Why Q4 is a great opportunity for business development teams

John McCrea, 28 November 2024

The fourth quarter of the year — spanning from October to December — can present a number of unique opportunities for business development teams that are often overlooked.

This includes an influx of cash-rich, growth-mode businesses into your target market, as financial submissions pour in as companies scramble to meet the Companies House accounting deadline on 31 December.

Q4 also tends to see a surge in equity funding, as venture capitalists ramp up investments, enabling companies to make use of funds ahead of the financial year-end on 31st March.

Contrary to conventional wisdom, this period isn’t just about wrapping up for the end of the year. It’s actually a vital time to lay the groundwork for lucrative opportunities in Q1 of the following year — if you know where to look.

This makes Q4 a great opportunity for business development.

The main challenge facing business development teams

Aside from the wealth of data available on their target audience, one reason that business development teams come back to our platform is the ability to find new companies and therefore fresh leads.

But finding the companies is only one part of the equation. The key pain point we hear when talking to prospective subscribers is the time spent reaching out to businesses that simply don’t have the budget to be sold to at that moment in time.

Q4 offers a distinct opportunity to remedy this challenge. Here’s how.

How Q4 opens up new opportunities for BD teams

The Companies House accounts filing deadline

Following the end of the financial year on 31 March, companies have nine months to file their annual accounts. Failure to file accounts before 31 December can therefore result in fines between £150 and £7,500. These are doubled if a company is late in two consecutive years.

Because of this, there is almost always a mad scramble towards the end of the calendar year, as companies attempt to get their paperwork ready for the 31 December cut-off. September 2024 alone saw over 19.1k company filings submitted, according to our own data.

This flurry of new account filings in December — many from companies with strong financial performances in the most recent financial year — is great news for your business development team, if they have access to the data.

Book a tour of the platform

Year-end investment and ‘growth mode’

While the Q1 often sees the highest number of finalised deals, much of the groundwork happens earlier in Q4 of the previous year.

Venture capital firms tend to accelerate deal-making during this period. For example, £5.92 billion was invested in Q4 2023, the highest in the year, as shown by our data.

This makes Q4 a particularly useful period for analysing investment trends. Recently secured funding for example can suggest that a company is likely to expand its operations, develop new products, or enter new markets — all tell-tale signs of ‘growth mode’.

This therefore reduces the likelihood of business development teams being turned down with the budget objection. And as with companies submitting strong financial accounts, they’re much more likely to welcome discussions about new opportunities.

Identifying and targeting these companies between October and December therefore maximises the chances of a successful conversation.

How to find companies with budget

So, with all this in mind — let’s explore how clients use Beauhurst to find companies more likely to have a healthy budget.

We’ve produced some custom Advanced Searches that your business development team can use to get ahead, if they’re subscribed to the platform.

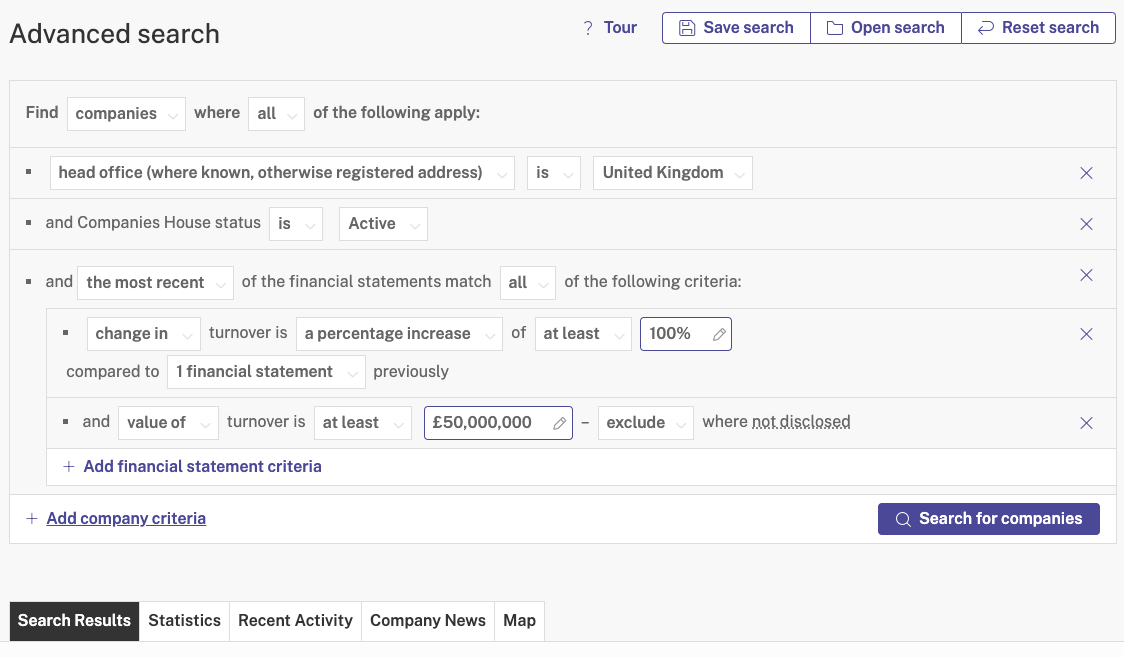

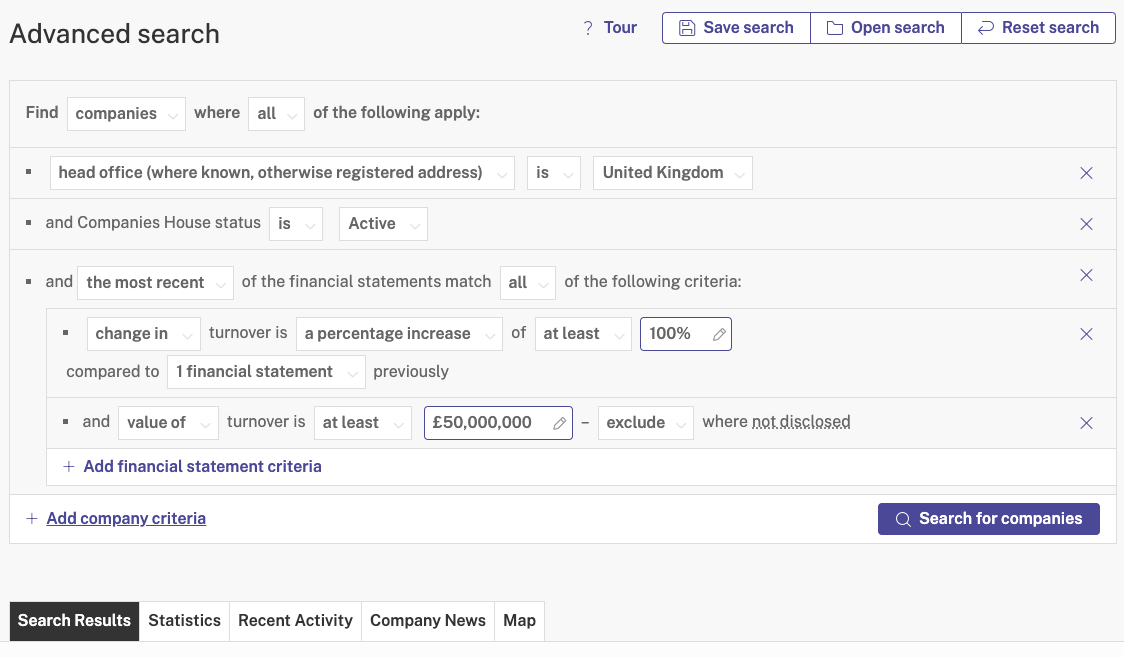

Turnover increase (%)

Firstly, let’s look at companies that have experienced significant turnover growth. Navigating to advanced search, search for companies and add a head office location and select the United Kingdom. You should also add an ‘active’ Companies House status to filter out any companies that have ceased operating.

Next, you’ll want to add criteria around their latest financial statement, stipulating the percentage increase in turnover.

For this example, we’ve selected 100% to show only companies that have doubled their turnover against their previous financial statement. Finally, we’ll set a minimum amount of turnover to filter out companies with lower turnover than your ideal customer.

Headcount increase (%)

Another useful way to find Q4 opportunities on the platform is to measure company growth by increase in headcount. You can run this search here.

Similar to the previous search, much of the methodology remains the same. Instead of turnover, however, your team can simply add a percentage change in number of employees. Here, we’re looking for companies that have doubled their headcount.

In addition to this, setting a minimum number of employees (we’ve chosen 50) will filter out companies that have technically doubled their headcount, but only from one small number to another.

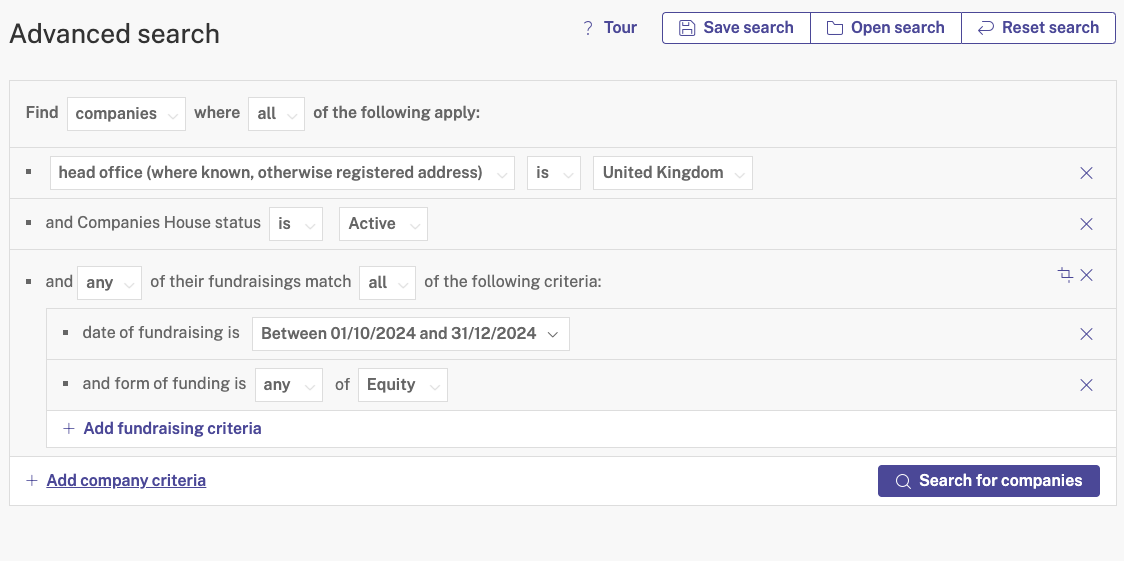

Fundraising dates in Q4

Finally, to find companies that have received an injection of capital between 1 October and 31 December (Q4), give this search a try.

Adding a fundraising filter, and stipulating the dates (and form of funding) will capture every UK-based company that has received equity investment during that period.

You can of course tailor these searches to your business, perhaps by changing the location to your local area, adding industry filters for specific industry analysis — or by setting a minimum amount of investment.

Plus, we now carry German data on the platform, so changing your search to find German companies can give you insights into another of Europe’s largest markets.

Looking ahead to Q1 2025

With Q1 just around the corner, and the dust beginning to settle from the Autumn budget — plus the UK and US elections now resolved — the market is expected to respond accordingly, aligning with renewed investor confidence.

For 2025, early indicators suggest that industries such as greentech and artificial intelligence will remain investment hotspots. Our own research also found that biotech companies are seeing notable growth in the tech industry.

Companies operating in these industries are likely to seek partnerships and services that can help them accelerate their growth, making them ideal targets for your own teams’ business development efforts.

By using Beauhurst, your team can stay ahead of these trends and identify companies with strong financials, recent funding, and ambitious growth plans. If you have any questions about how to make the most of this dataset, get in touch with your account manager. And if you’re new to Beauhurst, book a tour of the platform today.