Deloitte Fast 50 Companies — Where Are They Now?

Category: Uncategorized

Launched in 1998, The Deloitte UK Technology Fast 50 is one of the UK’s most prestigious technology awards. The Fast 50 ranking is a subset of the Deloitte Technology Fast 500, spotlighting the upper bracket of winners. Deloitte runs Fast 50 in many countries around the globe, but we’re looking exclusively at the UK awards.

The list evaluates companies that offer technology-related products, services, and intellectual property. Deloitte ranks them by percentage rate of revenue growth over the last four years. Entrants can be a public or private company, but winners are usually private (as public companies are often far more established).

With Deloitte’s Fast 50 2020 update due for release next month, we’re revisiting 10 of the 2018 winners to track where they are now. Which are the most interesting stories of the last two years? Which companies have reached even higher heights, and which stars have burnt out too quickly?

Key statistics on the Deloitte Fast 50 2018 cohort

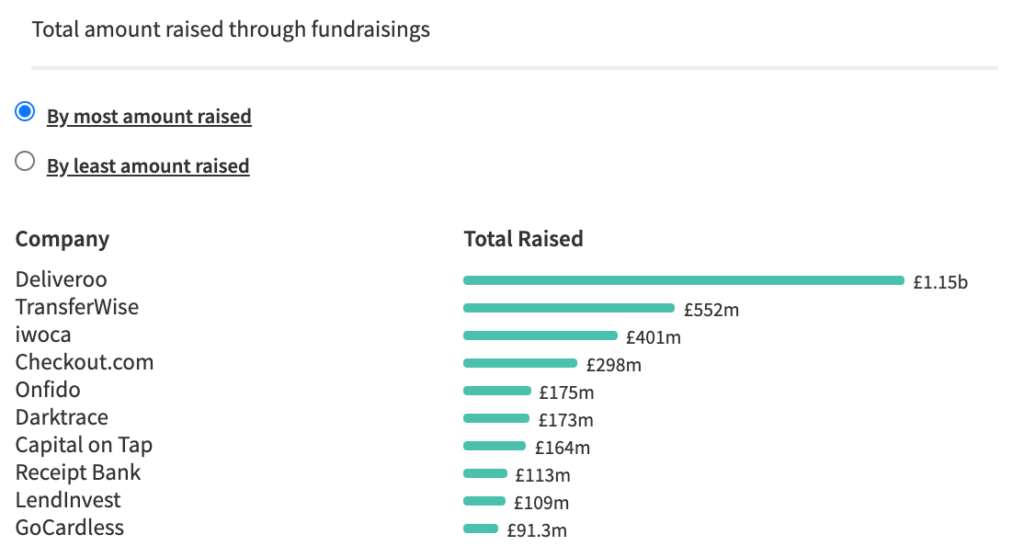

The graph below highlights the companies from Deloitte’s 2018 list by total amount raised to date.

68% of companies are headquartered in London, compared to 66% in 2017 and 64% in 2019. Fintech has been heavily represented in recent years: of the 2018 cohort, 28% of the companies were fintechs, compared to 24% in 2017 and 30% in 2019. Four of the companies on this list went on to become unicorns (startups valued at more than $1b), and we’ll go into each of these in more detail below. Also, check out our write up of the Deloitte Fast 50 2020 winners here!

Our 10 spotlighted Deloitte Fast 50 companies— where are they now?

Bloom & Wild

Founded: 2013

Headquarters: Lambeth

Status: Active, Growth Stage

Total funds raised: £22.2m

Amongst all of the fast-growing fintechs and accomplished AI startups, Bloom & Wild has taken root by cornering the flower-delivery market. Founded in 2013 and headquartered in Lambeth, Bloom & Wild sends flowers purchased as gifts via postal delivery, taking orders either through its website or mobile app.

Bloom & Wild was born when co-founder Aron Gelbard noticed that the flower-delivery market was “strangely commoditised and clinical.” He saw a gap in the market for next-day, personalised, high-quality flower delivery—and seized it. Since then, this tech-savvy startup has appeared on both Deloitte’s 2017 and 2018 Fast 50 lists, boasting a 13,818% and 2,098% growth rate respectively. The company placed second in 2017 and 14th in 2018.

The company’s last equity investment was the £15m it received in October 2018 from Burda Principal Investments, MMC Ventures, and Piper Private Equity—which valued the company at £70.8m. Recently, it became the official supplier for Ocado and formed a partnership with Sainsburys, meaning that we’ll all be seeing Bloom & Wild flowers across the UK in retail outlets for the first time.

Last month, Bloom & Wild hired its first ever CTO—the company’s first c-suite level hire in five years—following announced plans to scale up vastly over the next two years. Bloom & Wild has also made headlines because of its tailored marketing: the content shown on the company’s website and the email marketing clients receive is catered to the individual. For example, certain events like Mother’s Day are sensitive to people, so customers can opt-out of related communications. This is a great example of personalised and “thoughtful” marketing, which has now turned into a 130-company-strong initiative where brands share open-source knowledge and resources.

Bloom & Wild has continued creating job opportunities through COVID-19, now employing over 100 people. Since appearing on Deloitte’s list, the company has expanded into France and Germany, too.

Deliveroo

Founded: 2012

Headquarters: City of London

Status: Active, Growth Stage

Total funds raised: £1.15b

We all know Deliveroo by now, don’t we? In case you need a reminder: Deliveroo provides delivery services for restaurants, using technology to predict the time taken to prepare meals and the most efficient way of delivering orders by calculating the location of restaurants, customers, and riders. 2018 was Deliveroo’s second year winning Fast 50. It won Deloitte’s 2018 listing with a 15,749% revenue growth rate, and was the previous winner in 2017 with an incredible 107,117%.

Since its inception in 2012, the company has become ubiquitous, growing with incredible pace. In 2019 it became the most-funded startup in UK history, taking just 5 years to reach a £1b valuation. This also means that Deliveroo is one UK unicorn company out of four in this list, and of 24 altogether. Deliveroo has secured a massive £1.15b in fundraising overall, the most notable being a £449m equity round in 2019 for a 20% stake from Amazon, Fidelity Management, Greenoaks Capital Management, and T.Rowe Price—resulting in a £1.83b pre-money valuation.

But it’s not all positive news for the company. COVID-19 pushed Deliveroo to the brink, with an announcement in April that it wouldn’t last without a £400m cash injection from Amazon. Restaurant closures and reduced consumer spending led to a decline in revenues, and low-profit margins on deliveries meant that Deliveroo couldn’t afford the hit. Despite a huge market share, the company racked up an operating profit of -£257m in 2018.

The Competition and Markets Authority (CMA) initially blocked the cash injection from Amazon on grounds of the deal discouraging competition, but eventually gave it the green light. By June, the CMA stated that following a “significant increase” in order volumes, Deliveroo had “both been profitable and had a positive cash flow”. Deliveroo also began to offer groceries and participated in the Eat Out to Help Out scheme, and oversaw many partnerships—one with Lloyds Pharmacy for medicines delivery in June 2020, one with Holland & Barrett, one with Aldi, and Morrisons too.

Since lockdown measures were eased, Deliveroo has seen recovery. But with the company forced to cease operations in many countries, It’s safe to say that COVID-19 and 2020 uncovered a vulnerability in the business model.

Checkout.com

Founded: 2012

Headquarters: Westminster

Status: Active, Established

Total funds raised: £298m

Checkout.com is another fintech unicorn, and has developed software that lets businesses accept and process e-payments in many different currencies. It was one of the big winners of Deloitte’s 2018 ranking, placing second—only behind Deliveroo in terms of growth, with a rate of 15,548% versus Deliveroo’s 15,749%. This was its first time appearing on the list, although it has since appeared on the Tech Track 100 in 2019 and 2020.

The company is now one of the most valuable fintechs in the world, working with huge enterprise customers such as Grab, Revolut, Klarna, TransferWise, and Adidas. It saw a 250% increase in online transactions between May 2019 and May 2020, and now processes transactions in more than 50 countries and over 50 currencies.

Since featuring on the 2018 list, Checkout.com has been busy moving from strength-to-strength: in May 2019 the company secured £176m in equity fundraising, which is still today the largest ever fintech Series A round, and made them the first and only company to reach a billion-dollar valuation in its first equity round.

In February 2020 it acquired ProcessOut and in May acquired Pin Payments, streamlining expansion into France and Australia respectively. In June 2020, the company received another fundraising, this time for £121m. The purpose of this investment is for R&D and working capital—to facilitate product development and improve the balance sheet. The investors backing Checkout.com are as follows: Blossom Capital, Endeavour Catalyst, DST Global, Government of Singapore Investment Corporation, Insight Partners and Coatue Management.

In 2019 Checkout.com moved its 300 employees from Fitzrovia to Wenlock Works in Hoxton, with view to aggressive expansion and hiring on the back of recent huge equity rounds. To date, it employs over 750 staff.

Hostmaker

Founded: 2013

Headquarters: Southwark

Status: Dead

Total funds raised: £22.6m

This one isn’t a success story, we’re afraid. Hostmaker is the only company in the 2018 cohort not actively trading today. Founded in 2013, the company provided short-let property management, housekeepers and concierge services, as well as pricing advice to Airbnb hosts. It raised £22.6m in fundraising across six rounds, growing alongside the Airbnb boom.

The company never managed to generate profit, however, operating at -£14.2m in 2019. Hostmaker also garnered much negative press for “unscrupulous property management” and for advertisements encouraging landlords to switch to short-term lets, which were ordered to be removed by Sadiq Khan.

Unable to secure further investments and operating at a severe loss, the company was forced into insolvency in March 2020—unrelated to COVID-19, it seems. A company with a similar business model to Hostmaker, Houst, took over all of its contracts and services on the same terms.

City Pantry

Founded: 2013

Headquarters: City of London

Status: Acquired

Total funds raised: £7.08m

City Pantry is an online marketplace for ready-to-eat food deliveries in London. It placed 25th on Deloitte’s Fast 50 2018 list, with a growth rate of 1,140%. The company is one the few on the list to have exited since 2018. It was acquired by JustEat, which is another—and the first ever—UK unicorn. The acquisition was agreed at £16m, allowing JustEat to expand into the B2B catering and delivery market using City Pantry’s existing network, technology, and sector knowledge.

Founded in 2013, and a graduate of retail startup accelerator TrueStart, the company has raised £7.08m in fundraising across seven rounds before being acquired in July 2019. Throughout the pandemic, City Pantry partnered with Mindful Chef to offer pantry boxes available to purchase for staff working from home, and also set up an initiative to feed frontline workers and at-risk groups.

JustEat’s move to City Pantry is one of JustEat’s incremental acquisitions, part of their bid to continue momentum against its two big competitors: UberEats and the aforementioned Deliveroo.

TransferWise

Founded: 2010

Headquarters: Hackney

Status: Active, Established

Total funds raised: £552m

TransferWise placed 26th on Deloitte’s Fast 50 list, with a 1,107% rate of growth. The company has developed a platform that allows individuals and SMEs to transfer money abroad using real exchange rates, offering customers more competitive rates than banks.

Here we have another fintech unicorn that’s seen huge growth since 2018—reporting a 70% revenue rise since 2019, processing £42b in cross-currency transfers and £67b including domestic payments. Overall, the company has raised £552m across ten equity funding rounds to date.

TransferWise is one of the few seriously profitable fintechs—with fintech being such a young and disruptive industry, populated heavily by startups, it is common for them to operate significantly in the red whilst they focus on growth. The 2020 financials are looking very healthy, with a turnover of £303m and an operating profit of £21.8m.

In September, Transferwise stated that it has hired 243 new people remotely since March—quite the feat. It now employs over 2,000 people working in 13 different cities across the world. Earlier In August 2020, the company extended its partnership with Mastercard, meaning it can now issue cards in any market where Mastercard is accepted. TransferWise has been busy partnering with more banks to integrate its API, including Monzo in the UK, N26 in Germany, and Neon in Switzerland.

TransferWise has secured three equity investment rounds since appearing on Deloitte’s list in 2018, but the most notable was its £248m fundraising in July 2020 from Vulcan Capital, Lone Pine Capital, LocalGlobe, Fidelity Investments, D1 Capital Partners, and Baillie Gifford—giving the company a colossal valuation of $5b. This round was a liquidity round—when existing shareholders sell shares rather than issuing new ones, allowing for liquidity gain through private markets—which begs the question: when will it IPO?

Vizolution

Founded: 2008

Headquarters: Port Talbot, Wales

Status: Active, Growth

Total funds raised: £23.3m

Founded in 2008 and headquartered in Port Talbot, Wales, Vizolution is a customer experience technology company. Their software optimises sales processes that exist across multiple channels, streamlining complex customer journeys.

The company’s latest funding round took place in November 2018, raising £5.01m at a pre-money valuation of £54.2m. In 2020, Vizolution became the first ever Welsh company to feature on the Future 50 growth accelerator programme by Tech Nation, which helps tech companies scale up operations through access to resources, expertise, and networks. Many of the companies on this list—and 12 UK unicorns—have also graduated from Tech Nation’s accelerator.

Clients now include HSBC, Santander and RBS. Just last month, with the help of the Development Bank of Wales, Vizolution partnered with W2 Global Data—a due diligence, compliance and security SaaS startup—allowing the companies to integrate each others’ B2B solutions.

Onfido

Founded: 2010

Headquarters: City of London

Status: Active, Growth

Total funds raised: £175m

Onfido provides employers with an online platform to carry out background checks and employment screening. It is essentially an end-to-end, AI-powered ID verification outfit that keeps fraudsters off its client’s platforms. The company placed 7th on Deloitte’s Fast 50 in 2018, with a 3,857% rate of growth. It also placed 10th in 2019 with 2,855% growth over four years.

Onfido has had a busy 2020: winning ‘AI-based Solution of the Year’ last month from the CyberSecurity Breakthrough Awards, securing partnerships with Deliveroo and WorldRemit, and announcing 130% year-over-year growth alongside accelerated US expansion.

The company has received two fundraisings and one grant since appearing on Deloitte’s list. Firstly a £38.1m equity investment in April 2019, and secondly a £79.2m equity investment in April 2020. This latter investment gave the company a £227m pre-money valuation. The grant was for £5m and came from the Banking Competition Remedies Board, an independent body that administers funds to the UK’s most capable and innovative SME fintechs. Overall, the company has now raised £175m, and shows no signs of slowing.

Moving forward, Onfido is looking to rapidly ramp up expansion into the USA, Europe, and Southeast Asia, while investing in and further developing many areas of technology: biometric fraud detection, data anonymisation, and document fraud prevention. The company now employs over 400 people around the globe, with offices in London, New York, San Francisco, Lisbon, New Delhi, Paris, and Singapore.

Synpromics

Founded: 2010

Headquarters: Edinburgh, Scotland

Status: Acquired

Total funds raised: £7.83m

Synpromics is a Scottish biotech company that develops and commercialises synthetic gene promoters, which control the expression of particular human or non-human genes under specific conditions. Its product has a range of uses, including in biotechnology manufacturing and gene therapy. Founded in 2010 and based in Edinburgh, the company placed 12th in Deloitte’s 2018 rankings with a 2,485% rate of growth. Synpromics was the only Scottish company on the list.

We’ve chosen to look at Symoprimics as it one of just four companies to have exited through an acquisition. Lending Works, Thoughtonomy, and CityPantry are the other companies also acquired since featuring on the list. Synopromics was acquired by US gene therapy company AskBio in 2019, and is now operating as a wholly-owned subsidiary, still based in Edinburgh.

The amount AskBio paid for acquiring Synpromics has not been disclosed anywhere, but the move has been hailed as crucial to the Scottish life sciences industry, and is allowing Synpromics to invest more into R&D. CEO of AskBio, Sheila Mikhail, says that with this acquisition the company is now the technical leader of successful rAAV-based therapeutics development, and that “by combining AskBio’s AAV delivery platform with Synpromics’ gene regulation platform, we have created an unrivalled offering in gene medicine.”

Darktrace

Founded: 2013

Headquarters: Cambridge

Status: Active, Established

Total funds raised: £173m

Darktrace develops AI-powered security software that identifies behavioural anomalies that may signal security threats. Darktrace is the fourth and final unicorn on Deloitte’s Fast 50 list.

The company is based in Cambridge, was incorporated in 2013, and was spun out from the University of Cambridge. Today it has over 1,300 employees working across 44 offices globally. 2020 has been a successful year for Darktrace, with a doubling of customer numbers since January 2020.

Much has happened since Darktrace appeared on Deloitte’s list in 2018: it won the award once again in 2019, placing 12th; its billionaire investor Mike Lynch departed the company after facing fraud charges; its solution launched in the Amazon Web Services marketplace; it won Lloyds Bank National Business Awards’ ‘Artificial Intelligence Award’ in 2019; and finally, it has seen a business boom across Asia Pacific.

Many believe that Darktrace is due to float anytime now, after reports of the company searching for a bank to head its IPO process in 2020. But with Goldman Sachs actually turning the company down, this could be more of a struggle than anticipated.

As you can see, featuring on Deloitte’s Fast 50 is a key indicator of business potential.

That’s why high-growth lists are one of the tracking triggers we use to find the UK’s most ambitious companies.

We track 8,273 high-growth companies from high-growth lists. Easily search across them using hundreds of variables—such as sector, location, turnover, and company size. You can even discover the network of people, funding sources, and unannounced deals behind each name. Higher- quality leads and actionable data, in a fraction of the time.

Enter your details below for a free, no-hassle demo of the platform—and we’ll show you exactly what you’re missing out on.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.