Most Active Corporate Venture Funds in the UK

Category: Uncategorized

Corporate venture capital, or CVC, is a form of venture finance in which corporations are directly investing into private companies, providing growth capital as well as industry knowledge and corporate resources for product development. By acquiring equity stakes in these innovative businesses, CVC funds can gain a competitive advantage and access to new markets. In turn, this investment facilitates and accelerates innovation by pairing growth capital with industry knowledge and corporate influence.

A key driver of innovation in new markets, activity in the corporate venture ecosystem has grown dramatically in the last decade, with global corporate venturing reaching a record $73.1b in 2020, according to recent research by PwC and CB insights. Our own research also shows continued growth in the UK, with corporate giants from all over the world looking to UK startups for the next generation of new technologies.

In this article, we’ve compiled a list of the most active CVC investors in the UK, their investment philosophies, and the types of companies they’re backing. This ranking has been determined by the number of announced equity deals made into high-growth UK companies throughout the past decade. Although we track all equity fundraisings in the UK, we won’t know which funds have participated in a round unless it is announced to the public, so actual portfolio numbers may be larger where investments remain undisclosed.

Download our free PDF to see our full list of the most active CVC investors.

How is Corporate Venture Capital (CVC) different from Venture Capital (VC)?

Before we get into the list, let’s first discuss the difference between corporate venture funds and traditional VC funds.

Corporate venturing is very similar to venture capital, as both involve investors backing external startup companies and entrepreneurs. But whilst the VC model is based around LPs (Limited Partners) and GPs (General Partners), corporate venture capital typically involves large companies acting as a single LP. They usually have specific venture arms that are managed by specialised divisions. Intel Corporation’s CVC investment fund, for example, is managed by Intel Capital.

Another key difference between VCs and corporate investors lies in investment objectives. Venture capital funds look for strong financial returns for their LPs, often through high valuations at exit events (IPOs, mergers and acquisitions). Whereas, CVCs have additional objectives to consider alongside ROI, such as technology exchange between portfolio companies, strategic partnerships, brand reputation, and getting ahead of new trends.

Venture arms at large corporations also differ to VC firms in their level of involvement in investee companies. VCs tend to seek greater control over their portfolio companies, typically providing guidance and follow-on investments, in exchange for a seat at the table.

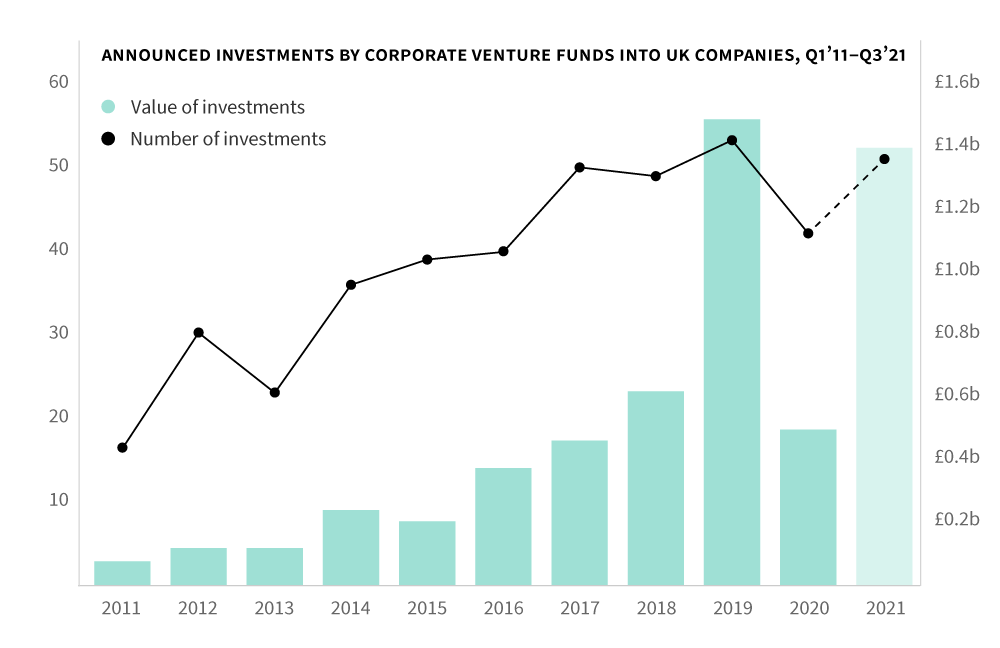

UK corporate venturing trends over time

Since 2011, we’ve tracked 429 announced CVC deals into UK startups , with a value of £5.55b in total. This is in comparison to the lowest ebb of investment in 2011 in which there were 16 deals worth £17.1m.

There has been a particularly steep increase in the value of investment made in recent years, with a high of £1.5b in 2019. And whilst 2020 saw a predictable dip, mostly due to the impact of the Coronavirus pandemic, 2021 is already proving very strong, with 51 deals and £1.39b of investment recorded so far.

This growth is reflected across the globe as corporations seek new channels of growth. While the UK continues to be the powerhouse of CVC investment in Europe, other countries are also getting involved.

Most active corporate venturing arms in the UK

UK Steel Enterprise (UKSE)

Based in Sheffield, UK Steel Enterprise is a subsidiary of the steel-making conglomerate Tata Steel. UKSE is a corporate venturing arm that is solely responsible for assisting the economic regeneration of traditional steel communities. It was founded in 1965 when changes in the industry resulted in a loss of jobs.

The fund’s investment thesis centres around areas affected by the decline of the steel industry and funding is available across many business sectors, including manufacturing and services to businesses. UKSE typically invests between £25k and £1m, and at least 51 UK companies in its portfolio, including FuelActive, Celtic Recycling and Martin Aerospace.

Martlet Capital

A subsidiary of the engineering and technology services company Marshall Group, Martlet Capital is a Cambridge-based, early-stage investor. Founded in 2011, the fund is sector-agnostic, looking for businesses that match the following criteria: teams of at least two founders, evidence of a large global market, can demonstrate high-growth potential, defensibility in speed to market, know-how or patents.

Martlet Capital invests in B2B companies across markets, but primarily those also located in Cambridge. They’ve backed at least 30 high-growth UK companies to date; notable portfolio companies include Ieso Digital Health, Undo Software and Audio Analytic.This fund does not publish its investment range, but Beauhurst research indicates that it typically invests between £100k and £150k.

GV (Google Ventures)

GV, formerly Google Ventures, is the venture capital investment arm of Alphabet Inc—the parent company of Google. Founded in 2009, it’s one of the most prolific corporate venture funds worldwide. Typically investing between $2m and $30m, GV looks to invest in disruptive technology and divides this into the following categories: Consumer Life Sciences, Healthcare Data and AI Enterprise Robotics, Cyber Security and Agriculture.

So far, GV has backed at least 23 high-growth UK-based companies. This includes digital security unicorn Snyk, the widely known Blockchain.com, and Secret Escapes, a members-only, luxury British travel company. Across the globe, the fund has backed more than 500 businesses.

Unilever Ventures

Unilever Ventures is the venture capital and private equity arm of multinational consumer goods company, Unilever. It was founded in 2002 and, for almost two decades, has been working with innovative personal care brands and digital technology businesses.

The type of investment Unilever Ventures aims to make is in companies with outstanding management teams, clear opportunities for global expansion, and the ability to benefit from its global reach and market knowledge. It also looks to sustainable brands.

Unilever Ventures has backed over 70 companies, globally, at least 14 of which are UK-based. Its high-growth portfolio companies include the meal kit retailer Gousto, healthcare technology company, Huma, and leader of liquid repellent nanotechnology, P2i.

Indie Growth Fund

Indie Growth Fund is a team of corporate venture capitalists which provides support to the UK’s independent creative sector. A subsidiary of Channel 4, it invests in film and television production companies that show high growth potential, and a strong product or brand.

Indie Growth Fund was founded in 2014 and has since backed at least 19 high-growth UK companies. Their notable portfolio companies include Rated People, Spelthorne Community Television, and Arrow Media.

Spelthorne Community Television is a particularly interesting example. Founded by Andrew Newman and Sacha Baron Cohen, the company has a unique vision and holds a strong position within the world of film, creating a popular mix of comedy work. Alongside the Indie Growth Fund, Channel 4 also provides airtime for equity via the Channel 4 Ventures fund.

Breed Reply

Breed Reply is a corporate VC based in Westminster. Founded in 2014, the fund is part of IT service management company Reply Group. The fund focuses its investment predominantly in Europe and the USA, but will also consider new ventures outside of these regions. It primarily invests in the Internet of Things (IoT) sector; this includes companies developing technologies and initiatives that support the development of IoT products.

The fund’s investment strategy considers the following when looking for new opportunities: a strong and capable team, potential for growth and expansion within the target market, products or services with a competitive advantage. Breed Reply has 22 portfolio companies worldwide, and has backed at least 11 high-growth UK companies to date, including AppyWay, Iotic Labs, and Zeetta Networks.

BP Ventures

BP Ventures, the subsidiary of BP Alternative Energy, was founded in 2012. Investing in technology and energy companies, the fund focuses on five themes: advanced mobility bio and low carbon products, carbon management, digital transformation, power and storage. So far, it’s backed over 60 companies, globally.

BP Ventures has invested in at least 11 high-growth UK companies, including Heliex Power, and chemical processes company, C-Capture. Its investment in autonomous vehicle software, Oxbotica is also worth mentioning. As one of the first organisations to develop Level 4 autonomous vehicles, Oxbotica has raised more than £70m to support its work.

Legal & General Capital

Legal & General Capital is the corporate venture arm of the multinational financial services company, Legal & General. Founded in 2013 in London, the fund has a particular interest in housing, infrastructure and clean energy. It’s invested in at least 11 UK companies to date.

The fund’s high-growth portfolio companies include Oxford University-led Oxford Photovoltaics and the innovative fintech platform, Salary Finance. It has also played a key role in the growth of Tokamak Energy—a rapidly growing organisation at the forefront of innovation across fusion power research.

Download our free PDF to see our full list of the most active CVC investors.