The Latest Figures on the Enterprise Investment Scheme (EIS)

Category: Uncategorized

What is EIS?

The Enterprise Investment Scheme (EIS) is a government-backed tax relief scheme. It was designed to encourage investment into small, high-risk and often knowledge-intensive companies by individual private investors, by providing them with both income tax relief and capital gains tax (CGT) relief (in the form of deferral relief and disposal relief).

These EIS tax incentives, along with the Seed Enterprise Investment Scheme (SEIS), help support the United Kingdom’s early-stage businesses, providing loss relief for early-stage investors and better access to growth capital for qualifying companies.

The latest trends in EIS uptake

Whilst Beauhurst tracks every equity investment into the UK’s private startups and scaleups, we usually don’t know the tax status of the individuals involved in those deals. Even if the recipient company is EIS-eligible, it’s impossible to tell, for example, whether an investor received EIS income tax relief on a particular investment, whether they had used up their investment allowance for the tax year, or if they’re not even a UK taxpayer. For these reasons, HMRC’s official data are useful firstly to understand the popularity of EIS.

We’ve previously analysed the last two years of HMRC’s official data on EIS and SEIS. In last year’s article, we were disappointed to find that both the number of companies using EIS and the amount raised via EIS had fallen, compared with the previous tax year, even if the falls were relatively modest.

How many companies used EIS in 2020?

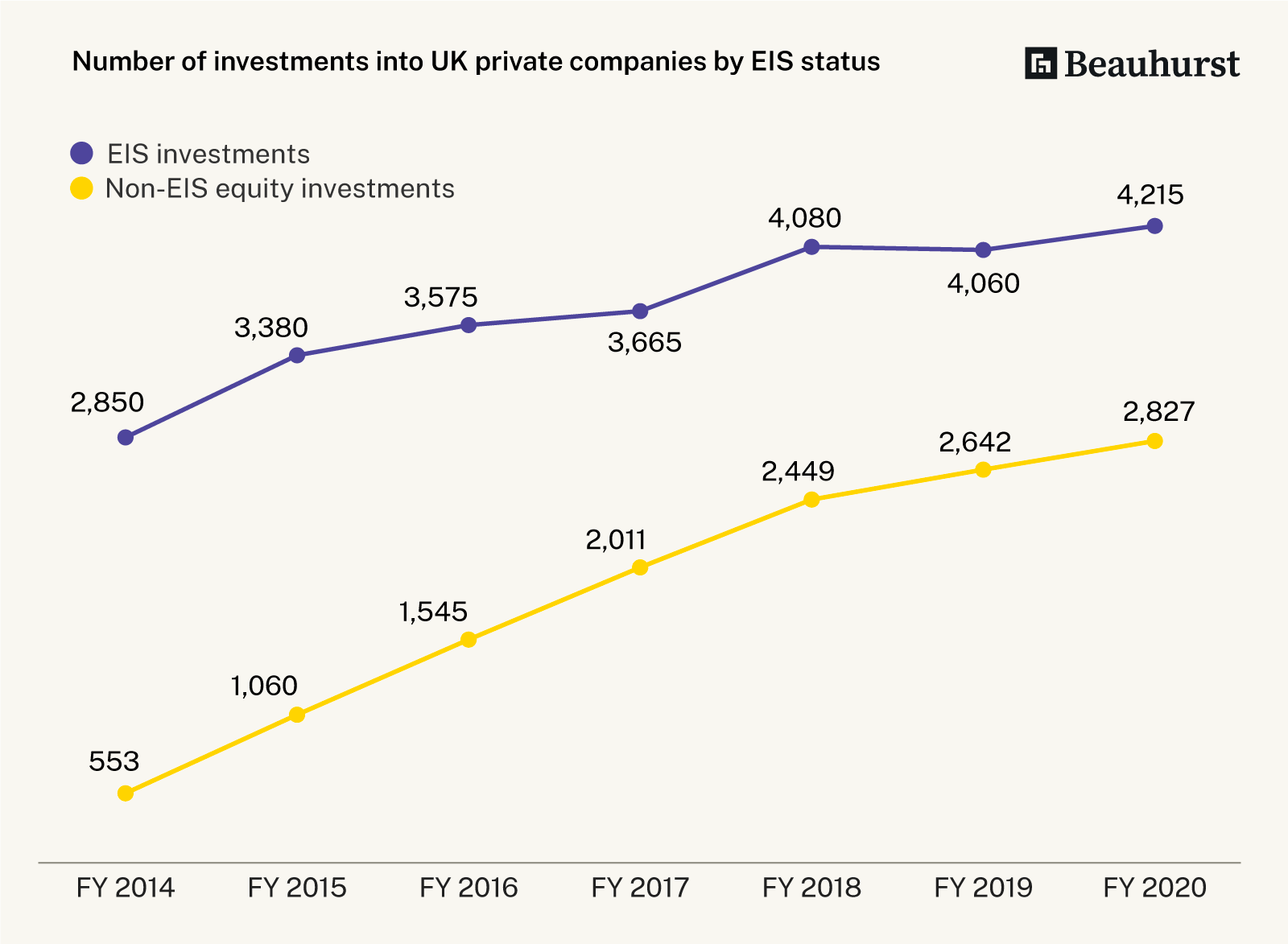

Pleasingly, the latest set of EIS statistics allow us to paint a rosier picture. The number of companies raising EIS has increased by 4% and the amount raised through EIS shares has grown by 2%.

How many knowledge-intensive companies used EIS in 2020?

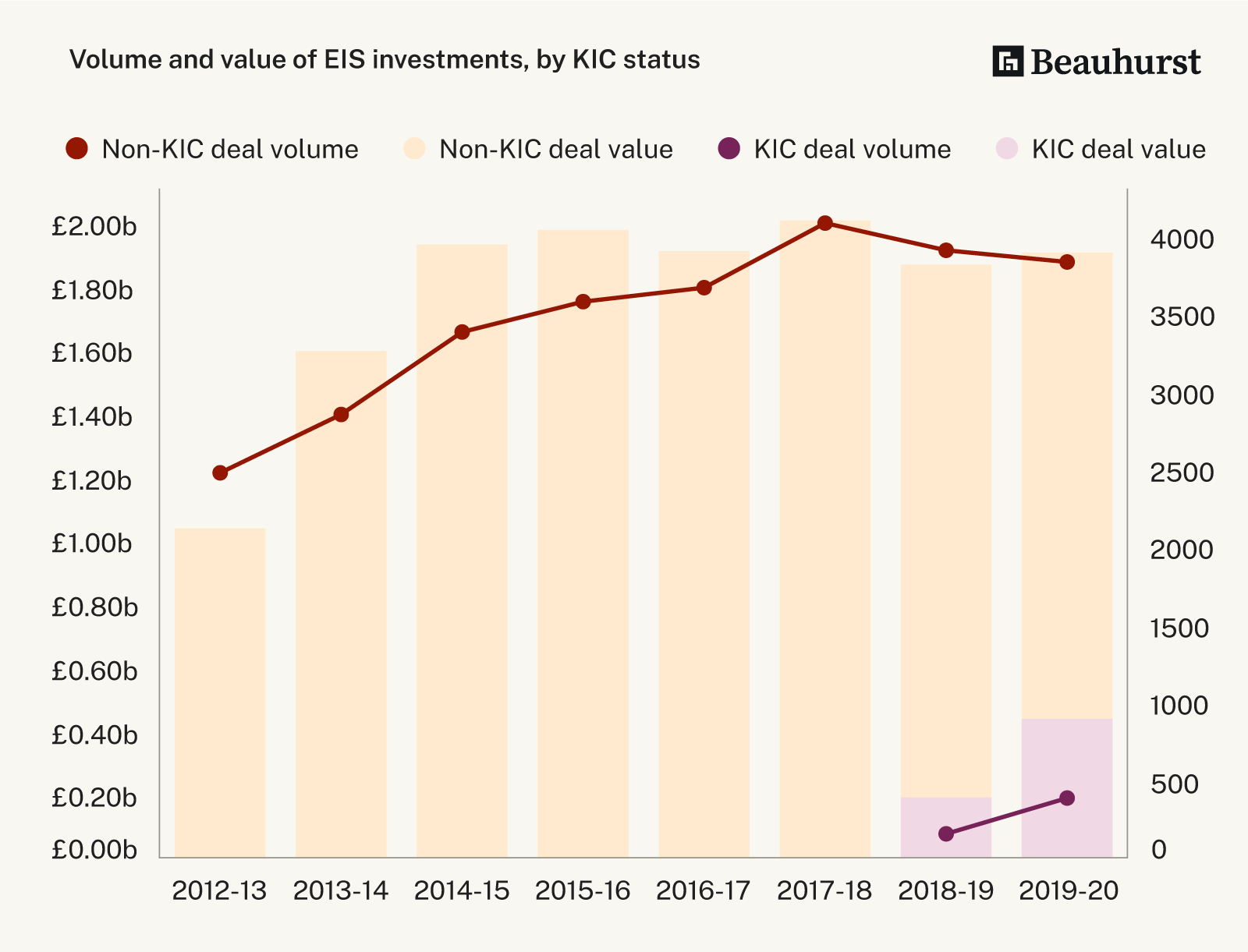

More notably, the number of knowledge-intensive companies (KICs) using the scheme has more than doubled, growing by a whopping 131%. KICs are those that are innovating and conducting research and development at the point of raising investment.

Knowledge-intensive companies can raise more under EIS and can also be larger and older than standard EIS companies. In order to be recognised as a knowledge-intensive company by HMRC, a business must be developing IP that will be core to the business model, have 20% of its employees researching the IP for three years with a Master’s degree or higher, and be spending between 10% to 15% of operating costs on the IP. Only the KICs that need to use the scheme’s extensions will be actively identifying themselves as such, so it’s likely a lot of the rest of the EIS investment is also going to these types of businesses.

How much money was raised using EIS in 2020?

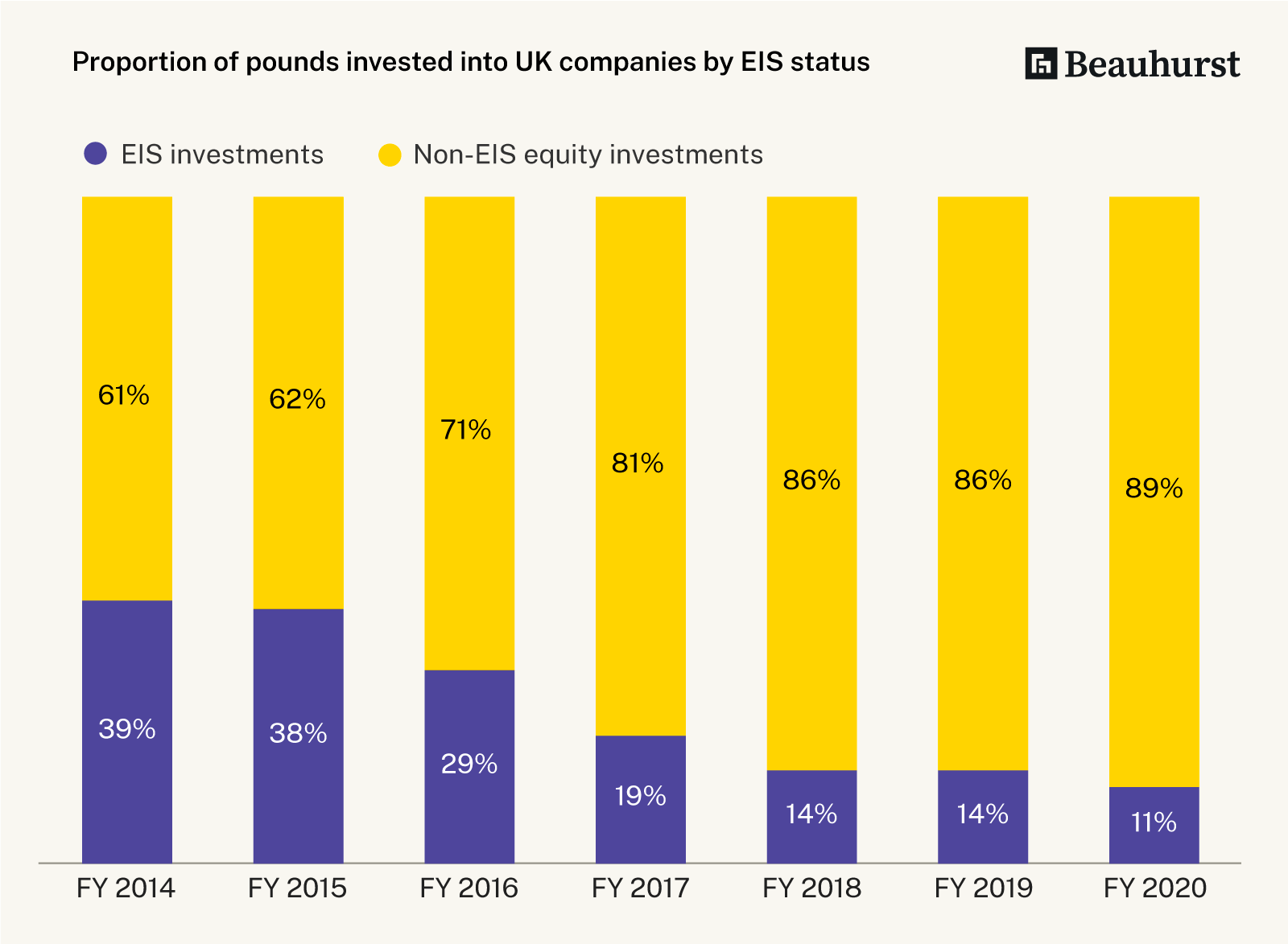

Although the total amount raised under EIS has grown slightly, this growth is set against a backdrop of extreme growth in the UK’s wider equity investment landscape.

This is to be expected when the number of investments that are taking place without using the EIS tax relief scheme are increasing so quickly.

What does the future look like for EIS?

Given the limits on how much a business can raise in a single EIS investment, and in total over its lifetime, we expect this trend to continue. Put another way, as more and more companies raise megadeals, a single transaction can put them beyond the scope of the EIS scheme. But this is a good thing—up to a point. SEIS is the pipeline for EIS, and EIS is the pipeline for later-stage investments made by larger investors (not individuals). The SEIS and EIS schemes’ purpose is to make sure small companies with higher-risk profiles can access smart and patient capital when they need it. EIS seems to be functioning well enough in that regard.

Changes in the market, however, are seeing individuals have less and less access to investment opportunities. But so long as individuals can get into the investments at earlier stages, they’ll participate in the firm’s growth that is supported by later-stage investments. The proper functioning of SEIS is therefore more important. But as we’ve shown in our report with SFC on seed-stage investment in the UK (which we’ll be publishing an update to later this month), the alarm bells are still ringing, even if the volume’s changed.