Do UK startups still have support from abroad?

Category: Uncategorized

Last year, we published a report that analysed where investment into UK companies was coming from. We found that foreign investors were contributing a significant amount of capital to the UK’s high-growth economy, and tended to invest in higher value deals. So to what extent are foreign funders bankrolling high-growth British businesses, and should we be worried that the current chaotic climate is discouraging investors from abroad?

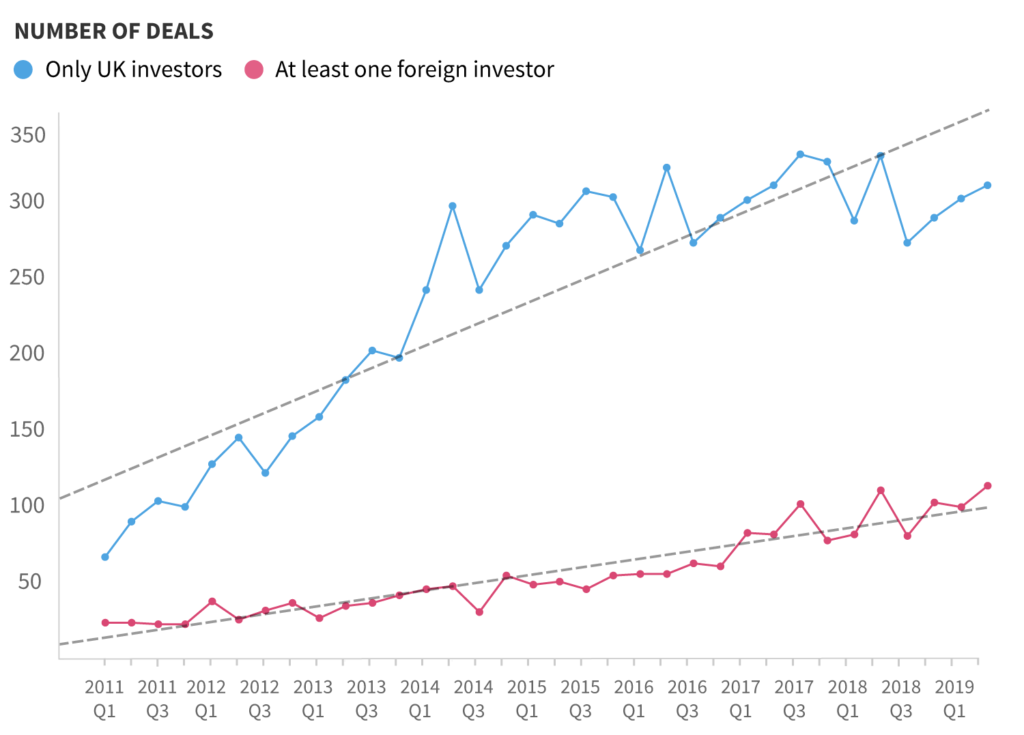

Number of deals completed

Interestingly, with 114 deals completed, Q2 2019 was the best quarter on record in terms of number of rounds that included at least one foreign investor. This might seem surprising, given the ongoing uncertainty of the UK’s economic position. But global investors are more concerned with how the market is going to look around the time that they expect to see a return on these investments, in around a decade or so. So whilst this record figure says very little about the current state of affairs, it does demonstrate confidence in the future of the UK’s market.

When we look at the wider trends, the number of UK only deals being completed is growing at a much faster, but less consistent rate than their foreign counterparts, with more quarter-on-quarter fluctuations.

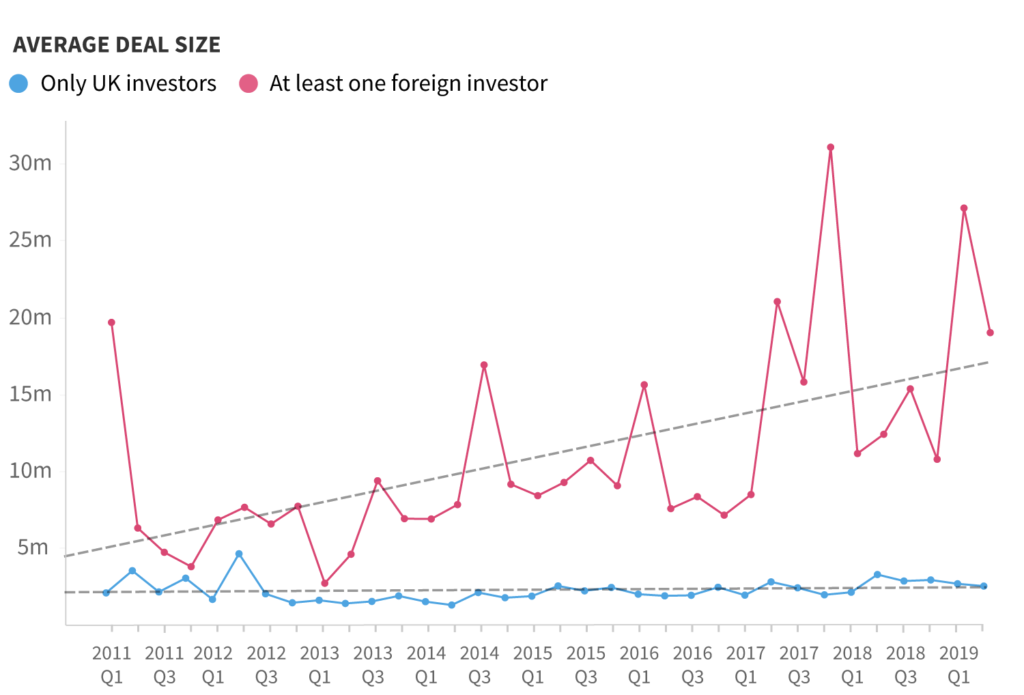

Average deal size

The average deal size that includes at least one foreign investor is invariably higher than UK only deals, and is climbing at a more dramatic pace. Q4 2017 had the highest average, standing at £31m. There were a number of gargantuan deals during this quarter, the two largest of which were funnelled into insurance groups by Canadian funds. BGL Group received a massive £625m from Canada Pension Plan Investment Board, and Hyperion Insurance Group secured $400m from Caisse de dépôt et placement du Québec (CDPQ). With a quarterly average deal size of £19m, Q2 2019 was significantly lower than the record figure, but the drop is in keeping with natural market fluctuations, and remains above the trend line.

The average size of UK only deals, on the other hand, has remained fairly stagnant since 2011 with the trend line flat lining at around £2m.

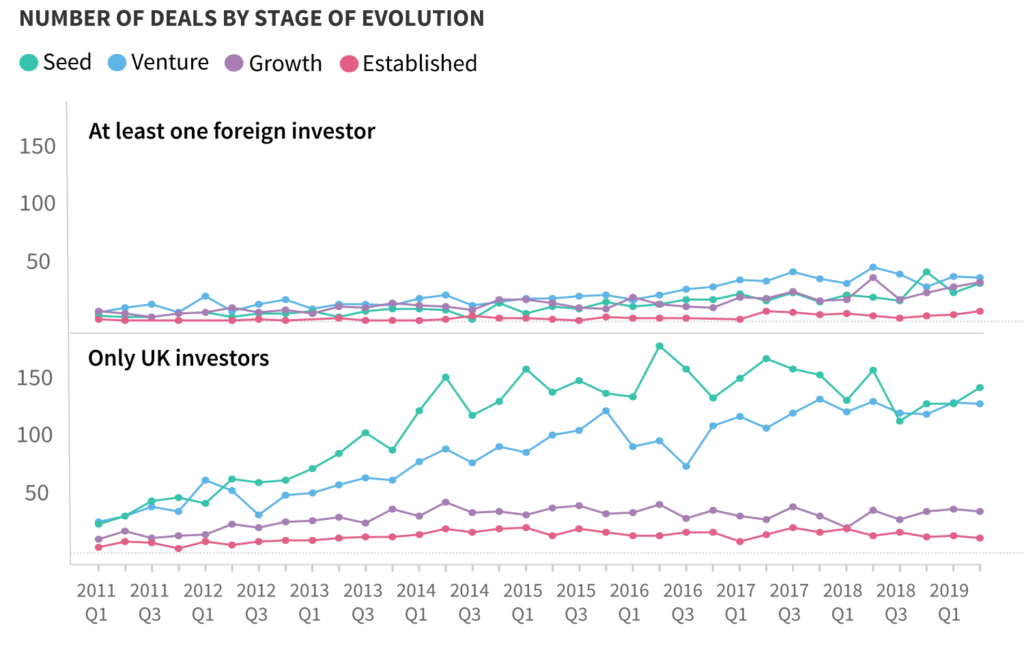

Deal numbers by stage of evolution

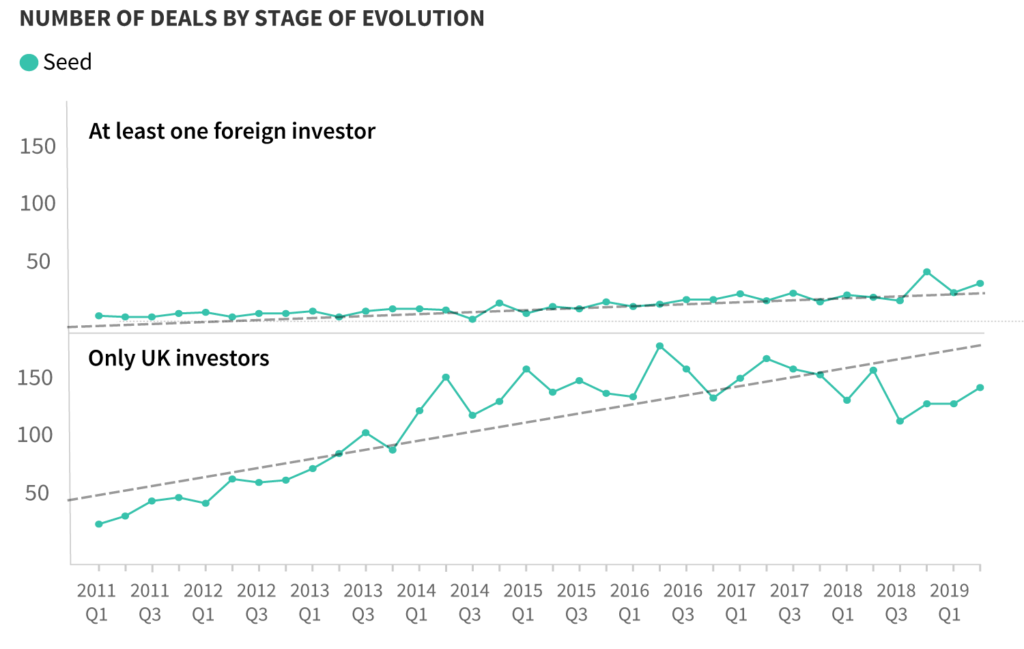

The variance between these graphs is explained by the stage of evolution in which investment takes place. Foreign investors are, for the time being, most active in venture-stage deals, with seed and growth stage deals continually vying for second spot. Interestingly, the number of seed stage deals spiked to 43 deals in Q4 2018, above all other deal stages. This is a testament to innovative young British businesses, which are now able to draw the attention of foreign investors from an earlier stage than before.

The record cohort of deals in late 2018 included a €534k round for AI driven fashion platform Intelistyle led by Greek VC Metavallon, and a $4.50m deal for clinical diagnostics company Cambridge Cancer Genomics. Investors included Silicon Valley funds AME Cloud Ventures, Refactor Capital and YCombinator, and Boston-based Romulus Capital.

In comparison, it’s the smaller, seed-stage deals that are almost invariably more popular among UK only investors, with venture stage deals proving more common in just a few quarters.

This pattern is more in keeping with what we hope and expect to see in the high-growth ecosystem: finance for young, high-potential and risky businesses is the most prevalent deal type, with each larger and later stage deal less common.

So it’s UK-based investors that are buoying the UK’s earliest stage startups, with much more of a focus on seed stage companies than foreign investors. These deals are innately smaller than the deals secured by more mature companies, which require more capital to scale their business. Supporting these businesses from a young stage populates and strengthens the pipeline of investable companies at later stages of growth, which are more attractive to foreign investors.

Foreign investors, then, are able to supply vast amounts of capital to scaling companies, helping them step up their operations to the next level. As long as domestic investors are able to support startups to reach later stages of evolution, and develop world-class, innovative products and services, then it seems unlikely that we’ll see a decline in investment from abroad.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.