New figures show negative outlook for UK SMEs

Category: Uncategorized

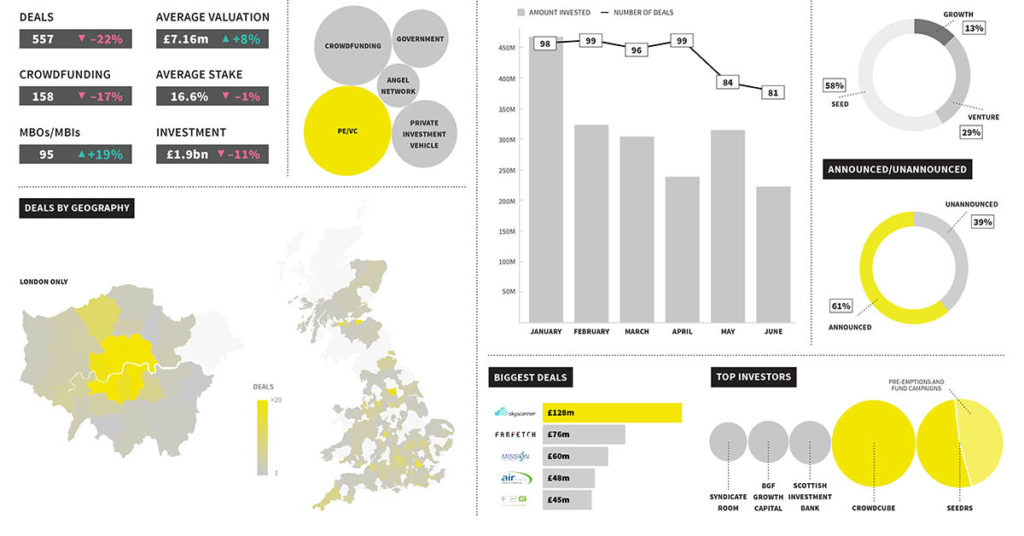

We’re delighted to release the latest edition of The Deal – our analysis of equity investment in UK SMEs and high-growth businesses. It’s free, and (we hope) packed full of useful information, data and analysis.

If you’re not familiar with The Deal, these reports are written by our in-house Research team. They examine the nature of the companies securing equity fundraisings, from their stage of evolution, sector and geography; as well as the funders that are backing them.

Our headline findings include a 20% decline in investment in UK SMEs in the last 6 months across the board – even including crowdfunding (for the first time on record).

The Brexit claxon sounds loudly at this point, but to pin the negative outlook solely on the referendum vote doesn’t quite tell the whole story. Back in January, before the campaigns even kicked off, we predicted that 2016 would be a slow year. Indeed, the slide in deal numbers has been apparent as far back as the third quarter of 2015. The current level of political uncertainty is, we believe, merely exacerbating a pre-existing underlying trend.

We list the biggest deals so far this year, and look at some stellar valuations, and look in detail at recent acquisitions of UK tech from US social networking giants.

And we look at how different funder types are performing, from institutional investors such as private equity and venture capital firms, to crowdfunding platforms, government investment and corporate venture funds.