How Do Corporate Banks Use Beauhurst

Lily Ruaah, 31 October 2024

It goes without saying that the banking industry is competitive. With businesses and individuals alike tending to choose their provider and stick with them throughout their lifetime (or at least a significant period), there’s a slim window of opportunity to get in front of them in the early stages and showcase why you’re the best provider for them.

It’s also essential for banks to gain and retain clients through thorough client monitoring and effective relationship building and management, which means you always need to be on top of what’s going on with your clients and the market space in general.

One of the best ways to do this is by utilising the power of data. Our platform, BeauhurstAdvise, can give you access to that data.

What is BeauhurstAdvise?

BeauhurstAdvise is a data and news platform that brings together millions of profiles of active UK companies into one searchable system. We provide up-to-date visibility on every industry and sector using a unique blend of machine learning models, data extraction tools and 60+ data analysts. The resulting data is accurate, verified and relevant. And because we’re constantly developing and updating the platform and data, our customers have everything they need—at every stage of the process.

The data platform for banks

Discover how BeauhurstAdvise can help you gain and retain more clients.

Why do banks use BeauhurstAdvise?

Our platform is tailored to meet the unique needs of those working in or running a bank. It empowers teams to work more efficiently, make data-driven decisions, and enhance customer experiences. But how can banks benefit from Beauhurst?

Corporate banks

In corporate banks, your teams work on understanding client companies’ latest news, financial health, valuation, and exit options, particularly in cases where they advise on mergers, acquisitions, or financing for growth. Beauhurst can help a corporate bank thrive from support with relationship management, M&A advisory, data for benchmarking and market analysis, live news on client companies, and information on pre-IPO companies.

Relationship management

For relationship managers at corporate banks, staying informed on the latest developments regarding their clients is essential. Access to live news alerts, along with updates on critical changes — such as new regulatory filings, shifts in executive leadership, and other significant company events — equips them to maintain a proactive and responsive approach.

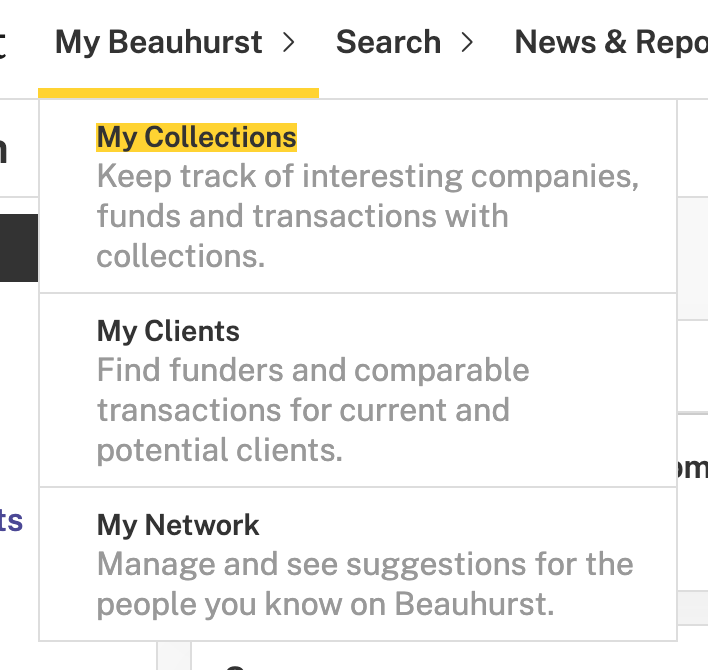

With Beauhurst, you have access to real-time intelligence through our Collections. Setting up a Collection either on a set of companies or clients means you’ll be automatically alerted to any changes or important news, directly into your inbox.

This allows relationship managers to anticipate client needs, respond quickly to emerging challenges, and deliver high-value, informed guidance in a fast-evolving business landscape.

M&A advisory

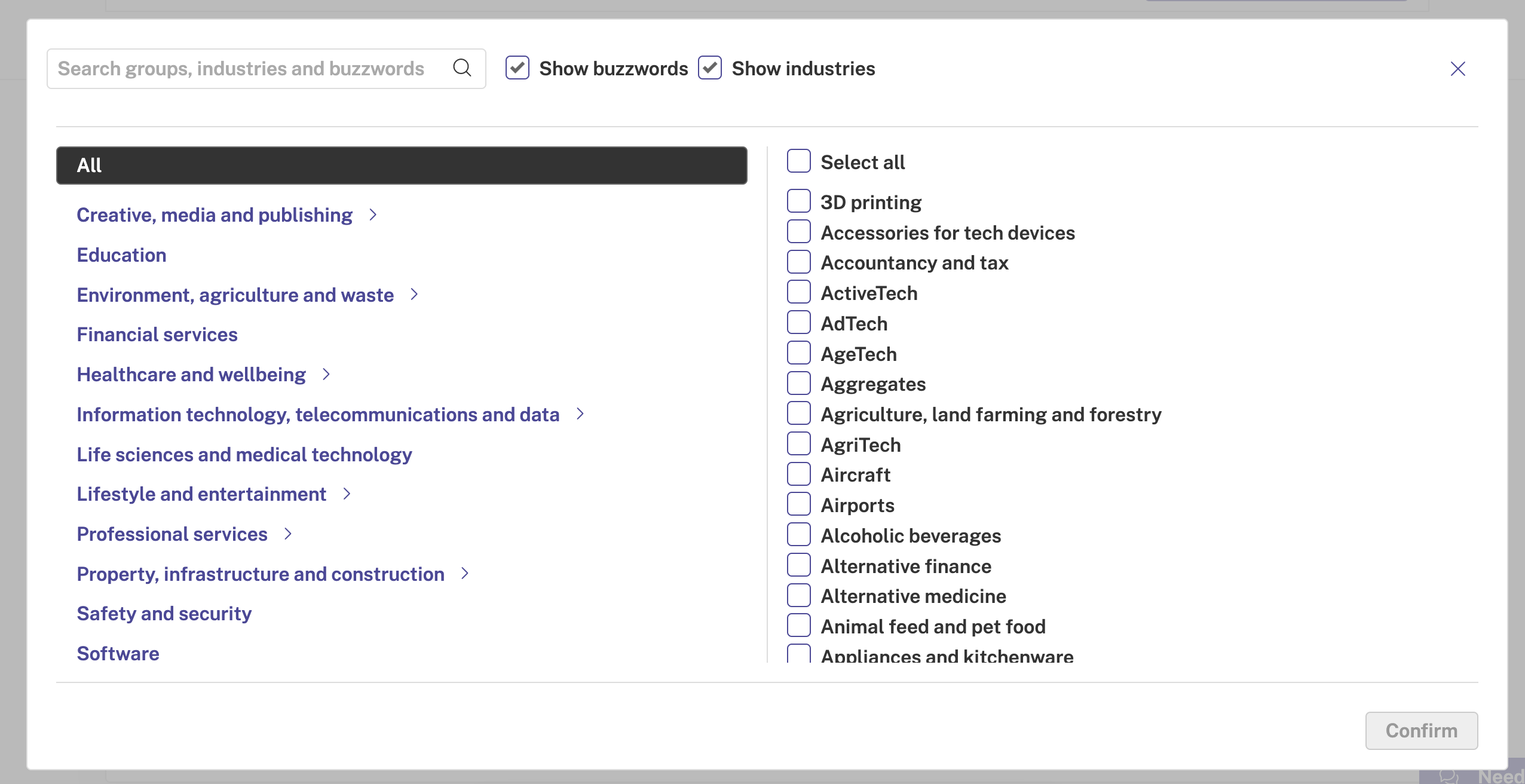

Our Advanced Search feature on the Beauhurst platform allows you to search across millions of companies, people, fundraisings and more. You will have access to a number of search criteria options so you can find exactly what you’re looking for no matter how niche it is.

For example, as you can see above, under our ‘significant events’ drop down, you can easily search via acquisitions — allowing you to identify patterns in acquisitions and spot opportunities for the future.

Benchmarking and market analysis for strategic planning

Beauhurst gives you access to industry benchmarking data. For example, you can compare clients’ financial health, growth rates, and operational efficiency to their competitors. This helps you deliver strategic advice to clients.

Our industries and buzzwords data provides you with insights into broader market trends, which can guide advisory services and position your bank as a knowledgeable partner.

Pre-IPO financial analysis

Corporate banks frequently need to evaluate companies nearing IPO to assess readiness for public markets. This includes analysing cash flow, profitability, and EBITDA. So it’s key for you to be able to source companies at different life cycle stages — you can find all of that information on the BeauhurstAdvise platform.

How to source companies at different life cycles using Beauhurst

You can easily find companies at different stages using the Beauhurst platform, by adding criteria to the Advanced Search feature such as employee number, turnover or amount raised. For example, in the image below we’ve narrowed down our search by including employee count 10-24 and amount of equity raised at least £100k — to find early stage companies that are receiving significant funding.

To narrow this down and find companies that might IPO, you might want to look at building some alerts.

Companies likely to IPO typically show steady revenue growth, strong investor backing, and may go through structural changes, like simplifying their corporate structure or reducing debt. They often increase capital investments, enhance financial reporting standards, and build up executive teams with IPO experience.

Using Beauhurst, you can get notified of changes like these — transactions, events, news and more — so you can keep on top of pre-IPO companies automatically.

How do corporate finance teams use Beauhurst?

Learn how corporate finance teams use Beauhurst to find opportunities — and how the platform provides a competitive advantage for advisors.

Business banks

Find high-potential businesses using Beauhurst

Finding businesses when they’re in the early stages is vital if you’re looking to develop long and trustworthy relationships. Our platform has signals for high-potential and high-growth companies—funding, scaleups, spinouts, high-growth lists and accelerators—which mean you never miss an opportunity.

You can use these signals to get automatically alerted when a new company shows early signs of growth. And you can combine this with other criteria such as sector or location to find exactly the right businesses at the right time.

Enhanced credit and risk assessment

Beauhurst provided access to comprehensive financial data. For a business bank, this data can improve credit assessments and risk profiling by offering a deeper look into potential borrowers’ financial health, cash flow stability, and growth potential. On the platform, you can find all financial data on a company profile, or you can search over financials in our Advanced Search feature.

Supporting due diligence for complex accounts

For SMEs with complex corporate structures or multiple shareholders, Beauhurst gives you access to easy to understand corporate structure data. Under the ‘corporate structure’ tab on a company’s profile, you’ll find all the information you need to understand a company’s legal structure. You can also view their complete cap table, and changes to this over time, on the ‘ownership’ tab. This is critical in meeting compliance requirements and assessing group-level risk.

Taking this further, Beauhurst’s real-time updates on business developments, such as fundraising events, management changes, or significant news, can give you immediate insight into any potential shifts in a client’s risk profile or financing needs, helping you respond proactively.

Private banks

Private banks, serving high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), need support when it comes to finding investment opportunities, wealth management, and relationship building — this is where Beauhurst comes in.

Identifying high-growth investment opportunities

Beauhurst’s database includes high-growth and innovative private companies as well as information on founders, directors, investors, and management teams. This allows private banks to identify potential investment opportunities that align with their clients’ risk and return preferences.

Sourcing HNWIs using Beauhurst

As a private bank, you need to source HNWIs. But how can you do that?

You can easily find HNWIs on Beauhurst using the ‘people’ search option on Advanced Search. Here you can add criteria such as the person’s estimated paper wealth in shareholdings or their job title. After you’ve run your search, you’ll have a list of names with contact details including LinkedIn profiles, so you can reach out to people directly.

Tailored wealth management and strategic advice

Private banks can use Beauhurst’s data to help clients benchmark their personal business performance against similar companies in the market. And with data on high-performing industries, investment flows, and private equity trends, Beauhurst can help you provide strategic guidance for wealth allocation.

For example, you may suggest opportunities in growth-stage tech companies or early-stage green ventures after seeing these industries do well on our Explore page.

Networking and relationship-building

Beauhurst includes detailed information on individuals through our ‘people’ search option — this can provide private banks with valuable insights into potential partnerships or networking opportunities. This is useful for UHNWIs who may want to expand their influence or engage in strategic partnerships.

Private bank relationship managers must keep up with all client-related developments to provide timely and effective support. Real-time updates, including live news alerts and notifications on regulatory filings, leadership changes, and other significant events, are crucial for staying ahead.

With Beauhurst’s Collections feature, tracking clients and target companies becomes seamless. By setting up a Collection, managers can receive instant alerts on important changes and updates straight to their inbox, ensuring they’re always equipped with the latest information to better serve their clients.

We also have a weekly newsletter where Managing Director of Research and Consultancy, Henry Whorwood, discusses business news for the week and brings you invaluable insights.

The Beauhurst Newsletter

For a private bank, Beauhurst offers a unique way to deepen client engagement, support investment decisions, and provide comprehensive business planning advice. Through Beauhurst, private banks can identify new investment opportunities, streamline due diligence, enhance regulatory compliance, and deliver personalised wealth and succession planning solutions.

How Coutts is finding and winning new clients with Beauhurst

Keeping track of transactions and activity in the market

Keeping track of transactions and activity in the market is essential for all types of banks. Beauhurst can play a pivotal role in helping you do this.

Set up alerts

Our alerts function notifies you by email if any new people or companies fall into a saved search. This means that you don’t miss out on opportunities or new companies on the scene, so you can be the first to reach out. You can also proactively monitor your existing client base by receiving alerts on news, transactions, filings, and other events, ensuring you’re always in the know.

Working with Beauhurst

At Beauhurst, we want our clients to extract the most value possible from our data. That’s why we invest so much time into understanding exactly what your needs are and how we can support you – not just through the data available, but also through personalised insights and advice from our experienced account management team.

From helping you build out targeted searches, to advising on best practice campaign ideas, we’re always here to help boost your business strategies and see success through our platform. If you’d like to find out more about how we can work together, speak to a member of our team today. You can also see how the platform works by booking a demo.

Data-backed advisory is here

Discover how BeauhurstAdvise can help you make a real difference.