Cleantech companies: innovating towards a low-carbon future

Category: Uncategorized

Earlier this month, the energy policy website Carbon Brief reported that the UK’s CO2 emissions had dropped to levels not seen since 1890. This has been attributed chiefly to a drop in the use of high-emission coal. However, it’s also worth noting that the overall consumption of energy in the UK has dropped by over 10% since 2002 (despite a population increase), as our technology becomes increasingly energy efficient. “Cleantech companies” refers to the enterprises which are helping to commercialise these new sustainable technologies.

In this blog, we take a look at some of the high-growth cleantech companies in the UK, and how they are helping the drive towards a low-emission economy.

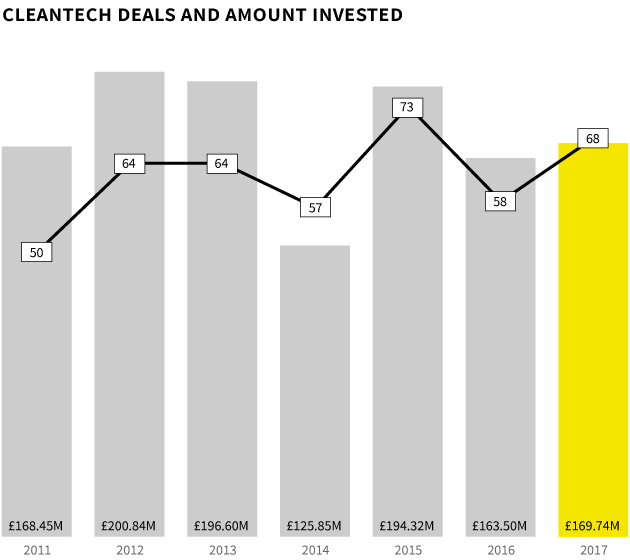

Understandably, the amount of equity pouring into the cleantech sector pales in comparison with consumer-focussed sectors such as fintech, which is growing faster than any other in the UK. 2017 saw around £170 million invested into cleantech companies, almost just a tenth of the £1.3 billion invested in fintech. Indeed, this is roughly the same figure as invested back in 2011, and investment into cleantech companies hit a ceiling of around £200m back in 2012.

As we reported in March last year, cleantech companies are much more likely to fail than the cross-sector average. This risk could help explain the plateauing of investor interest. With that being said, 2017 saw some interesting investment activity in the cleantech space.

The market map of Britain’s cleantech sector includes four key subsectors:

Renewable Energy Generation

Energy Storage Technology (Batteries)

Smart Grids

Electric Vehicles

Renewable Energy Generation

Whilst the majority of large renewable energy projects go to international corporations, several UK cleantech companies are developing new and improved renewable energy technology, which could well be used in future projects.

One such company is Kite Power Systems, which uses a system of offshore kites to generate energy, as opposed to traditional wind turbines. KPS raised £2 million from the Scottish Investment Bank in March last year, which followed on from a £5m injection the previous December from a consortium that included Shell’s Technology Ventures Fund.

Big Solar, which develops flexible, high-efficiency photovoltaic cells known as Power Roll™, has received £263k in 6 grants, the majority of which came from Innovate UK. It’s also raised about £5m in equity over 4 unannounced rounds.

Battery Storage

Renewable energy sources such as solar and wind have seen significant drops in cost over recent years. However, the fact remains that they depend on natural conditions, which cannot be manipulated to coincide with peak demands of power.

This has led to a massive interest in technologies that can store this power when it is generated, for use later on when the demand is greater. Green Hedge received £30 million from Zouk Capital last August, to help expand its Energy Barn™ technology. Essentially, the company pays landowners to accommodate energy storage structures, which are connected to the national grid. These then charge during periods of peak generation, and feed electricity back into the local area when it is needed, helping to balance pressure on the grid. Founded in 2010, the company achieved scaleup status in 2013.

Sheffield’s Faradion, on the other hand, is developing new sodium-based energy storage technology, which it claims will be much easier and cheaper to produce than current lithium batteries. To this end, it completed a £3.2m equity round in January 2017, with investors including Mercia Fund Managers and Finance Yorkshire.

Another company making inroads in this sector is Moixa, an installer of connected battery and solar panel systems. These systems can be managed by the user via an online platform, which displays energy generation and usage in real time. Since 2010, it’s received nearly £2 million through 15 grants. It also received a £5 million equity injection from Itochu Europe just a few months ago. One of their key competitors, Powervault, raised £1.5 million on Crowdcube last June, and has also attended the Climate-KIC accelerator programme.

Smart Grids

Increasing grid stress, alongside the development of “smart home” software, has led to another cleantech avenue – smart grids. The idea here is that the consumers of energy can now communicate the patterns of their usage back to the suppliers. If suppliers can measure where and when grids face the most demand, they can allocate energy appropriately, reducing waste generation and alleviating pressure on power networks. Whilst a lot of the innovation in this sector will come from established providers, two smart grid-focussed startups (Limejump and Upside Energy) raised £11.5m in 2017, with backers including SET Ventures, Passion Capital and the investment arm of Legal & General.

Electric Vehicles

With the UK government announcing a ban on new diesel and petrol vehicles from 2040 onwards, another key focus of UK cleantech companies is the development of electric/hybrid automotives, and their associated infrastructure.

YASA Motors, which spunout from the University of Oxford in 2010, manufactures a “power dense” engine for electric and hybrid automotives. Their motors are used by manufacturers such as Nissan and Jaguar Land Rover. Since July 2017, it has raised £30m through two equity rounds, which both involved Parkwalk Advisors. Vantage Power, which raised £2.5m just over a year ago, manufactures a similar product – hybrid engines for London’s double-decker buses.

On the other side of the power socket, POD Point develops and installs charging points for electric vehicles. They’ve got three models available – for homes, commercial stations, and offices. Within a month last year, they completed 3 fundraising rounds, two of which took place on the crowdfunding platforms Crowdcube and Seedrs. Engenie, a direct competitor, took £1.85m from SyndicateRoom just last month.

Cleantech: what next?

Whilst the investment into the UK’s cleantech companies appears to have tailed off over the past 6 years, there are still plenty of high-growth enterprises driving innovation in this space. With government legal frameworks requiring a 80% reduction in emissions on 1990 levels by 2050 (the figure is currently 42%), it will be interesting to track how the high-growth sector steps up to the challenge.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.