Could Releasing Equity Investment Make Europe Safer?

It is rare for a niche industry conference to dominate global headlines, but the recent Munich Security Conference may be an exception. During the event US Vice President J.D. Vance scolded European leaders for relying too heavily on American military might and claimed Europe needs to ‘step up in a big way to provide for its own defence’. His speech was met by a war of words from many European capitals, but it has set alarm bells off across the continent. And they may have reason to worry.

Are we spending enough on defence?

Commenting at the time, MD One Managing Partner Will McManners was right to suggest that ‘whilst the US have long made clear their position regarding European NATO expenditure; the abrupt manner of delivery, within the backdrop of a highly concerning state of European security, has placed the message at the forefront of the market’.

But European leaders might be looking at the wrong solutions. Despite the Trumpian rhetoric and calls for NATO members to increase defence spending to 5% of GDP, Europe’s weak spot is not capital spending but rather procurement.

Together the EU and UK combined are second only to the US in global defence spending, with a budget significantly larger than Russia’s. Although spending is high, European countries have also struggled to quickly replace depleted weapon stockpiles and deliver on their arms commitments to Ukraine.

This is a problem which afflicts all of Europe. A report by the UK’s House of Commons Defence Select Committee found the British Army ran out of ammunition eight days into a US wargaming exercise. Former Belgian commander Marc Thys has claimed Europe’s defence industry needs between ‘five to seven years’ to deliver at scale and serve as an effective deterrent.

UK Defence Tech 2024

European defence firms are struggling to attract investment

Part of the problem is cultural, but it is also procedural. Defence spending remains controversial in some European countries after the Cold War — especially in Germany — with businesses often struggling to secure investment and grants. Although the European Defence Industrial Strategy (EDIS) has tried to streamline regulation, it remains commonplace for many institutional investors to have portfolio restrictions around companies involved in the defence sector — effectively denying challenger firms of much needed capital.

Summed up aptly by Labrys CEO August Lersten.

"Europe’s challenge isn’t the amount of capital - it’s how that capital reaches the first that can strengthen our security infrastructure."

August Lersten

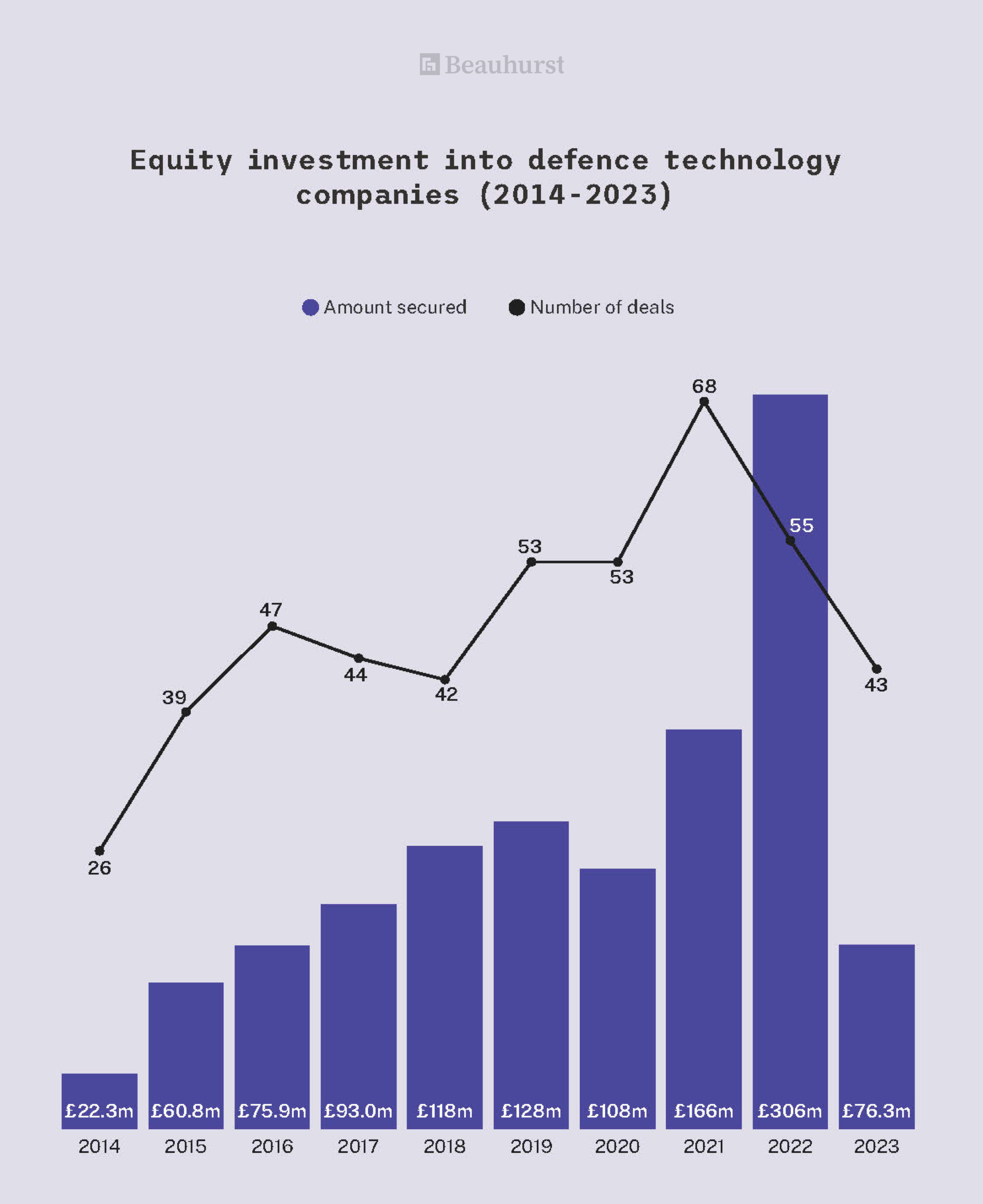

This problem is especially acute in the UK. Britain has a series of strict regulations which pose a significant challenge to investors. As a result, Beauhurst’s recent report with MD One found that investment into Defence Tech businesses has fallen at a faster rate than the wider investment landscape despite rising geopolitical tensions. In 2023 defence tech firms secured £76.3m in equity investment, down from £306m in 2022 with the number of deals also falling by 22%. Meanwhile, defence-related investment deals in the US have grown by a third in the last two years, valued at almost $40b (£31.7b).

Take a tour of our platform

While some firms are experiencing spikes in investment, urgent action is needed fill in the gaps

Although the gulf appears large, there are signs investors are beginning to take a more active approach towards British and European defence industries. In short, the industry is beginning to pivot with Greenjets CEO recently claiming ‘we are seeing a transformation in how MoDs in Europe are operating’.

In 2023 London-based Labrys Technology successfully secured a £4.42m equity investment to help scale-up its world-leading defence tech offering. Material Nexus has received £2.34m through two successive fundraising rounds since 2020 – including capital from German-based VC High -Tech Gründerfonds (HTGF) – and Britain’s Serco has announced plans to purchase Northrop Grumman’s mission training and satellite ground network software business for $300m (£238m) in January 2025.

Meanwhile in Europe, Munich-based Helsing AI has raised £649m from some of the world’s largest funders (e.g. Accel, Saab and Lightspeed VC) through multiple rounds of fundraising since 2021. Helsing has since become one Europe’s highest valued private tech companies.

Although such investments are reassuring, total equity investment across Europe remains dangerously low and puts our security at risk. EDIP is a good start, but Britain and the bloc need to provide more support to early-stage Defence Tech businesses and provide better incentives for investors if they are to retain a technological advantage in the years ahead.

A turning point for defence tech?

Vice President Vance’s speech may have been controversial but it marks an inflection point. The ‘long peace’ is over. European leaders can no longer rely on the post-war international order for protection and our defence industries are unprepared to deliver for the future Europe now faces.

They say ‘amateurs discuss tactics, professionals talk logistics’. In the words of Materials Nexus CEO Jonathan Bean — ‘now is the time for Europe to show the world what it can do’. If Europe is serious about ‘stepping up’ to provide for its own defence, freeing up equity investment for cutting-edge firms would be a good place to start.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy