The new Midlands Engine Investment Fund: a £250m pot

Category: Uncategorized

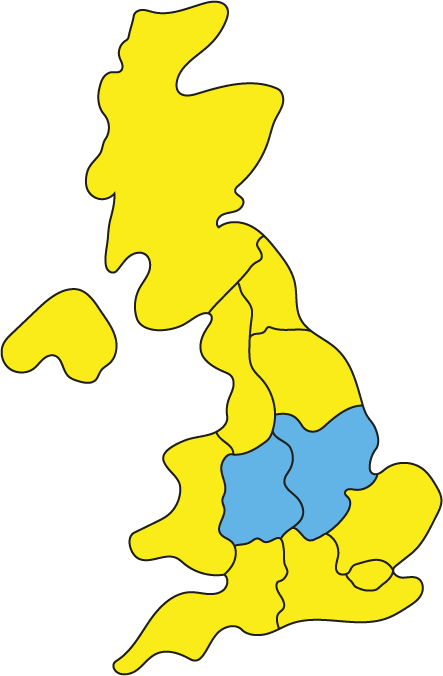

The new Midlands Engine Investment Fund (MEIF), which aims to drive economic growth across the Midlands region by financially supporting SME development, has just been launched. The £250m initiative is part of the government’s aim to rebalance the UK economy and provide growth across the country by 2022. Helping the government implement this scheme is the British Business Bank and 10 LEPs located in the West and South East Midlands.

The Midlands Engine Investment Fund

The MEIF will provide finance to SMEs in four different ways.

Early concept/Proof of concept

Provides up to £750k in equity for early stage start-ups looking to get their service or product off the ground

Small Business Loans

Provides a £25k – £150k loan for new growing businesses

Debt Finance

Offers a loan of £100k – £1.5m for businesses that can demonstrate potential growth

Equity Finance

Equity funding ranging from £50k – £2m for businesses with ambitious plans for growth

Alongside providing financial leverage, the Midlands Engine Investment Fund is expected to benefit the region in a number of other ways, including creating an estimated 3,800 jobs in the Midlands. As this is the first time Midlands LEPS have collaborated and pooled their resources on such a large scale, the fund should also help to create a more unified support network of advisors and funders.

Why the Midlands?

The Midlands is currently contributing 13% to the UK economy, but a 2015 study shows on average the region is also 13% less productive than other UK areas. Taking this into consideration, and also that 14% of the UK’s highest growing businesses are located in the Midlands, the MEIF is anticipated to provide a foundation for the region’s future economic growth. On a UK wide scale, businesses across the region are less likely to scale-up compared to others, and The British Business Bank’s Small Business Finance Market report (using Beauhurst data) revealed significant regional imbalances in the supply of equity finance across the UK.

We hope with the launch of the Midlands Engine Investment Fund we’ll see an increase in the number of successful startups and scaleups in the region – a few of which we’ve profiled below.

Located in the East Midlands and founded in 2011, Unidays operates an online student community which enables users to gain discounts for relevant brands and services. The company now operates across 32 countries and has nearly 10 million student users worldwide.

The seed stage company, located in the West Midlands, has developed a wearable device and subscription service that allows parents and guardians to track the movements of their children via mobile app. The device also sends a message to parents if the device is removed from the child’s wrist. Since its founding in 2013, the company has in total raised £270k in equity.

Solar for Schools is an Derbyshire based company which operates a programme that aims to supply schools with free solar panels, overseeing the funding and installation process as well as the management of them for 20 years. Founded in 2015, the company has raised £678k.

Access Fertility is an East Midlands based company which provides IVF loans and treatment plans to consumers, with the opportunity of a refund if a baby isn’t conceived. It has raised £396k since being founded in 2013.

Advanced Anaerobics develops technology for anaerobic digestion plants that generate electricity from cow slurry. The Herefordshire-based company, founded in 2012, has raised £796k.

Get a free tour of the platform.