How to Spot MBO and MBI Opportunities Before Anyone Else

Management buyouts (MBOs) and management buy-ins (MBIs) can be a lucrative opportunity for investors, private equity firms, and corporate finance professionals.

But identifying promising opportunities early is difficult. That’s why we’ve put together this article — exploring why finding MBO and MBI transactions before anyone else is so important, how you can spot these opportunities, and even some tips and tricks to automate the work for you.

Understanding MBOs and MBIs

Differences between an MBO and an MBI

A management buyout (MBO) happens when a company’s existing management team acquires a significant portion or the entirety of the business they currently operate. This is typically when the current owners, such as founders or private equity firms, decide to sell, allowing the management team to take control of the business’s future.

A management buy-in (MBI) involves an external management team purchasing and taking over a company. In this case, the incoming team aims to use their expertise and experience to improve the company’s operations or drive growth.

Breakdown of the key differences

Purpose

MBOs focus on continuity and using the existing management’s insider knowledge, while MBIs often introduce fresh perspectives and strategies from external executives.

Process

MBOs usually benefit from smoother transitions, as the team is already familiar with the business. MBIs may involve more due diligence and adjustments due to the external team’s learning curve.

Outcomes

MBOs often prioritise stability, while MBIs are geared toward transformation and growth.

Ready to upgrade your approach?

Discover how BeauhurstAdvise can open the door to more opportunities.

Signs of a potential MBO/MBI opportunity

Early indicators to watch for

One of the key things you need to be doing if you want to spot MBO and MBI opportunities before anyone else is to look out for early indicators from companies. This means staying on top of what companies are doing, their news, and their data. Here are some clues that might help you.

Positive profitability

Take a look at a company’s revenue streams. If a business has an established revenue stream, with profitability over a number of years, this could be a starter indicator that a company would suit an MBO or MBI.

Leadership transitions or succession planning

Positive growth potential with untapped value

Market and company trends

Industries with frequent MBO/MBI activity

Some industries have historically seen more MBO or MBI activity in the UK. Beauhurst data shows these are the top five industries for number of MBOs and MBIs in the UK over the past ten years:

1. Distribution and wholesale

2. Application software

3. Manufacturing

4. Parts and components

5. Human resources

Focussing on these industries therefore might increase your chances of identifying new MBO and MBI opportunities.

But depending on your niche, you may want to focus on other areas. The Beauhurst platform tracks all MBOs and MBIs in the UK, with detailed industry classifications covering the whole economy, so you can dig into any industry or specialism you choose.

Want to see more on MBO and MBI data? If you’re already a subscriber just click here. Or book a meeting with one of our experts and they can talk you through it.

Analysing trends in funding rounds, shareholder changes, and corporate filings

It’s also important to keep up with any company changes to spot any trends or patterns, such as funding rounds, shareholder changes and new corporate filings. An easy way to do this is to use a data platform like ours — where you can get automatically updated on any company changes to companies added to your Collections. Find out more now.

How AlbionVC Uses the Beauhurst API to Enrich Its Data

Tools and strategies for early detection

Data platforms for deal sourcing

Data platforms (like ours) provide valuable tools for identifying potential MBO/MBI opportunities by aggregating and analysing critical company information, including financials, news, cap tables, and transactions.

Data platforms allow users to:

- Track financial performance, funding rounds, and valuations.

- Identify executive changes, leadership transitions, or ownership shifts.

- Monitor industry-specific trends and emerging opportunities.

Proactive monitoring techniques

Setting up alerts for relevant company events

Building a pipeline of potential targets with predictive data

Leveraging relationships and networking

Relationships with industry insiders, such as executives, advisors, and consultants, can provide early access to information about potential buyout opportunities. Informal conversations and networking events are often the first places where whispers of impending deals emerge.

You might also want to partner with advisors or brokers who specialise in MBOs and MBIs.

Building long-term partnerships with brokers who understand your investment criteria and can proactively introduce relevant deals is a great way to get access to off-market opportunities that you’d miss otherwise.

How to spot MBO and MBI opportunities using Beauhurst

You can do all of the things above using the Beauhurst platform. Here’s how:

1. Use our Advanced Search and filtering options to find companies that might MBO or MBI

You can use the Beauhurst platform to find companies of interest to you that also might MBO or MBI. Using our Advanced Search, you can start by filtering your search by industry and size.

It’s best to narrow your search to industries known for frequent MBO/MBI activity or companies of particular interest to you.

2. Identifying key indicators of an upcoming MBO/MBI within company profiles

With Beauhurst, you can track a number of key indicators that a company might be moving towards a MBO or MBI. On our company profiles, you can see all about company changes. For example:

Leadership transitions — you can quickly identify any management changes using our ‘People’ section on a company profile. From here you can also see the age of founders, directors and shareholders. For example, if one director is in their 70s and another director in their 30s, we may see a change of leadership coming up soon.

Financial performance — you can easily access a company’s financial filings under our ‘Financials’ section, and spot companies with stable or growing cash flows but that are facing shareholder fatigue or a need for strategic redirection.

Funding rounds — you can also search over ‘Fundraisings’ to find late-stage funding or signs of investor exit, such as private equity firms nearing the end of their investment cycle. Want to know more about how to do this? Speak to one of our team, or take a look around our BeauhurstInvest page.

3. Set up alerts for key events

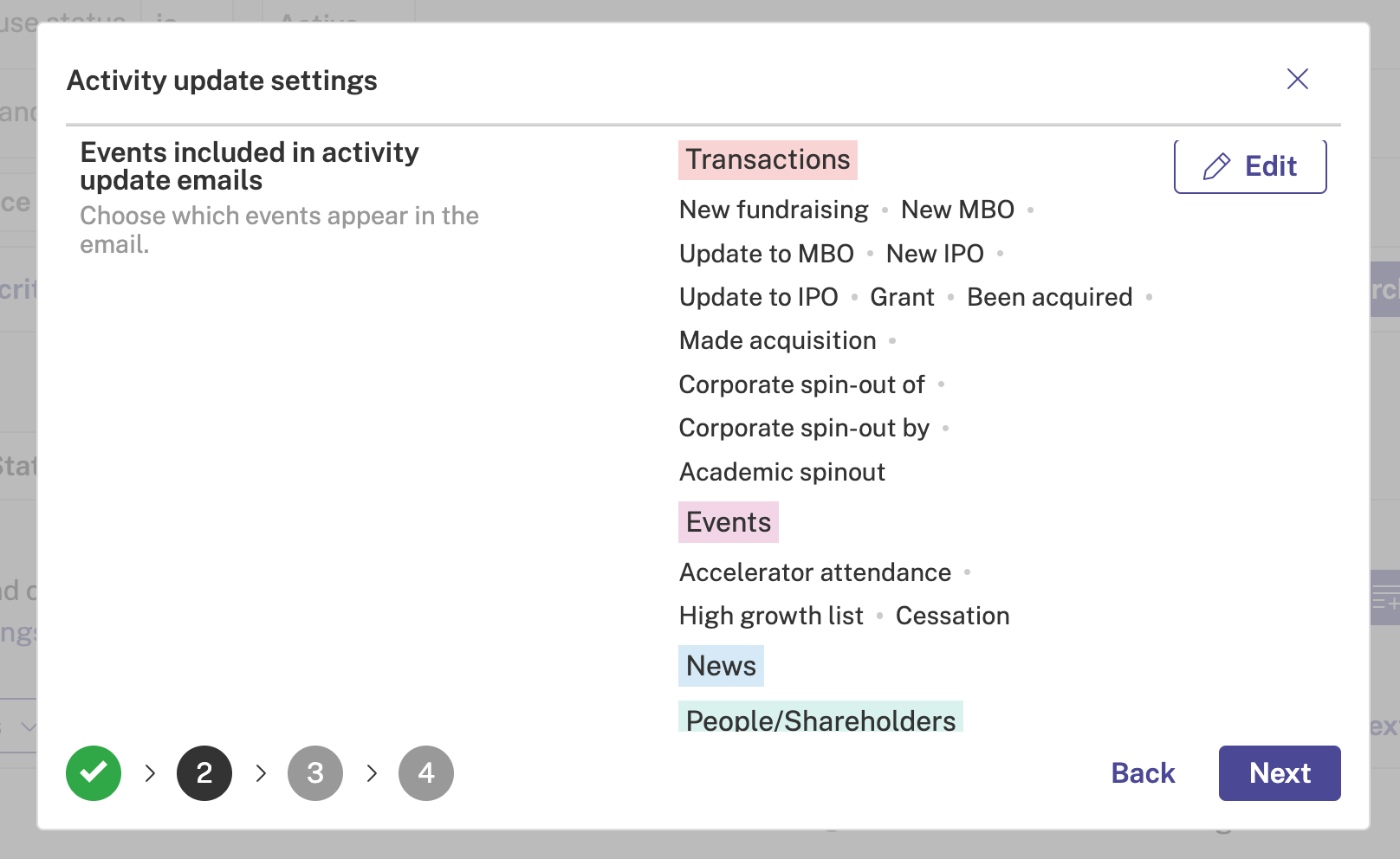

One of the key benefits with Beauhurst is that you can create custom alerts for events such as funding rounds, leadership changes, and shareholder exits. This means you don’t have to manually check this data — it’ll just land in your inbox whenever you want it.

You can do this by using the method above to create an Advanced Search to find companies of interest, then adding them to a Collection.

You can set up a Collection by clicking on the right-hand side button; ‘Add to Collection’, once you’ve run your search. From here you can select which types of alerts you’d like and how frequently you want them in your inbox.

You can also be alerted when new companies fit your search criteria; these can automatically be added to your Collection, so you never miss a new opportunity.

Use these alerts to act quickly when a potential opportunity arises, giving you an edge in competitive markets.

You can also use the Beauhurst platform to:

- Analyse historical trends by using our data on companies that have been through successful MBOs or MBIs to identify patterns.

- Collaborate with partners by sharing insights from Beauhurst with advisors, intermediaries, or brokers specialising in MBO/MBI transactions.

- Validate opportunities brought by your network or to negotiate better terms through data-driven evidence.

Explore our YouTube channel

Discover our YouTube page where you can watch videos on everything from finding investment opportunities to how to conduct a company financial health check.

Avoiding common pitfalls: Mistakes when pursuing MBO/MBI deals

Entering deals too late

Overpaying due to competitive pressure

Why MBOs/MBIs fail

Poor financial planning or execution

Lack of alignment between buyers and sellers

How to mitigate risks

Due diligence

Structuring deals to protect all parties involved

- Include performance-based earnouts or staggered payments to align interests and reduce upfront risk.

- Ensure clear agreements on post-deal roles, responsibilities, and governance structures to avoid conflicts.

- Seek professional advice to optimise tax implications and financing terms for all stakeholders.

How Beauhurst can help you find MBO and MBI opportunities

Spotting MBO and MBI opportunities early can be the difference between securing the deal of a lifetime and missing out entirely. From understanding the nuances between MBOs and MBIs to identifying key indicators like leadership transitions, financial pressures, and market trends, early detection is crucial. Tools like Beauhurst make this process not only possible but also efficient.

With Beauhurst, you can uncover potential opportunities before your competitors do. Our platform’s advanced search, real-time alerts, and detailed company profiles give you the insights you need to identify promising candidates, monitor critical developments, and act fast when it matters most. Plus, our analytics tools help you validate opportunities and make informed decisions backed by data.

Don’t let opportunities pass you by — start leveraging the power of Beauhurst today to stay ahead in the deal-making landscape.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy

FAQs

An MBO (management buyout) involves the existing management team purchasing the business they currently manage.

An MBI (management buy-in) occurs when an external management team acquires and takes over a business, bringing fresh leadership.

1. Employee buyout: The broader workforce, often alongside management, acquires the company.

2. Leveraged buyout (LBO): The purchase is financed primarily through borrowed funds, with the company’s assets serving as collateral.

3. Institutional buyout: A private equity firm or financial institution partners with management to acquire the business.