The relationship between equity and Innovate UK grants

Category: Uncategorized

At Beauhurst, we provide data on the grants awarded by Innovate UK, the government’s innovation agency. They aim to support businesses with the research and development of future technologies. We thought it would be interesting to take a look at these companies, and see how they relate to the Beauhurst triggers for ambitious companies. Just in case you’ve forgotten, our triggers include companies that have:

– received equity investment

– undergone an MBO/MBI

– attended an interesting accelerator programme

– secured venture debt funding

– been spun out of an academic institution

In many cases, we found that being supported by Innovate UK increased the performance of a business and improved their likelihood to exit.

To date, Innovate UK has supported 11,365 UK businesses with one or more grants. 17% of these have met one of the triggers Beauhurst uses to qualify companies as high growth. Perhaps unsurprisingly, three quarters of these companies fall into the technology sector, with SaaS and life sciences being most common. Around a third of businesses were in an industrial sector.

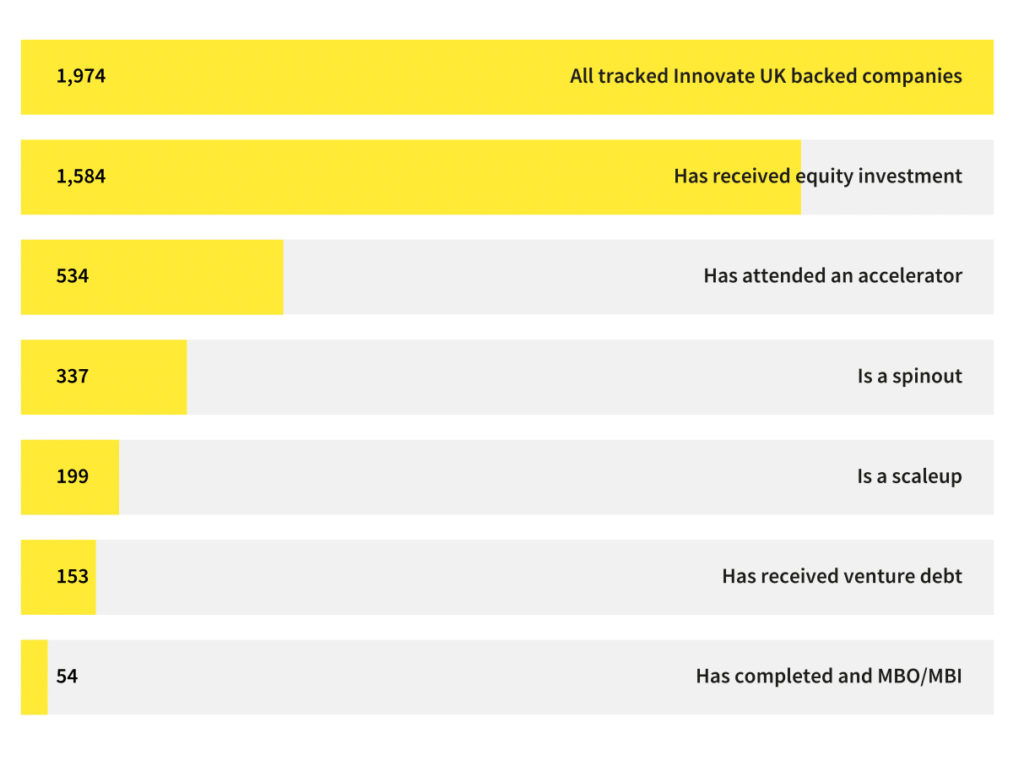

Most of these were drawn to our attention as a result of securing equity investment, but a large number also met one of our other triggers. A full breakdown of this can be seen in the chart below.

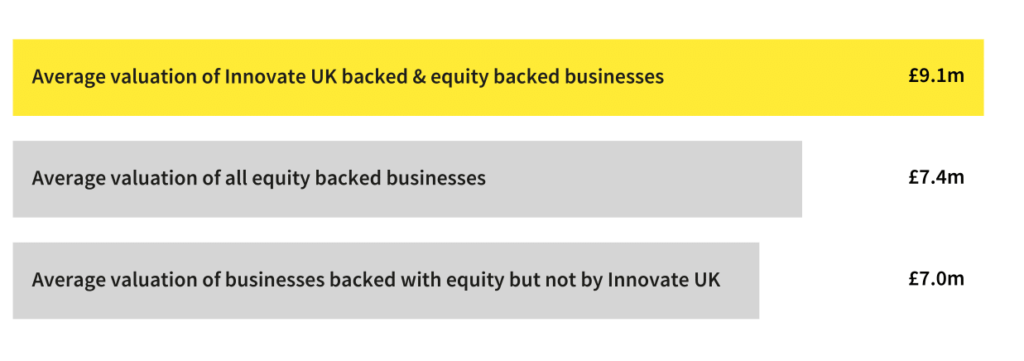

Looking at individual triggers, the most common reason for tracking is that the company has received equity investment, with 14% of all grant recipients doing so. Interestingly, companies that have received both an Innovate UK grant and equity investment have a higher valuation on average than companies that have received only equity investment. This is reassuring to see, since it suggests that the different forms of support offered to start-ups can be combined to produce more promising businesses.

It’s worth noting that these high valuations may be skewed slightly by the fact that Innovate UK focuses on supporting tech-heavy businesses, and many go on to achieve large late-stage valuations. However, since the average valuation of equity backed tech companies is still only £7.8m, it seems a large part must be down to Innovate UK’s involvement. This being said, very few of the highest valued private businesses have received Innovate UK support. Only two of the UK’s 15 unicorn companies received grants; Improbable was given £788k to help develop tools for managing autonomous operations, and Oxford Nanopore received £199k to aid research in the diagnosis of different flu strains.

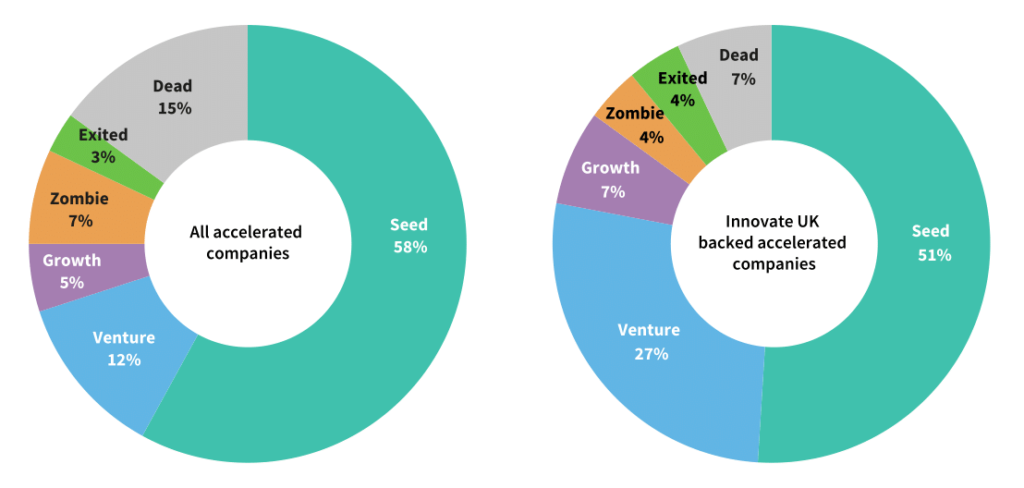

Another interesting area to look at is accelerator programmes. Overall, 5% of Innovate UK grant recipients have attended a recognised accelerator. With the support of a grant, the companies that attend these programmes are more likely to progress to growth stage or exit, and significantly less likely to die, as shown below.

This further reinforces the idea that providing ambitious businesses with several different forms of support is a good way to increase their chances of success. One notable company that exited following Innovate UK backing and acceleration by Entrepreneur First was Magic Pony Technology, a software development start-up that specialises in creating visual processing and video enhancement software. It was acquired by Twitter in 2016 for $150m, giving Entrepreneur First a whopping $6.5m return on their initial $16k investment.

The improvements in exit rates following Innovate UK support also extends to the UK’s scaleup population. 18% of scaleups that received grants went on to exit, compared with the average scaleup exit rate of 10%.

All in all, it seems that to give ambitious businesses the best chances of success, they need access to a number of different methods of support. Combining Innovate UK grants with equity investment or accelerator attendance looks like a sure way to boost exit rates and improve valuations. Our data shows that the UK’s funding and business support system is at its best when its constituent elements work together.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.