Equity crowdfunding: the definitive data and guide

Category: Uncategorized

Equity crowdfunding is one of the most interesting areas of equity investment, but crowdfunding data is often difficult to find. We’re here to help.

We cover the most prolific equity crowdfunding platforms in The Deal, which we update each quarter. In these indices, we publish not only the volume of deals undertaken by each platform, but also the precise amounts invested by crowdfunding platforms into young companies – data you can’t find anywhere else.

Beauhurst also works closely with the British Business Bank on an equity tracker (find 2016’s here), and in 2015 partnered to analyse crowdfunding in particular as part of this. So, what do the statistics say?

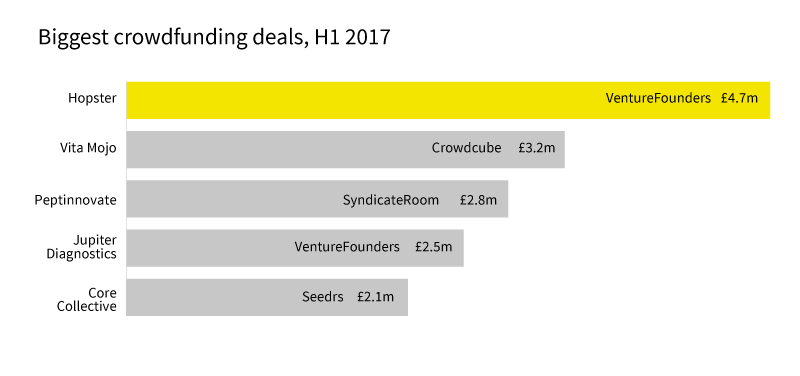

Looking at data since 2011, the three biggest and most active equity crowdfunding platforms are Crowdcube, Seedrs, and SyndicateRoom. Following them is a host of others including Angels’ Den, Collider, VentureFounders, Ignite, Angel Cofund, and more than 40 others.

The overlap with angel groups is worth noting: contributors to equity crowdfunding rounds are acting as smaller-scale business angels with each investment they make; the platforms simply facilitate lots of investors working together.

Whilst the majority of crowdfunding investment goes into consumer-facing businesses, as time goes on we see increasingly specialist platforms coming to the fore – no doubt partly due to the ease of accessing white-label platforms. AllBright, for instance, is sector-agnostic but exclusively backs female founders; Eos Ventures (amongst others) limits itself to fintech; Capital Cell concentrates on medical science companies. Platforms may also specialise by concentrating not just on sector, but on region, although there’s currently little evidence that regional platforms are widely used.

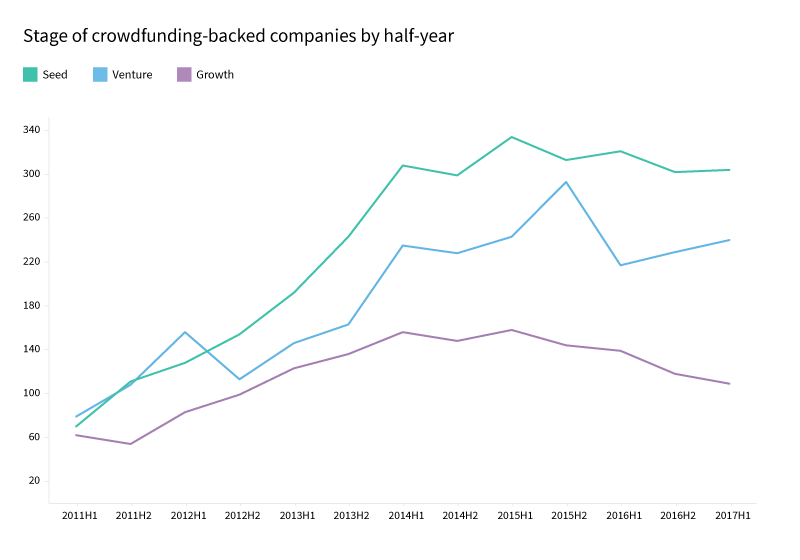

Equity crowdfunding has in the past been considered more controversial than traditional investment processes; in its early years, failure rates were significant – although these appear to have fallen to more palatable levels since. Nonetheless, when we last assessed the market in 2015, crowdfunded companies were keeping comparatively large portions of equity during funding rounds, despite being more likely to undergo down-rounds (i.e. fall in valuation) in the future.

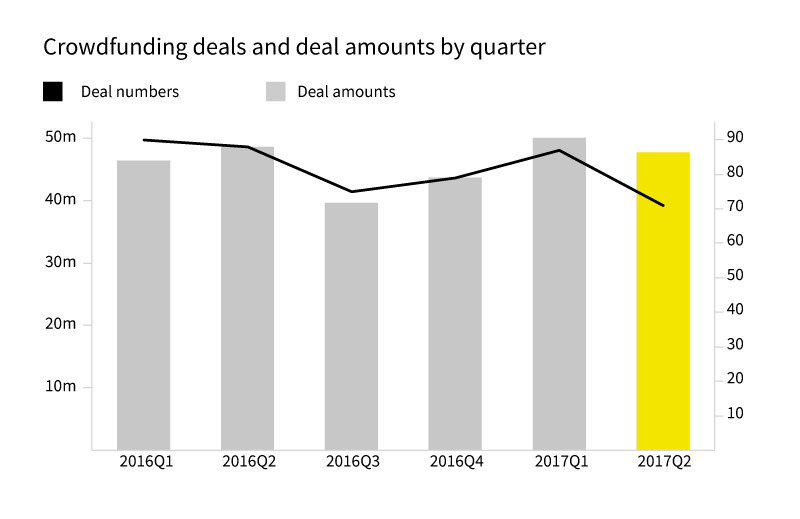

It’s impossible to know for sure what the future of equity crowdfunding holds, as deals decline across the board, but our own Head of Research suggested that the platforms may yet be eyeing a bigger prize.

As with other types of equity investment, the crowdfunding statistics tell us that technology firms dominate the market, taking roughly 28% of crowd investment since 2011.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.