Edinburgh – London’s challenger city

Category: Uncategorized

In this, the first in our UK city series, we take a closer look at the Scottish capital. From the ‘second largest financial centre in the UK’, to a ‘mini Silicon valley’; Edinburgh has been exalted by entrepreneurs for its intimate, yet vibrant ecosystem. And with a unicorn valuation – courtesy of Skyscanner – already under its belt in 2016, the city has hit equity headlines. But is it all high-flyers in this hill-side city?

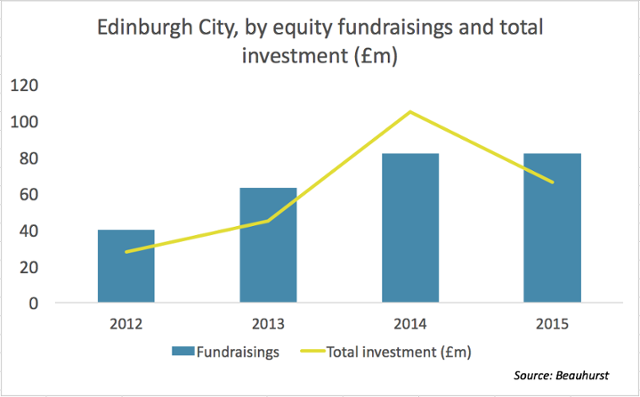

Investment over time

Looking at Edinburgh’s top-line figures, we can see that the number of equity fundraisings flatlined between 2014 and 2015. Total investment fell by almost 40% – decreasing from £105m in 2014, to £66.3m in 2015. Looking more closely at our data, though, we can see that the spike in total investment in 2014 was caused predominantly by a single outlier venture-stage deal – a £40m fundraising completed by NuCana BioMed.

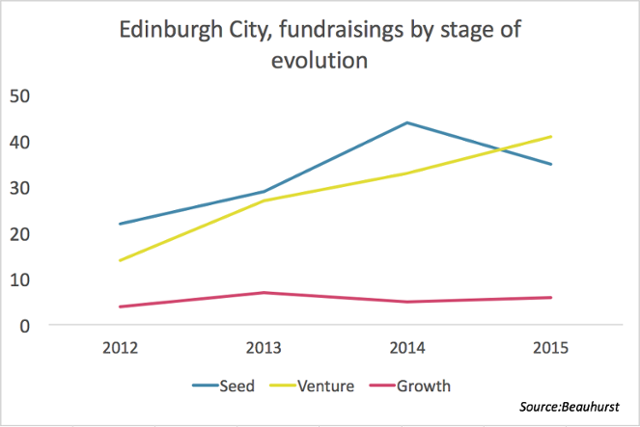

Stage of evolution

In 2015, Edinburgh recorded 41 venture-stage equity fundraisings – almost three times the number completed in 2012, and a 24% increase on 2014 figures . Growth-stage fundraisings flatlined, registering a relatively paltry 6. Seed-stage performed the worst, with a 20% drop in the number of fundraisings.

Venture-stage companies, then, are increasingly dominating Edinburgh’s private equity market – with funding gaps potentially emerging at the seed- and growth-stages. But what could be causing this trend?

With fundraising numbers flatlining overall, as well as at the growth-stage, it could be that venture-stage fundraisings have increased at the expense of seed-stage companies. This might reflect a lack of confidence on behalf of investors, who are choosing to back more established and arguably less risky venture-stage companies. But with venture-stage companies completing deals that might otherwise have gone to seed-stage businesses, perhaps this is instead indicative of an investor pool not keeping pace with the growing school of fast-growth companies in Edinburgh.

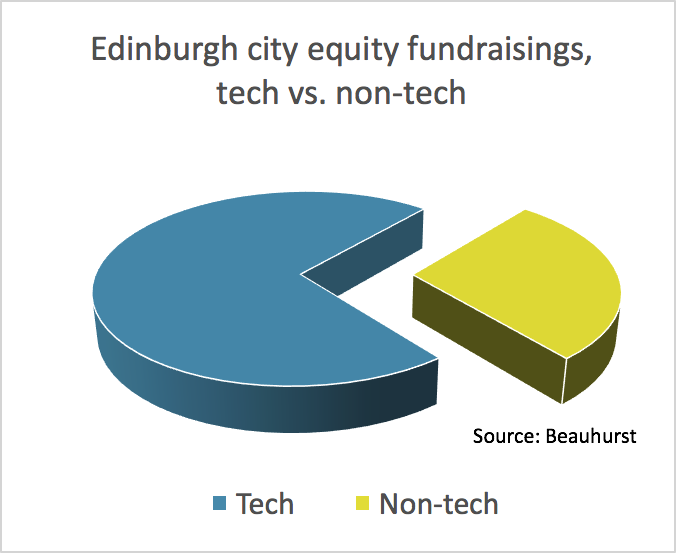

Tech continues to dominate

Edinburgh is worthy of its accolades as a ‘major technology hub’. In 2015, Edinburgh tech SMEs secured £43m equity investment, completing 59 fundraisings – 72% of all fundraisings recorded by the city that year.

Breaking-down these tech fundraisings, we can see that the average investment in 2015 was to the tune of £741k. On average, companies parted with a 17.5% equity stake, at an average valuation of £4.32m.

The highland big-hitters

Edinburgh is home to a number of heavyweight SMEs across the sector spread, with 17 companies securing £10m + valuations.

Genius

Genius manufactures and supplies gluten-free food products. Aside from winning at the Freefrom food awards in 2009, the company has received celebrity thumbs-up from Greg Rutherford, and Dawn O’Porter.

Back in 2014, the company completed an undisclosed fundraising with Brussels-based Verlinvest for what was described only as a “significant capital investment of millions of pounds”. Our researchers verified this to be a £10m equity investment in exchange for an 18.5% stake, at a tasty £54m valuation.

Skyscanner

We’ve written about Skyscanner before here at Beauhurst, and it’s no surprise. Starting in Edinburgh in 2003 with just three team members, Skyscanner – the search engine that compares flights, hotels, and car hire prices – now boasts almost 800 employees across 10 international offices.

In January this year, Skyscanner completed a huge £128m equity fundraising with a cohort of high-profile backers including: Artemis, Vitruvian Partners, and Yahoo! Japan. The deal elevated Skyscanner to unicorn status – with a valuation of over £1bn.

2016, the story so far…

Undeniably, Skyscanner is the big story so far for Edinburgh, but we’ve also tracked 13 other fundraisings into the city – 4 of which were unannounced. Together with the Skyscanner deal they already amount to Edinburgh’s highest ever yearly investment total of £137m. Encouragingly, seed-stage companies are responsible for just under half of these fundraisings, with venture- and growth-stage companies completing 5 and 3 deals respectively.

Look out for our more in-depth report on Edinburgh, the hilly city, in upcoming weeks.