Britain’s leading female fintech entrepreneurs

Category: Uncategorized

As we reported in our annual edition of The Deal, the UK’s fintech sector enjoyed a stellar year of funding in 2017, which far surpassed the level seen in any prior year. Indeed, the sector took the lion’s share of total funding received (taking £1.3b out of a total £8.27b). Fintech has secured its position at the leading edge of Britain’s burgeoning tech sector.

Beauhurst recently published data on the representation of women in high-growth businesses. Our findings supported the verdict of SyndicateRoom’s Gonçalo de Vasconcelos, that “the traditional venture capital (VC) industry is predominantly made up of white males – and its investments reflect that demographic.”

We wanted to explore whether the lack of gender diversity was true for fintech as well as the broader high-growth ecosystem. Traditionally, the top spots in finance are still held by men. Last year, a report by Morgan Stanley found that just 17.6% of senior executive roles in financial firms were filled by women.

Unfortunately, the figures for fintech startups are comparable. Of 743 fintech companies operating in the UK’s high-growth sphere, just 88 (or 12%) had a female founder or co-founder.

This figure is slightly different from the one by Morgan Stanley, as it’s comparing senior positions with the initial founders – some of these startups will have hired female senior execs since their inception. That being so, the figure is still disappointing.

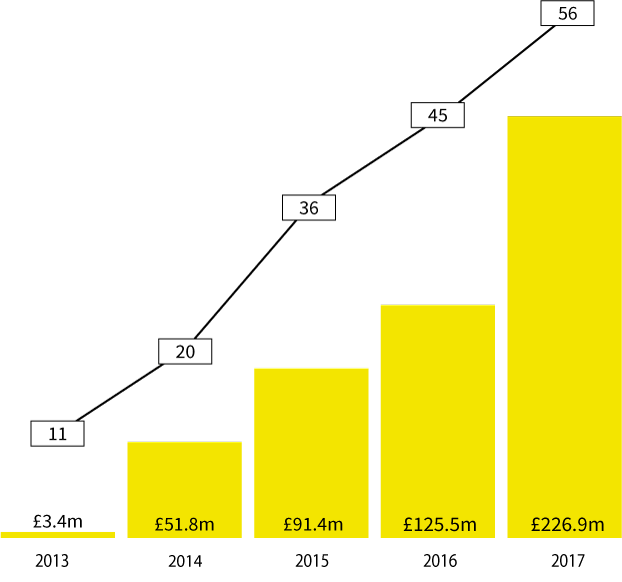

But it’s not to say female entrepreneurs aren’t already making a big impact in Britain’s fintech sector. The graph below shows the amount of equity financing the startups these women have founded have raised over time, representing a steep increase.

Amount raised and deal numbers for fintech companies with female founders

As such, we’ve highlighted some of the UK’s leading female fintech entrepreneurs, by the amount of investment their startups have raised and the amount of turnover they’ve generated.

Female fintech entrepreneurs: the leading 5

Francesca Carlesi

Francesca Carlesi founded the part proptech, part fintech Molo Finance. Just last week, they raised £3.7m in their first ever seed round. With this cash, Carlesi is looking to completely digitise the mortgage process, creating a seamless, customer-friendly user experience. (Currently, the average mortgage takes roughly 6-weeks of paperwork to complete).

Most decisions in the Molo Finance’s mortgage tech will be automated through the use of “robo-advisors”, and all information will be processed through a completely digital platform. The company aims to disrupt the mortgage market, in much the same way that startups such as Monzo or Bulb have revolutionised their respective markets.

Michelle Pearce

Michelle Pearce co-founded Wealthify back in 2014 as a low-cost investment service that was easy to use, with the aim of opening up investment products to the millennial market. Last year, they were acquired by AVIVA in a pioneering deal for Britain’s robo-investment sector. Robo-investment refers to digitised investment platforms, where a user’s money is invested by “robo-advisors” – in other words, an algorithm. These companies claim their algorithms are more efficient than traditional financial advisors, plus they don’t charge hefty commission fees.

The terms of its acquisition by AVIVA haven’t been disclosed. However, the original management team have stayed in place, and Wealthify is now featured as part of AVIVA’s online product platform, myAVIVA. At any rate, this constitutes a rapid exit for the founders, who had only diluted their holdings with £2.14m of equity funding prior to the acquisition.

Charlotte Ransom

Charlotte Ransom co-founded Netwealth. This startup offers a similar product to Wealthify, except that it is aimed at disrupting the wealth management market, rather than opening up a new one in the millennial market. After graduating from the University of Bristol where she studied Spanish and Portuguese, Ransom worked at Goldman Sachs for nearly 19 years. Netwealth, of which she is now CEO, started up in early 2015. The company has gone on to raise nearly £16.6m through two unannounced equity rounds.

Catherine Wines

Catherine Wines joined KPMG as an Audit Manager after graduating from the ACCA in 1988. After a varied career in several accounting and payment processing firms, Wines founded WorldRemit in 2010. This company operates an online transfer platform, through which workers operating abroad can send remittances back to family and friends in their country of origin. This company is much more developed than the above companies, having raised £152m through 6 rounds, and having generated a considerable £42m in turnover when they last filed financials in 2016 (though they also burned through a considerable amount of money in the same period).

Such a turnover shouldn’t be overlooked – it puts Wines’ company in the top 10 earners in Britain’s fintech sector, only a short way off companies such as Transferwise and Wonga.

Anne Boden

Boden is one of London’s leading fintech figures as the founder and CEO of Starling. This challenger bank is seeking to disrupt Britain’s banking market by helping users manage their money with an intuitive, insight-generating mobile app. As we reported, the bank recently raised £10m in unannounced funding, bringing the total raised to around £58m through 2 fundraising rounds.

Whilst Starling’s turnover is much lower than WorldRemit’s (Starling only generated a turnover of £13k in 2016), it is also younger, having started up in 2014. Recent filings on Companies House also suggest their valuation is more than £100m.

However, Starling faces a tough fight if it is to win the war of the Challenger Banks – Revolut was recently valued at over $1b, whilst Monzo and Atom have both won large sums of venture capital. Starling by contrast is currently much smaller. It will be interesting to see whether Boden can steer her young bank to victory.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.