The Impact of COVID-19 on Life Sciences Companies in the UK

Category: Uncategorized

The life sciences sector covers companies that develop pharma, medical devices, and research tools and reagents that are based on scientific research of organisms. Recently it has been pulled into sharp focus in the fight against COVID-19, with a massive wave of medical technology, health technology and drug development in progress.

The United Kingdom is a world leader in the life sciences sector, with an incredibly varied portfolio of companies with a reported combined turnover of £4.9b. As it currently stands we track 865 of those life sciences startups and scaleups.

In this post, we’ve taken a look at the impact of COVID-19 on these companies and the wider life sciences industry. From the impact on everyday operations to jobs at risk and fluctuating investment figures, we examine how these UK startups are holding up.

Impact overview

The life sciences sector is one of the few sectors which has demonstrated growth in the past quarter. Unsurprisingly, this is in part due to the ongoing work in the search for a vaccine for COVID-19.

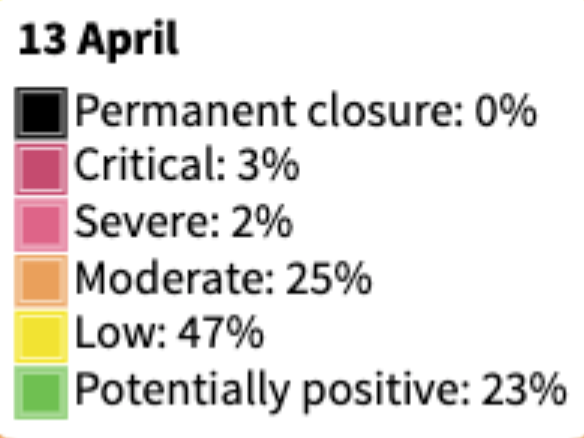

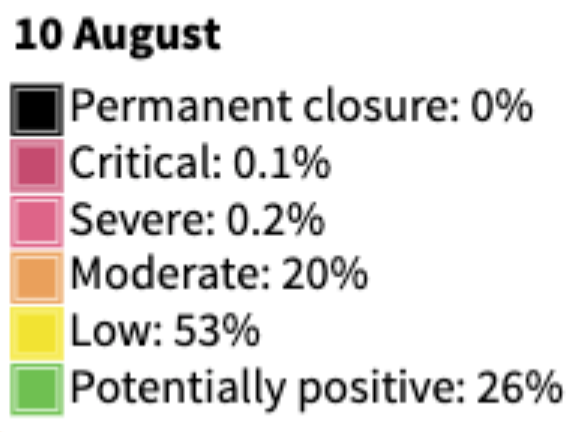

Across the landscape, 53% of life sciences startups are currently at low risk – considerably more than the wider ecosystem average of 42% – whilst an impressive 26% are potentially positively affected.

Our research has revealed that only 0.1% of life sciences companies are critically affected and 0.2% are severely affected by COVID-19. This is low compared with the current wider ecosystem, where 7% of high-growth companies fall into these categories. There have been no permanent closures.

When comparing these stats with April (not long after lockdown measures were put in place in the UK) there has been a decrease in the number of companies critically and severely affected by the pandemic, whilst the number of potentially positively impacted companies has increased by three percentage points. This is a clear indication of signs of improvements within the life sciences sector.

Impact on employment

Whilst employment in the UK fell by the largest amount in over a decade between April and June, the life sciences sector is in a fairly strong position. Our research shows that just 9% of UK life sciences jobs are under critical, severe and moderate risk compared with 38% of employees in the wider ecosystem.

Meanwhile, 62% of jobs in the life sciences sector have been potentially positively impacted — that’s nearly double the wider ecosystem where only 35% of high-growth startup employees fall into this same category. With much of the sector playing a vital role in finding ways to combat COVID-19, it comes as no surprise that many life sciences professionals are less likely to be at risk.

Specific areas of impact

When looking at the data on a more granular level, we’ve found that a massive 33% of life sciences companies are experiencing a surge in demand. Likewise, 14% of life sciences companies are creating job opportunities, including biotechnology startup Immunocore. Several companies have confirmed that they are experiencing both; including Perspectum Diagnostic, Biofortuna and Almac. These companies have been well placed to weather the coronavirus storm as they are all well funded pharmaceutical companies or specialise in developing medical devices that help fight and identify diseases.

Other companies faring well include Randox, a company which develops clinical diagnostics for illnesses such as cancer, cardiovascular disease, and Alzheimer’s disease. In April, the company partnered with the government to develop a new coronavirus testing program. Likewise, BenevolentAI used artificial intelligence to identify and analyse an approved drug that may have potential as a coronavirus treatment which is currently undergoing trials.

This isn’t to say that the life sciences sector hasn’t been negatively impacted at all. In fact, 32% of companies have had to limit physical services provided. This is most likely due to the fact some existing projects and research can’t be carried out remotely. On top of this, supply chains for some healthcare providers and pharmaceutical companies have been negatively impacted, with longer lead times than usual. And with attention shifted to fighting coronavirus, industry insiders have cautioned that those not working on COVID-19 projects may risk having their research and clinical trials delayed, or may fall by the wayside if investor confidence wanes and attention shifts towards vaccines.

Fundraising trends

To date, there has been around £5.4b of announced investment funneled into the UK’s life sciences sector. Despite the restrictions and lockdown measures, Q2 2020 was a strong quarter for life sciences, with 32 deals totalling £342m – the fourth highest number and third highest amount since our records began.

2020 looks like it will be a strong year for the life sciences sector, with companies set to secure over £900m of equity investment by the end of the year, easily beating the £577m raised in 2019. Deal numbers, however, look like they’ll continue on the current downwards trajectory. This is due to an increased number of large value deals, and a lower number of small deals.

Early stage life sciences companies are going to need a new wave of capital if they are to continue developing and growing. But with so much focus on COVID-19, especially as a second wave is starting to rear its ugly head, this could prove extremely difficult for those operating in other areas, especially those conducting clinical research that may have been postponed due to the pandemic.

Want to see the full year figures? Download our free equity report.

The top life sciences companies in the UK

Ranking in the first place is Oxford Nanopore Technologies, which has secured a whopping £571m in fundraisings. Founded back in March 2005, the company develops a range of portable DNA and RNA sequencing devices, that are also capable of characterising epigenetic modifications. In 2020, it raised £78m through 3 fundraising rounds and has been using its nanopore sequencing technology to research COVID-19. Its investors include Invesco Perpetual, IP Group, and Illumina.

Runner up is Univesity of Oxford spinout Immunocore, which is a company that develops drugs to treat cancer, viral infections and autoimmune diseases. To date, it has received £281m in equity fundraisings and £2.41m in grants. The most recent fundraising activity was in March 2020, when Immunocore secured £30.2m to further expand and accelerate its clinical-stage pipeline.

In third place is Kymab, a company focused on discovering and developing human monoclonal antibody therapeutics with its proprietary technology, IntelliSelect. The company has raised £225m through 8 rounds of funding and has also received a whopping £7.39m in grants. Investors include LifeArc, Malin Corporation, and ORI Healthcare Fund. The most recent funding for the company was secured in October 2019 and totalled £15.5m.

Want to gain access to our exclusive COVID-19 impact dataset?

When the pandemic broke in the UK, we undertook the mammoth task of determining the individual business impact of COVID-19 on the 32k companies we track and their respective sectors.

Now, using our powerful search tools, you can identify opportunities in both positively and negatively impacted companies, understand your exposure to risk and help companies in need of business support, plus, so much more.

Book a 30 minute demo to see how you can navigate the changing economic landscape to ensure your business is focusing its efforts in the right direction.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.