How Corporate Finance Teams Use Beauhurst

At Beauhurst, we’ve been working closely with corporate finance teams for over a decade. From sourcing high-quality opportunities to conducting detailed financial analysis, we empower them with the data and insights they need, when they need it.

In this article, we’ll explore how our clients in this sector use the platform — and share some tips on how you too can get the most out of Beauhurst.

Key challenges facing corporate finance teams

Competition for deals

Sourcing credible opportunities

Agreeing valuations

Agreeing a company valuation can be a challenge, especially when the business and corporate financier don’t see eye-to-eye.

Being able to justify a valuation is therefore key. This is dependent on comparable data and financial history — but this isn’t always straightforward to find.

Complex corporate structures

Due diligence is a time-sink for financiers — especially when companies exist in labyrinthian corporate structures that, even after hours of research, don’t always make sense.

Being able to expedite the finding of a UBO (ultimate beneficial owner), and the jurisdictions in which the company operates, can slash due diligence times.

Access to accurate, reliable, and timely data

Underpinning all of these challenges is the access to accurate, reliable data. This is true whether you’re looking for thorough financials of a pre-IPO company, or you’re researching the market space for a disruptive, early-stage startup. Disparate data, siloed in different tools and locations, makes this far more complex.

How corporate financiers use Beauhurst to source opportunities

Whether interested in seed companies or businesses about to IPO, corporate finance teams use Beauhurst to source opportunities at every stage of a company’s evolution.

There are a number of ways to do this with our data, depending on your teams’ specialism and the maturity of your target companies.

Seed

Finding founders

On Beauhurst, you can find key people within any business with ease. Simply open up a company profile and click the ‘People’ tab in the side menu.

Here you’ll find key stakeholders in the business, from CEOs and directors to heads of departments. But you can go further, with each key person possessing their own page, detailing their current and historical roles.

Analysing market size and industry trends

Looking to see how a seed company compares to its wider industry? No problem. Simply fire up Advanced Search and select your industry of choice.

For example, if you’re looking for a comprehensive view into the UK’s femtech industry, simply navigate to buzzwords and industries and select femtech. Further refinements can be made to finetune your search — such as region, the companies’ stage of evolution, or even to return only companies with a patent or innovation grant.

Beauhurst Industries, which we developed as a panacea to the highly flawed and dated Standard Industrial Classification (SIC) codes, is a highly versatile classification dataset that is unrivalled in scope and accuracy.

Venture

Performing a competitor analysis

Sure, you could manually trawl LinkedIn and Google for research data on a company’s competitors.

Or, you could simply save hours and use our ‘Similar companies’ feature. Combining machine learning with 14 years of manual data curation, this flags companies that operate in a similar space to your chosen company. From here, you can add these companies to a Collection for comparative analysis later.

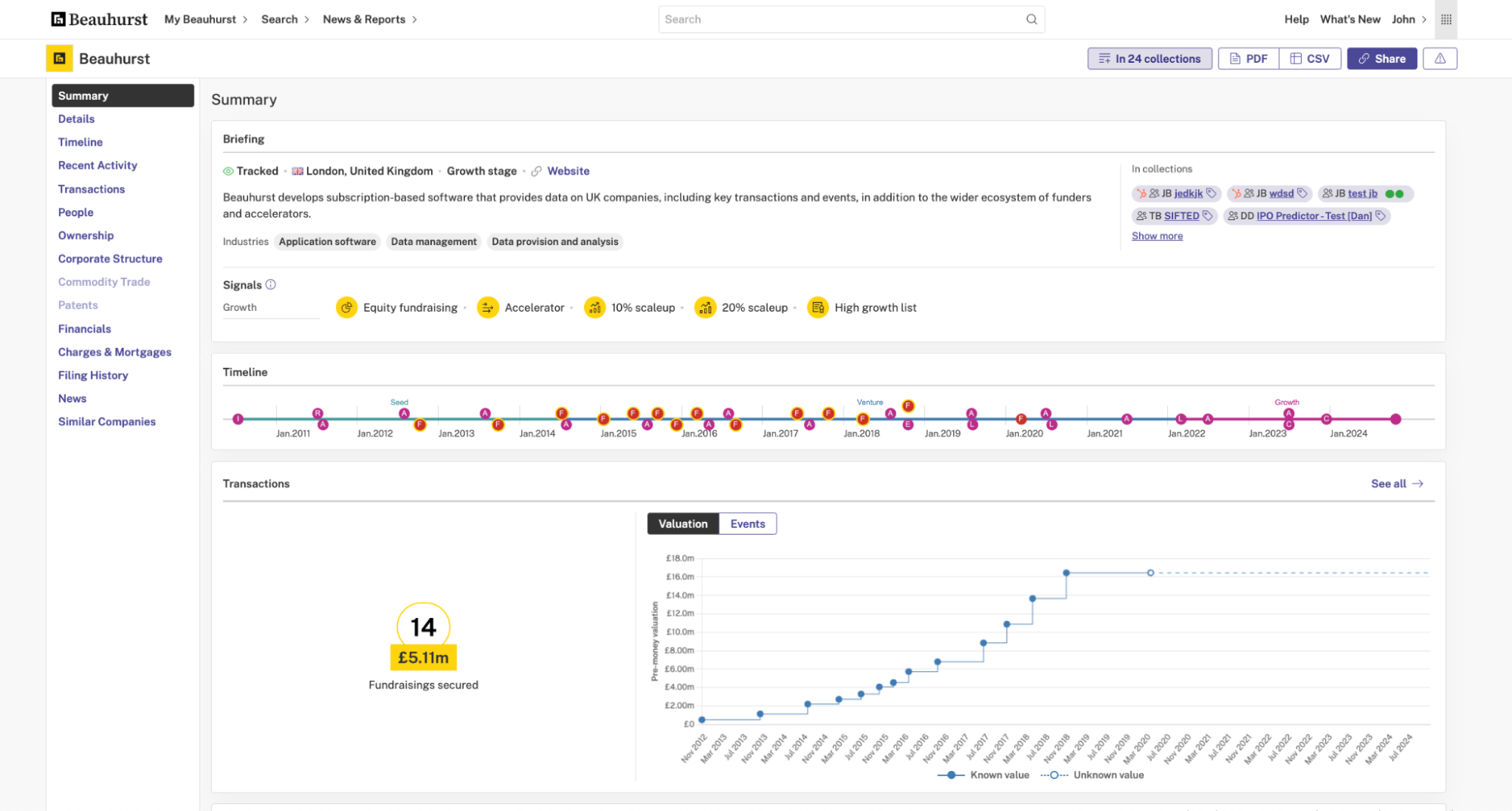

Analyse a company’s fundraising history

Another area of research that corporate financiers will typically look for is a company’s success in raising equity and securing grants. After all, this is a signifier of growth, and an endorsement from a third party in that company’s growth potential.

All of this information is displayed prominently on each company page, including a full history of raises and valuations. You can even dig deeper and see which funds or grant bodies were involved — and any advisors involved in the deal.

Growth

Detailed financial statements

With Beauhurst, you can explore current and historical financial statements, including revenue, profitability, cashflow, debt levels, operating expenses, and much more.

Corporate financiers can use this information to establish trends and assess whether a company meets their criteria.

Additionally, as companies grow and exceed certain revenue or asset thresholds, they may be required to undergo a formal audit. Beauhurst helps advisors track these financial milestones via growth and innovation signals.

Analysing funds

Fund profiles are another way corporate financiers use Beauhurst. By accessing detailed profiles, corporate financiers can track the performance, size, and focus of various investment funds, helping them identify potential investors or partners for their clients.

Our platform provides insights into a fund’s portfolio companies, past transactions, and investment strategies (including co-investment and sector preferences), enabling corporate financiers to match the right funds with businesses seeking investment.

Identifying merger and acquisition opportunities

Corporate financiers look at mergers, acquisitions, and partnerships to help growth companies expand faster — and Beauhurst helps them find suitable companies for these opportunities.

By acquiring other businesses or forming strategic alliances, companies in the growth stage can rapidly scale, enter new markets, and increase their market share. Corporate financiers with the knowledge of and connections with high-synergy companies can be a key differentiator from competitors.

Established or pre-IPO

As companies reach the established or pre-IPO stage, corporate financiers must gain a comprehensive understanding of a company’s financial health, valuation, and potential exit opportunities.

Our data helps to streamline this research, making vital data simple and actionable.

Pre-IPO income analysis (financials)

Before a company exits via an IPO, corporate financiers need to assess the company’s financial performance in great detail. This includes understanding its profitability, liquidity via cash flow, and operational efficiency via EBITDA — all of which are crucial when preparing for a potential IPO or acquisition.

Corporate financiers can get all of this company information, centralised on one page and fully sourced, without the need for manual research and sifting through company filings.

Valuation and market positioning

At the pre-IPO stage, determining a company’s valuation becomes critical.

Corporate financiers assess this by comparing the company’s performance to similar market transactions, benchmarking it against industry standards, and projecting future growth based on this data.

This not only provides investors and stakeholders with a clear understanding of the company’s value but also reinforces the corporate finance team’s expertise and authority in guiding strategic decisions.

Exit opportunities

For established companies, our data can help corporate financiers identify potential exit opportunities, such as prospective buyers for an acquisition or private equity firms with a history of investing in companies of a similar profile.

This data — including past transactions, investor profiles, and market trends — is vital for plotting out the most strategic exit routes for the company, whether through an IPO, acquisition, or other forms including private equity and management buy-outs (MBOs).

The top five ways corporate finance teams use Beauhurst

We’ve explored the value of Beauhurst for advisory firms at each stage of company growth — and how they use it.

But what are the most common uses we see for corporate finance professionals? Here we’ve compiled a top five, exploring how they can be done using Beauhurst.

Scoping out the competition

Corporate finance teams use our industries dataset to quickly identify competitors within a given market.

Our tailored industry classifications, which go beyond the limitations of SIC codes, can pinpoint established competitors and emerging players in the same space. This enables advisors to conduct a more nuanced benchmarking analysis, and therefore compare their client’s performance to companies of a similar size and growth stage.

Identifying acquisition targets

In order to scale and enhance their market share, companies may seek to acquire smaller startups that can fill a gap in their offering.

One way advisors use Beauhurst is by identifying the most suitable candidates for an acquisition via our advanced search and Collections functionality.

For example, if an advisor is working with a growth stage agritech company with scale-up ambitions, they can search Beauhurst for innovative, seed stage agritech companies based in the UK.

Uncovering new funding opportunities

If a client seeks additional funding, corporate finance teams can explore funds on Beauhurst via advanced search — filtering by type of fund, favoured transaction type, historical investment data, and lots more.

Think of it as a tailored fund finder, sifting through vast fund activity to bring you only the key funds your client is eligible for.

Taking Westminster-based Index Ventures, for example, we can see that the fund typically invests between £100k and £100m into micro companies, small companies, and medium companies — and usually prefers to be a co-investor in a fundraising round.

We can also see that in 2021, the fund launched Index Origin which supports seed companies all the way through to IPO.

Researching valuations

A significant amount of research goes into determining a valuation, from evaluating market conditions at the time of fundraising and analysing comparable companies’ activities, to reviewing a fund’s average valuations within a given sector.

This process also includes projecting future growth potential based on financial performance such as turnover, and wider trends in the industry. Advisory firms can easily search for companies in a specific sector, featuring accurate valuations and turnover multiples.

Tracking market transactions

The best corporate finance teams are always the most knowledgeable people in the room. By using Beauhurst, they are equipped with the knowledge their clients and prospects need, before they know they need it.

And that includes knowledge of market activity across their clients’ industries. In this instance, we can see how advisors can track the latest fundraisings. This enables them to stay abreast of the latest developments in the equity market at all times.

Additionally, they can also look at grant activity, new academic spinouts in their clients’ sector, and similar companies that have recently registered patents, to gain an even more holistic and informed view.

Conclusion

These are just a handful of ways that corporate finance teams use Beauhurst, supporting their clients whether they’re a seed company in a developing industry or preparing for an IPO.

From identifying acquisition targets and tracking valuations to analysing competitors, Beauhurst provides the insights that advisors need to make well-informed decisions throughout every stage of growth.

If you’d like to explore how BeauhurstAdvise can support your client work and open up new opportunities, book a demo to see the platform in action.

Discover our data.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.