The 9 Most Active Female Angel Investors in the UK

Category: Uncategorized

Angel investors are an incredibly important source of funding in the equity landscape, providing relatively small ticket sizes to small businesses that are of personal interest and have high-growth potential, with the aim of eventually making a return on investment. Many unicorn companies started out with friends, family and angel rounds, and this early-stage finance is often necessary to gain the traction needed to bring venture capital funds, private equity firms, and other institutional investment funds on board.

Gender diversity in angel investing

In 2021, we published a list of the top ten stakeholders in the UK’s tech ecosystem, who owned shareholdings in more than 30 businesses. Much to our disappointment, but unfortunately not to our surprise, no women featured on that list. Now, we’re shining a spotlight on the most active female angels, profiling those that have backed the most UK companies in the past decade.

There’s a certain level of personal wealth necessary to start angel investing. As such, many angels get started by reinvesting money they’ve made from their own ventures into the ecosystem, to nurture the next generation of entrepreneurs and early-stage businesses. This means that the lack of gender diversity among both entrepreneurs and private investors alike is a vicious cycle—just 11% of high-growth companies that have undergone an IPO in the past decade have been female-founded, whilst data from the UK Business Angels Association (UKBAA) suggests that only 13% of angel investors in the country are female.

The women featured on this list, however, are looking to break that cycle, along with growing networks of many others. Some are entrepreneurs turned angels, others are career investors who are now putting their own wealth into the private market, but all of them are paving the way to a fairer future.

Methodology

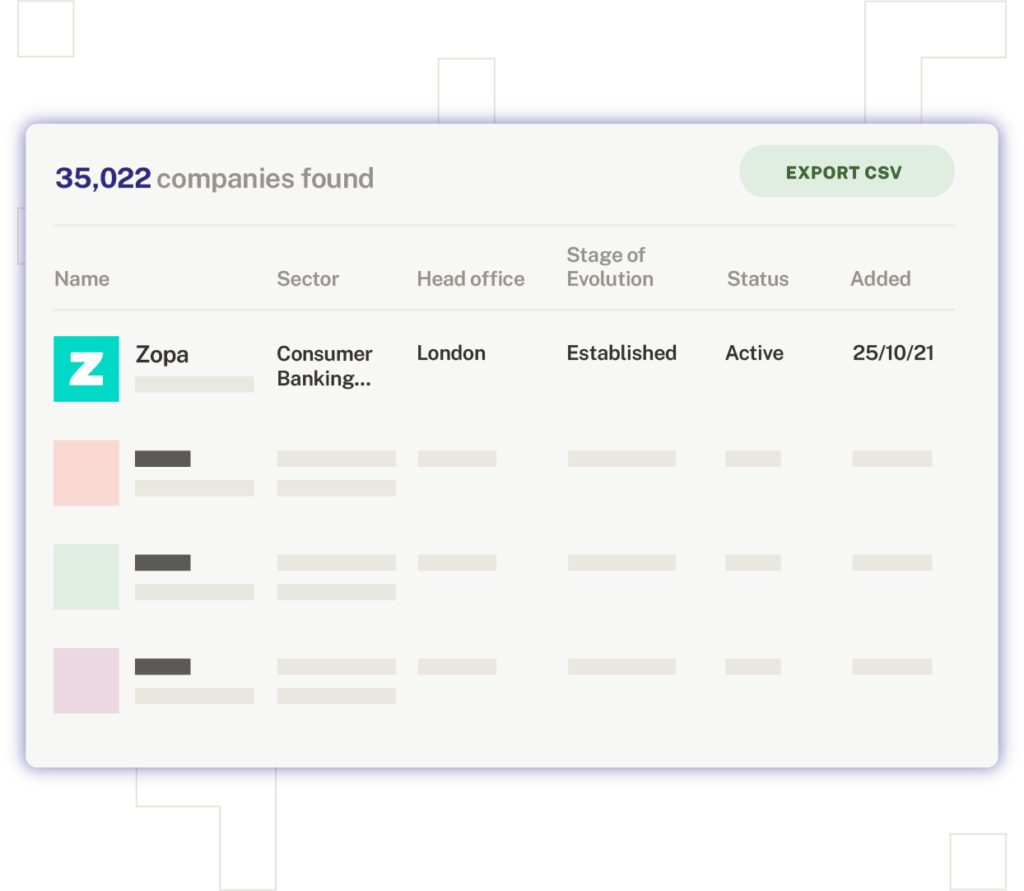

We’ve identified these angels by the number of companies that they have shareholdings in, based on data from Companies House, restructured and made searchable by the Beauhurst platform. But some angels may have invested in a greater number of companies than mentioned here. This might be because:

- The deal has been made through a nominee structure or private investment vehicle, which means the individual’s name will not appear on the cap table

- The company is yet to submit an updated CS01 filing, reflecting the individuals’ share ownership

- The investment was made through an Advanced Subscription Agreement (ASA), whereby the shares will be transferred at a later date. Records of these investment types won’t show up through Companies House until the shares have transferred.

We’ve also excluded anyone who doesn’t have a public profile (such as via LinkedIn or other social media), which suggests they’re not interested in inbound investment opportunities. And at least two of the individual’s shareholdings have to have been held in companies that haven’t raised crowdfunding rounds, in order to identify genuine business angels with their own deal flow.

The Most Active Female Angels in the UK

Melissa Murdoch

Serial entrepreneur and angel investor Melissa Murdoch currently has shareholdings in 34 active UK companies, according to Companies House. Originally from California, Melissa has a background in human rights and international development, now sits on the board of a number of charitable and philanthropic organisations, and invests in early-stage businesses alongside her husband, Stephen.

Having invested extensively through ClearlySo Angels, an impact investing fund that seeks businesses fighting climate change, many of Melissa’s portfolio companies operate in the cleantech and green energy sectors. This includes Bio-Bean, which turns coffee waste from thousands of coffee shops into biofuel, and Switchee, which has developed a thermostat that turns the heating on and off in relation to the homeowner’s routine and habits.

Melissa has also backed numerous healthtech companies, including DocTap, which operates a GP consultation booking platform, allowing users to book same day appointments with private accredited doctors, and mental health startup Thrive, which develops mobile apps for employers to detect, track and help manage mental health conditions in their employees.

Two additional companies that Melissa has invested in, Ellumia and Fluency, have ceased trading. Both companies happen to be edtechs that shut up shop in 2018. She has sold shares in a further two active companies, and has supported one company, Upside Energy, to exit. Upside Energy developed technology to aggregate energy stored in devices owned by households and businesses, such as heating systems, in order to manage electricity demand on the national grid at peak times. The company was acquired by Octopus Group in 2020. So, in total, Melissa has backed 39 high-growth UK companies.

In 2019, Melissa co-founded neat. with CEO Ryan McSorley. Based in Stratford-on-Avon, the company produces eco-friendly and vegan cleaning products in reusable aluminium and glass packaging, in an effort to cut down on single use plastics. Melissa has also co-founded The Glasshouse, a social enterprise that trains and employs prisoners in horticulture, with the ultimate aim of reducing reoffending. Plants are sold directly through the charity’s online shop, its bespoke corporate gifting service, and plantscaping for offices, hospitality and retail.

Lynne Ross

With a background in the energy sector, Lynne Ross is an active seed investor, with a particular focus on green energy and cleantech solutions. She’s the first of three angels on this list to be investing heavily into the Scottish innovation ecosystem. Lynne began her career in Scottish Power and SSE, where she worked until 2013, when she first began angel investing.

Lynne now invests in early-stage companies both directly and through a number of syndicates, including Par Equity, Gabriel Investments (where she is chair), Equity Gap (where she is NED) and Green Angel Syndicate. Lynne now holds shareholdings in 29 active, high-growth companies in the UK, and has supported one business to exit: Spoonfed, which develops software to help caterers or food franchise operators manage their business, was acquired by US-based 365 Retail Markets in December 2021.

Other notable portfolio companies include Switchee, Sunamp, which develops thermal energy storage devices, and Trojan Energy, a manufacturer of compact street chargers for electric vehicles, where she is also Chairman.

Alongside her investment activity, mentoring, NED and chair roles, Lynne also sits on the Social Growth Fund Credit Committee at Social Investment Scotland, and supports ambitious entrepreneurs through the Strathclyde University Enterprise Partners programme and Edinburgh Centre for Carbon Innovation.

Helen Chang

According to data from Companies House, Helen Chang has shareholdings in 27 active UK companies. Alongside these UK companies, Helen has invested in other early-stage private companies at Seed and Series A rounds with keen focus on sustainability, female-founded enterprises, technology-enabled and purpose-driven organisations.

A graduate from London School of Economics & Political Science, Helen has built her career in trading and risk management at global investment banks since 2001, which she credits as important factors in preparing her personal investment journey. She completed her Executive MBA at London Business School in 2017, where she was surrounded by classmates and alumni who were pursuing entrepreneurship and investing themselves, further strengthening her angel investing network.

Helen is member of E100, LBS’s private angel investment group, Angel Academe, a syndicate that backs female founders, and Green Angel Syndicate, which backs cleantech and green innovation businesses. Majority of her opportunities come through these angel networks.

Many of Helen’s portfolio companies are women-led with strong sustainability principles, including NatureMetrics, which develops eDNA (environmental DNA) testing kits, to allow the biodiversity of an aquatic habitat to be determined from trace amounts of DNA found in environmental samples. Good-Loop looks for an ethical approach to advertising which makes the connection between brands and people more meaningful, while Qflow collects real-time materials and waste data at source for construction teams and takes a data driven approach to make informed decisions on cost, carbon and quality.

Want to find the UK’s next unicorn?

Beauhurst helps you find the most exciting companies in the UK in the time it takes to read this sentence.

Grace Cassy

Grace Cassy has active shareholdings in 23 private, high-growth companies in the UK, and a further three via a private investment vehicle. Grace left her role in Government in 2008, after 10 years in the UK Diplomatic Service working on global security policy, and serving as foreign policy Private Secretary to Prime Minister Tony Blair between 2004 and 2006. She has since co-founded Epsilon Advisory Partners and CyLon, both with Jonathan Luff.

CyLon, which stands for “Cyber London” is an accelerator-turned-fund that supports the security tech of the future, with the belief that no future technology will reach its full potential without secure foundations. For Grace, that has evolved into active seed investing in the space, both within the UK and abroad.

The vast majority of her portfolio companies operate within the digital security sector, which stands to reason, given Grace’s background. Notable portfolio companies include Immersive Labs, which provides online cyber security training for businesses, Tessian, which develops software designed to detect phishing, unauthorised and misdirected emails, and Senseon, which develops software that utilises machine learning to automate and analyse intelligence.

A further three companies Grace has backed have since ceased trading, whilst one has exited the private market. ThreatInformer, which developed software for cyber insurance underwriters that analysed security metrics, generated tailored policy reports, and helped balance overall risk, was acquired by CFC Underwriting in 2020.

But Grace also advises companies across other themes, such as energy efficiency, healthtech, computer vision, AI and analytics, and will invest in those areas where she sees a great opportunity. When asked why there’s a gender disparity in investment, and how she sees that changing in the future, she told us:

“The relative lack of female angel investors is reflective of a wider challenge in the sector. Angels are often also entrepreneurs (whether exited or not), and we similarly lack a deep pool of female entrepreneurs in tech. More positively, I see more women starting companies now, and am hopeful that this will soon translate into more female angel investors.

And aside from founders, I hope more women with experience in engineering, sales, marketing, legal, regulation, HR or frankly any aspect of business will take the opportunity to support a startup as an angel. These skills are of high value at the early stage.”

Margaret Coughtrie

Margaret Coughtrie has shareholdings in 20 active, high-growth UK companies, all but one of which are headquartered in Scotland. A graduate from the Universities of Edinburgh and Strathclyde, Margaret has been investing professionally since the 80s, and is now an investment director at abrdn, and board member of Edinburgh Innovations. So it should come as little surprise that her personal investments remain in Scotland too.

In a historic achievement, Margaret co-founded the first all-female hedge fund, Deco Capital. Together with her co-founder Niru Devani, she launched the Boadicea fund in 2001. Now, Margaret is investing her own money into Scotland’s innovation landscape. Beauhurst data suggests that Margaret has predominantly invested via angel networks Equity Gap and Gabriel Investments Syndicate.

Some of her most notable portfolio companies include EnteroBiotix, which uses gut bacteria to develop therapies for bacterial illnesses in a non-invasive manner, Qikserve, which has developed an app for ordering and paying for food using a phone instead of queueing at a restaurant counter, and novosound, which prints ultrasound sensors, allowing them to be produced on a mass scale for a range of industries, such as healthcare and veterinary services.

Sara Halbard

After graduating from Imperial College London, with a degree in Chemistry, Sara Halbard embarked on a career in finance, specialising in leveraged buyouts. She has served as Head of Fund Management at FTSE 250 company Intermediate Capital Group, as well as Non Executive Director and Advisor to a number of investment companies—including British Business Bank since 2016.

Since 2015, she has also been investing into the private market as an angel, and currently holds shareholdings in 19 active UK companies.

Some of Sara’s notable portfolio companies include Zero Carbon Food, where she has served as a board member since 2017. The London-based startup uses redundant underground spaces to produce greens and herbs using LED lights and hydroponics. She has also backed Cambridge-based Cell Guidance Systems, which manufactures reagents for the stem cell industry.

On top of this, Sara has invested in leading crowdfunding platform Crowdcube. Beauhurst data suggests she may also invest via the platform for some of her deals, given the significant crossover in portfolios.

Kirsten Connell

Kirsten Connell is a venture capitalist and angel investor who currently has shareholdings at 20 active, high-growth companies in the UK. She joined Seedcamp back in 2011 as General Manager, and the company’s fourth employee, growing their portfolio from just 30 companies to over 200. She left in 2015 to become Managing Director at CyLon, working alongside fellow angel Grace Cassy, and is now a Venture Partner at VC firm Octopus Ventures.

The majority of Kirsten’s portfolio companies operate in the tech sector, specifically digital security, which is unsurprising given she first explored the world of angel investing whilst working at CyLon. Kirsten is also dedicated to investing in female founders via Alma Angels, a community of investors who have pledged to invest in female-founded startups, in order to reduce the gender gap in tech. Invited members share deals, carry out due diligence in groups, and sometimes co-invest.

30% of Kirsten’s active portfolio companies have a female founder. This includes CyberSmart, which has developed software to automate certification and compliance with cyber security standards, Zamna, which develops software that verifies the identity of airline passengers prior to their arrival at an airport, and YEO, a SaaS company which develops secure messaging and project collaboration software for businesses. Other notable portfolio companies include Tessian, Immersive Labs and Senseon.

In keeping with her clear interest in backing female entrepreneurs, Kirsten is also committed to increasing diversity amongst angels themselves, and has previously stated that her mission is “to change your perception of the typical angel investor. Europe’s startup scene is booming and the entire industry would benefit from a broader, more diverse angel base.”

Judith Wilson

Armed with a degree in mathematics, Judith Wilson has built a career as an entrepreneur, CEO, board member, chair and investor. She co-founded and led marketing firm Marketry as CEO for 23 years, between 1992 and 2015, and then tried her hand at angel investing. She now has shareholdings in 22 private companies active in the UK.

On top of these investments, Judith recently supported adtech app Appsumer to exit, with an acquisition by InMobi in October 2021. And she’s invested in a further five companies that are no longer trading.

Some of Judith’s most notable portfolio companies include Flexciton, which develops software that uses machine learning algorithms to increase efficiency of rotating equipment, and Q-Bot, which develops robotics for monitoring and maintaining buildings and infrastructure, with the aim of making construction and the built environment more efficient.

Judith currently acts as Chair for Stampede, which helps hospitality companies understand and communicate with their customers by collecting information from them via WiFi. The company is based in Edinburgh, as are the majority of Judith’s portfolio companies.

Sophie Marple

With current shareholdings in 18 high-growth companies, Sophie Marple is an active angel investor, backing environmental impact businesses and edtech companies. She started angel investing as part of the Addidi angels group in 2011, then became a member of Clearly Social Angels soon after.

Sophie’s primary focus is as co-founder and trustee of Gower St, a family trust set up in 2006 that originally supported girls’ education in Sub-Saharan Africa, but has since shifted focus towards the fight for a liveable climate. It aims to make a difference by supporting opportunities that contribute to positive and lasting impact in the climate sector.

She has also co-founded the Mothers Climate Action Network, a growing network for mums who are climate concerned and are ready for community action, and acts as advisor for Impatience Earth, a consultancy offering pro-bono advice to philanthropists.

Some of Sophie’s most notable portfolio companies include LettUs Grow, which develops tech to grow food without the need for soil, designed to reduce food wastage and the carbon footprint of produce growing. Another is Ananas Anam, which develops, manufactures and sells Piñatex, a leather replica made from pineapple leaves, which is currently raising a £4m series B round. She’s also invested in neat., fellow angel investor Melissa Murdoch’s sustainable cleaning startup.

Sophie has a successful track record with angel investing, having supported Upside Energy to its acquisition by Octopus Group in November 2020, and Suffolk-based Raising IT (via The Marple Charitable Trust), which was bought by The Access Group in 2019.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.