The first megadeals of 2020

Category: Uncategorized

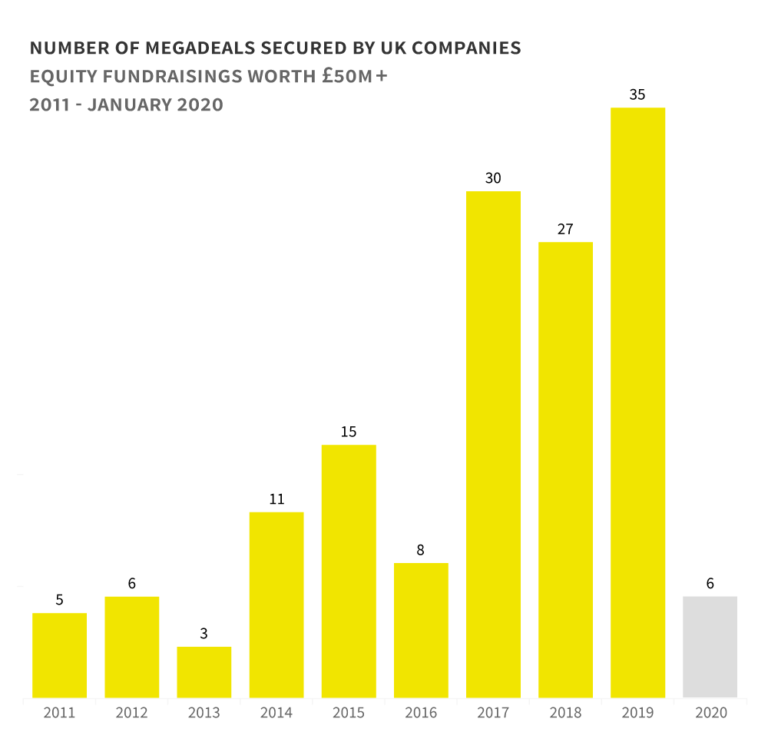

January has been a record breaking month in terms of megadeals, with six equity fundraisings worth over £50m secured by UK companies during the first 31 days of the year. This is more than the number secured in any single month in 2019, which saw a total of 35 megadeals completed in the year. If the UK’s fastest-growing companies continue to secure these deals at the same rate throughout the rest of 2020, then we could see that 2019 figure doubled by the end of the year.

What does this increase in megadeals mean?

A maturing and increasingly competitive market

The increase in megadeals is evidence of the maturation of the UK’s equity market. More capital is available for the growing number of companies that are able to take on large sums of money. The rise also represents an increase in competition – in an environment of intense innovation, cash is king, and is necessary in chasing and maintaining an advantage.

A change in timelines for equity backed companies

Where public markets would previously be the obvious avenue for private companies looking to raise large sums of finance, the rise of megafunds means that startups can reap the benefits of staying private (namely lower regulation) for longer.

The first companies to secure megadeals in 2020

1. Receipt Bank

Date of round: 3rd January 2020

Amount raised: £55m

Total raised: £113m

Location: London

Predictably, it was a London-based fintech that secured the UK’s first megadeal of the decade. Receipt Bank develops accounting software that allows users to save and edit scanned invoices, bills and receipts. The documents can then be shared with accountants or synchronised with bookkeeping software, streamlining the accounting process for all parties. Coming up to its tenth birthday, Receipt Bank is currently in its growth stage of evolution and most recently reported a turnover of £18.6m.

This latest round of £55m was a mixture of equity and loan funding, and has been earmarked to help the company expand into new markets across Europe and Asia. The raise was led by Insight Partners with participation from Augmentum Fintech and existing investors, Kennet Partners and the Canadian Imperial Bank of Commerce. The total amount raised by Receipt Bank now stands at £113m.

2. Arrival

Date of round: 16th January 2020

Amount raised: £85.5m

Total raised: £318m

Location: London

With the aim of making commercial transport more sustainable, Arrival manufactures parts for heavy electric vehicles. The company has been around since 2015, and secured a hefty £21.6m fundraising within just six months of inception. The investment was made by Kinetik, a fund backed by entrepreneurs, for a 76% stake in the business, setting a pre-money valuation of £6.65m. Since then, Arrival has raised a further four funding rounds worth £296m.

The latest round saw automotive giants Hyundai and Kia inject €100m (£85.5m) into the company. This corporate investment is a real testament to Arrival’s innovative technology, with Hyundai and Kia planning to ‘supply eco-friendly vans and buses – built in volume and using Arrival’s technology – to European logistics companies and mobility companies that provide on-demand ride-hailing and shuttle services.

3. Tokamak Energy

Date of round: 20th January 2020

Amount raised: £67m

Total raised: £123m

Location: Oxford

Oxford-based Tokamak Energy aims to advance the development of energy production by the process of fusion, using devices that combine plasma in a magnetic field along with superconductors. In its own words, the team focuses on ‘developing compact spherical tokamaks to generate fusion reactions and, ultimately, produce a plentiful supply of clean, safe, secure and affordable energy.’

Such an endeavour doesn’t have the same quick turnaround as the traditional equity-backed tech firm. Spun out from the Culham Centre for Fusion Energy in 2009, the team aims to ‘demonstrate the feasibility of fusion as an energy source by 2030’. With this timeline in mind, and currently operating at a loss of £17m, Tokamak is a great example of a high-potential company that has to rely on the ecosystem around it in order to power through such a capital intensive research and development.

Indeed, players from all corners of the UK’s high-growth ecosystem are rallying behind the company. Innovate UK has awarded the team four grants worth a combined £375k, and a total of £123m worth of equity finance has been pumped into Tokamak over 10 rounds. Investors include Legal & General, Oxford Innovation, and the Stephenson Fund (backed by the Institutions of Mechanical Engineers and managed by Midven). The latest fundraising, and first megadeal for the company, was led by the Swiss billionaire behind Capri Sun.

But Tokamak isn’t just accessing financial support. It also participated in the Royal Academy of Engineering’s SME Leaders Programme in February of 2019, which gave the team access to one-to-one personal leadership coaching, provision of an experienced business mentor and masterclasses and workshops for senior business leaders, as well as a £10k grant for additional leadership training.

4. Snyk

Date of round: 21st January 2020

Amount raised: £115m

Total raised: £200m

Location: London

The most recent addition to the UK’s billion dollar club, Snyk develops tools that alert users and help fix security vulnerabilities in their open-source coding. It was reported that the $150m funding round valued the company above $1b, although the exact figure has not been disclosed. The round was led by Stripes with participation from Amity, BoldStart, Coatue, Salesforce Ventures, and Trend Forward.

The Hackney-based company has now raised a total of £200m over seven funding rounds and has an employee count of around 300 – not bad for a company that is yet to turn five. Snyk has some impressive names on its client list, including Google, Mastercard, Salesforce and the BBC.

5. Currencycloud

Date of round: 26th January 2020

Amount raised: £61.2m

Total raised: £125m

Location: London

Currencycloud has developed a global cloud-based platform which facilitates cross-border payments between businesses. The platform has four main functionalities. ‘Collect’ issues businesses with local accounts to ensure that their customers can be easily and quickly paid through local accounts. ‘Convert’ gives companies real-time access to wholesale exchange rates, resulting in low-cost currency conversion rates. ‘Pay’ provides a range of flexible payment options, including cost effective local payouts to over 35 countries. Finally, ‘Manage’ gives businesses control over their multi-currency account, with management features such as payment tracking and pricing management easing control.

Now in its established stage of evolution, Currencycloud has raised a total of £125m over 11 funding rounds. The latest round was backed by a number of investor heavyweights, including GV (Google Ventures), Notion Capital, Sapphire Ventures, BNP Paribas and Visa.

In March of 2019, Currencycloud joined Tech Nation’s prestigious Future Fifty accelerator, which has helped support more unicorns than any other UK programme. Late last year, Currencycloud placed 23rd on our fintech top 50, and we’re excited to see where this new funding round lands the company by the end of 2020.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.