How Do Venture Capital Firms Use Beauhurst?

Sarah Cheeseman, 04 MAy 2023

Data and information are at the centre of most decision-making processes, and when it comes to driving investment opportunities, they’re even more vital.

Although company data has been openly available for many years through a variety of sources, there has been a distinct lack of in-depth, ‘single-truth’ information. Without up-to-date, relevant data in one place, venture capital firms (VCs) can be at a disadvantage when making investment decisions.

That’s where BeauhurstInvest comes in. Our platform brings together data from numerous sources to enable VCs to find information on every UK private company, from startups to scaleups, and to use this knowledge to build deal-winning intelligence.

So, what is BeauhurstInvest?

BeauhurstInvest is the data platform for investors and accelerators by Beauhurst, the ultimate private company data source. BeauhurstInvest is a searchable platform housing data on every registered company in the UK. It’s a centralised location for all the data and insights you need to make fast, informed decisions.

But how does it work? In this article, we’ll look at how VCs use BeauhurstInvest and the multitudes of data points that can be extracted.

Why do venture capital firms use BeauhurstInvest?

From visibility to screening, here are some of the most popular (and successful) ways that we see VCs using our platform.

Identify ideal investors

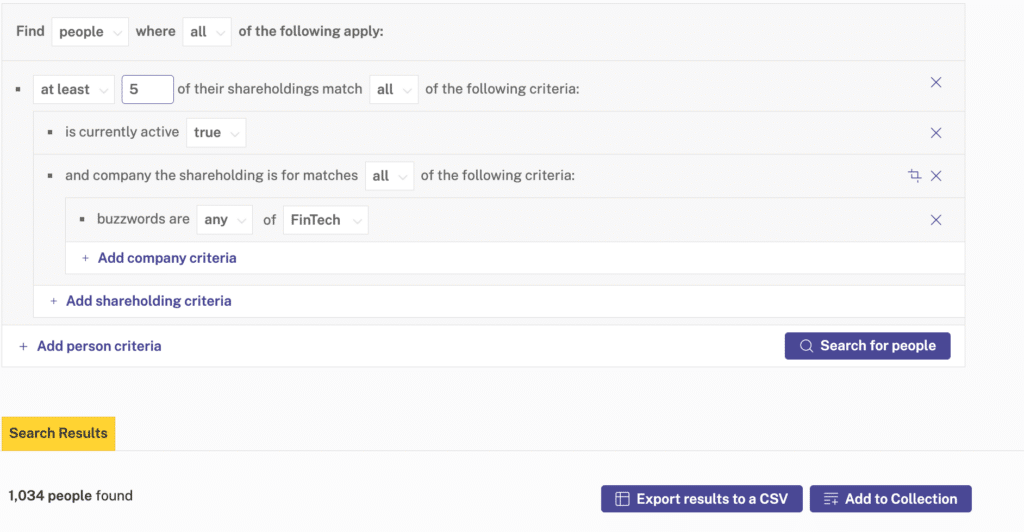

As you know, finding high net-worth individuals to invest in your fund is one of the first steps. With BeauhurstInvest, you can identify those who match your investment thesis and are aligned with the types of investments that you want to make—for example someone who has multiple investments within the fintech sector. We’re also able to give an estimated ‘paper worth’ of individuals, saving you valuable time on research.

A good example of a recent search can be found in the platform screenshot below. This simple search was performed by one of our VC clients who was looking for people with shareholdings in fintech, and it returned over 1k results. We then refined this by looking at the most prevalent angel investors with a percentage of at least 1% for all five holdings, returning 24 results.

Find exciting companies to invest in

The BeauhurstInvest platform enhances your ability to scan over the whole UK private market using specific search criteria, data sources and growth triggers, to create a list of ideal investment opportunities.

Our platform can also automatically alert you to new or emerging companies that fit into your segmentation, putting you ahead of competitors looking to invest. And thanks to the team of 60+ data experts working with the latest machine learning models and data extraction tools, you can be sure you’ve got a complete picture of the UK private market. This means your firm is always equipped with up-to-date, accurate data.

But that’s not all—we also publish weekly articles to spotlight the most exciting companies that we’ve found through our platform in areas such as fintech, AI, cleantech, contech, and medtech.

Get greater visibility

Our platform gives you access to data that you can’t find elsewhere. Our in-house data curators work hard to provide you with insights into the market and deal-winning intelligence. Whether you want to see where the money is flowing, how this has changed over time or what sectors are popping up that you should be aware of, our platform is there to help you to form and develop your investment thesis.

Screen inbound leads

One challenge we know many funds deal with is managing and screening inbound leads. With potentially thousands of people getting in touch to discuss funding for their business, manual reviews are often time consuming and costly. With BeauhurstInvest in your toolkit, you can screen these companies in just a few minutes, enabling you to make better decisions, quicker. And for those companies that are of interest, you can access more details in a few clicks.

Complete top-level due diligence

Due diligence is, understandably, part and parcel of running a VC. Whilst there’s some information that you can only gather from face-to-face meetings, desk-based research enables you to start painting a picture of prospective clients. Our platform is the ideal tool for carrying out high-level checks for things such as shareholder information, investor details and director data. We can help you to ensure potential clients’ backgrounds are aligned with the type of business you’re looking to invest in.

Make indisputable deal comparables

Our platform provides you with ‘one version of the truth’ comprehensive funding and valuation data that is indisputable, including announced and unannounced fundraisings. With BeauhurstInvest, you have access to information on all the acquisitions, IPOs or valuations in your chosen sectors to pull together a complete market outlook. This supports the development of accurate company valuations and enables easier, data-driven conversations with founders.

Track where other funds are investing

Smaller funds may be interested in taking a look at what other investors are doing in their space, either to get an idea of where they should be putting their focus, or even to potentially find other funds who may be open to co-investing in a deal.

Our client, 24Haymarket, is a leading deal-by-deal investment platform focused on high-growth businesses. It uses Beauhurst to identify and validate new investment opportunities. Since working with us, they’ve identified a number of promising investment opportunities using our advanced search capabilities, as well as improving their efficiency for the first stage investment process. Read more about how 24Haymarket use our platform.

What can I use BeauhurstInvest data for?

With over 5m+ profiles on active UK companies, we source data from almost anywhere you can think of to build out our platform. For VCs in particular, there are a number of key areas that can be hugely beneficial for the day-to-day management of funds and for future planning.

1. Company and fund watchlists

If you’ve got your eye on any particular companies or funds, you can set up watchlists (or ‘Collections’) to track them and follow their growth. By tracking your existing portfolio, for example, you can then use this to isolate areas of growth that you want to double down on, or analyse the portfolio of competitor funds to identify any new areas that you want to explore and understand better.

2. Review relevant statistics

Our platform gives you instant access to accurate and reliable data, enabling you to quickly review trends and discover insights across a range of different industries. These can be set up for your own portfolio, or to help you keep an eye on sectors that you’re not currently working with so you can be alerted to any interesting opportunities. These statistics can be particularly useful when you’re competing with other VCs for an investment and want a data-driven edge to your proposal.

3. Detailed searches

With our advanced search tools, you can overlay specific criteria to generate results for whatever you’re looking for. This gives you a clear view of what’s happening at the moment in any given space, for instance, who’s receiving funds, who’s investing, which markets are growing, and vital valuation information.

Some of the common searches we see from our VC clients include segmenting the data by:

- Sector

- Equity raised

- Ordinal number of investments received

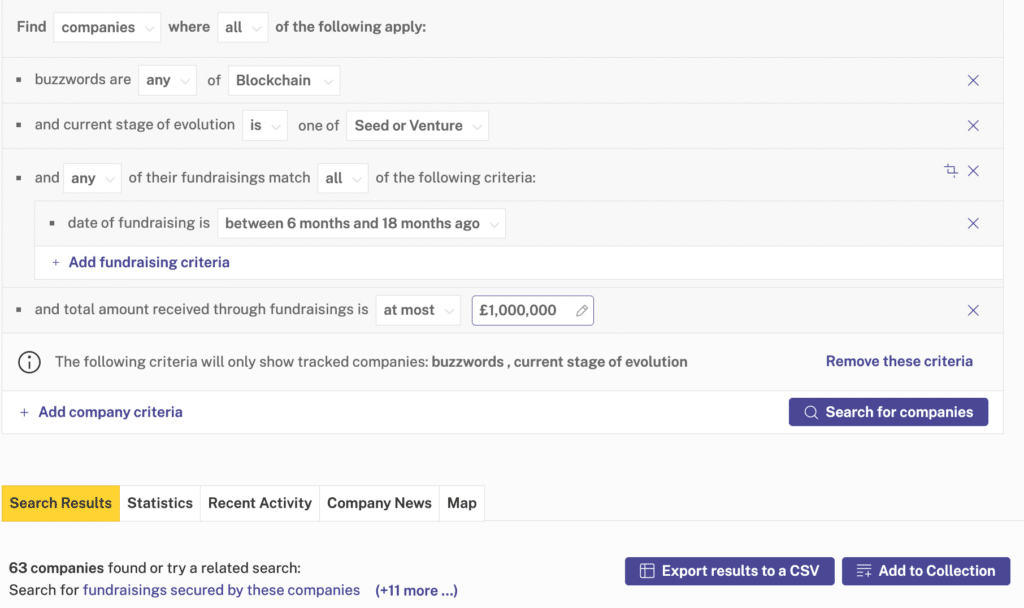

- Time since last funding (e.g If you're only interested in investing in blockchain, that has already received funding between £500K -£1M in the last 12 months.)

Putting all of the above together, we can run a search for e.g. “All Series A Blockchain companies with less than £1m total investment, which received their latest round between 6 and 18 months ago.

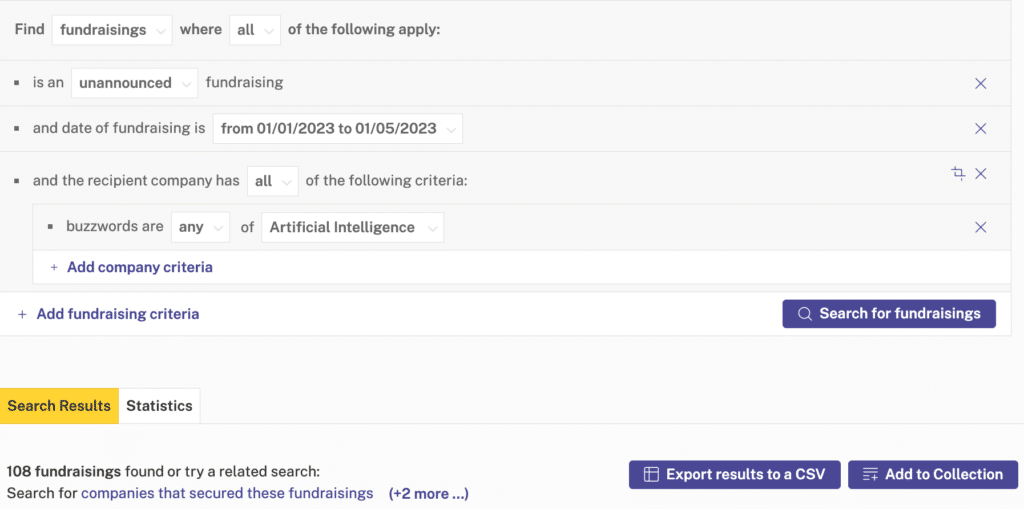

4. See unannounced funding rounds

Not all investment is made public. And yet with our platform, you can see both announced and unannounced funding, so you can confidently go into conversations with more knowledge than other potential competitors. Not only can this boost your reputation, but it also keeps you from making decisions based on bad data. For example, at the time of writing, there have been 72 unannounced fundraisings in AI companies, something you may not have previously known.

5. Monitor activity in your portfolio

You can set up automated email alerts for your portfolio to notify you of new activity from a company, so you’re always in the know. Common alerts we see are for:

- Capital/fundraising

- People appointments

- Account updates

We see VCs commonly use this to stay up to date and to identify timely opportunities for investment.

6. Get early stage visibility

One of the most exciting things about our platform is that it offers early stage visibility for exciting opportunities—before anyone else. By setting up alerts for people who have had previous success in their sector, you can be one of the first to find out if they get any new directorships or start any new companies, long before it lands on LinkedIn.

Working with Beauhurst

With BeauhurstInvest, you don’t just get access to industry-leading, you also get day-to-day customer support to make sure that you and your team always get the most out of it.

Interested in learning more? Book a demo or speak to a member of our team today.

Uncover the most innovative tech companies in the UK.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.