What is due diligence?

Category: Uncategorized

Due diligence is a process by which financial professionals attempt to determine the viability of a given investment opportunity. “Diligence” itself is defined as “careful or persistent work or effort”, whilst “due” in this case means “of the proper quality or extent”. Taken together in a business context, and this term refers to the work undertaken to ensure any decision taken with regards to a third party has taken into account all the potential risks that could emerge such a relationship, as well as the benefits.

In the investment world, which is largely based on evaluating the prospects of third parties, due diligence is an important part of everyday work. The “Big Three” consulting firms (Mckinsey, Boston Consulting Group, and Bain & Co) all offer due diligence services to the private equity sector, on the premise that due diligence service can be quicker and more rigorous if outsourced to a (reputable) independent third party.

In the private equity context, due diligence can take place across several stages. This starts with an “investment thesis”, whereby a team makes a proposal as to how a specific deal will make the private equity firm money. It ends with the creation of a post-deal agenda, which stakes out a management plan for how the deal will continue to add future value after the transaction has taken place.

In between, several methods are employed to ensure the PE firm can price the deal correctly. These can include what one would usually expect – financial analyses determining the company’s past, current and projected cash flow. However, other methods employed can include fieldwork, i.e. interviewing customers, suppliers and competitors to help uncover potential commercial risks (or opportunities) not visible in their accounts.

To look at one company in particular, Mckinsey offer several services to private equity firms, which lie at each key point along the investment-exit cycle. In order, these are:

1. Investment screening

2. Due Diligence

3. Portfolio Development

4. Exit Support

Whereas Mckinsey seperates investment screening and portfolio development from due diligence, Bain & Co regards them as part of a larger due diligence pathway. To some professionals, due diligence augments the whole investment process, not just the start.

Due Diligence in Venture Capital

Whilst due diligence is more of a standard, perhaps mechanical process in private equity, the process is more fluid in venture capital. When you are dealing with early-stage deals, the considered companies are generally pre-revenue, so you cannot analyse past cash flow, and it is much harder to anticipate future commercial success. VC firms are also well aware that the majority of their investments will fail.

As such the selection becomes more a process of carefully hedging bets on a group of very risky young companies, in the hope that one will become a market leader or establish a new market. This isn’t always easy – as we have documented, the UK’s venture capital scene is littered with expensive startup deaths.

Due diligence for a VC firm therefore depends on selecting potential, rather than proven success. Usually, this comes down to a promising senior executive team, and/or the technology they have created. Aside from looking at the founders, this may also include looking at which early backers have got behind the venture. Just over a year after it was founded, Facebook raised $12.5m from Accel Partners.

Whilst the founding team was very impressive, Facebook had already received an angel investment from one of Paypal’s founders. Sean Parker, one of Napster’s co-founders, had also joined the young company’s board as president. Such a team amassed around a very young startup would have made the due diligence process simpler for Accel.

At the other end of the scale, due diligence can help alert VC firms to outlandish or sometimes fraudulent ventures. The investors behind Powa Technologies, which we recently listed as the UK’s top startup failure this decade, is an example where this process perhaps went wrong.

This story in the FT illustrates how key investor Wellington Management took an overly laissez-faire approach, declining to investigate the company’s day to day operations, which included an infamously opulent central London office. Oddly, Wellington also boosted the company’s valuation shortly after hiring Deloitte to assess whether the company was insolvent, suggesting a lack of proper due process within the firm itself. This hands off approach clearly isn’t adequate when dispensing large sums of investment in a high risk sector.

Many VC partners may use a range of more qualitative assessments to determine whether the management team should be trusted with the firm’s investment. For young companies, this will include detailed research into the founders’ pasts, including interviews with past colleagues. In the case of serial entrepreneurs a good place to start are the board members at past companies. As the stereotypical entrepreneur is both charismatic and self-willed, this can be a useful way of accurately judging past performance.

Due Diligence Checklists

Private Equity

A due diligence checklist for a more traditional, private equity investor can take the following structure:

1. Financial Information

This detailed analysis of a company’s financial performance will include annual and quarterly reports for a set period in the past and future, usually three years. Projecting the future growth will necessarily take into account a wide range of factors, including risks to foreign business operations (e.g. via currency fluctuations, or government instability), and macroeconomic factors underlying assumptions about future success, such as steady economic growth.

This part of the report will also include capital structure of the company, indicating who owns the company’s outstanding shares, alongside a schedule of all options, warrants, rights, and other potentially dilutive securities. In other words, any arrangement that may dilute the stake the investment firm takes in the future.

2. Products

This is a detailed description of the company’s key products, including market share, its cost structure and how this translates to profits for each unit.

3. Customer Information

Usually this will include a list of the company’s top customers, including revenue from top customers, alongside a list of strategic partnerships, and any partnerships that have been severed in the past two years.

4. Competition

Competitor studies are predictably an important part of due diligence – who are the main competitors, what are their respective market shares, what stands the perspective investee out in particular?

5. Marketing and Sales Strategy

This part of the report details all the expenses relating to marketing and sales efforts, including success rates, and strategies to grow sales in the future. Essentially, how is the company planning on increasing its revenues into the future?

6. Research & Development

Many startups and SMEs will have some sort of R&D process dedicated to improving their product or service, even if its not particularly high-tech, or being completed in a laboratory. As part of the due diligence, the amount of effort dedicated to this, and the potential benefits this might bring in terms of improved technology, will be taken into account.

7. personnel

An important part of a due diligence checklist outlines who leads the company, including their employment histories, past successes and failures. As well as the senior management, good due diligence will seek to uncover any significant issues that have arisen between the business and its employees, and reach a figure for head count turnover.

8. Legal and related

Finally, the investors will conduct a legal review to determine any legal obligations the company has, including outstanding lawsuits initiated against the company, and/or by the company.

Venture Capital

As mentioned earlier, the process for venture capital due diligence is more fluid, and has less structure. Broadly speaking, however, venture capital due diligence can be boiled down to three main steps:

1. Investment Screening

Partners at VC firms will start the due diligence process by ensuring the potential deal is one that matches up with the investment strategy of the firm, i.e. the right sector, the right deal size, and the right round of deal (i.e. is the .

2. Business Screening

Perhaps the most important and in depth stage of the venture capital due diligence process is business screening, or rather, assessing the startup’s potential to achieve high levels of growth. Ideally, the VC firm will want their investees to complete some sort of exit within an established time cycle, usually around 10 years.

3. Legal Screening

Once the partners are happy they have found a venture they have faith in, they will employ a legal team to establish the legal basis for the investment transaction, and ensure the startup’s legal affairs are in order.

How investors use Beauhurst for due diligence

One study found that ‘the median VC reviews 87 opportunities before making 1 investment’, meaning reviews have to be thorough and time effective. Beauhurst can add great value to this process, with powerful tools for due diligence.

The market

Evaluate a company’s market position with an advanced search of the relevant sector. See data on all the companies and fundraisings across the industry, including the best funded companies and the most active funds, and a comprehensive picture of sector growth.

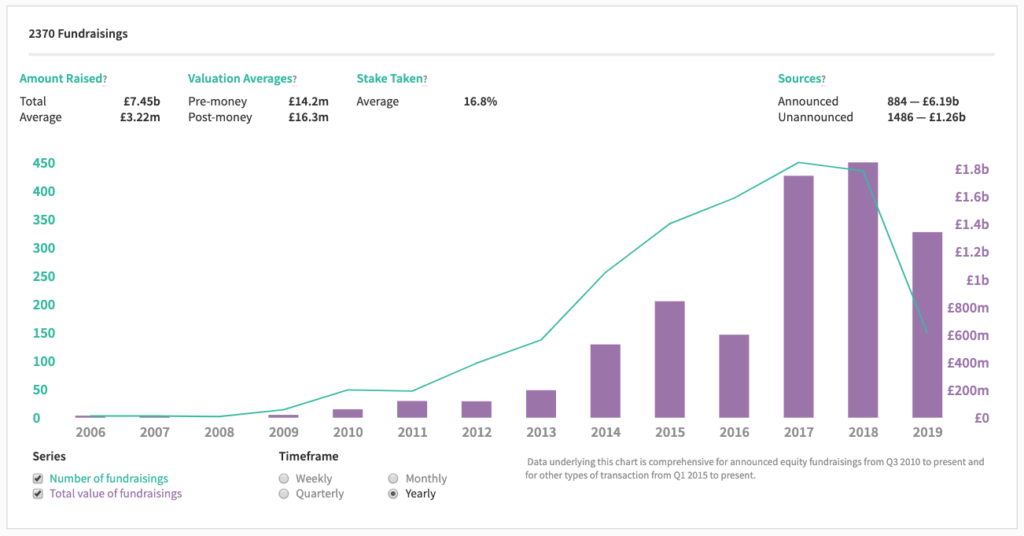

Total fundraisings into UK FinTech companies

The company

Our Company Timeline and Financials tab compile data from Companies House in a clear and exportable format, allowing you to easily assess past performance. See past investors in to the company, all their previous fundraisings, credit scores, and people. Use the Similar Companies tab to build a comprehensive list of competitors based on sectors, buzzwords and descriptive text.

You can explore the people behind the companies further with our new Networks feature, which shows all of their directorships, shareholdings, and C-suite appointments at any high-growth company.

the portfolio

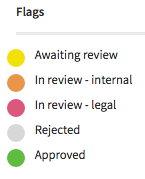

Collections allow you to stay up to date with all your new prospects, sending you an email alert whenever they hit the news. Use a custom flagging system to indicate how far along the screening process each company is. You can also set up a Collection for your existing portfolio, to track news mentions and check stats at a glance, or monitor a Collection of competitors.

Read the full case study here.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.