Silicon Valley investment into British tech reaches record highs

Category: Uncategorized

In partnership with global law firm Penningtons Manches, Beauhurst recently produced a ground-breaking report on the investment dynamics between Britain and the investment firms of the United States. The results were fascinating, revealing that investment from the West Coast of the US into British tech has increased to record levels over the past eight years.

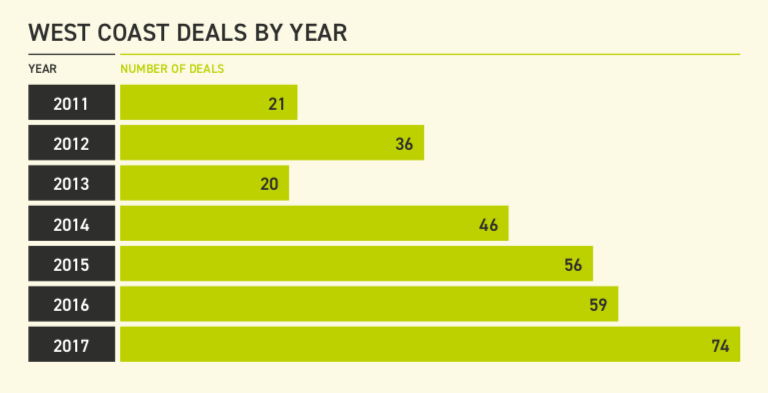

Indeed, since 2011 the numbers of deals backed by West Coast investors (which are dominated by Silicon Valley firms) has grown by 252%. In 2017, West Coast investors were involved in 74 deals with UK companies, totalling £1b in value and representing around 5% of all announced deal numbers into independent UK startups and scaleups that year. This is up from 59 deals in 2016, and 21 in 2011.

The UK’s software-based companies are the most popular destination for Silicon Valley investment, and have received £2.2b of funding from these firms since 2011. Life science companies were the next most invested in, taking £472m over the same period.

San Francisco-based 500 Startups was the most prolific US investor in terms of number of deals completed, making eight investments into UK companies in 2017. Matt Lerner, a partner at the firm, said “the UK has an abundance of talent, lots of companies accessing global markets – or Europe at a minimum – and its fintech and healthtech innovation is ahead of the Valley.” They were closely followed by Partech Ventures, which made six investments into UK-based companies in 2017 and GV (the corporate venturing arm of Google), which made five.

In interviews with US investors, researchers at Penningtons Manches ranked the top five reasons why they were interested in British tech:

East Coast vs West Coast

Whilst East Coast investors have been less prolific than their West Coast counterparts, they still play an important role in funding elements of Britain’s high-growth sector. Investors from New York and Boston were slightly less interested in software companies, but invested much more than West Coast investors in Britain’s life science sector. This matches up with the specialties of the two areas – Silicon Valley is known as the software capital of the world, whilst Boston on the East Coast is probably the world’s leading hub for life science and biotech research.

From the Golden Gate to the Golden Triangle

One of the most interesting things we discovered whilst producing this report was the geographical end-point of this US funding. Between 2011 and 2017, 79% of American investment went to companies located in the so-called “Golden Triangle”. This refers to an area in the Southeast England focussed around the universities of London, Oxford and Cambridge, which rank amongst the best-respected in the world.

In 2017, this region received a record breaking £2.1b through deals which involved US (not just West Coast) investors, a 64% increase on the year before.

One of the trends we are seeing which contributed to this sizeable increase is the rise in megadeals worth £50m or more. 29 of these deals were completed by Golden Triangle companies in 2017, 10 of which (about a third) were backed by US investors.

This increase in West Coast investment could well be part of a broader picture, which is seeing the UK’s tech scene become more respected and attractive on the international stage.

You can read the full report here.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.