The data on UK startup accelerators

Category: Uncategorized

Update: See our new report on every accelerator in the UK here.

What are accelerators?

Accelerators are programmes that seek to help startups grow. In that, they’re similar to startup incubators: both can provide office space, access to professional networks, mentoring, legal advice, workshops, and similar facilities.

But there are also a few things that set accelerators apart. In order to be classified as an accelerator according to Beauhurst, the programme must:

- Take place in the UK

- Be aimed at early-stage companies (or entrepreneurs that will become a team by the end)

- Have a fixed programme length (usually 3-6 months – longer than this and a programme starts to look more like an incubator)

- Involve competitive selection

- Provide investment or investment opportunities (e.g. a demo day)

- Involve an educational element, e.g mentoring

We’re careful in our definition because we treat accelerator attendance as a sign of likely growth, and want to ensure that the companies featured on the Beauhurst platform are ambitious and scalable.

How do programmes differ?

Accelerator programmes tend to specialise according to the interests of those who founded them. Climate-KIC, for instance, was founded by an EU body to concentrate on environmentally-minded growth, and now accelerates cleantech startups. Pi Labs is a mentor-led proptech accelerator, and is sponsored by BOSA Properties (amongst others). Wayra is the accelerator arm of telecommunications company Telefónica, which accelerates young firms partly in the hope of one day acquiring them.

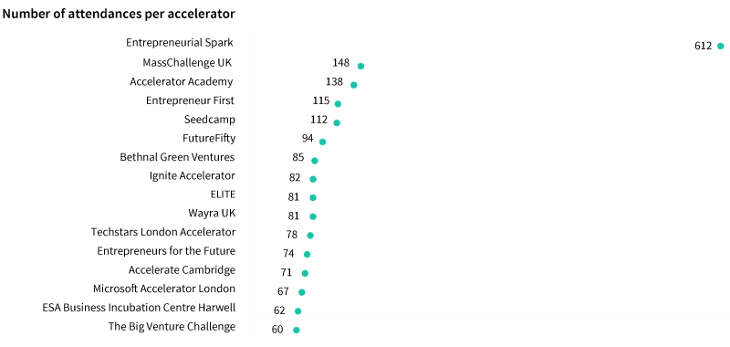

Below are the top accelerators by number of attendances.

What does the data say?

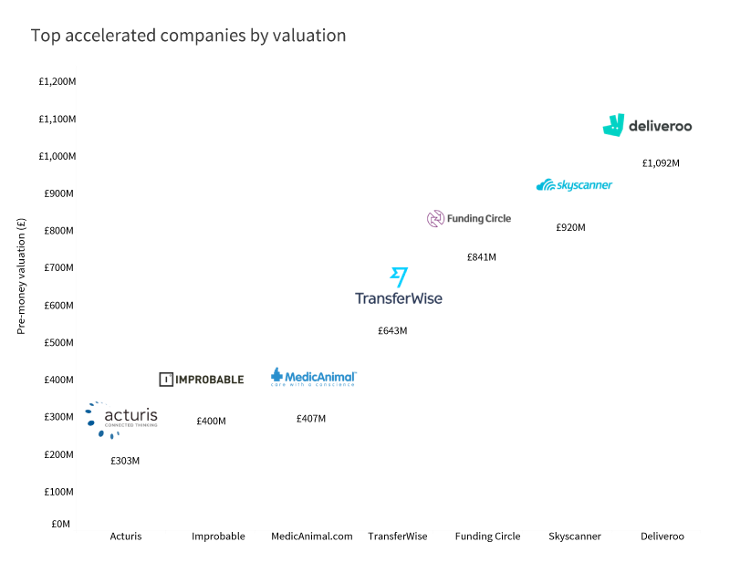

In the UK, 100 accelerators are currently active. Our platform tells us that almost 1,500 companies have participated in their programmes – including household names like Deliveroo, Funding Circle, FarFetch (FutureFifty) and Improbable (Upscale).

The majority of accelerated companies (41.9%) are tech-based, with almost 25% in business and professional services. The death rate is 10%, a little lower than the average for equity-backed companies (taken from the five-year progress of companies that raised in 2011).

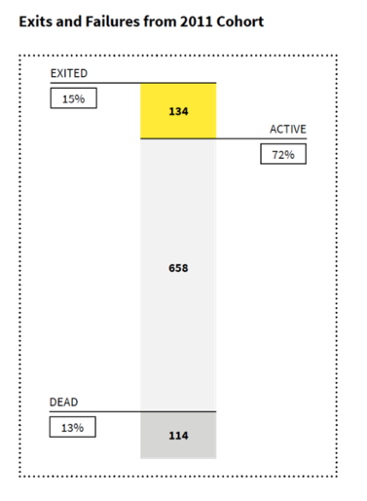

But only 3% of accelerated companies have exited thus far, whereas for the 2011 cohort we found that an average of 15% of equity-backed companies proceeded to IPO or be acquired (see right).

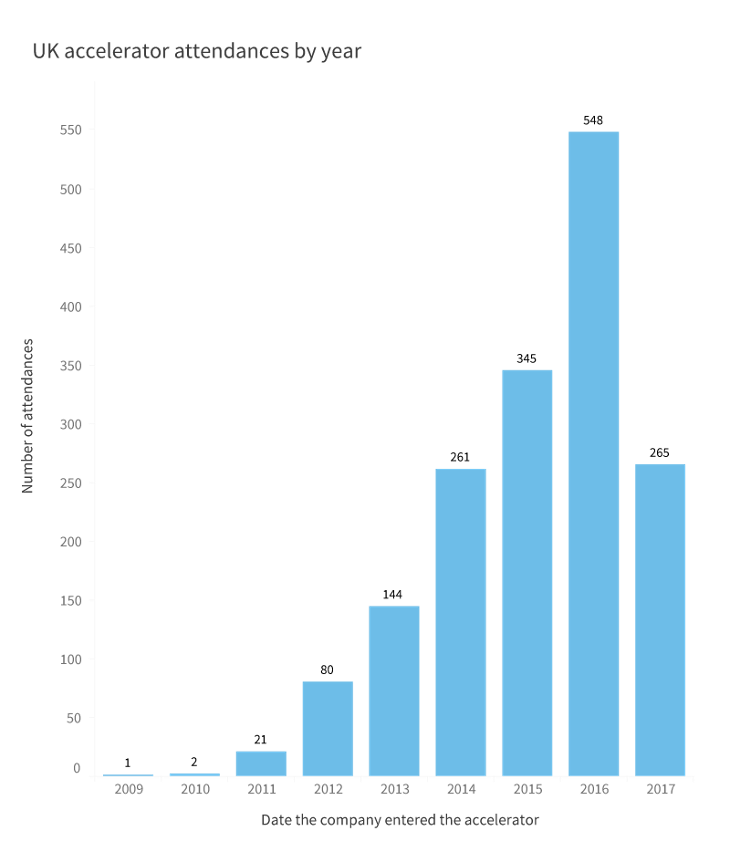

We shouldn’t be surprised by the low percentage, however. Between 2009-2015 there were 854 attendances, compared to 813 in 2016-17 alone (with two months of this year remaining).

Even if accelerators do make companies more likely to exit, many attendances were so recent that companies have not had time since in which to do so. The keen reader will also note that this means they haven’t yet had time in which to die after leaving the accelerator.

Because we define accelerators as having competitive entry requirements, it’s also possible that the programmes do not create winners so much as pick strong companies to participate – companies which might well have gone on to succeed anyway.

There’s no definitive answer here, but either way: we’re confident that accelerator attendance is correlated with high growth, to the extend that we’ve chosen it as a trigger for including companies on our platform.

Indeed, the average valuation (where calculable) for an accelerated company is £11.9m, compared to £6.32m for the average non-accelerated company on Beauhurst.

Below are some of the most highly-valued accelerator participants.