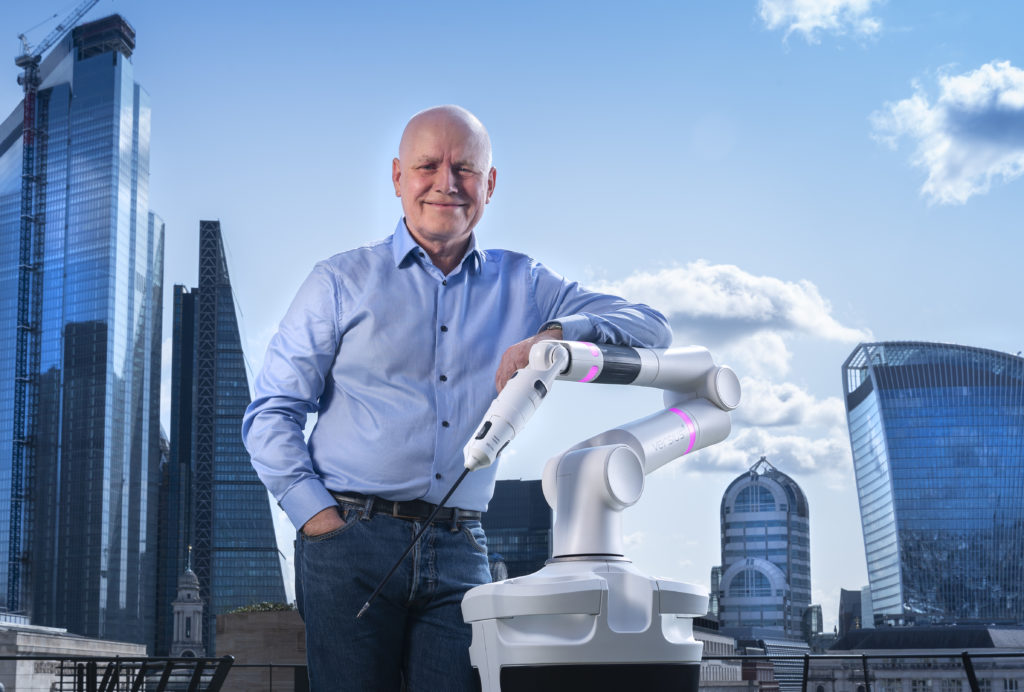

CMR Surgical raises £195m: Interview with Martin Frost CEO

Category: Uncategorized

A few weeks ago, we released our report on the UK’s Unicorn companies. CMR Surgical is the latest addition to the herd of billion dollar businesses, having raised £195m of equity finance, catapulting the company valuation beyond the $1b mark. CMR was founded by a team of five in January 2014, springing out of a passion to address a pressing need in surgery; not enough people have access to minimal access surgery. Led by co-founder and CEO Martin Frost, the company is using pioneering technology to make minimal access surgery more accessible for patients, and more cost-effective for healthcare providers.

We sat down with Martin to learn more about the company’s growth journey, and how they reached a billion dollar valuation. In this interview, he tells us how the company’s location in Cambridge has supported and facilitated their growth, the difficulties in raising finance with just an idea and the challenge of collaborating with the NHS.

a firm foundation

With five founders, CMR Surgical has the largest founding team of all UK unicorn companies. Martin cites this “fully formed management team” as one of the key factors that enabled the company to get off to a flying start. Together, the team cover all of the main business functions and benefits from vast experience across a variety of roles. From Keith Marshall’s position as a Senior Mechanical Engineer at Xerox to Mark Slack’s post as Head of Gynaecology at Addenbrooke’s Hospital. Having started out in financial positions for the likes of KPMG, Martin has since led a number of companies including another Cambridge-based medical technology company, Sagentia.

an essential product

Another factor to the company’s early success was the clear need for innovation in surgical technology. “We were very confident we had a product market fit from day one because it was never a technology looking for a market – the need for the products already clearly existed,” Martin explains. Minimal access surgery is a better procedure than an open surgery for a number of reasons. It reduces complications and blood loss during the procedure, and leads to less scarring, faster recovery time and less need for painkillers afterwards. “It’s a better option for patients because it’s less invasive, and it benefits hospitals because it’s less costly than the alternatives.”

The road to medical innovation is, by nature, is slower and more heavily regulated than for the average tech company. “We got to our first prototype within the first year, but it’s taken us five and a half years to complete the medicalisation and product approval process too.”

an innovative community

Although headquartered in north Cambridge, CMR is not formally connected to the University. Nevertheless, proximity to one of the world’s leading academic institutions has been “absolutely pivotal in scaling the company,” says Martin, “there are few locations in the world where you can innovate and grow at such a fast pace. The university has been a hugely important institution to us for two reasons; a number of our leaders have been recruited from Addenbrookes Hospital [part of the University] and it is one of the biggest investors in Cambridge Innovation Capital, which has participated in four of our investment rounds.” On top of this, CMR have their pick of a huge pool of local graduate talent.

research intensive, development intensive, capital intensive

Raising money for any early stage company is an incredibly difficult and time consuming process. But for companies that are as R&D intensive as CMR, which needs to win investors over with just a prototype and a vision of how it could be developed, the fundraising journey can be even more arduous. CMR’s first equity funding round of £3.8m took Martin around a year to secure – much longer than the average tech company. So what factors contributed to the company’s success in raising a multimillion pound equity round whilst still at seed stage?

“We’ve always had a fully formed management team, even in the very earliest stages of the company. The fact that our core team cover engineering, commercial and clinical points puts us in a great position to raise capital. Secondly, we’ve always delivered what we said we would do, so each round has been very well supported by a previous shareholder. This kind of long term relationship with shareholders who share our vision has been absolutely critical to our success in raising funds”. Investor confidence in the company has been further consolidated by the massive expansion of the market – even within the lifetime of CMR; “our backers really do believe that we can deliver what we have set out to do.”

In terms of who those backers are, the profile has changed a little over time. “Over the course of our funding journey the characteristics we look for in investors has changed a little bit. In our latest round we brought on money from US investors because North America is a really important market for us. But the common denominator across all of our shareholders is that they are completely aligned with our vision – something which is absolutely critical and unchanging for us.”

Having grown the company to 400 employees across 4 continents, the next stage for CMR is to continue scaling internationally – “we’ve now got all of the capital on board that we need to fully fund our business plan”.

scaling in solitude

According to Martin, this is a lonely country for innovative medical devices companies – the UK doesn’t have much of the infrastructure needed to effectively nurture and grow this type of business. “The UK’s engineering resources are excellent, especially around Cambridge. But we’ve had to look pretty far afield in order to grow a global commercial function because we’re not following in the footsteps of another company – the UK hasn’t been a very happy hunting ground for medical devices.” Martin cites Smith and Nephew as an example of this; a UK company that’s listed on the London Stock Exchange but with most of the company resources in the United States. “So as well as delivering our mission and growing a company of real merit, we’re endeavouring to show that it is possible to build a world-class medical devices company from the UK.”

Of course, this opportunity to lead the way has its merits; “we’ve started with a fresh pair of eyes and are forging our own path on a global stage.” Given that Martin and his team are pioneers in their industry, they look across sectors for inspiration “I really love reading and learning from people who have lead disruption in other industries. For example, the electric vehicle wasn’t Elon Musk’s own idea, but he’s building a different type of electric vehicle than had previously been imagined, and doing so at an admirable speed – there’s a great deal of stuff we can take from other disruptors like this and apply to CMR.”

innovation without competition

When asked about potential rival companies, there aren’t any direct competitors for the time being. “We’re not worried that we’re going to be threatened by another British surgical robot company right now – it’s a very long timeline to bring an idea to market.” But the company is more than happy to pave the way for other healthcare innovation businesses to work with the UK’s public institutions. “I do see ourselves as a trailblazer in medical devices. We want to change the way in which procurement happens in hospitals and how the NHS thinks about the adoption of new medical devices. So if other people can learn and benefit from that, then that can only be a great thing.”

building meaningful relationships

Martin and his team were made aware of the potential tribulations of working with the NHS from the very beginning of their funding journey. “When we first started out, we were frequently told by venture capitalists that they didn’t want to work with another business that relied on collaboration with the NHS.” But the team has managed to prove these cautious investors wrong. “We now work very closely and effectively with the NHS and are confident that hospitals will be using our products very soon. The current chair of NHS England, Lord Prior, was gracious enough to open our newest building, which just goes to show the strength of our relationship with the institution.”

But that’s not to say that it hasn’t been a challenge. “I don’t think there are many CEOs of NHS trusts in the UK that have a KPI of adopting innovative new technology – everything is about efficiency and costs, not necessarily innovation. This is partly why alignment with our customers, and having long term contracts in place with our clients is so important for us.” CMR structure their contracts over six years to enable customers to pay for the technology over the lifetime of the contract, making it as cost-efficient as possible.

a challenge worth facing

So would another country be preferable for scaling the company? “I do think that American companies are at an advantage when it comes to innovation in healthcare, because the country spends so much on the sector – around twice per head of what we spend in the UK. The domestic market is simply much bigger over there. But ultimately, if you overcome a challenge you become a better company for it – learning how best to collaborate with the NHS is a good challenge for us to be facing.”

completing the mission

Like many of the UK’s companies that have reached unicorn status, Martin and his team aren’t too fussed over the fairly arbitrary accolade. “We don’t define success by the unicorn badge that’s been attributed to us. Our goal here is to build a different type of medical devices company, which is not only built on ground breaking, next generation technology, but also delivers an entirely new and collaborative approach to customers. Alignment with customers is something we think about all the time here, and something we believe will be a massive game changer. I will only be happy when we have a device that’s doing hundreds and thousands of procedures for patients who wouldn’t otherwise have received minimal access surgery.”

Download the full report to read

our exclusive interviews with OakNorth Bank, Deliveroo and OVO Energy.