Your Complete Guide to Due Diligence When Buying a Business

Acquiring a business is complex. The process is often inevitably lengthy, requiring extensive time for commercial research, in addition to thorough financial and legal due diligence. However, when done improperly, errors in due diligence can be costly, both financially and reputationally.

In this guide, we’ll walk you through some of the key steps involved in an acquisition, and explain how some of our clients are using Beauhurst as part of their broader due diligence strategy.

What is due diligence?

In short, due diligence is the process of verifying the facts and becoming aware of any risk involved in a transaction.

In the context of an acquisition — where enormous amounts of capital changes hands — due diligence is done in forensic detail. After all, the larger the deal, the greater the risk. One only needs to look at either the TimeWarner & AOL acquisition or Hewlett Packard’s acquisition of Autonomy to see how poor due diligence can result in billions of pounds worth of losses.

It’s therefore important not to rush this process — rushing in order to complete a deal faster can result in a litany of errors. These include gaps in financial analyses, an incomplete understanding of compliance in the company’s jurisdiction, and failing to gain a full understanding of the business’s commercial viability.

It might sound obvious, but without investigating further, you won’t know what you’re missing.

What are key areas of M&A due diligence?

- Financial due diligence

- Legal & compliance due diligence

- Commercial due diligence

- Operational due diligence

- IT and cybersecurity due diligence

Who can help with M&A due diligence?

Due to the complexity of mergers and acquisitions, there are always a number of parties involved in the process. This includes accounts (both internal and external), corporate finance, lawyers, and dedicated M&A consultants.

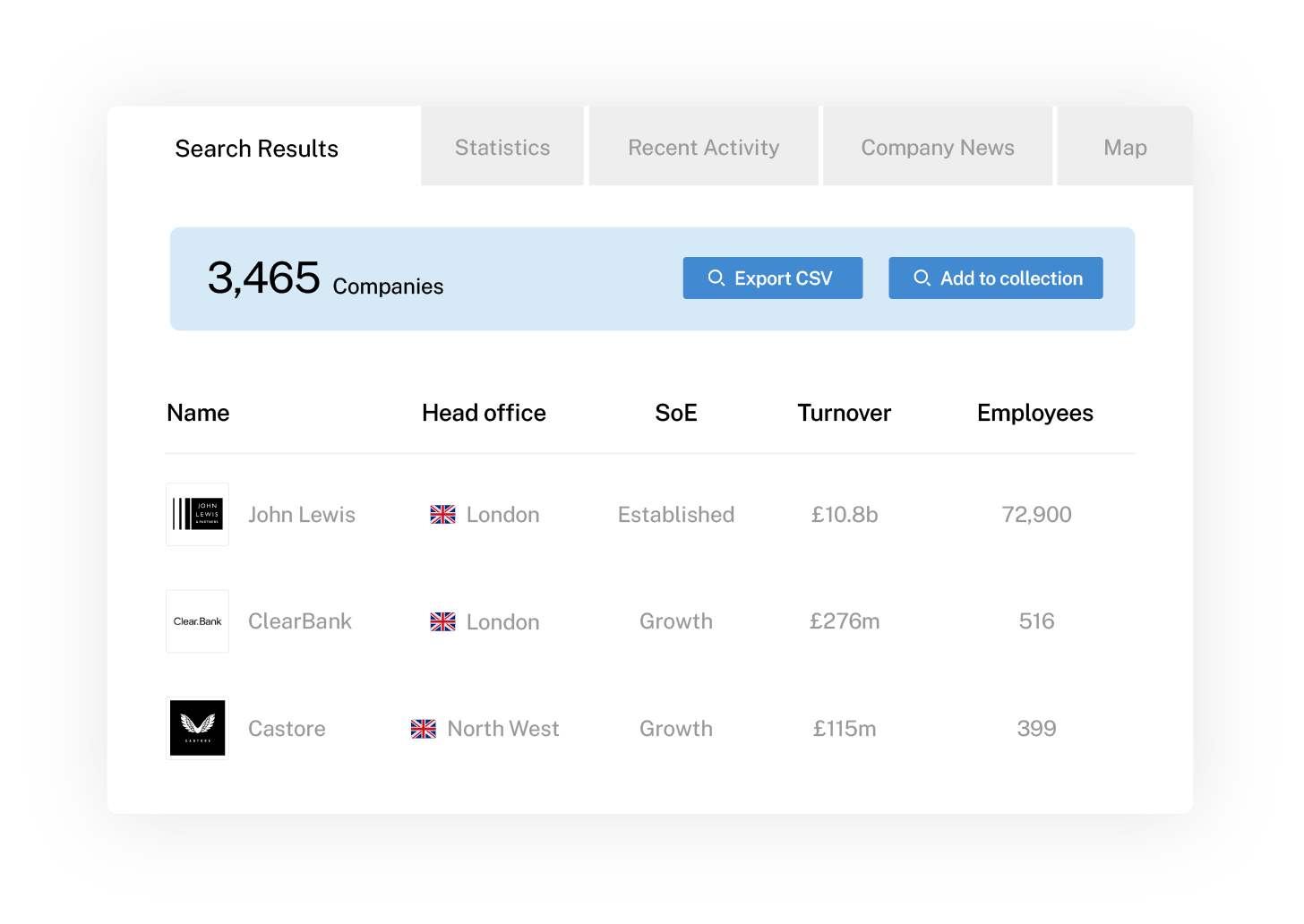

Having a company database (like Beauhurst) can also help with this process, and our clients in corporate finance and M&A consultancy use the Beauhurst platform throughout the acquisition process. This varies from simple company checks to make sure the company exists, through to more detailed cash flow analysis and patent information.

Discover how Yeo Ventures uses Beauhurst from deal origination to closure

Why due diligence matters when acquiring private companies

Investing in private companies can be more complex than in public companies — especially when it comes to due diligence. This is because private companies are not obligated to publicly disclose as much corporate information as a publicly listed company. Amongst other things, it can make valuations particularly tricky to settle on.

There is therefore a lot more research involved in a private company acquisition. One of the key challenges is gaining access to reliable data. Lack of access to this information can have a material impact on the buyer’s decision-making, so it’s important to get it right.

This requires close collaboration with the acquiree’s due diligence team. And, invariably, there is a lot of back-and-forth communication between both organisations — plus any advisors and lawyers — to establish the facts.

See the data in action

Want to see the data in action? You’re in luck. Take a virtual tour of the platform and discover how we get our unbeatable data insights.

How long does due diligence take?

The timescale from making an offer to completing a deal can vary. According to legal firm Harper James, the process is estimated to take anywhere between a few weeks to several months.

Due diligence forms a significant part of this time for a number of reasons. Firstly, as we’ve discussed, it takes time for all parties to gather and pool all the relevant information. Depending on the evidence produced, due diligence may lead to renegotiations over company value or other terms, which can slow down the acquisition process.

Information gathering and due diligence:

A four-step guide

In this section, we’ll demonstrate how you can use Beauhurst to assist with the information gathering stage of your due diligence process.

Step One: Business overview

You’ll need to begin with high-level research and initial screening. This will help you decide whether or not to engage with a business, and to help identify any potential red flags early on.

For example, a firm considering the acquisition of a tech startup can use Beauhurst to examine the company’s funding history, its market competition, and whether it has a dependency on a single investor – just to name a small handful of uses.

How Beauhurst helps

- Company identification and profile: This includes its registered name, Companies House ID, year of founding, base financials, shareholders, and directors.

- Funding and investment history: Explore past funding rounds, participants, and any InnovateUK grants awarded.

- Corporate structure and ownership: Verify the company’s ultimate beneficial owners (UBO) and the business pedigree of its directors.

- Market positioning and growth potential: Assess turnover growth, headcount increases, recent entrants into the market, and more.

You can find this information using a combination of Companies House, the company’s own website, LinkedIn, and other forms of research available to you. However, most companies use a company database like Beauhurst as it saves time, and ensures the quality and consistency of data.

Step Two: In-depth analysis

Once you’ve screened a potential acquisition target, you can examine the company’s financials, regulatory compliance, and intellectual property information with greater scrutiny.

How Beauhurst helps

- Analyse financial performance: With Beauhurst, you’ll have access to historical revenues, profit & loss trends, and outstanding loans. These can then be compared with industry benchmarks on the Beauhurst platform to form a more detailed financial health check.

- Intellectual property ownership and patents: Find out more about patents —is the company’s technology patented? And if so, does it possess patents internationally?

- Adherence to sector-specific compliance: Industries such as banking, financial services, and healthcare are highly regulated. This is the time to ensure that the company has approval to sell its products (for example, MHRA-approved drugs in the pharmaceutical industry).

Using this information you can verify the company’s sources of R&D funding and patent ownership, ensuring intellectual property assets are both legitimate and protected. It also ensures that the company you’re proposing to purchase can legally operate in that industry.

Step Three: Evaluate risks

Next, you can collate any risk factors found in the previous steps and raise them with the company’s due diligence team. Settling these risks now will make the broader process run more smoothly.

How Beauhurst helps

- Financial risk: Use Beauhurst’s Risk Signals to identify down rounds, short runways, CCJs, and signs of insolvency.

- Negative press: Stay informed with Beauhurst News. This curates news events and articles for every company on the platform.

- Sector or supply chain reliance: Find out how diverse the company’s revenue streams are. Can it resist short-term shocks in the industry, such as a supplier or manufacturer going bust?

Step Four: Reporting and decision-making

Finally, consolidate all your findings, including data gathered from Beauhurst, into a due diligence report. This will help your firm make an evidence-based decision whether the acquisition is viable.

How Beauhurst helps

- PDF tear sheets: For a top-level glance at a business’s vital information, simply download a PDF tear sheet.

- Data visualisation: Export vital information as tables and graphics from the platform, or simply connect Beauhurst via API to your data visualisation tool of choice (e.g. PowerBI).

- Enable alerts: Set up email alerts on your chosen company to be updated on any developments prior to any finalised deal.

Get Started with Beauhurst

Whether you’re making an acquisition or you’re a M&A advisor facilitating such a deal, join our clients who are simplifying the information gathering stage of the due diligence process.

To see the data in action, take a quick online tour. Or to discuss your organisation’s specific needs, book a quick chat to talk to a member of the team.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy