High-growth business: what constitutes high-growth?

Category: Uncategorized

Startups play an increasingly important part of economic growth – if successful they have the opportunity to grow at an astonishing rate. The most obvious example is Deliveroo. This high-growth business topped the FT 1000 last year with revenues growing by over 100,000% over the period 2013-2016. As the FT noted in their introduction: “Europe is enjoying a sustained, if not evenly shared, recovery. Part of this expansion is being delivered by the start-ups and other fast-growing companies that are adding jobs, disrupting industries and spreading far beyond their home turf.”

However, Deliveroo is an extreme example of a success story, and may well become the UK’s most famous tech export. Few ever achieve anything approaching this success. In fact, 90% of all new startups end up failing. As such, it can be hard when looking at Britain’s youngest companies to separate the wheat from the chaff, and discern which are going to make big contributions to the UK’s economy.

We estimate that there are 40,000 private high-growth businesses in the UK with the potential to disrupt their respective sectors and attract significant amounts of overseas investment. Currently we use a combination of tracking triggers – essentially methods to identify fast growing companies – to find and monitor over 20,000 of them, which have together raised £45 billion in investment since the start of 2011. Many of these are part of the UK’s burgeoning tech scene, fulfilling Marc Andreessen’s prediction that “software is eating the world”.

Supporting these businesses will be a vital aspect of a successful Brexit. But to support them we first need to know who they are. One of the best indicators of potential can be analysing which companies have raised equity finance – the procedure for securing venture capital and angel funding is full of comprehensive due diligence programmes, and competitive application processes. Whilst investors sometimes control very large funds, they will not part with funding lightly. A startup which secures this form of funding will feasibly have potential, which has been picked up by the investment team.

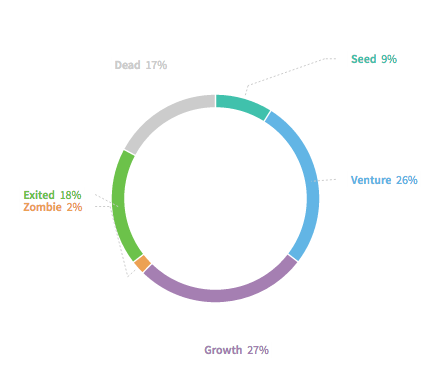

Our research bolsters this view. Of the private British companies which raised equity in 2011, 17% have died, whilst 18% have exited. Whilst not all those exits will have seen investors make a significant return, it’s a promising figure, especially when you consider that 90% of total startups usually fail.

Current stage of evolution of 2011 cohort

Beyond just investment

We know that – whilst interesting – raising money is not the only indicator of a company’s either attainment or potential to grow quickly. Accelerators have become increasingly prominent in the UK’s high-growth ecosystem, usually led by the past executive teams of successful startups, and an increasing number are being sponsored by large corporates. The U.S. model, where hand-picked startups graduate from “elite” accelerators (such as Y Combinator and 500 Startups) has already resulted in the outrageous success of companies including Airbnb, Stripe and Twilio. Look out for our analysis of the UK accelerator scene that we’ll be publishing over the next few weeks.

Beauhurst also recently acquired Spinouts UK. The UK’s universities are world-leading, and their research departments are establishing stronger networks than ever before with industry and the UK’s funding networks. Darktrace and Oxford Nanopore, two of the UK’s twelve startup unicorns, originated in the universities of Cambridge and Oxford, respectively. This illustrates how valuable these sorts of companies can become. As such, we now track all university spinouts in the UK.

We also know that large funding rounds and stellar valuations do not always translate into sales (see Blippar). For a company to attain high-growth in terms of turnover, strong growth should be elicited over several successive years.

We track companies based on whether they can “scaleup” in such a manner, using the Scaleup Institute’s definition that a company’s turnover should grow by 20% year-on-year over three consecutive years. Currently, we have about 5,000 of these on the product, the highest per capita concentration of which is actually found in Birmingham, not London.

Our work analysing the UK’s scaleups in partnership with The ScaleUp Institute can be found here.

Lastly, our most recent addition to our tracking triggers looks at companies that are profiled by some of the UKs’ top high-growth lists, such as Fast Track, Fast 50 and FT 1000. With a combination of editorially-picked “ones-to-watch” and metric-driven rankings, by monitoring these lists, we can identify some of the most exciting and dynamic companies in the country.

And of course, every business we track gets its own highly-detailed profile on the Beauhurst platform, hand-curated by our in-house Data team.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.