Trends in Startup Job Functions: Where Are All the Finance Directors?

Category: Uncategorized

Hiring for a startup is no easy task. Early employees are incredibly influential over the future growth and culture of a business, and building a talented team with a shared vision could be the difference between success and failure—no pressure then.

Finance functions are a particularly important asset to any business. According to EmergeOne, bringing in a Chief Financial Office (CFO) or Finance Director (FD), whether part of full-time, may be the difference between running out of money today or giving yourself the runway you need to get to your next milestone.

But Beauhurst data shows that this function is heavily undervalued. In this article, we’ve looked at what proportion of fast-growing companies have hired senior finance executives, and how that changes across different stages of growth, target markets and regions. And perhaps most telling is the relationship between turnover figures and senior staff functions…

So why the scarcity of senior finance executives amongst the UK’s high-growth space? It’s certainly becoming more popular to outsource costly functions like this, but it seems outdated attitudes towards finance may also be at play. We’ve asked Aarish Shah ,CEO of EmergeOne—which offers scalable in-house solutions to help early-stage ventures build their finance stack—why startups seem so hesitant to make such an investment in their growth.

Methodology

At Beauhurst, we collect data on 30,000+ high-growth companies in the UK, from the smallest startup to market-leading businesses with hundreds of employees. As part of this, we track key people at all of these firms, including their gender, job title, job function, and business networks, allowing our subscribers to search across any of these criteria to find certain people, or identify companies with or without certain positions.

But the range of job titles used at startups can make it challenging to find what function people actually perform (we’re talking about you, Chief Unicorn and Head of Fun). To make the search process easier for our users, our data team created a classification algorithm for job functions, with simple categories like ‘Sales/BD’, ‘Finance’ and ‘Legal’. Since July 2020, subscribers with access to our Networks add-on have been able to filter by job function in the platform’s Advanced Search.

We’ve implemented 32 job themes so far, some more popular than others. For example, almost every company has someone operating in a strategy function (as you would hope and expect, no one wants to board a ship without a captain). But other functions are less popular, and some to a surprising extent. Financial and legal employees, for example, appear to be few and far between in the startup world.

There are a few things to point out here. We only collect data on executive decision makers, that means C-suite employees, heads of departments, presidents and directors. Some companies will have more junior staff working in these functions, but they’ll only be accounted for if there is a senior employee in that category, such as a CFO or Finance Director.

Other companies may outsource some of their functions. This is a particularly popular choice for startups, who often have limited staff and may rely on graduate talent. Outsourcing legals is especially common, as they may only be required on an ad-hoc basis, and would require significant funds to bring in-house. These numbers are thus indicative of how many companies see these functions as central to their operation.

The data on startup finance directors

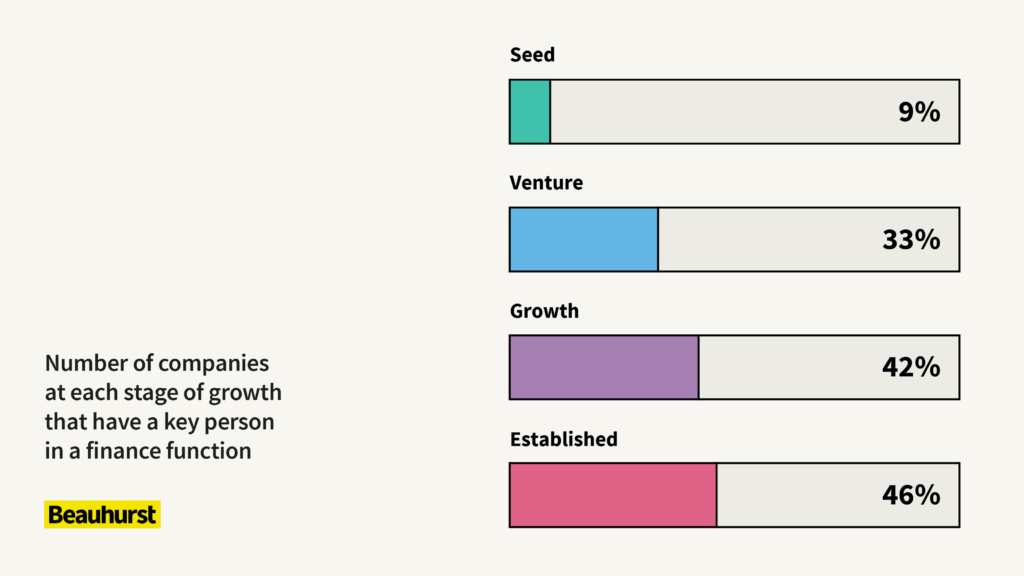

Firstly, it’s clear that few early-stage companies see finance roles as essential. Just one in ten seed-stage startups (young ventures with small teams, low levels of investments and uncertain product-market fit) have a key person in a finance function. This increases to just under a third by the venture stage, and then increases at a slower rate through growth and established stages.

So what may be going on here? According to Shah, this is down to one key factor:

“For early-stage ventures and especially for first-time founders who’ve never had the benefit of a great CFO, the finance function is all too often seen as a cost instead of an investment.”

And there’s a lot contributing to this attitude: “maybe they think it’s going to be too expensive, or they think that they aren’t big enough, or even that bringing on a startup CFO will just entail taking on a huge amount of processes that the company simply isn’t ready for yet”.

There may well be some truth to that, because a good-quality CFO certainly appears expensive, starting upwards of £100k. That appears even greater when you’re used to drawing on graduate talent pools, and don’t fully understand the value of the role.

“Today’s CFOs aren’t just there to say ‘no’ to spend, they work on building revenue, optimising the structure and using data to drive decisions into the future, rather than just reporting what’s already happened.”

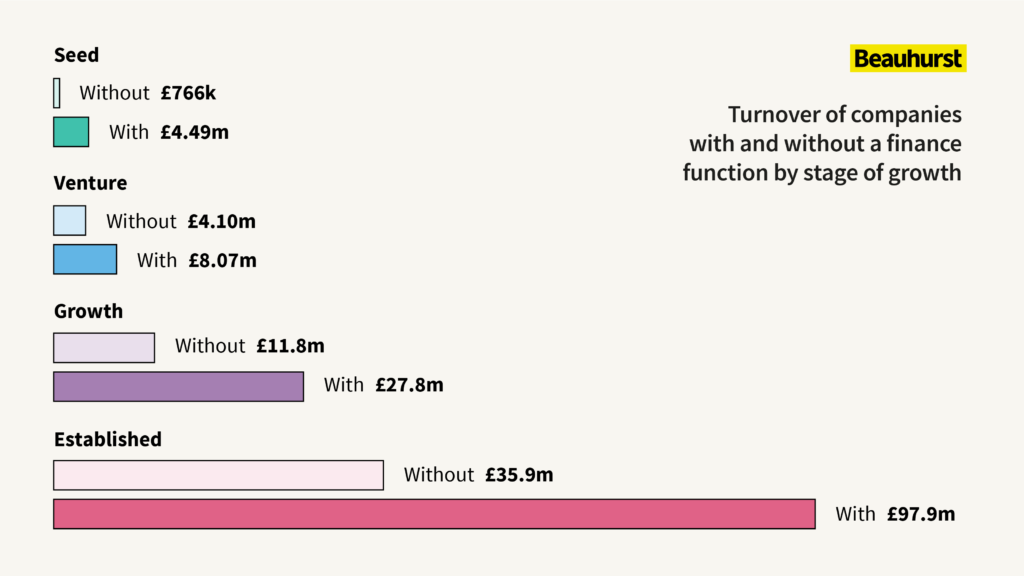

This becomes very clear when we compare the average turnover of startups with and without a CFO function.

Those companies that have made a senior finance hire have significantly higher average turnover than those that don’t. Of course, there’s an obvious causation issue here. We don’t know whether senior finance hires have driven this turnover, or whether companies with greater turnover are simply more likely to make a senior finance hire because there’s more to manage. It seems likely that it’s a combination of the two.

Drawing on his own experience, Shah says that “As a CFO, a large part of my role is commercial, I work with the CCO to ensure that we are driving the business towards the sort of revenue targets that we need to achieve our plans. But not only that, I’m inputting to the pricing strategy, the product mix as well as the overall commercial strategy because ultimately, as CFO, I have visibility over almost the whole business in a way that others simply don’t”.

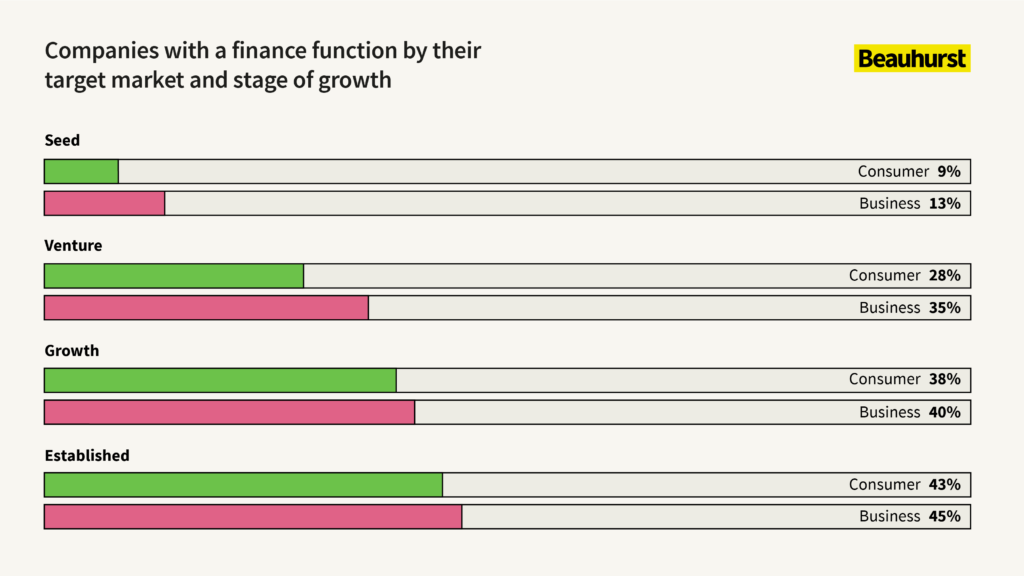

For some businesses, this seems a no-brainer from the very beginning. Certain sectors are more likely to have finance directors, such as fintech and banking, of course. But there are also discrepancies across target markets. Our data shows that companies catering towards consumers are less likely to have a senior finance function across every stage of evolution that those that serve other businesses.

According to Shah, this discrepancy is at least partly attributable to the level of rigour with which buyers will assess the company.

“B2B businesses are often dealing with sophisticated, well-structured and established businesses. As a scrappy startup or scaling venture, you need to have someone on the team that can help bridge the gap between the sophistication of a mature client business and the often loosely-structured nature of a growth business. That means putting in processes that can help you scale, developing systems that help identify when things are moving, like identifying revenue churn or understanding how acquisition costs drive revenue.”

“Consumer businesses are slightly more forgiving because an individual can make a decision quickly and without having to refer to anyone else, they don’t necessarily need to know what’s going on inside your business. But when you’re selling to other businesses and especially if you’re selling something critical to their functioning then they need comfort around what’s going on inside. A strong CFO can act as a good source of comfort!”

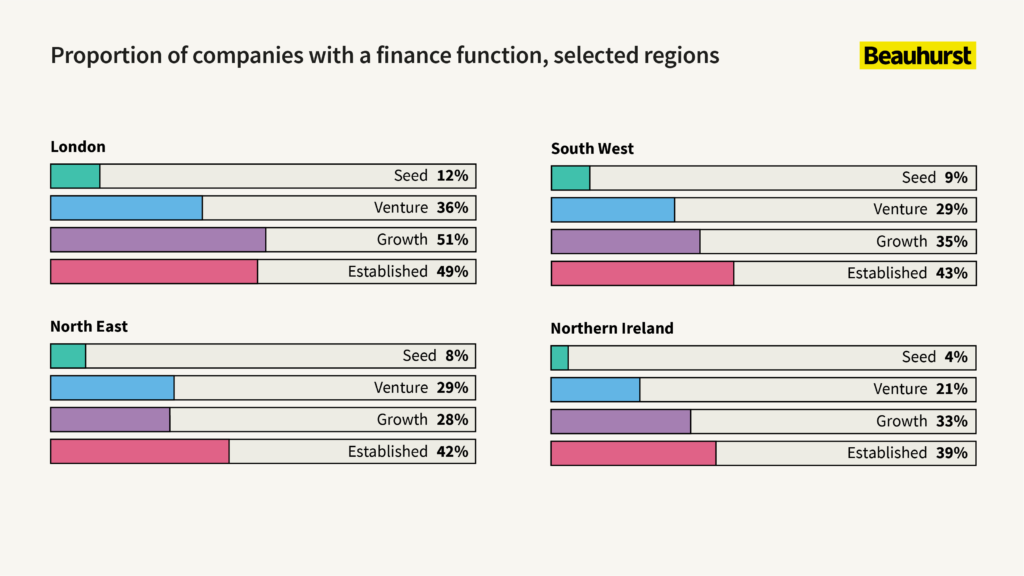

And it’s interesting to note discrepancies across the country, too. Across every stage of evolution, companies based in London are almost always more likely to have a senior finance function than those based in other UK regions. Perhaps this shows an issue with access to talent, with full time CFOs more available in the Capital than elsewhere. Or perhaps it illustrates a different attitude to finance. Northern Ireland, in particular, has a very low proportion of high-growth companies with a senior finance function.

The risk of ignoring the finance function

So what are these startups risking by waiting to bring on a CFO, or in some cases not bringing one on at all?

“CFO’s usually have a tonne of experience under their belt, which will allow them to pick up on simple things that can be fixed quickly, like looking at how to optimise revenue or margins, where to invest in headcount or how to provide the data that drives decisions.”

“They also know what to look for when negotiating, whether that’s with suppliers, employees or (and for most ventures this is the crucial one) with potential investors. Importantly, they’ll assess how much money the business actually needs to raise, who it should come from and how much equity the company should sell.”

“And a great CFO won’t just look at the economics, they’ll look at the control too: have you given up a board seat you didn’t need to, are there pre-emptions or preferences snuck in to the term sheet that could derail you down the track?”

Whilst the outright cost of an experienced senior finance hire may be a little eye-watering for a young startup, the potential payoff is huge, and there are less costly options out there. Hiring a part-time CFO or FD, for example, may allow for a slightly lower initial investment, whilst still gaining the long term benefits, which could be critical to the future success of the business.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.