Understanding Patient Capital & Why It’s Important For Startups

Category: Uncategorized

You’ve probably heard of patient capital, even if only in the context of Neil Woodford… But what is it exactly, and how do patient capital funds differ from traditional private equity or venture capital firms? We’ve taken a closer look at this particular investment strategy, including the outcomes of the Government’s Patient Capital Review, and the state of the UK’s patient capital market in 2021.

The number of private UK companies raising first-time equity investment declined by 19% last year, the biggest year-on-year drop on record, amidst the COVID-19 pandemic. It’s clear many entrepreneurs are now in need of long-term capital fundraising, to help nurture their high-potential companies from startup through to scaleup. Patient capital could be the answer.

What is patient capital investment?

Patient capital does not have a rigid definition, but generally refers to long-term investment, where investors are prepared to wait a considerable amount of time (3-5 years in some sectors, 10-15 years in others) before seeing any financial returns. For this reason, fund managers implementing a patient capital strategy will maintain their investments even if they’re seeing short-term losses for the fund.

Pension funds and sovereign wealth funds are typical examples of patient capital. But, in recent years, patient capital has also come to be associated with impact investing. In this context, rather than maximising immediate returns for shareholders, the focus is on maximising the positive social or environmental impact of an investment, alongside financial gains. Non-profit investment fund Acumen, for instance, defines patient capital as “investment in an early-stage enterprise providing low-income consumers with access to healthcare, water, housing, alternative energy, or agricultural inputs.”

The difference between patient capital and venture capital

Both patient capital and venture capital seek a return on investment. But where patient capital funds focus on long-term growth, venture capitalists prioritise more immediate financial returns, such as those delivered by a high-valued IPO—venture capital funds are willing to sacrifice future gains in order to maximise ROI in the short term.

Besides its longer time horizon, patient capital also has a higher risk tolerance than traditional forms of investment, and patient capital funds will often provide greater support to entrepreneurs, helping them to build sustainable business models and long-term growth.

Why entrepreneurs might seek patient capital

Whilst venture capital has backed some of Silicon Valley’s greatest success stories, startup founders are increasingly looking to alternative forms of growth finance, which let them retain more control over their business.

Looking beyond traditional VC funding sources can also reduce the pressure on entrepreneurs to grow and exit their startups as fast as possible (‘growth at all costs’). By securing investment from patient capital funds that share their values or vision for the company, founders can focus their time on building sustainable growth plans, instead of frequent fundraisings or increasing their valuation.

What was the Patient Capital Review?

Following the Brexit vote, the Government was called on to ensure that incentives were in place for investors to continue supporting UK businesses. So, back in 2017, alongside numerous initiatives to boost economic growth and innovation, HM Treasury (HMT) and the Department for Business, Energy & Industrial Strategy (BEIS) published the Patient Capital Review. This was an investigation into the state of patient capital in the UK, particularly with regard to high-growth companies looking to scale up.

Beauhurst data was used as evidence in the Government’s Financing Growth in Innovative Firms consultation, as part of the Review, signalling a lack of patient capital in the UK. We found that ambitious startups were struggling to scale, with 19% of the companies that raised seed rounds in 2011 still at the seed-stage six years on. You can read our thoughts on the consultation here for more detail.

Outcomes of the Patient Capital Review

In response to the consultation and Patient Capital Review, the Government announced plans to provide more than £20b in growth finance to innovative firms, over the next 10 years. This included establishing a new £2.5b investment fund with the British Business Bank (which would co-invest alongside the private sector), supporting first-time funding managers, unlocking funding for knowledge-intensive industries through the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs), and encouraging foreign investment into UK venture capital.

British Patient Capital, the aforementioned £2.5b fund and one of the most significant outcomes of the Patient Capital Review, was launched by the British Business Bank in June 2018. It set out to support high-potential businesses in the UK to access the long-term investment required to help them scale. The British Business Bank also announced it would transfer any existing and approved commitments (totalling ~£400m) from its VC Catalyst programme to British Patient Capital.

In December 2018, the Financial Conduct Authority (FCA) set out its own proposals to better facilitate investment in patient capital from retail investors, through unit-linked funds. It also published a broader discussion paper, inviting feedback on how the existing regulatory framework could be changed to give fund managers greater access to patient capital investments.

What does UK patient capital look like in 2021?

The majority of patient investors are non-institutional, such as angel networks or crowdfunding platforms, but institutional investors typically have much more money to invest. Our analysis below focuses on seven institutional funds characterised by their willingness to wait: BGF, investment management firm Invesco, publicly-listed VCs Augmentum Fintech and Molten Ventures (previously Draper Esprit), and commercialisation companies IP Group, Cambridge Innovation Capital and Oxford Science Enterprises (previously OSI).

We compared all equity deals secured by high-growth UK companies this year with just those rounds involving patient capital investments. Whilst we’re obviously relying on averages here, and a relatively small collection of funds as a proxy for the patient capital market, the difference in investment strategies is striking.

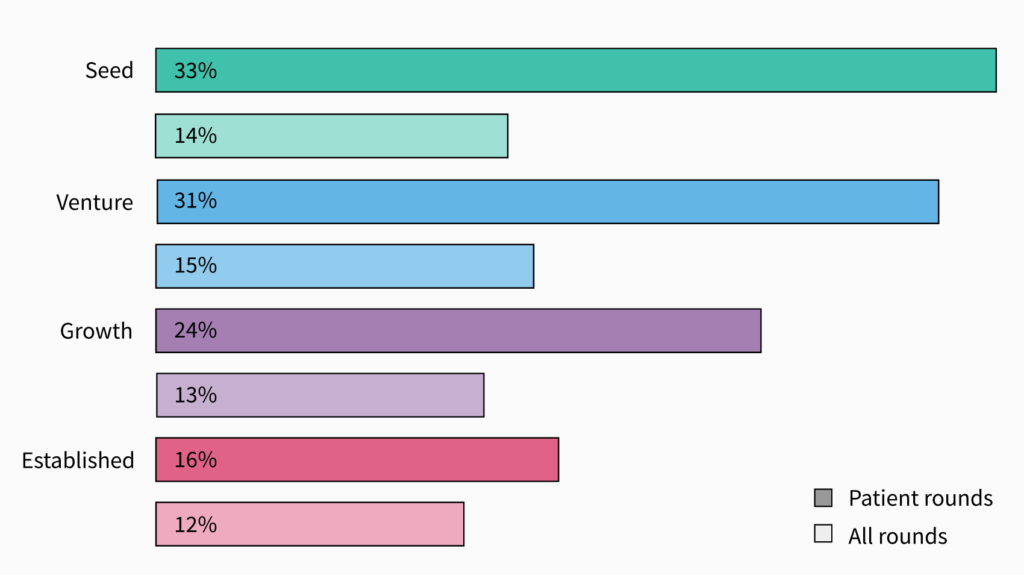

We found that, in the earliest stages of a company’s growth journey, on average, patient capital investors took a far greater proportion of equity from their investees: 33% versus 14% at the Seed stage, and 31% versus 15% at the Venture stage. This gap begins to narrow by the Growth stage (24% versus 13%), unsurprisingly, since long-term investment isn’t as crucial for more mature firms. But by the established stage, patient capital funds still take a greater equity stake (16%) than the average investor (12%).

Average stake taken in patient capital deals in 2021, compared to all deals (by investee stage of evolution)

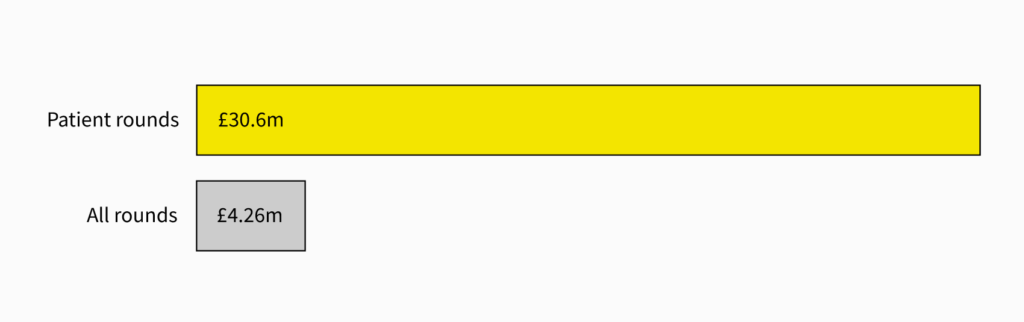

Patient capital rounds also tend to be larger than those completed by conventional investors. So far in 2021, equity deals into high-growth companies that involve patient capital funds are worth £30.6m, on average. The median round size is also high, at £8.27m. In comparison, across all UK equity deals with any investor type, average deal size is £4.26m, and median deal size just £365k.

Average round size of patient capital deals in 2021, compared to all deals

All in all, it’s clear that patient capital is an underexplored area of equity investment in the UK’s startup ecosystem. But we’re likely to see more funds entering this space in the coming years, as the impacts of the Patient Capital Review continue to materialise.

Have you read our latest equity market update yet?