (93) in 2018, these deals averaged the second largest in amount raised (avg. £12.4m), after funding rounds held by Growth stage companies (avg. £17.2m). This data suggests that there could be opportunity for equity investors to further fuel renewed growth and success of Britain’s more mature companies.

Next in the series...

While this blog has discussed the distinctions that appear between investor types at the forensic level of the average deal, the next blog will assess the diversity at a macro scale. Building a picture of the differentiated geographical activity and sectoral preferences of the investor types, the next edition will explore the strategies of investors, and unexplored areas.