How venture capital firms use Beauhurst for due diligence

Category: Uncategorized

There is no denying that the venture capital due diligence process can be laborious. It usually involves hours of trawling through Google searches and Companies House filings, weighing up the risks and rewards of making an investment. Due diligence typically gets more detailed (and expensive) as a deal progresses towards term sheets and material contracts. Whilst many firms will outsource due diligence to professional advisors—particularly at later stages in the deal process— it’s not economically viable to do this with every company that comes through your door.

The Beauhurst platform can simplify this screening process at all stages of the deal pipeline and provide a wealth of additional data, so you can be sure you’re picking the right high-growth companies for your fund. We track over 32,000 of the UK startups and scaleups, and have curated company profiles from tens of thousands of sources.

You can investigate prospects with ease by using our intelligent set of monitoring and analysis tools. Check up on everything from financials, valuations, and transactions, to social media and management teams. Due diligence becomes more thorough and faster, so you can confidently anticipate future commercial success of an investment prospect.

The Company

The majority of VC firms deal with early-stage companies, which tend to be pre-revenue. This makes it especially difficult to anticipate future commercial success.

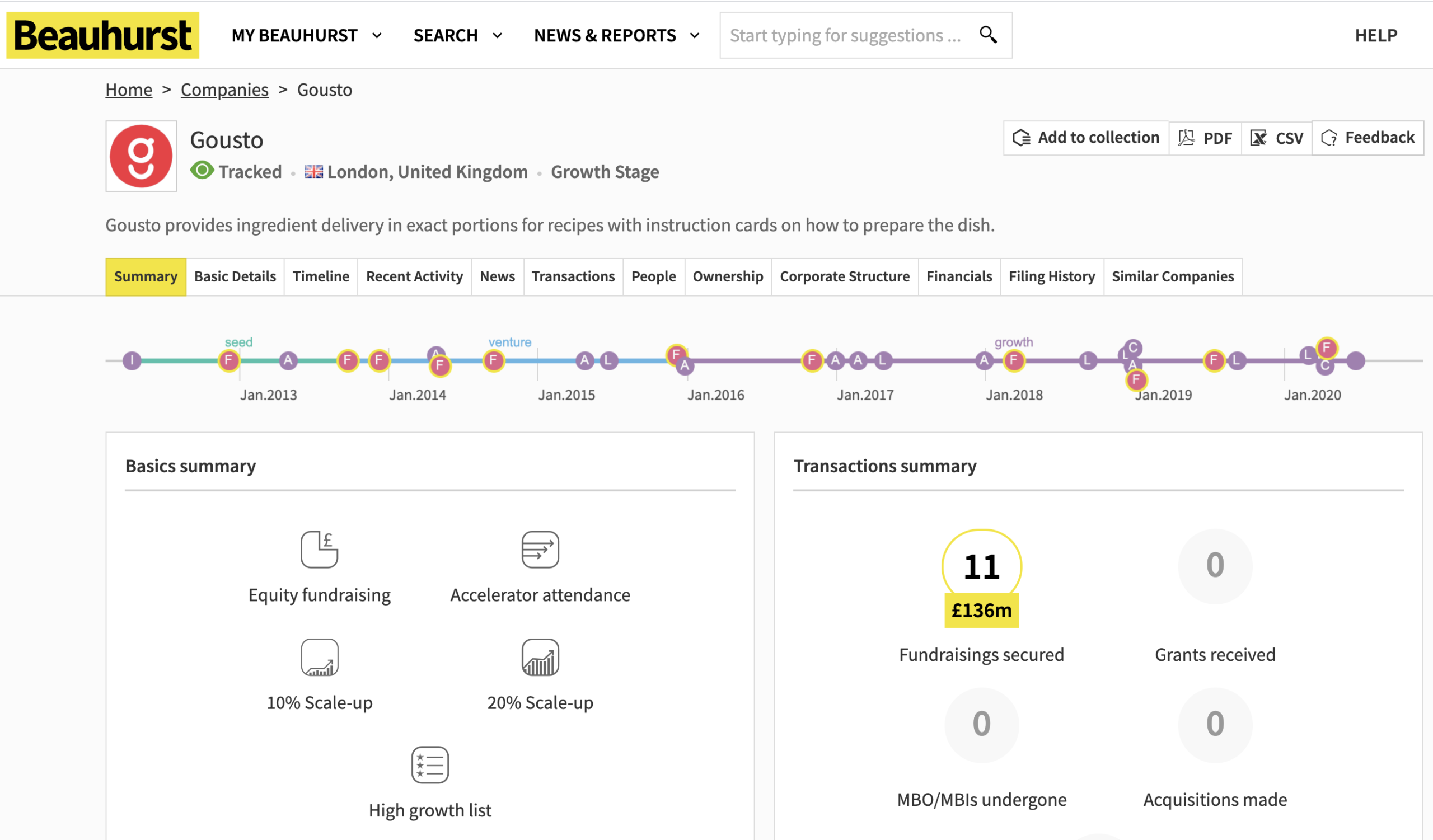

We track 30,000 ambitious, high-potential companies on the Beauhurst platform. Use the search bar to quickly find one of your prospects, and click through to its profile page. The profile provides everything you need to know for an initial screening. This includes the company timeline, detailing each of its previous transactions, as well as all of its financial statements in a clear and exportable format.

Start digging into the specifics with data on headcount growth, key strategic changes, press announcements, and previous investors. And you’ll be able to see all the investments the company has secured so far; Beauhurst is the only data provider in the world to track unannounced fundraisings, which make up 70% of all investments in the UK.

The People

Companies House holds some important data on registered company directors, but doesn’t provide any further information on senior management or the founding team. The Beauhurst platform reveals all of this data, and shows you a breakdown of each key individual’s personal network; see each person’s directorships, shareholdings, and C-suite appointments at other high-growth companies.

The Market

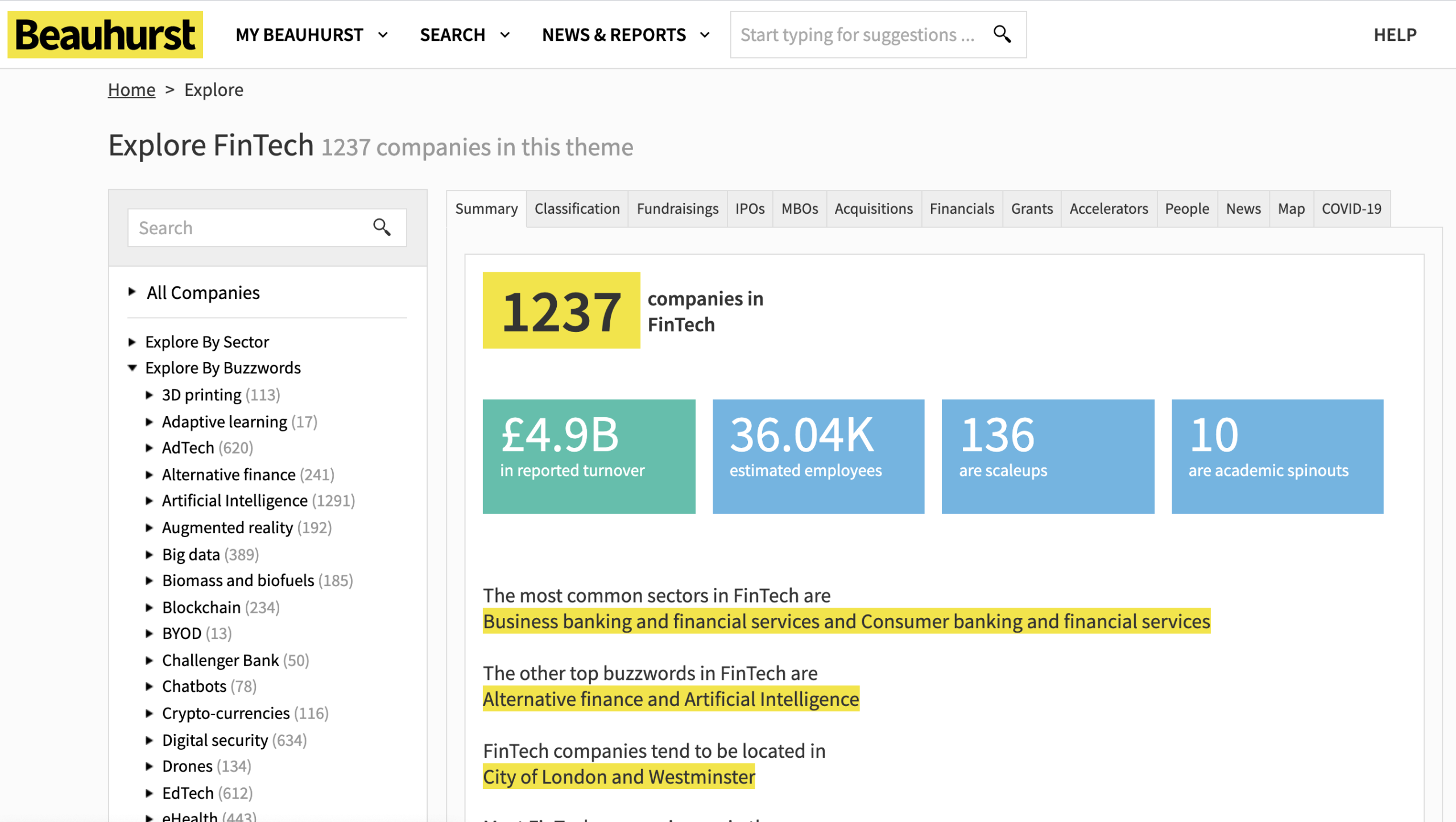

Quickly evaluate a company’s market position with our Explore feature. See comprehensive data on a specific geographic region or industry, including the best funded companies and the most active funds in the space, plus a picture of sector growth and investments over time.

Need to do a quick competitor analysis? Our Similar Companies tool uses machine learning to build a comprehensive list of competitors based on sectors, buzzwords and descriptive text.

Keeping Track

Our ‘Collections’ tool allows you to stay up to date with all your new prospects, sending you an email alert whenever they hit the news.

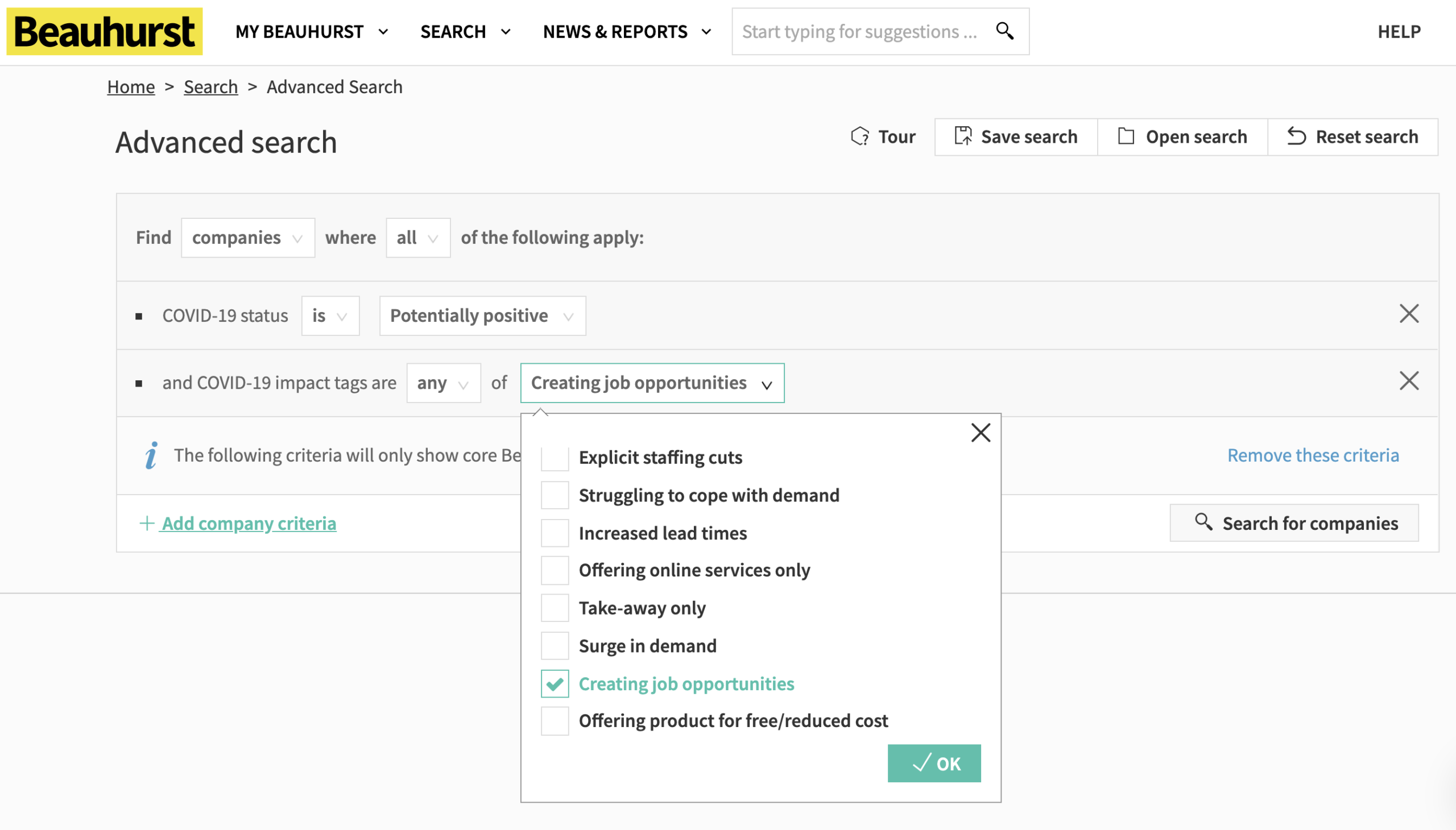

With our latest COVID-19 Impact Data you can also keep up to date with how companies have been affected by the pandemic. From the impact on everyday operations to the overall status of the company—we alert you of any changes so you can make better investment decisions.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.