How to Find Mid-Market Corporates on Beauhurst

We need to talk about mid-market corporates (MMCs).

They’re a vital part of the UK’s business economy, contributing over 27% of the total turnover in the UK. However, unlike small and medium-sized enterprises (SMEs) and large corporates (LCs), mid-market corporates lack a clearly defined identity.

This ambiguity inevitably leads to misunderstandings on what MMCs actually are. More broadly, this crisis in identity means that MMCs benefit from fewer support schemes than SMEs and large companies.

In this article, we’ll explore the complexities behind defining MMCs and how — from an account management perspective — sleeping on company growth metrics can lead to lost opportunities as your SME clients transition into the middle market.

What is a mid-market corporate?

Ask anyone in business for a definition of a mid-market corporate and they’ll likely give you a different definition to the next person.

HMRC itself seems to define middle-market corporates in different ways, with a 2014 report defining a mid-size business as one with turnover between £25m and £200m per annum, with more than 20 employees. Meanwhile, its 2021 ‘mid-sized business customer survey’ — the latest of its kind — defines MMCs as “those with Corporation Tax or Income Tax Self-Assessment turnover of £10 million or more and/or more than 20 employees.”

It’s an admittedly slippery definition, but there is some consensus. Middle-market corporates tend to be defined (albeit loosely) via a combination of turnover and headcount.

For the purpose of this article, we’ll define MMCs in the following way:

- Turnover of between £25m and £500m

- Headcount of between 50 and 499

- An EBITDA of 10% turnover margin (between £2.5m and £50m)

But in order to see a working definition of MMCs in practice, it’s worth examining the German business industry and its own equivalent ‘Mittelstand’.

Germany’s Mittelstand: A benchmark for success?

When discussing mid-market companies, Germany’s Mittelstand offers a useful comparison. The Mittelstand refers to the country’s highly successful mid-sized businesses, typically family-owned or privately held, that form the backbone of Germany’s economy. One key difference between the UK and Germany is that SMEs form part of the Mittelstand in Germany.

Unlike the UK, where mid-market companies often struggle with visibility and a lack of tailored support, Germany’s policy framework nurtures Mittelstand businesses. This includes favourable financing conditions through loan-based SME financing, targeted government support, and a culture that values sustainable, steady growth over rapid scaling.

Understanding the success of the Mittelstand underscores the importance of tracking company growth and ensuring that businesses receive the right level of support as they scale.

How to Source High-Quality Leads

We explore how to source high-quality leads. Where can you find leads that will actually convert? Find out all this, and more, including our best practices on lead capturing.

Why tracking client growth matters

The semantics of defining middle-market corporates is less important than identifying when a company transitions into a different growth stage.

In practice, this means being able to spot when your clients are about to undergo a period of sustained growth, which can be indicated by:

- An increase in turnover/EBITDA

- A sustained increase in headcount

- Recent private equity investment

Defining these parameters too narrowly will mean that you could miss out on working with your clients as they become a middle-market company. Looking too broadly meanwhile could result in a lack of focus.

Failing to spot these opportunities could mean losing a high-growth client to a competitor, and forfeiting future business as that company grows.

For advisory firms

From an advisory perspective, your SME clients’ needs will change significantly as they move into the mid-market.

They’ll encounter more complex financing structures, new regulatory obligations, and a potential increase in M&A activity.

If you’re not ahead of these shifts, you risk missing key opportunities to provide value at a time when clients need new solutions.

For sales teams

From a sales perspective, time is money. And if you’re not monitoring a company’s growth trajectory accurately, you could end up misallocating account resources.

For example, treating a rapidly growing company as a small account could result in a competitor stepping in with a more tailored approach. Sales reps that fail to recognise this shift risk offering the wrong level of engagement or solutions at the right time, leading to costly losses in commercial opportunities.

This is especially important, given that acquiring a new customer can cost anywhere between five and 25 times more than retaining an existing client.

Defining these parameters too narrowly will mean that you could miss out on working with your clients as they become a middle-market company. Looking too broadly meanwhile could result in a lack of focus.

Failing to spot these opportunities could mean losing a high-growth client to a competitor, and forfeiting future business as that company grows.

Staying ahead of your clients’ growth metrics, and equipping yourself with data-backed insights, empowers you to grow with your client, increasing retention and generating more lucrative business opportunities.

Your guide to finding middle-market corporates on Beauhurst

There are a number of ways to find middle-market companies on Beauhurst, whether you’re looking for existing clients or potential new business opportunities. Here we’ll focus on two of the most popular ways our clients use the platform.

Using Advanced Search to find middle-market companies

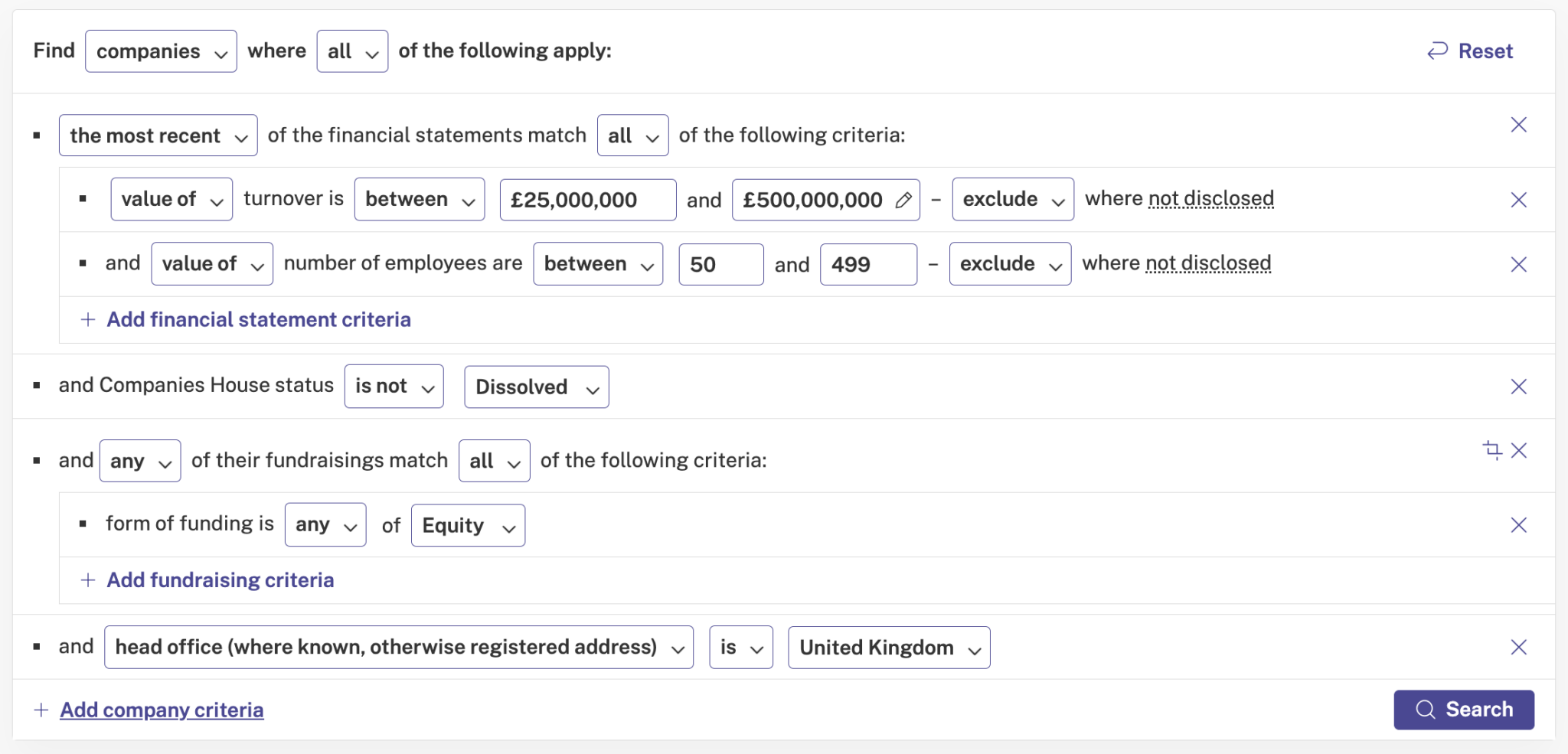

Firstly, we’ll look at how you can find companies that fall into the mid-market classification we outlined earlier in the article. Load up Advanced Search on the Beauhurst platform, and add the following criteria.

Search for companies, where the most recent financial statement shows a turnover of between £25m and £500m and a number of employees between 50 and 499.

You’ll also want to ensure the companies are still operating, which can be done by adding a Companies House status of ‘is not dissolved’.

If you want to focus more on externally-funded companies, you may also wish to add a criterion stipulating that the company has received at least one round of equity fundraising.

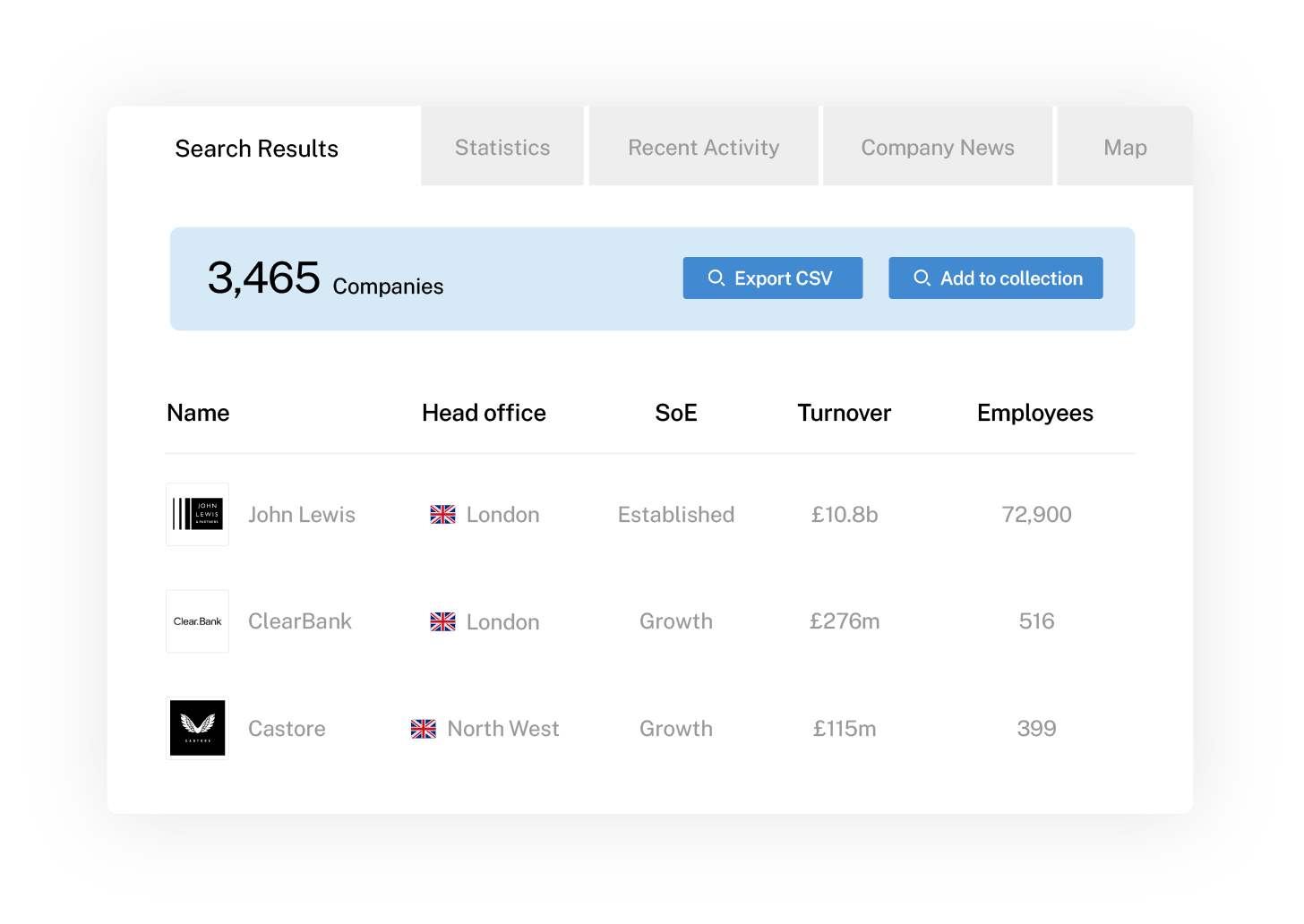

Finally, add that the company is headquartered in the United Kingdom. Your search should now look like this.

You can add additional criteria — such as the industry your target markets operate in — or amend the range of turnover to further fine tune your results.

These companies can then be added to a company Collection, which we’ll turn to next.

See the data in action

Want to see the data in action? You’re in luck. Take a virtual tour of the platform and discover how we get our unbeatable data insights.

Track client growth with Collections

Collections is another powerful tool available to Beauhurst clients, enabling them to set up email and platform alerts when companies file their accounts, appear in the news, or hit a custom threshold.

Collections allow you to:

- Monitor your clients’ growth journey over time

- Spot industry trends, before your competitors

- Collaborate with your team by easily sharing company lists

To do this, simply upload a list of your clients to Beauhurst and the platform will automatically match them with the right company profile. You can then tailor alerts for your clients to track company news, growth and key milestones. This may include funding rounds and private equity investment, as these are common factors for MMCs seeking to scale.

By enabling tracking of key growth metrics such as turnover, EBITDA, employee count, funding rounds, and acquisitions, your team is never blind-sided by client growth, ensuring you’re always there for them with the right solution, at the right time.

Supporting your clients’ growth journeys with Beauhurst

Tracking client growth is essential to staying ahead in the mid-market space. With accurate, real-time data, you can identify when an SME transitions into an MMC, ensuring you adapt your engagement strategy before competitors step in.

With rich insights into company growth, from turnover and headcount changes to funding rounds and M&A activity, our platform helps you track, anticipate, and act on business expansion — so you never miss a key opportunity.

Want to see the platform in action? Take a quick online tour, or fill out the form below to talk to our team.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy