Returns on startup investing

Category: Uncategorized

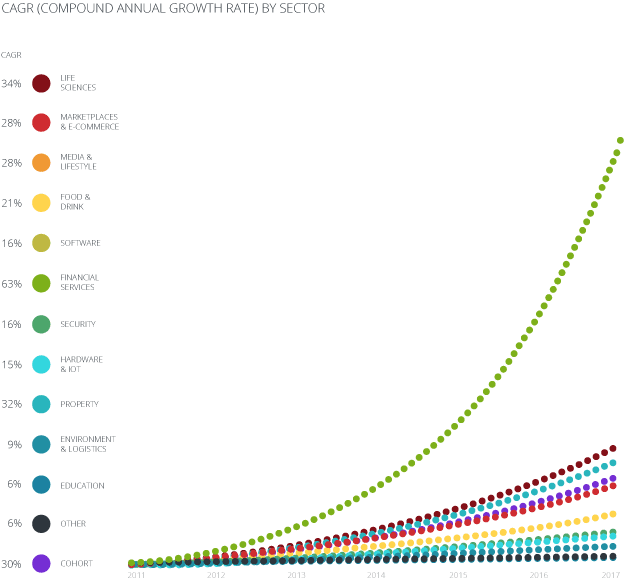

Last year, SyndicateRoom commissioned Beauhurst research to look at startup investing, tracking a cohort of companies that raised seed or venture funding in 2011 through to where they are now. We’ve partnered with them again on their latest report, Early Stage Equities: A Long Term Study, and repeated the research on the same cohort of companies.

Main findings

On average, the companies increased in value at a rate of 30% per year.

If you had invested £10,000 into this cohort of companies in 2011, your investment would now be worth £63,848.

As an EIS-qualifying investor, you would have received net cash returns of £23,745 and still have £38,294 invested.

Thanks to EIS relief, the failures (14% of the companies), would only have cost you £341.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.