The Fintech Top 50 UK | 2025

John McCrea, updated: 16 January 2025

The 2010s saw an explosion in fintech company activity in the UK, with household names such as Monzo, Starling Bank, and Revolut all launching their consumer-focused challenger banks. Putting this in perspective, investment in fintech companies accelerated from £768m in 2014 to a height of £7.18b in 2021.

And whilst investment in fintech has cooled since 2021 — as it has across most industries according to our annual equity report, the Deal — 2024 still saw a healthy £2.42b raised by UK fintechs.

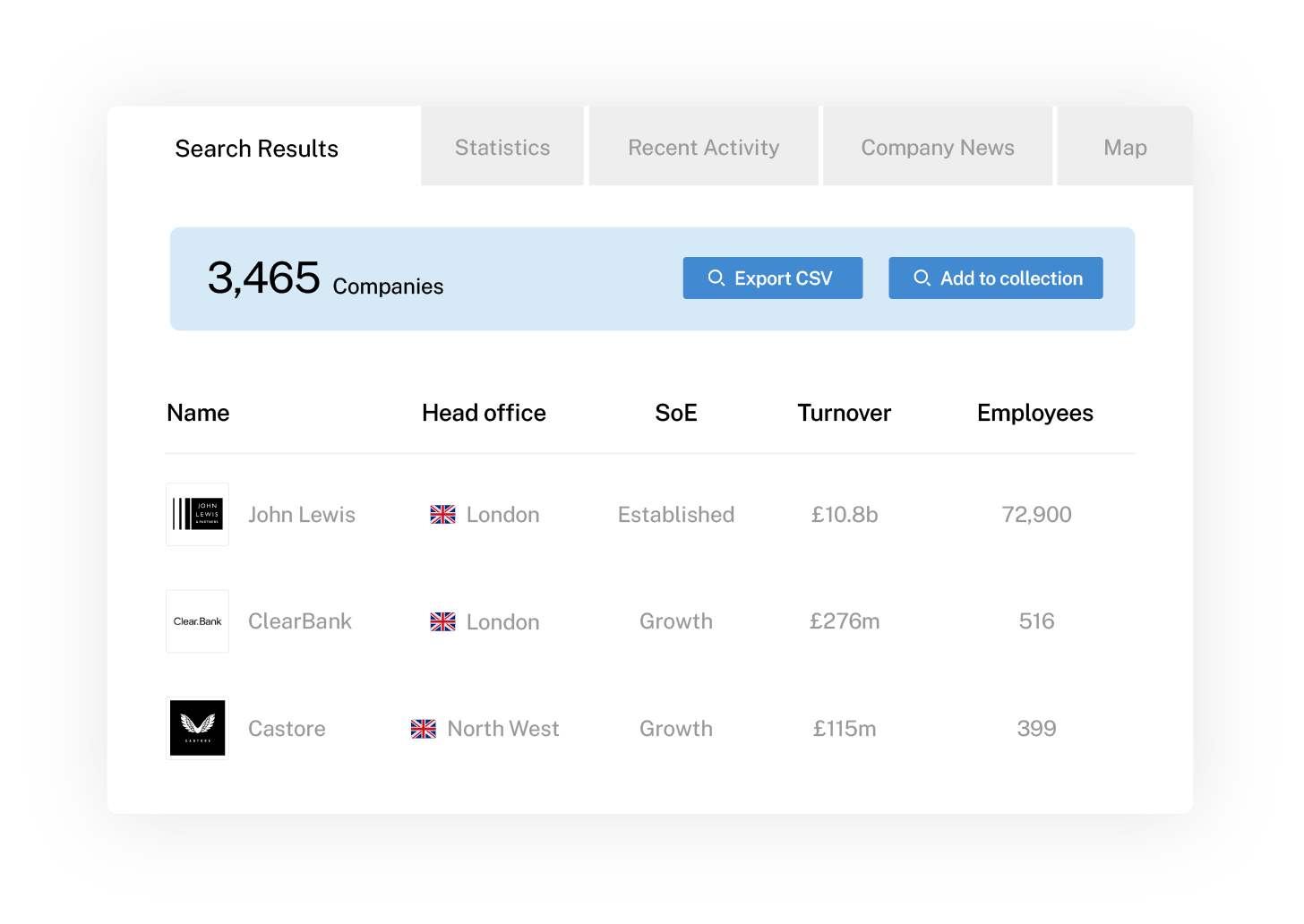

We’ve ranked the top 50 most valuable fintech companies in the UK (using their latest pre-money valuation), sourced from data on the Beauhurst platform.

What is fintech?

Fintech, a portmanteau of “financial technology”, is an industry seeking to make financial services more efficient and accessible for businesses and consumers alike. This includes technology companies such as challenger banks, payment processors, budgeting apps and cryptocurrency startups.

Fintech companies often use artificial intelligence, machine learning algorithms, blockchain and automation, along with other kinds of digital banking technology. To learn more, check out our blog on the top London-based, early-stage fintech startups.

Take a tour

The state of fintech in the UK

Fintech is one of the UK’s strongest startup sectors, with more than 1,800 high-growth fintech companies currently active and 18 fintech unicorns. Collectively, UK fintech companies have raised £31.0b in equity funding so far, with a staggering £21.4b secured since 2020 alone.

As they continue to grow, these fintech startups and scaleup companies are successfully disrupting the traditional banking and financial services industry, and catalysing innovation amongst incumbent companies.

In our ranking, we’ve included companies that are currently tracked by Beauhurst, with their head office in the United Kingdom.

Methodology

To be included in this list of fintech companies, companies must be:

- Headquartered in the UK

- Operating in the ‘Fintech’ Beauhurst industry classification

- Listed as ‘Active’ on Companies House

We’ve then ranked these companies by their latest pre-money valuation.

And if you’re a Beauhurst subscriber, you can try this search for yourself.

All data for this article was taken from the Beauhurst platform, and is accurate as of 9 January 2025.

The Fintech Top 50 UK

50. Sokin

49. Perenna

48. Elliptic

47. 3S Money

46. Banked

45. Habito

44. Wirex

43. Smarkets

42. Crowdcube

41. Yapily

40. Weavr

39. Capital on Tap

38. Archax

37. Hokodo

36. Chip

35. Pollinate

34. Apron

33. Fintech Farm

32. Monument

31. TransferGo

30. Primer

29. Moneybox

28. FINBOURNE

27. iwoca

26. gohenry

25. Modulr

24. ClearBank

23. Atom

22. Wagestream

21. Moneyfarm

20. Flagstone

19. 9fin

18. Featurespace

17. 10x Banking

16. Form3

15. TrueLayer

14. Codat

13. Curve

12. Zego

11. Tide

10. Paddle

09. Zopa

08. Zilch

07. Funding Circle

06. Starling Bank

05. Lendable

04. Monzo

03. Zepz

02. Wise

01. Revolut

The Fintech Top 50 UK

10.

Paddle

Valuation: £780m

Established: 2012

Location: Islington

Islington-based Paddle has developed payment software that provides a range of financial services to businesses, including payment processing, invoicing, currency exchange and customer analytics and insights.

The company, which acquired US-based Profitwell in 2022, has raised £233m across seven fundraisings. Its most recent raise, also in 2022, was worth £161m and designed to support new product development projects and expand capacity to meet increased customer demand.

The 10th most valuable fintech company on our list, Paddle had a pre-money valuation of £780m according to our latest data.

09.

Zopa

Valuation: £840m

Established: 2004

Location: Southwark

Formerly a global peer-to-peer (P2P) lending platform, Zopa now operates an online bank. In December 2021, the London-based fintech firm announced its decision to close its P2P operations after 16 years, to focus more on its challenger bank offering. Zopa Bank was launched in 2020 and has been granted a full banking licence.

The company, which was established in 2004, has appeared on 10 high-growth lists between 2015 and 2024, its most recent appearance being on the Deloitte Fast 50 2024.

Zopa has raised £657m in equity across 14 rounds, including a £68m round in December 2024, giving the company a pre-money valuation of £840m. Participants in this latest raise included UK-based Augmentum Fintech and SilverStripe Investment Management,

in addition to US VC fund Davidson Kempner Capital Management and Danish fund A.P. Moller.

08.

Zilch

Valuation: £1.44b

Established: 2018

Location: Westminster

Westminster-based Zilch provides zero-interest buy-now-pay-later credit cards to consumers via its proprietary app. The business, which is one of the youngest fintech companies on our list, has experienced exponential growth reflected by its appearance on four high-growth lists.

With nine equity fundraisings worth £313m — and an acquisition of US-based financial services company, NepFin — Zilch has a pre-money valuation of £1.44b. This is based on our data from the company’s latest raises in 2023, which saw £19.2m invested by Zilch’s existing investors, and a further £1.20m invested by eBay Inc.

07.

Funding Circle

Valuation: £1.50b*

Established: 2010

Location: City of London

Incorporated in 2010 to help SMEs access funding more easily, Funding Circle facilitates the means for savers and investors to lend money to small businesses. And since the company was established, it has enabled SMEs to borrow over £13.6b.

In 2018, Funding Circle floated on the London Stock Exchange raising £300m and achieving a market capitalisation of £1.50b. Prior to its exit, Funding Circle had raised £256m in equity, the latest being a £82m round in 2017 at a £837m pre-money valuation, and made one acquisition.

*Based on the company’s market capitalisation at IPO

10.

Total amount raised: £185m

Total equity rounds: 5

Established: 2014

Location: Oxford

9. Callsign

Total amount raised: £215m

Total equity rounds: 5

Established: 2010

Location: City of London

8. Lendable

Total amount raised: £216m

Total equity rounds: 7

Established: 2014

Location: Hackney

06.

Starling Bank

Valuation: £2.61b

Established: 2014

Location: Tower Hamlets

Winner of the Best British Bank award for four consecutive years from 2018 to 2021, and in 2023 won Britain’s Best Current Account for the fifth year, Starling Bank also operates a challenger bank. It offers various consumer accounts (personal, joint, business, and euro) as well as business accounts with same-day setup, no monthly fees, and easy accounting tools.

Through the company’s mobile banking app, users also benefit from instant notifications on spend and income, no overseas fees, and 24/7 support. In 2021, the fintech company introduced its ‘Bills Manager’, helping customers to pay their bills on time and better manage their money. It allows users to automatically pay Direct Debits and standing orders from a Saving Space.

Starling Bank has secured £715m in equity fundraisings so far, through nine rounds, alongside a £100m innovation grant in February 2019. It also acquired Hampshire-based lender Fleet Mortgages in July 2021. In its most recent raise in April 2022, Starling Bank had a pre-money valuation of £2.61b.

05.

Lendable

Valuation: £3.02b

Established: 2014

Location: Hackney

Lendable is a peer-to-peer lending platform for consumer finance that uses AI and automated underwriting to rapidly approve loans. The company — which topped our list of the UK’s top 50 most valuable AI companies — has raised £216m across seven rounds.

The Hackney-based fintech and AI company has featured in five growth lists, has seen its turnover grow from £36.1m in 2020 to £116m in 2023, and is now available in over 16 countries worldwide. And with a valuation of £3.02b, Lendable takes the fifth spot in our most valuable fintech companies.

7. Huma

Total amount raised: £236m

Total equity rounds: 10

Established: 2011

Location: Westminster

6. Patsnap

Total amount raised: £251m

Total equity rounds: 4

Established: 2007

Location: Southwark

5. Quantexa

Total amount raised: £286m

Total equity rounds: 6

Established: 2016

Location: Lambeth

04.

Monzo

Valuation: £3.13b

Established: 2015

Location: City of London

Also operating a challenger bank is Monzo. Fully authorised and regulated by the PRA and FCA, over 10m people use Monzo to manage and spend their money around the world. The London-based fintech company employs over 3,100 people, with offices in London and Cardiff.

With an impressive 16 equity rounds under its belt, Monzo has secured £1.42b in equity investment so far, with investors including Accel, Coatue Management, Abu Dhabi Growth Fund, General Catalyst Partners, and Crowdcube.

In 2024, the company generated £880m in turnover — almost doubling its 2023 figures — and had a £3.13b pre-money valuation in its latest round in May 2024, based on the latest data from the Beauhurst platform.

03.

Zepz

Valuation: £3.93b

Established: 2009

Location: City of London

Zepz has created a digital platform that allows migrants and expats to transfer money to friends and family in other countries. It works across two brands: WorldRemit, an app that allows you to send money to over 130 countries, and Sendwave, which facilitates the transfer of money to friends and family in Asia and Africa.

This company has featured on a staggering 19 high-growth lists, including the Deloitte Fast 50 three times, 1000 Companies to Inspire Britain twice, and most recently, the London Tech 50 in 2020.

Altogether, Zepz has raised £712m in equity investment across nine funding rounds — its most recent being a June 2024 raise worth £209m, which saw the company valued at a princely sum of £3.93b.

02.

Wise

Valuation: £7.96b

Established: 2010

Location: Hackney

Wise, formerly known as TransferWise, has developed a platform that enables individuals and SMEs to transfer money abroad using real exchange rates. The company, which was founded in 2010 raised £305m across 10 fundraisings before its IPO in 2021 at a market capitalisation of £7.96b.

Wise, which has previously received investments from funds including Baillie Gifford and Fidelity Investments, has appeared on 21 high growth lists in total, and attended Tech Nation’s Future Fifty accelerator in 2014. Its IPO market capitalisation of £7.96b ranks Wise at number two on our list of UK-based fintech companies.

*Based on the company’s market capitalisation at IPO

01.

Revolut

Valuation: £35.3b

Established: 2013

Location: Tower Hamlets

Topping our list is fintech unicorn and challenger bank, Revolut. The company provides a financial services and digital banking app where users can track and send money, trade cryptocurrency, and more. In December 2021, Revolut was granted a full banking licence by the European Central Bank and acquired both ePOS software provider Nobly and Wanted — the US-based online job marketplace — in quick succession.

To date, the company has secured £1.27b in equity investment across 10 funding rounds, with investors including Seedcamp, Index Ventures, Molten Ventures, Ribbit Capital, Schroders, and Tiger Global.

Revolut announced record profits of £438m in 2024, with a turnover of £1.80b. And off the back of this growth, the bank — which now has over 50m users worldwide — is planning to offer a private banking facility for wealthy individuals in 2025.

4. Gousto

Total amount raised: £321m

Total equity rounds: 14

Established: 2012

Location: Shepherds Bush

3. Cera

Total amount raised: £366m

Total equity rounds: 9

Established: 2015

Location: Islington

2. Thought Machine

Total amount raised: £392m

Total equity rounds: 8

Established: 2011

Location: Islington

1. Graphcore

Total amount raised: £528m

Total equity rounds: 9

Established: 2016

Location: City of Bristol

The future of fintech companies in the UK

Whilst the number of new fintech company incorporations has contracted in recent years — from a height of 181 new companies in 2019 to just 25 in 2024 — investment figures have remained strong. And in 2025, Revolut has reached a stage of growth where it can offer a private banking offering for wealthy individuals.

And with mainstream adoption of artificial intelligence and blockchain technology only increasing, companies including Lendable are augmenting existing fintech with greater innovations. With this in mind, it’s possible that — depending on broader economic conditions — that we could see another uptick in fintech company incorporations in the next few years.

Discover even more insights into fintech companies across the UK and Germany. The Beauhurst company data platform enables you to be among the first to find the next generation of industry-leading businesses — as soon as they show growth potential.

With our data, you can analyse market trends, download charts, and export the information you need to make finding the next hot companies effortless. And with up-to-the-minute data and industry-leading insights, we make finding new companies simple.

To see the platform in action, simply book a tour of the platform using the form below or, if you’re short on time, try one of our online platform demos.

Recommended for you

Discover fintech companies.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.