Startup and high-growth investments at 3-year low

Category: Uncategorized

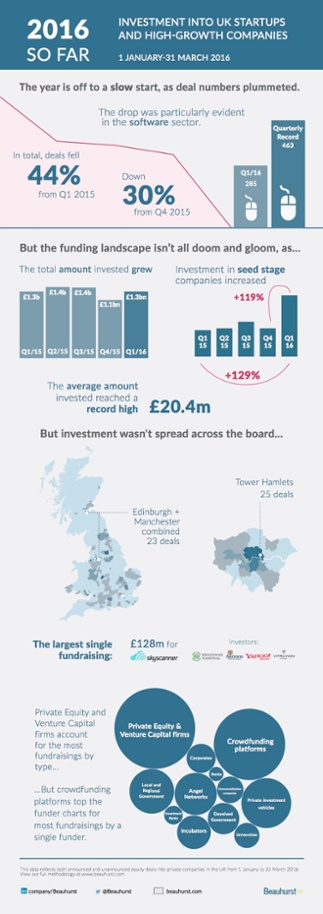

We have just released our latest version of The Deal, our review of investment in the UK’s startups and high-growth companies since the beginning of 2016, and the data shows the future is unclear for startup investment in the UK. Total deal numbers continue to fall heavily, but there are still signs of health, with the average investment size reaching record levels.

The key points at a glance:

The total number of UK equity investment deals into private companies fell 30% in Q1 2016 compared with the last quarter in 2015.

The drop was particularly evident in the software sector, with only 285 deals, compared to the quarterly record of 463.

The total amount invested in the quarter grew slightly to above £1bn, and saw the largest average investment size on record: £20.4m.

Continuing a growing trend, two crowdfunding platforms topped the charts for the most individual deals. But even crowdfunding was not immune from the slump in deal numbers, with a 25% drop from Q4/15.

The London Borough of Tower Hamlets saw more deals than the whole of Edinburgh and Manchester combined.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.