COVID-19 & The North-South Divide

Category: Uncategorized

As new coronavirus restrictions came into play last week, three-quarters of people in the North of England and the Midlands are now living in tier three zones, compared to just 10% in the South of England. These latest measures have added to existing concerns that COVID-19 is increasing the country’s North-South divide.

Indeed, Clare Bambra, a public health professor at Newcastle University, has said that “health and wealth in the northern powerhouse lagged behind the rest of the country even before the Covid pandemic, and over the last year our significant regional inequalities have been exacerbated.”

Of the 26,456 high-growth English companies currently tracked on our platform, 19% are based in the North of England (made up of the North East, North West, and Yorkshire and the Humber), and just 11% in the Midlands (East and West). In stark comparison, 32% are headquartered in the South (the South East, South West, and East of England), and 38% in London alone.

In keeping with this trend, southern regions also receive a far larger proportion of equity investment each year, even when taking London out of the equation. Many have argued that, after a decade of spending cuts, what the North needs most right now is a fairer share of investment, from both private and public funds, as well as additional support from government-backed schemes like the EIS.

So, as this challenging year comes to a close, how have regional funding landscapes in England changed? And has COVID-19 worsened the already troubling disparity in investment between North and South?

Deal numbers

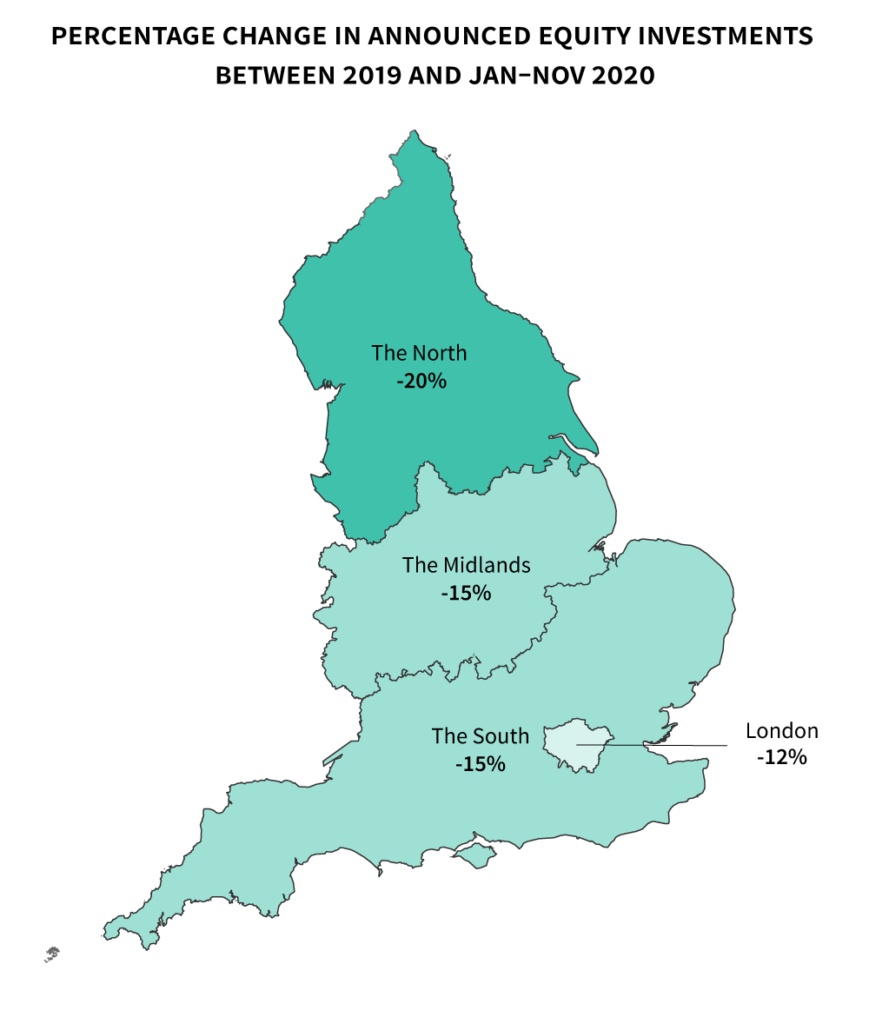

The number of announced equity deals secured by high-growth companies has gone down in nearly every region between 2019 and 2020.

Altogether, the North was most affected by this year’s drop in deal numbers, securing 194 equity investments between January and November 2020, compared to 241 in the whole of 2019. This marks a 20% decline in fundraisings. With that said, the North East is the only English region to have secured more equity deals so far this year than in 2019, with an increase of 8%—despite seeing the greatest proportion of closures linked to COVID-19.

The Midlands saw deal numbers decline by 15%, from 82 to 70, as did the South where the number of funding rounds fell from 391 to 332. Whilst London also saw a considerable drop in deal numbers, from 931 in 2019 to 823 in 2020, this marked the smallest change amongst the English regions, at 12%.

Proportion of deals

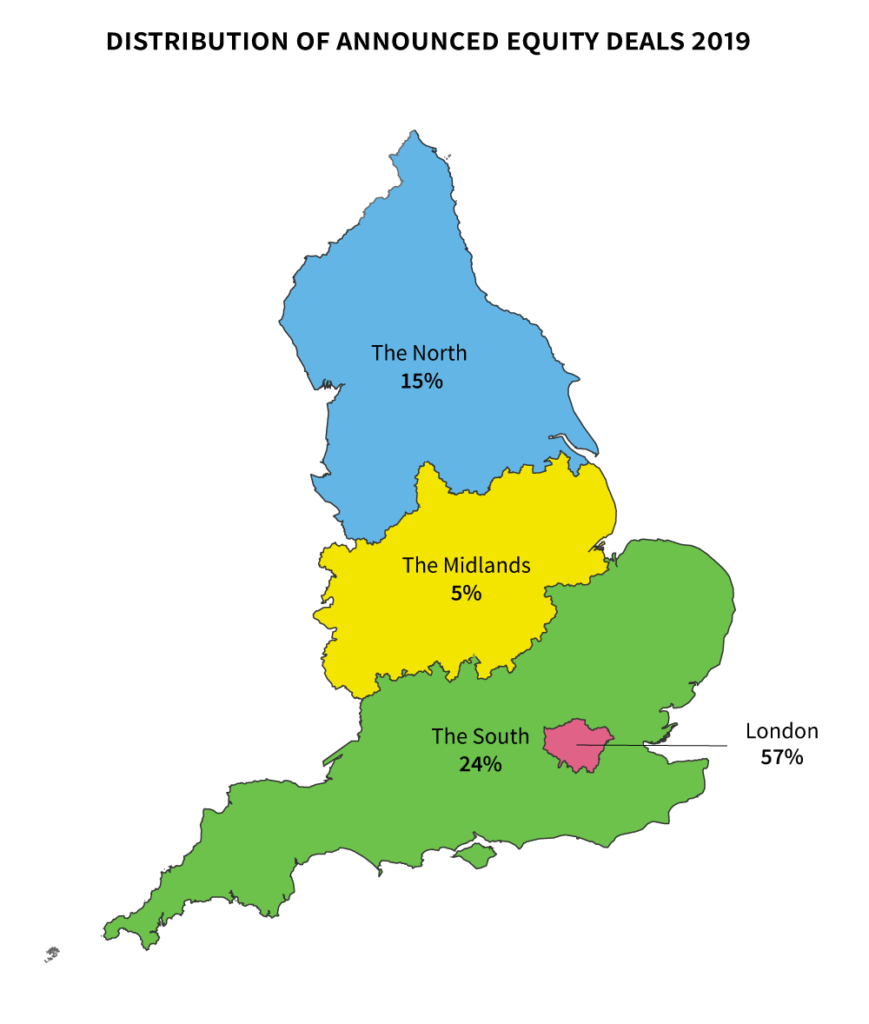

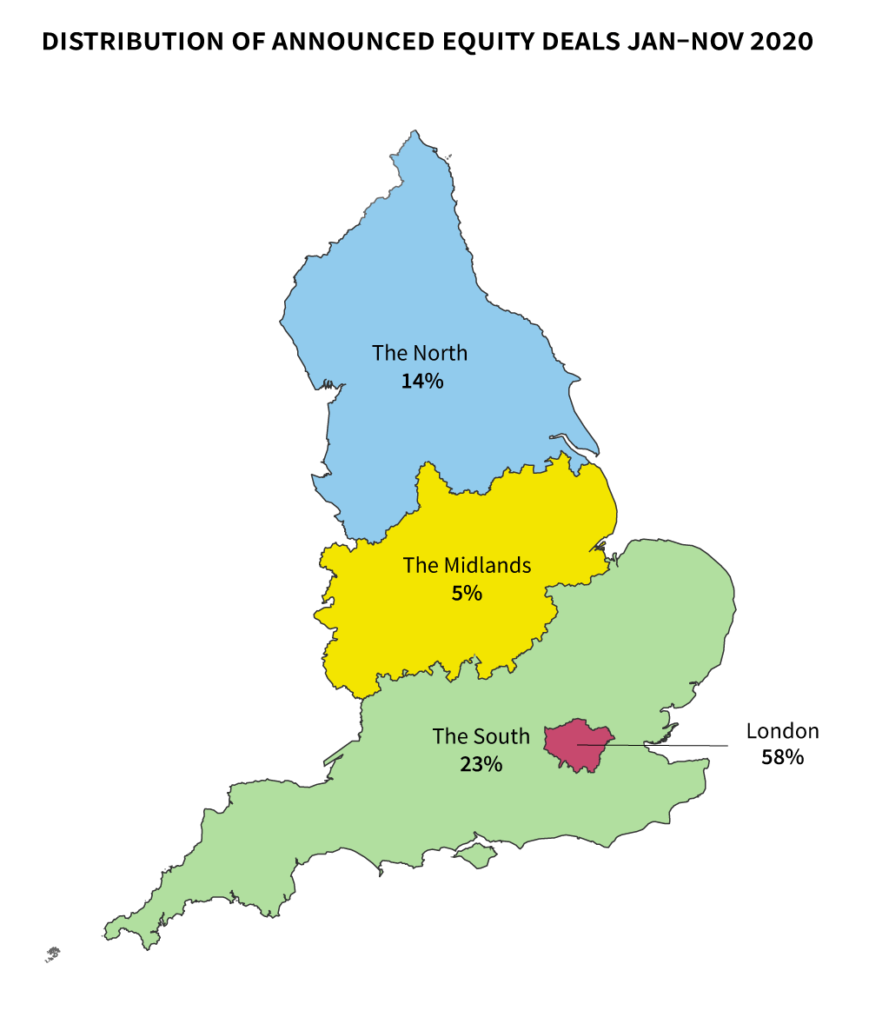

In terms of the proportion of announced equity deals in England as a whole, our data shows that there has been little to no change between regions since 2019. This consistency is good news for northern regions that have faced tougher restrictions and more severe outbreaks of coronavirus.

High-growth companies in the North secured 14% of English deals between January and November 2020, compared to 15% in the whole of 2019. Similarly, businesses in the South secured 23% of investment in 2020, down slightly from 24% the year before. The Midlands has so far secured 5%, the same proportion as last year, whilst London has secured 58%, up slightly from 57% in 2019.

Despite the arrival of COVID-19 at the start of the year, the distribution of equity funding across regions has changed little since 2019. This is a positive sign that stricter lockdown measures in the North haven’t dissuaded investors from investing in the region any more than in the South. It’s also an indication that initiatives taken by Local Enterprise Partnerships (LEPs) to support local areas during the pandemic have been successful.

Have you read our latest report on UK equity investment trends yet?

Most frequent investors

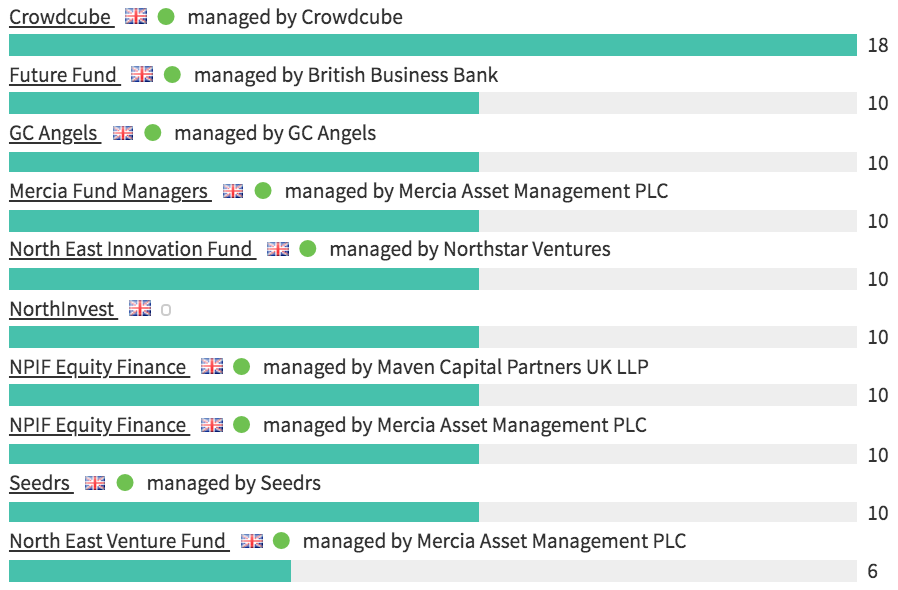

Across all English regions, the Government’s COVID-support scheme the Future Fund has been one of the most active investors this year. Whilst the Future Fund has been a notable addition to the list of top regional funders in 2020, several of last year’s key investors have remained, continuing to offer support and deploy capital during the pandemic. These include several regionally-focused funds, plus crowdfunding platforms Crowdcube and Seedrs.

The North

The North’s top ten investors, by number of announced equity fundraisings in 2020, include Manchester-based angel network GC Angels, which focuses primarily on early-stage companies in the North West, alongside a number of individual funds managed by Mercia Asset Management. Mercia’s focus is on ambitious regional SMEs, with a particular emphasis on the North, the Midlands, and Scotland.

The NPIF Mercia Equity Finance fund, like NPIF Maven Equity Finance, is part of the Government’s Northern Powerhouse Investment Fund (NPIF) scheme. Delivered by British Business Bank, and launched in early 2017, NPIF was created to provide support for small businesses and build a sustainable venture capital community in the North.

most active investors in the north: announced equity deals jan-nov 2020

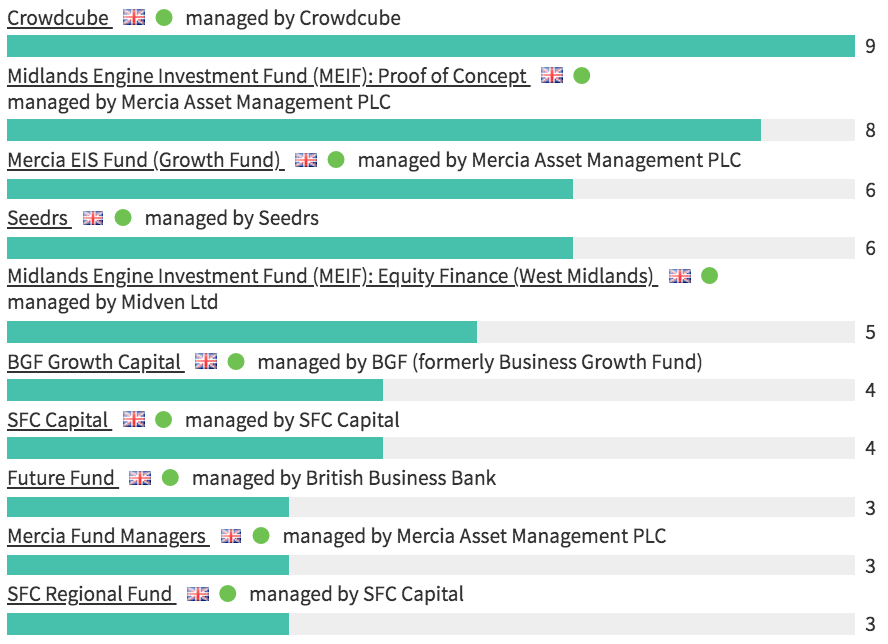

The Midlands

Meanwhile, in the Midlands, Mercia is again amongst the top funders in terms of announced equity deals, with both Mercia EIS Fund and Mercia Fund Managers making the list. Another key player is SFC Capital whose Regional Fund focuses on supporting businesses in areas of the UK that typically have less access to early-stage equity.

In addition to these, the Midlands Engine Investment Fund (MEIF) has also played a crucial role in the region this year. Two MEIF funds made the ranking, one managed by Mercia and the other by venture capital firm Midven, as part of the scheme backed by the European Regional Development Fund (ERDF), the UK Government, and LEPs.

most active investors in the midlands: announced equity deals jan-nov 2020

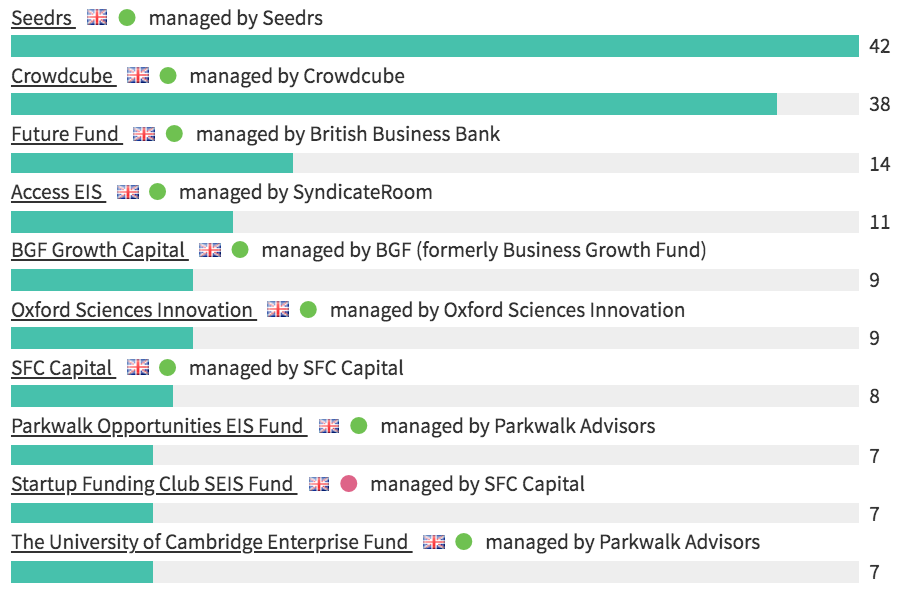

The South

In the South, Cambridge-based fund Access EIS, managed by co-investment platform SyndicateRoom, has been one of the most frequent investors this year. Alongside Access EIS, there have also been a number of very active funds with links to universities in the region. Oxford Sciences Innovation, for instance, has continued to provide growth capital and support to University of Oxford spinouts, reinvesting any returns back into the Oxford ecosystem.

Also on the list are two funds managed by Parkwalk Advisors. Parkwalk also manages a portfolio of investments in academic spinouts, in particular ‘hard science’ companies launched out of leading research universities like Oxford, Cambridge, Imperial, and Bristol.

most active investors in the south: announced equity deals jan-nov 2020

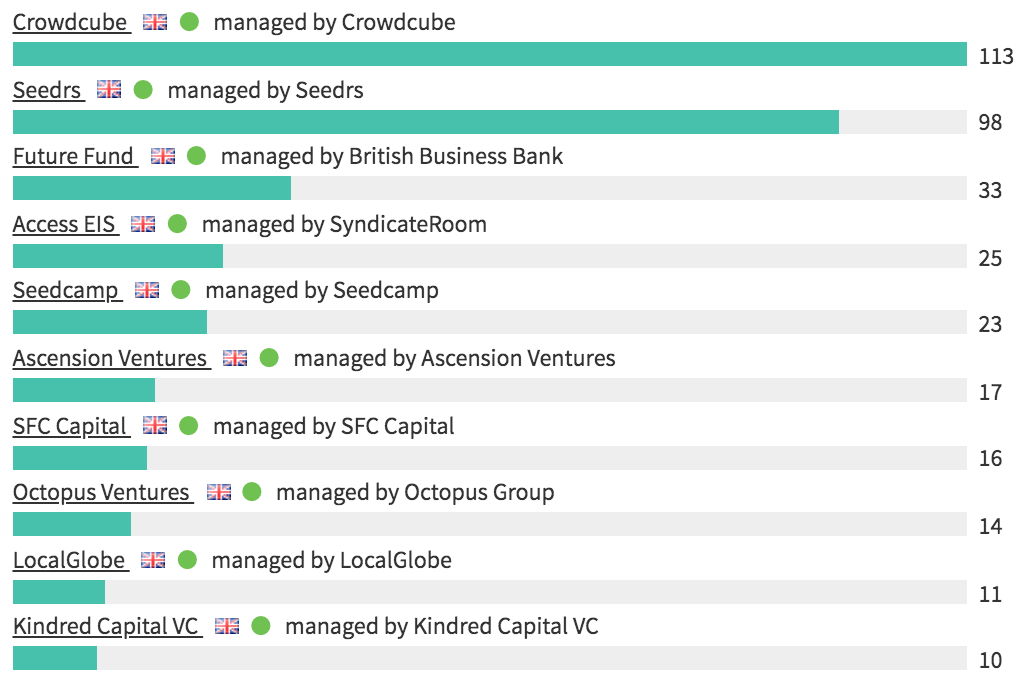

London

Lastly, the most frequent investors into private companies in the Capital have been predominantly London-based venture capital funds. These include early-stage VCs Seedcamp, Ascension Ventures, and Kindred Capital, as well as Octopus Ventures, and LocalGlobe which invests specifically in London founders.

most active investors in london: announced equity deals jan-nov 2020

Closing thoughts

Whilst deal numbers have fallen across the country this year, the proportion of funding secured by individual regions in England remains largely unchanged since 2019. From a high-growth perspective, it’s encouraging to see that, despite the North being disproportionately impacted by the pandemic, investors continue to focus on the long-term potential of these areas.

COVID-19 does not seem to have exacerbated the North-South divide in this regard, thanks in part to the strong degree of support received from government-backed funds and innovation schemes this year. We hope to see further investment into the North’s high-growth ecosystem in 2021, in order to support the region’s recovery, and to continue working towards a more equal spread of funding across the UK.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.