Top 10 UK Healthtech Companies | 2025

John McCrea, 23 January 2025

UK-based healthtech companies have been on a steady growth trajectory over the past decade, with the number of active companies growing from 107 in 2014, to as many as 465 in 2024.

Investment over time is where the figures begin to tell a particularly interesting story. The 2010s saw a healthy growth trajectory for healthtech companies, both in number of investments and the amount raised. However, since the COVID-19 pandemic, investment has soared, with 2024 seeing a record £795m raised by UK healthtech companies.

The impact of the pandemic has resulted in an acceleration of digital healthcare services — from booking vaccination appointments online to virtual GP appointments. And this blend of in-person and online services is proving to be a vital tool for easing pressures on public and private healthcare providers.

In this article, we’ll explore precisely what healthtech is, and how it could impact our healthcare systems both now and in the future. We’ll also rank the UK’s top 10 healthcare technology companies in order of total investment raised to date.

What is healthtech and how does it differ from medtech?

Healthtech is the use of technology — including databases, applications, and wearables — to improve the delivery, payment, and consumption of care. It also enhances the ability to develop and commercialise medicinal products.

Simply put, healthtech includes software, data, and other tech-enabled solutions that support healthcare. This means a primary focus on preventative care and personal health management.

Meanwhile, medical technology (or medtech) companies tend to enhance in-hospital diagnostics and treatment through technologies like innovative medical devices. Medtech products are typically used in clinical settings and generally require far more rigorous regulatory approval from the MHRA before they can enter the market.

While both fields play a vital role in advancing healthcare, focus and application is what typically sets them apart. You can learn more about the UK’s top medtech companies and their investors here.

Methodology

To be included in this list of healthtech companies, companies must:

- Be headquartered in the UK.

- Have received equity funding.

- Not be listed as ‘Dissolved’ on Companies House.

- Be operating in the ‘Life sciences and medical technology’ Beauhurst industry classification.

- Be classified with any of the following Beauhurst buzzwords: ‘Application software’, ‘Artificial Intelligence’, ‘Big data’, ‘Cloud computing’, ‘Internet of Things’, ‘Mobile apps,’ and ‘Software-as-a-Service’ (SaaS).

We’ve then excluded companies that would meet our definition of ‘medtech’, and ranked the remaining companies by their total equity funds raised.

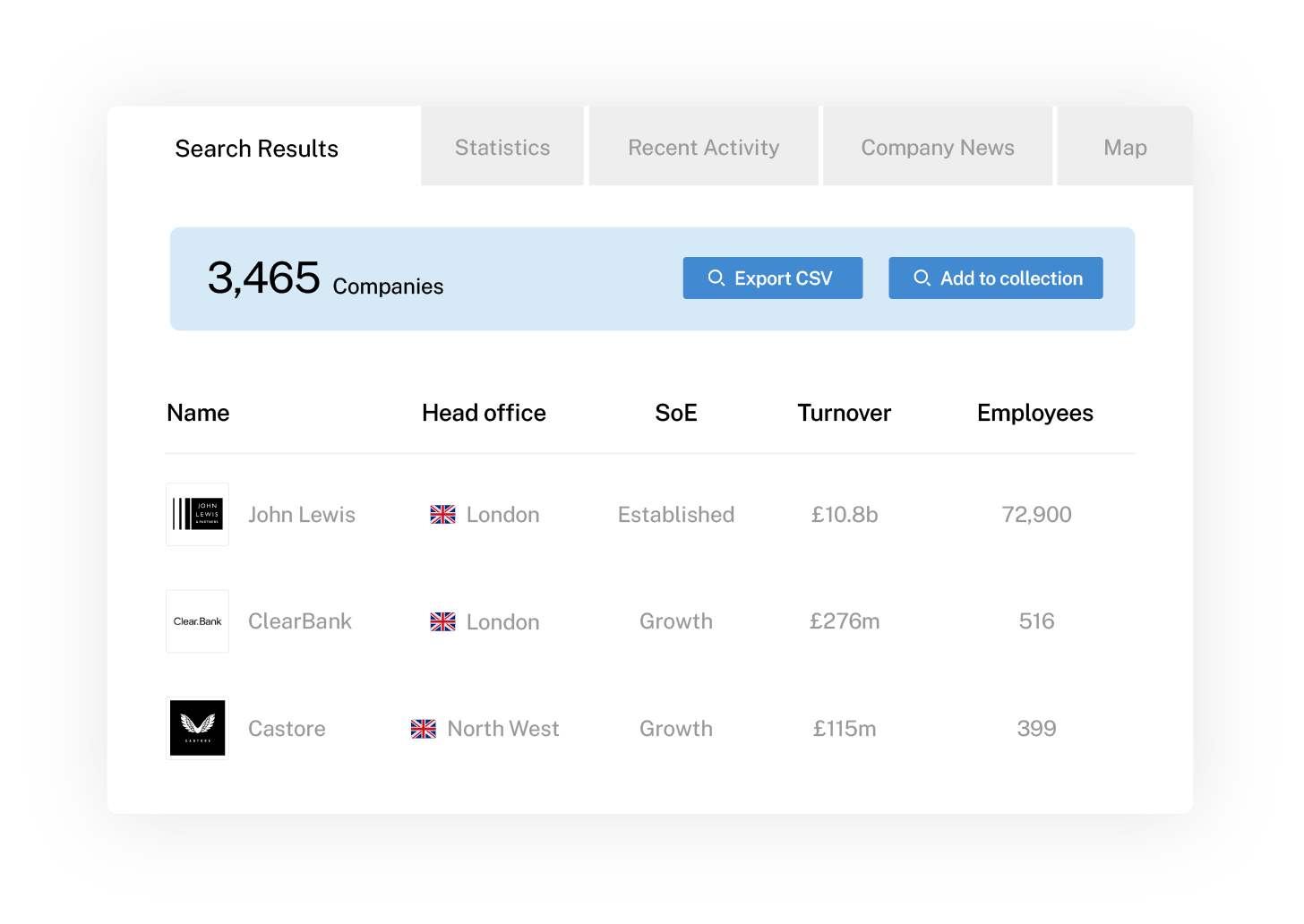

And if you’re a Beauhurst subscriber, you can try this search for yourself.

All data for this article was taken from the Beauhurst platform, and is accurate as of 20 January 2025.

Take a tour

The UK’s top 10 healthtech companies in 2025

10.

Healthily

Total equity raised: £51.0m

Established: 2013

Location: Bournemouth

Healthily, also trading as Your.MD, has developed a mobile app that enables individuals and healthcare providers to monitor health issues via a machine learning symptom checker.

Founded in 2013, Healthily focuses on preventative care, with the aim of reducing unnecessary visits to healthcare professionals such as A&E or the GP surgery. The company has raised £51.0m, with Smedvig Capital and Reckitt Benckiser involved in multiple rounds.

09.

Lifebit

Total equity raised: £52.1m

Established: 2017

Location: City of London

Lifebit operates a cloud-based platform designed to enable researchers to work with sensitive health and genetic data directly where it is stored. It also uses AI to track diseases, discover new medicines, and analyse real-world health data, in accordance with privacy regulations

The London-based AI healthtech company has appeared on four high-growth lists — including BusinessCloud’s MedTech 50 2022 cohort — and has raised £52.1m in equity, as well as being awarded £27.8k worth of grants from InnovateUK.

08.

Current Health

Total equity raised: £54.0m

Established: 2014

Location: Edinburgh

Current Health is an Edinburgh-based healthtech company founded in 2014. The company specialises in remote patient monitoring and care-at-home solutions. Combining wearable devices with artificial intelligence, its products track vital signs and deliver actionable insights for healthcare providers.

Its platform enables clinicians to monitor patients’ health remotely, enabling early intervention and reducing hospital admissions. To date, the company has raised £54.0m in equity funding.

07.

Numan

Total equity raised: £56.6m

Established: 2018

Location: Camden

Numan is a healthtech company based in Camden, London, established in 2018. The company provides digital healthcare services focusing primarily on men’s health. It also offers personalised treatment plans and consultations through a proprietary platform.

The company has raised £56.6m in total funding, acquired Sweden-based AI healthtech company Vi-Health, and appeared on five high-growth lists. Numan’s latest £30m raise in 2022 has enabled the team to scale up development, headcount, and expand internationally.

06.

Causaly

Total equity raised: £62.2m

Established: 2018

Location: Camden

Causaly has developed AI-based software designed to analyse large datasets for biomedical scientists and researchers. One of the younger healthtech companies to make our list, Causaly uses its technology to help identify genes present in diseases, which can assist with subsequent clinical drug development.

With £62.2m raised across four rounds, participants in the Camden healthtech company’s latest round of funding include Pentech Ventures, Index Ventures, and Greece-based Marathon Venture Capital.

05.

e-therapeutics

Total equity raised: £76.8m

Established: 2001

Location: Westminster

The oldest company on our list, e-therapeutics offers a radically different approach to clinical drug development. Using a combination of computational power and biological data, the company accelerates drug development and treatments for complex diseases, including cancer.

A spinout from Newcastle University, e-therapeutics completed an IPO on the Alternative Investment Market (AIM) in 2007. In 2024, the company went private again, raising £19.7m to begin funding further development of its platform by integrating AI systems.

04.

ZOE

Total equity raised: £89.9m

Established: 2017

Location: Lambeth

Established in 2017 and based in Lambeth, ZOE specialises in personalised nutrition. Using machine learning and biological data — including genomics and microbiome analysis — its app provides tailored dietary recommendations to users, with the aim of improving individual health outcomes.

ZOE has raised £89.9m across multiple funding rounds, with recent investments including a £11.7m fundraising in July 2024, backed by US-based fund Coefficient Capital. The company was featured on Deloitte’s Fast 50 high-growth list in 2024 and holds six patents in the United States for its innovative approaches to personalised health.

03.

Healx

Total equity raised: £90.3m

Established: 2014

Location: Cambridge

Founded in 2014 and based in Cambridge, Healx is a University of Cambridge spinout that develops AI-driven platforms for drug discovery, focusing on treatments for rare diseases. The company leverages machine learning to analyse disease-compound relationships, expediting the identification of potential therapies.

Healx has raised £90.3m across five funding rounds, including a £34.5m investment in August 2024 backed by Atomico, Balderton Capital, and a number of other venture capital investors, taking the company to third on our list.

02.

BenevolentAI

Total equity raised: £253m

Established: 2013

Location: Camden

Founded in 2013 and headquartered in Camden, BenevolentAI develops AI tools to accelerate drug discovery by analysing scientific data at scale. Like many other healthtech companies on this list, BenevolentAI uses these insights to focus on identifying novel drug targets and advancing precision medicine.

BenevolentAI has raised £253m across multiple funding rounds, including an £88.7m raise in 2019 and a subsequent £44.9m in 2020. In April 2022, the company was acquired by Odyssey Acquisition, and has since gone on to become a 10% scaleup.

01.

Exscientia

Total equity raised: £300m

Established: 2012

Location: Dundee

Dundee-based Exscientia tops our list with £300m raised across seven rounds and over £5.40m awarded in grants.

The company, which was established in 2012, uses artificial intelligence to design and prioritise small molecule drugs for clinical development. It then predicts their potency and effects, providing indications of which molecules are most likely to make successful drugs.

The team at Exscientia have been exceptionally busy in recent years, making two strategic acquisitions — including Allcyte in 2021 — and completed a £226m IPO on the NASDAQ Stock Market in 2021.

The future of UK healthtech companies

In June 2022, the Department of Health and Social Care shared a policy paper for their plan for digital health and social care. The paper outlines how advances were made during the COVID-19 pandemic, such as the huge increase in the number of people using the NHS App (32 million), will help push forward the digitalisation of the UK’s healthcare industry.

Digitalisation will include cloud-based records, robotic automation, the use of machine learning algorithms in decision making, and digital self-help, diagnostics and therapies.

And in January 2025, the UK government expanded upon this with an announcement of an acceleration in tech and AI adoption across the NHS and wider public services in the form of “Humphrey” — a suite of AI tools designed to streamline services, improve data sharing, and reduce costly reliance on consultants.

The combination of rising private investment and wider government commitment to AI and tech adoption in the healthcare system signals a positive future for companies operating in healthtech. And for the government to reach its targets, this will require continued innovation from the private sector.

Working with Beauhurst

Discover even more insights into healthtech companies across the UK and Germany. The Beauhurst company data platform enables you to be among the first to find the next generation of industry-leading businesses — as soon as they show growth potential.

With our data, you can analyse market trends, download charts, and export the information you need to make finding the next hot companies effortless. And with up-to-the-minute data and industry-leading insights, we make finding new companies simple.

To see the platform in action, simply book a tour of the platform using the form below or, if you’re short on time, try one of our online platform demos.