Funding statistics for UK female entrepreneurs

Category: Uncategorized

Over the course of the past eight years female entrepreneurs have made significant inroads into raising equity finance, a world that has traditionally been – and remains to be – dominated by men. The overall trajectory of funding into businesses with at least one female founder since 2011 remains positive, but progress is slow and inconsistent. 2018 has been a mixed bag, with a decrease in the percentage of deals going in to these companies, but a record high for the average deal size secured by women entrepreneurs.

In total, £570m was invested across 254 deals into female-founded companies in 2018, down from £650m across 304 deals in 2017. As we’ve seen in previous stories in The Deal, there was a slump in both size and number of equity investments across the market in 2018, but male-founded companies only saw a 6% decrease in deal numbers, compared to 15% for female entrepreneurs. Only 16% of 2018’s equity deals went into female-founded companies, compared to 18% in 2016.

Percent of deal numbers, female-founded businesses

2011

2012

2013

2014

2015

2016

2017

2018

But women saw less of a decline in investment amounts, with a 12%

decrease, compared to the 17% decrease experienced by men. Female entrepreneurs secured an 8% share of the amount of equity invested, down from 13% in 2015 and 2016, but on par with 2017. Most encouragingly, average deal size hit a new record, increasing from £2.22m to £2.33m in 2018. Of course, this still far below that for male-founded companies, who achieved an average deal size of £5.43m.

Percent of total amount raised, female-founded businesses

2011

2012

2013

2014

2015

2016

2017

2018

Citing the increase in the number of support systems put in place for female founders in the past few years, Navidski is optimistic that 2019 will be a more positive year, as the impact of these initiatives start to reflect in investment figures. But she maintains that the general perception that the male-dominated VC scene is aggressive and gender biased will continue to impact this progress.

“For women, entrepreneurship is about freedom and independence, and many consider traditional venture capital to be incompatible with this”. She acknowledges that shifting the perception of the industry will take time and a concerted effort from established VCs, who are often focused on chasing unicorns and rapid growth at any cost. “But the biggest change will be prompted by new industry players who can provide an environment that female founders can trust and relate to – and the ecosystem is more than ready for it”.

Who is investing in companies founded by female entrepreneurs

LocalGlobe tops the list of fund managers most frequently investing in female founded companies, with 7 investments in 2018. They participated in an £8.6m growth stage round into market analytics company Streetbees, a company they have supported since 2015. Streetbees have also secured investments from three of the other ranked fund managers; Octopus, Atomico and BGF.

Percent of deal numbers, female-founded businesses

Founder and CEO, Tugce Bulut, notes that she has been very lucky to receive a range of support throughout Streetbees’ fundraising journey. “As one of the few female founders in the tech sector, I feel very responsible for helping nurture the next generation of female entrepreneurs, so they can find their way through the VC jungle.”

What support is available for women entrepreneurs?

Indeed, more and more support networks and organisations are cropping up. From AllBright Collective, who support women to achieve their career ambitions, to Diversity VC, who are dedicated to creating a fairer and more diverse venture capital industry; and sector specific initiatives like accelerateHER, a programme which addresses the under-representation of women in technology. In 2018, they launched Male Champions of Change in Global Technology to enable male CEOs, founders and c-suite leaders to step up beside women to create a more gender equal future, and shift the conversation from equality as a ‘women’s issue’ and instead tackle the systemic failings in the industry.

We’ve also seen the rise of female-led investment bodies, such as the female focussed angel network Angel Academe and VC firm Voulez Capital. Founded by Anya Navidski in May 2018, Voulez Capital invests between £500k and £2m into female-founded businesses across Europe – and invested into two UK companies in 2018. This includes leading a $1m round in Sciapps, the creators of SkinNinja.

This company is bringing much needed clarity and transparency to the skincare market by giving customers an informed understanding of the ingredients in their products, and offers suggestions for alternatives that are less harmful.

Where is funding coming from?

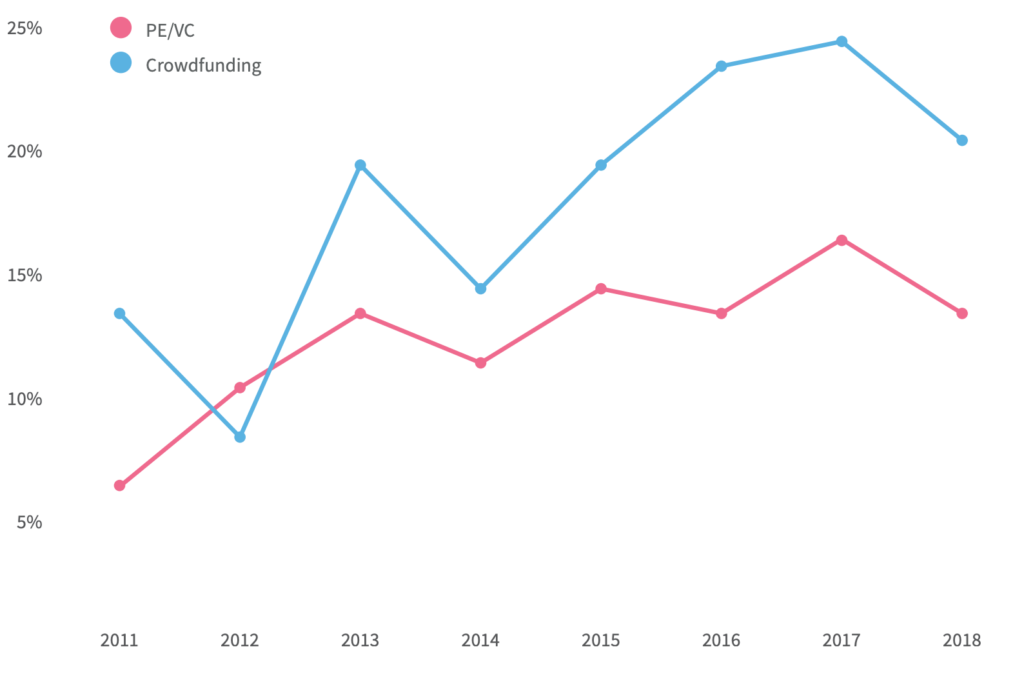

This account of women having a cynical impression of venture capital is borne out when we compare funding sources. Whilst the overarching patterns remain similar, there is variation in the percentage of deals secured from different types of funds. Female-founded businesses secured only 13% of VC deals in 2018, compared to 20% of crowdfunding investments.

crowdfunding vs PE/VC investment into female-founded companies

Crowdfunding platforms have seen more accelerated growth in the percentage of deals going to female entrepreneurs since 2012, when 10% of VC investments went into women-led companies, compared to just 8% of crowdfunded deals. Still, venture capital firms have seen a consistent and stable increase. The funding sources were most disparate in 2016 with 10% between them, and the gap has closed by 3% in the two years following, although in a downwards rather than upwards trend.

Julia Elliott Brown, CEO and Founder of female-focussed equity fundraising consultancy Enter the Arena, suggests that this discrepancy in investment figures is in part due to the failure of firms and corporations to recognise the gender funding gap as an ongoing issue, rather than a fleeting trend. “The crux of the issue lies in the fact that many corporates are more concerned with appearing to be making a change than with undertaking meaningful action and initiatives”. But some are making headway – Barclays set up the Female Founder Forum in partnership with The Entrepreneurs Network (TEN) in 2016 to connect inspiring and successful women entrepreneurs with those on the cusp of their own rapid growth.

Julia’s own initiatives include coaching, workshops and a new podcast series aiming to educate female entrepreneurs on the funding landscape. Programmes like these are providing the building blocks for aspiring, early-stage women entrepreneurs to access this market.

Room for growth

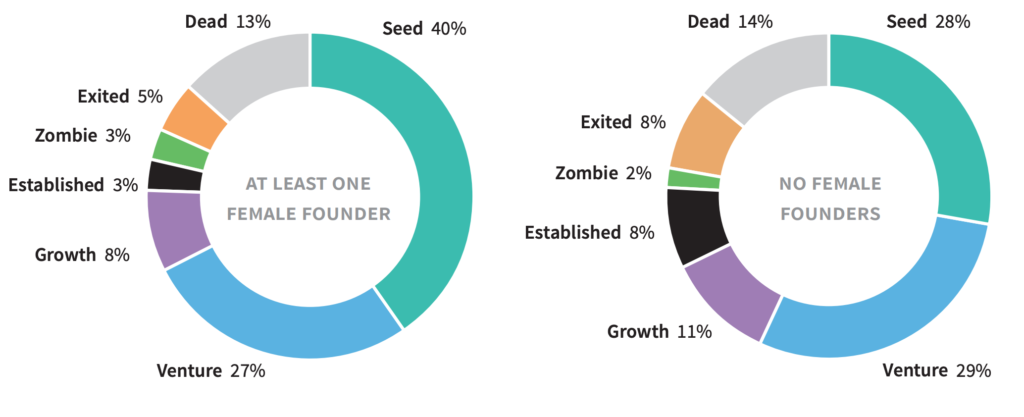

However, female-led business are struggling to grow past early stages,

with 40% of those that raised equity between 2011 and 2018 remaining in

seed stage, compared to just 28% of their male-founded counterparts. 16% of both categories are dead or zombies, but exits are 3% higher among male only founded companies. This is unsurprising given male entrepreneurs receive higher funding on average, facilitating faster growth.

Stages of evolution of female-founded companies

On balance, 2018 was by no means a stellar year for women-led companies securing equity, but some were very successful and gradual progress is taking place behind the scenes. Female founders are certainly ambitious and support needs to continue to be put in place to nurture this talent more effectively. Juliet Rogan, Head of High Growth & Entrepreneurs at Barclays, says: “we know funding is still a barrier for too many women when starting up and growing their business, but we’ve seen important shifts towards female founders taking place over the past few years”.

In 2019, we hope to see the investment figures reflect this, a growing number of meaningful initiatives with long term goals put in place, and the gender funding gap taken seriously amongst more industry players. After all, as Tugce Bulut puts it, “an ecosystem that only represents one point of view is ultimately poorer for us all.”