8 Startups Giving Nutmeg Investment A Run For Its Money

Category: Uncategorized

Born out of frustration from the investment world’s exclusivity and lack of transparency, Nutmeg aims to offer greater financial freedom and independence to its users, and has become one of the go-to personal investment platforms for consumers across the UK. Nutmeg is a ‘robo-advisor’—a type of brokerage account where customers receive automated financial advice with little human interaction.

Rated ‘excellent’ on Trustpilot, Nutmeg has developed an all round digital wealth management service, with products including pensions, stocks and shares ISAs (including tax-free and tax-efficient lifetime ISAs and junior ISAs) and general investment accounts, managed by Nutmeg’s in-house investment team. Nutmeg’s management fees depend on the customer’s investment strategy and style (Fully Managed, Smart Alpha, Socially Responsible, or Fixed Allocation portfolio).

The investment management app has a track record of fast growth, having gained 20% scaleup status since its inception in 2011, and raised £127m in equity investment across 11 funding rounds. The London-based company continues to hit the headlines with its recent John Lewis partnership and upcoming acquisition by JPMorgan Chase.

Having gained over 140k customers, other fast-growing companies are now trying to steal some of Nutmeg Investments’ market share, from green impact investment platforms to those focused on making personal finance low-cost and effortless. We take a closer look at eight ambitious UK businesses that are rising to the challenge and disrupting the investment and financial advice landscape in the process.

According to GlobalData’s study, robo-advice holds a small market share of the UK’s investment sector (3.4%), but its growth is expected to accelerate as the world continues to become digital-centric and people migrate away from traditional investment methods.

Rosecut Technologies

Rosecut technologies was established in 2018 and aims to give users the ‘future that they want’. The London-based company is paving the way in the robo-advisory space by delivering personalized investment plans. In its three years since launching, Rosecut has raised £1.24m in equity across three funding rounds, with key investors including Entrepreneur First.

Qiojia Li, a former Coutts and Credit Suisse banker, met her co-founder, Gustavo Silva, a machine learning guru, through Entrepreneur First. The two partnered on this venture with the aim to target high-net-worth, ‘NextGen’ individuals with liquid wealth (cash on hand or an asset that can be readily converted to cash) between £250k and £3m. A common criticism of ‘Robo-advisors’ is the lack of ‘human touch’ within customer service, however, Rosecut is renowned for its convergence of top-tier AI and human advice. Featured in the Financial Times and CityWire, Rosecut takes just three minutes to sign up to and offers clients access and monitoring of their investment portfolio and financial plan. Rosecut prides itself on its security, with various methods of protection from the Financial Services Compensation Scheme (FSCS) to data encrypted servers that use TLS v1.3.

Tulipshare

Hackney’s Tulipshare is a socially responsible investment platform that was established in 2020. The seed-stage startup is a prime example of how finance can be conducted ethically. Tulipshare adopts a vastly different business model from the other companies featured here, choosing to place ethics at the centre of its operations rather than as a minor optional aspect for customers. Tulipshare focuses on aligning customers’ values to their investment decisions whilst encouraging everyone to rethink the way they invest and participate in finance. With every share having shareholder rights and individual responsibility attached to it, Tulipshare offers customers the opportunity to support campaigns that tackle pressing issues. Examples of these ethical campaigns that customers can invest in include workers’ rights at Amazon as well as Coca-Cola’s contribution to climate change in the company’s plastic consumption. The company is currently working on constructing a user-generated activism tool where customers within the community can make campaign suggestions.

Regulated by the Financial Conduct Authority (FCA) Tulipshare has raised £730k in one funding round this year and is backed by investors including Speed Invest. Tulipshare is an activist investment platform currently in the UK but looking to expand to the US that is dedicated to social and environmental progress. Unlike Nutmeg, where you need either £100 or £500 to start investing, Tulipshare offers the ability to drive change and make an impact in two minutes with just £1.

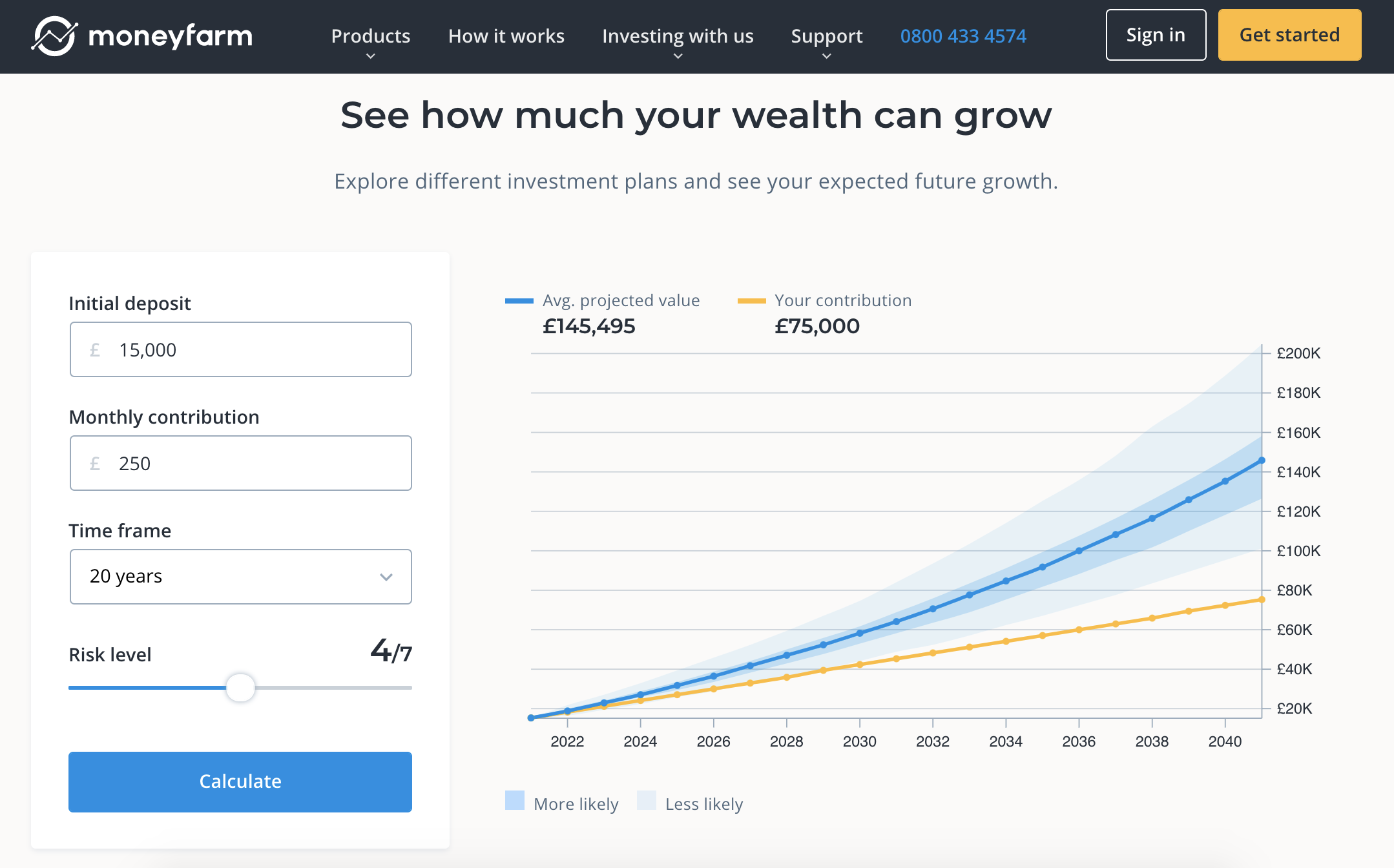

Moneyfarm

Unlike Nutmeg which caters solely to the UK market, Moneyfarm is considered the go-to pan-European wealth manager. Moneyfarm has raised £96m (the highest in the list) across five funding rounds and is backed by the likes of Cabot Square Capital, Endeavour Catalyst, Allianz, Fondazione di Sardegna, Poste Italiane, and United Ventures.

Like Nutmeg, Moneyfarm asks its users specific questions to understand an individual’s risk profile before their portfolio is created. Moneyfarm is attractive to many customers as you can speak to a financial advisor free of charge compared with Nutmeg which offers a free initial conversation followed by advice at £350. Customers are instructed to create a profile and answer some questions before they get matched with a good-to-go portfolio and a Moneyfarm financial adviser in order to reach their investment goals. Each portfolio contains a broad, handpicked mix of cost-efficient exchange-traded funds (ETFs).

Although offering free withdrawals and the ability to exit and avoid further costs, Moneyfarm requires £500 to start investing and only offers 7 managed portfolios compared to Nutmeg’s choice of 10. And whilst Nutmeg provides fives products, Moneyfarm has only three (stocks and shares ISA, personal pension, general investment account) as well as the option to invest in Socially Responsible portfolios. This February, Moneyfarm improved its services by enabling its users to invest in more than one of its portfolios within the same ISA.

Wombat Invest

Wombat Invest is also geared towards the younger market and first-time investors. The Camden-based wealth management venture was formed after a research project found that three-quarters (72%) of those aged 25 to 34 said their reluctance to invest was down to the investment process being too complicated. Customers have two account options: ISA or general investment and need £10 to start investing (fund costs are free up to £1000, above this customers pay a £1 subscription fee), Customers can then invest in UK and US shares by choosing opportunities that match their interests or investment style. The investment platform also offers a diverse range of suggested themes to fund from ‘the space age’ to ‘the gamer’.

Wombat Invest’s overall aim is to tackle global issues through its socially responsible impact investing arm, which includes five funds that make a positive social impact, from funding clean energy solutions to medical cannabis. Wombat’s ‘Learning Hub’ is an additional feature that enables the company to stand out from the rest whilst educating users. Another USP for Wombat is the ability for users to take part in ‘fractional investing’, which enhances inclusivity by enabling customers to invest no matter how much wealth they have whilst also creating the perception that Wombat is not a high-risk option.

Wombat Invest has raised five funding rounds, totalling £4.76m. Investors include Crowdcube, Fuel Ventures, and Seedrs. Wombat has exciting things in the pipeline with plans to create a “Wombat Junior” App, which will allow those under 18 to invest, and “Wombat Gift”, which will allow people to offer investments as a gift.

Multiply

Established in 2016, co-founders Vivek Madlani and Mike Curtis left behind their lives of trading derivatives and coding models of black holes to create Multiply, a free to download app that adopts artificial intelligence to provide consumers with unbiased financial advice. Multiply uses machine learning and financial modelling to create financial plans for consumers, from mortgages to investments and savings. The fintech startup aims to provide customers with ‘everything they need to buy their first home’, whilst also closing the advice gap by providing automated financial advice at no cost. Like Nutmeg’s extensive resources including tools and guides, Multiply’s one-minute news provides customers with relevant, filtered news educating them on their finances.

The first app to be FCA-approved and thus gain credibility and reliability as well as undergo stringent testing, Multiply offers stocks and shares ISAs or a general investment account with a monthly fee of £1, platform fee of 0.3%, and fund fee of 0.34% to 0.73% per year. Multiply has raised £3.49m and its investors include SyndicateRoom, Octopus Group, Entrepreneur First, and Portag3 Ventures.

Tickr

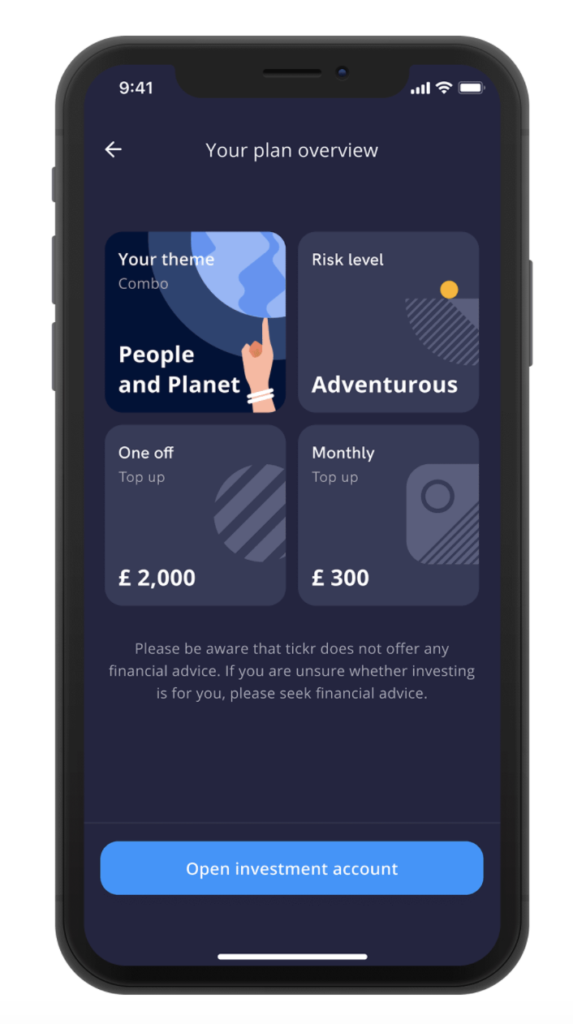

Launched in 2019, Tickr is another impact investing platform and alternative to traditional investment funds. The B corporated and certified startup generates positive outcomes for society, as well as financial returns for customers by focusing on three distinct themes to form a responsible portfolio: people (education, healthcare, cybersecurity), planet (renewable energy, clean water, sustainable food), or a combination of people & planet. The mobile-only app can be downloaded in five minutes and customers can invest as little as £5 a month, with the average user investing £150 a month. Unlike Nutmeg and despite providing extensive materials, Tickr doesn’t make any individual or personalised financial recommendations.

The London-based fintech has raised £6.66m across four funding rounds and is backed by investors including Ada Ventures, Fund Twenty8, Seedrs, SLJ Investment Partners. Tickr continues to receive praise for its proactive actions and ability to advocate change. Tickr offers customers the chance to join their ‘carbon offsetting subscription’ package that permits customers to allocate cash into impact projects as well as utilise their financial education resources available. The app uses a number of asset managers to provide the funds – BlackRock, Lyxor Asset Management and Legal & General and also has a range of UK impact-orientated partners including Bulb, Honest Mobile, Coral eyewear, Cuckoo, Elmo, and GRUBBY, to support its conscious approach to business.

Lumio

Established in 2017, Lumio is another exciting digital wealth manager to watch out for. Recognized as part of the top 100 Fintech Disruptor by BusinessCloud in 2020, ahead of challenger bank Monzo and crowdfunding platform Seedrs. With over 20,000 financial accounts already connected, over 100 million transactions analysed, and more than 8,600 customers on iOS and Android, Lumio has the mission to grow the wealth of one million customers by 2024. Known as the ‘Skyscanner for finance’ or the ’intelligent financial mentor’ Lumio replaces the need for financial advisors whilst integrating and automating individuals’ financial lives. The single view of all accounts in one place saves the time and hassle of tracking multiple accounts.

The London-based company has raised a total of £1.39m across three funding rounds since 2019, the first and third of which were funded via Crowdcube. Powered by Moneyhub’s (a third-party data aggregation provider) Open Finance Data & Intelligence API and Payment API, Lumio is free to use and offers intuitive financial guides and a bi-weekly Spotlight newsletter to improve financial literacy and enable smarter financial decisions. Last April, Lumio enhanced its customer proposition and value offering by partnering with PensionBee. This enabled customers the possibility to add a pension to their account and integrate their finances.

Tumelo

Bristol-based Tumelo (aka Hedge) is the only online investment company outside of London to make our list. The socially conscious company is an example of the University of Cambridge’s entrepreneurial talent that started as a university activism campaign, fighting to change the way Cambridge University invested its £6b endowment pot. Tumelo’s mission is to enable retail investors and pension members to create and benefit from a more sustainable investment system.

Tumelo has raised £2.20m so far across three funding rounds from various investors including singer-songwriter Peter Gabriel. Tumelo’s platform and services were developed through attending Addleshaw Goddard’s 10-month initiative for start-ups. This initiative enabled Tumelo to gain effective mentoring and legal support. Tumelo has both a personal and business arm and has begun to provide data to existing investment advice providers including Nutmeg, providing users with greater financial transparency. This works by integrating Tumelo’s software-as-a-service (SaaS) dashboard and underlying API into existing platforms. Advisors are charged a monthly access fee. Tumelo is also building a data service where it can show companies’ engagement data.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.