Are Healthy Snack Startups Still Interesting For Investors?

Category: Uncategorized

Snacking is big business. The 156 snacking startups Beauhurst tracks provide us with plenty of food for thought: they range from gluten-free giant Genius to personalised snack delivery company Graze. The UK’s appetite for alternative snacks has been steadily growing, bringing exciting new food and health innovators into our kitchens. Boosted by growing demand for convenient and healthy snacks, we can now refuel on avocado desserts, fruit & vegetable crisps or raw vegan snacks.

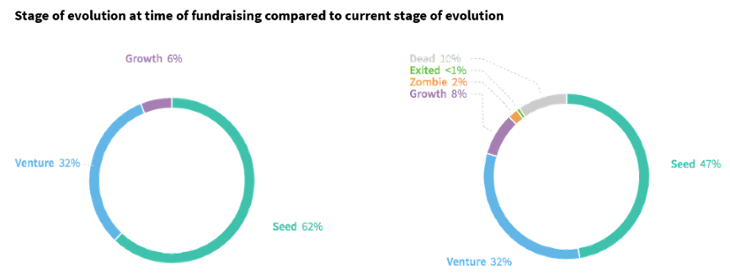

The majority (62%)of fundraisings into this sector have occurred at companies’ seed stages. Private equity and venture capital funds are by far the largest backers of this sector, followed equally by local or regional government and angel networks. Currently, almost half of these companies are at seed-stage, with fewer than 1% having exited. Over the last five years there has been a total of £138m invested into UK snacking startups, with an average raise of £462k.

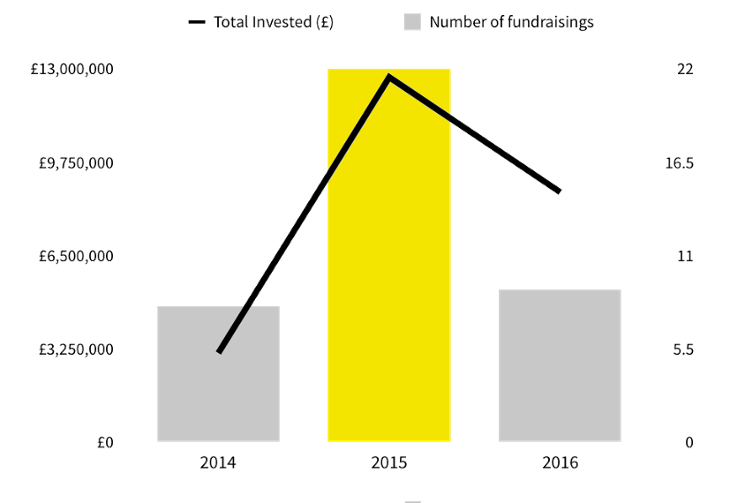

Food delivery services are widely seen as a growing sector; they cater to our busy lifestyles and desire to have meals designed for us by nutritionists. However, whilst investments in these kitchen-to-door startups were very much flavour of the month a few years ago, appetites may have soured or market saturation reached, with little evidence of new delivery services replacing traditional snack and fresh food shopping. The amount of equity investment into UK private food and snack delivery companies increased by over 300% from 2014 to 2015, but this went on to fall by about 30% in 2016. The same trend can be seen in the number of deals during the period:

Genius Foods, a producer of gluten-free foods, has raised the most by a significant margin of all private snack-related companies in the UK, receiving a total amount of investment almost four times that of the next largest (Propercorn). Since 2009, Genius has raised £26.8m through five fundraisings, the most recent of which was £10m in April 2014. Over their eight-and-a-half-year journey they have also acquired two companies; a Scottish bakery, and a pie manufacturer.

With Easter on the horizon, we’ve selected the chocolate industry as a snacking sub-sector to spotlight. In recent years, the chocolate industry has seen the emergence of increasingly artisanal chocolate and confectionary producers. Consumer preference for high-quality, ‘boutique’ chocolate that acknowledges health and sustainability in the product and its supply chain has flourished.

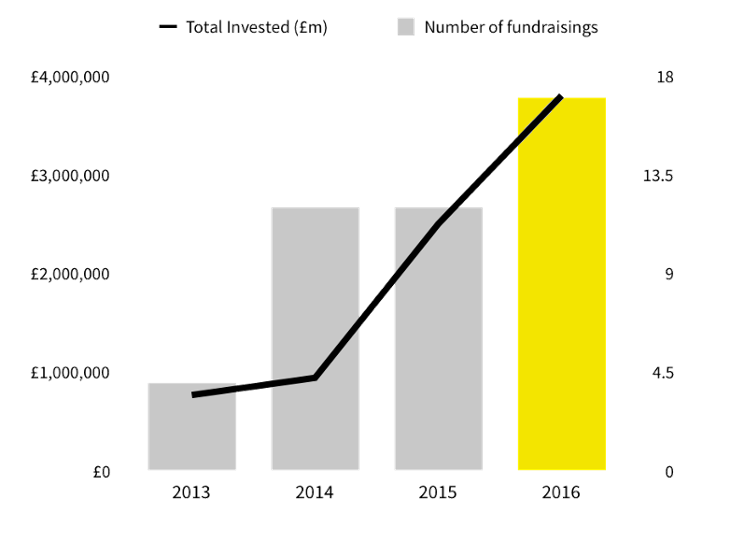

Indeed, there have been 51 equity deals into private chocolate and confectionary companies in the UK since 2011. As might be expected with a boutique product, the recipients are predominantly small or early-stage companies, with 76% of all fundraisings at seed-stage and the remaining at venture-stage. Crowdcube and Seedrs backed the largest number of companies and also invested the greatest amount; between them investing almost £2.5m into this sector. The number and value of fundraisings has grown year-on-year from 2013 through 2016:

Interestingly, none of these chocolate and confectionary companies has yet exited or progressed to growth-stage, but 12% have since died (including 2 firms that focused on mail order and delivery of their chocolate, ByPost and Yucoco). But why might it be that chocolate start-ups, whilst occupying a broadly similar niche to snacks discussed above, do not exhibit the post-2015 fall in investment seen in the sector as a whole?

It is worth noting that rather than competing directly with the large players such as Mars and Nestlé, these start-ups have carved a niche in offering a high-quality premium product for which demand is much less elastic (buyers know that they are purchasing luxury, and expect to pay accordingly). They are thus less vulnerable to the margin-squeezing increases in the global price of cocoa, and the depreciation of the pound that plagues the cheaper chocolate producers. But the question of why equity deal numbers and amounts have not fallen remains.

Deal spotlight

Doisy & Dam is a seed-stage chocolate company, producing ‘superfood-infused’ chocolates since March 2012. The company has received a £5k grant from Innovate UK under its Emerging and Enabling mandate.

In terms of equity, Doisy & Dam has raised a total of £640k over three separate fundraisings, the most recent of which was £177k in February 2017. Backed by Crowdcube, the company’s pre-money valuation at the time was £1.9m.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.